Jump to a section:

- Introduction

- Portfolio Diversification Before the Crisis

- The 2008 Financial Crisis

- The Impact of Diversification on Portfolio Performance

- Summary of the case study findings

Introduction

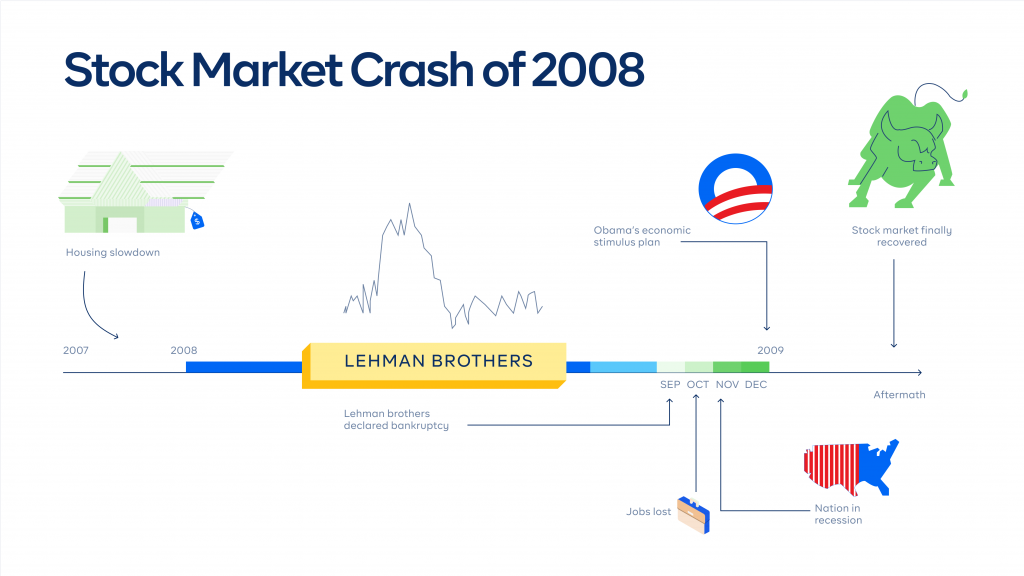

The 2008 financial crisis was one of the worst financial disasters in recent history. It was triggered by the collapse of the housing market, which led to a crisis in the financial sector and the broader economy. At its core, the crisis was caused by a combination of factors, including risky mortgage lending practices, the sale of mortgage-backed securities, and a lack of regulation and oversight.

The crisis had far-reaching impacts, with financial institutions around the world facing losses and many countries slipping into recession. The crisis also had a significant impact on investment portfolios, with many individuals and institutions seeing their investments suffer significant losses. In the face of these losses, it became clear that portfolio diversification was essential for reducing risk and achieving consistent, long-term performance.

Purpose of the case study

In this case study, we will examine the impact of diversification on portfolio performance during the 2008 financial crisis. We will explore the portfolios of investors who had a diverse mix of investments, as well as those who were heavily invested in the financial sector. By comparing the performance of these portfolios, we will gain insights into the role that diversification can play in reducing risk and preserving wealth during times of market turmoil.

Portfolio Diversification Before The Crisis

Overview of investment portfolios before the 2008 financial crisis

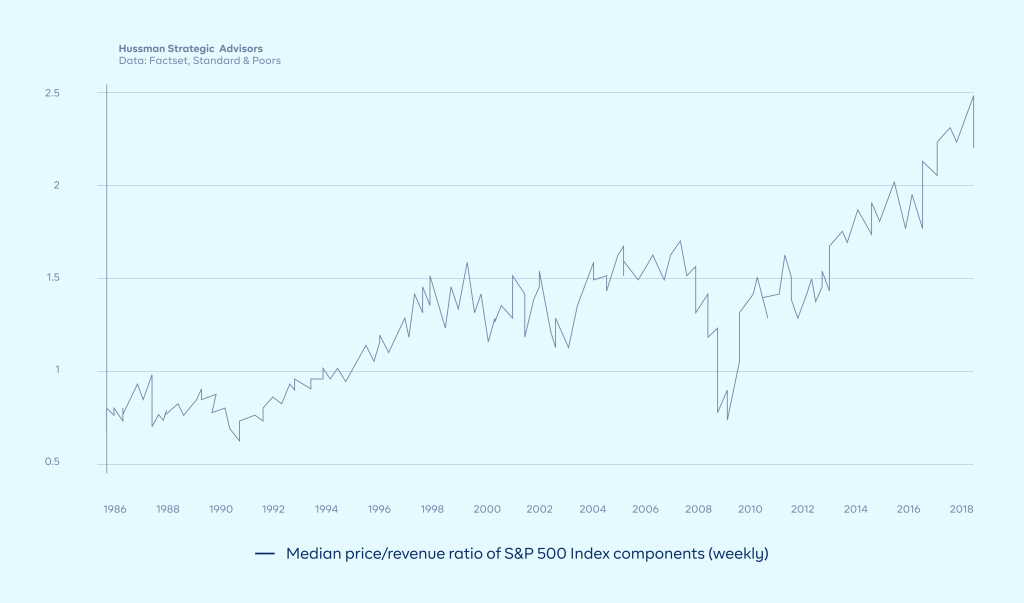

Before the 2008 financial crisis, many investment portfolios were heavily concentrated in the financial sector. This was due in part to the perception that financial stocks were safe, stable investments that offered high returns. In addition, many investors believed that the financial sector was less susceptible to economic downturns than other sectors.

As a result, investment portfolios were overly concentrated in financial stocks, with little diversification across other sectors or asset classes. This lack of diversification meant that portfolios were vulnerable to shocks in the financial sector, with any losses having a significant impact on overall portfolio performance.

In the years leading up to the 2008 financial crisis, many investors were riding high on the back of a bull market, with stocks reaching new highs and investment portfolios showing strong returns. However, this market success was built on a foundation of risky lending practices, and the sale of mortgage-backed securities, amongst other things.

Result of heavy reliance on financial sector investments

When the housing market started to collapse, it quickly became clear that the financial sector was in trouble, and that portfolios that were heavily invested in financial stocks were vulnerable to significant losses. The impact of the crisis on investment portfolios was far-reaching, with many investors seeing their portfolios decline in value and their wealth decline as a result.

The heavy reliance on financial sector investments before the 2008 financial crisis highlights the importance of diversification in investment portfolios. By spreading investments across a range of sectors and asset classes, portfolios can be protected from the impacts of any one sector experiencing a downturn. This is a key lesson from the 2008 financial crisis and one that continues to inform investment strategies today.

The 2008 Financial Crisis

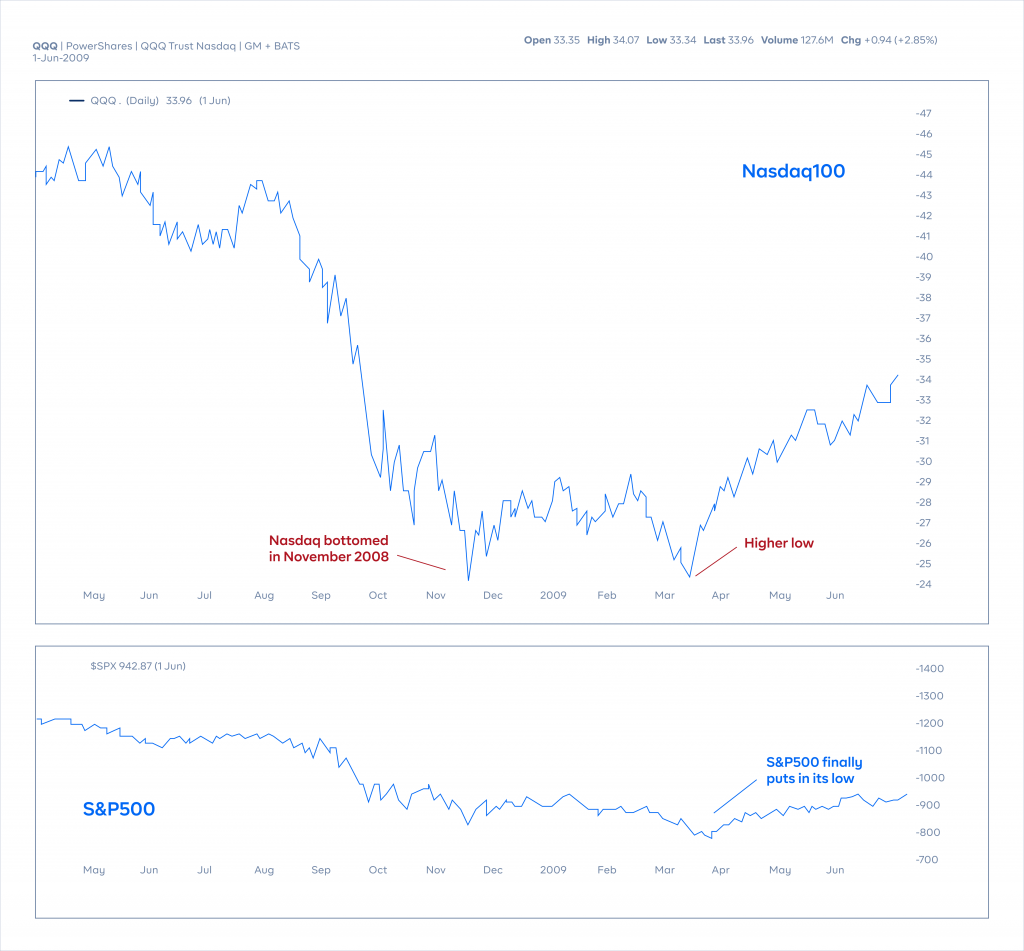

Graph 1: This graph shows the performance of the stock market indices, such as the S&P 500. It demonstrates the sharp decline in the stock market in 2008 and the slow recovery in the following months.

The 2008 financial crisis was a major global event that profoundly impacted the financial sector and the broader economy. As earlier mentioned, the crisis was majorly caused by a combination of factors, such as risky lending practices, the sale of mortgage-backed securities, and a lack of regulation and oversight.

The crisis was triggered by a collapse in the housing market, as the value of mortgage-backed securities declined and many borrowers found themselves unable to make their mortgage payments. This led to a wave of foreclosures and a decline in the value of these securities, causing a chain reaction that spread throughout the financial sector.

A deeper dive into the impacts on the financial sector and investment portfolios

The financial sector was hit particularly hard, with many financial institutions facing bankruptcy or requiring government bailouts to remain solvent. In addition, the crisis led to a sharp decline in the stock market, with many investors experiencing significant losses in their portfolios. In the United States, the government provided financial assistance to institutions such as AIG, Fannie Mae, and Freddie Mac, among others.

In terms of investment portfolios, the crisis led to a sharp decline in the stock market, with the S&P 500 index declining by about 50% from its peak in October 2007 to its low in March 2009. Many investors experienced significant losses in their portfolios, with some losing their entire life savings.

The crisis also had an impact on the broader economy, as the contraction in credit availability contributed to a global recession that lasted for several years. According to the International Monetary Fund (IMF), global GDP declined by 0.5% in 2009, marking the first time that the global economy had contracted since World War II.

In addition, unemployment rose sharply as a result of the recession, with the unemployment rate in the United States peaking at 10.2% in October 2009. This had significant impacts on the lives of millions of people, as they struggled to find work and support their families during a difficult economic period.

These statistics highlight the significant impacts that the 2008 financial crisis had on the financial sector, investment portfolios, and the broader economy. They demonstrate the importance of effective regulation and diversification in reducing the risks associated with financial crises and preserving wealth in times of market turmoil.

As we see above, the impacts of the crisis were not limited to the financial sector and investment portfolios, as the broader economy was also affected. The crisis also led to a sharp contraction in credit availability, which in turn contributed to a global recession that lasted for 19 months.

Lessons learned from the crisis

The 2008 financial crisis was a major wake-up call for the financial sector and policymakers around the world. The crisis highlighted the importance of effective regulation and oversight and the dangers of a lack of diversification in investment portfolios.

In the aftermath of the crisis, regulators worldwide took steps to strengthen the financial sector and reduce the risk of future crises. This included the introduction of new rules and regulations aimed at reducing the risk of mortgage-backed securities and other financial products, as well as measures to increase transparency and accountability in the financial sector.

Here is the synopsis of the lessons learned from the crisis:

- The importance of diversification

Many investors before the crisis had heavily relied on investments in the financial sector, which was hit hard by the crisis. By diversifying investments across different sectors and asset classes, investors can reduce their exposure to sector-specific risks and improve their overall portfolio performance.

- The need for effective regulation

Inadequate regulation and supervision of the financial sector before the crisis contributed to the development of risky financial products and practices, which ultimately led to the crisis. By implementing effective regulation, governments can help prevent financial crises and protect the stability of the financial system.

- The dangers of excessive leverage

Banks and financial institutions before the crisis had used large amounts of debt to fund their operations, which left them vulnerable to losses when the crisis hit. By reducing leverage, financial institutions can reduce their risk of failure and improve their resilience in times of market turbulence.

- The importance of transparency

Before the crisis, many banks and financial institutions had used complex financial products and practices that were not well understood by investors and regulators. By improving transparency in the financial sector, regulators can better monitor risk and prevent the development of risky practices that could contribute to future financial crises.

These lessons highlight the importance of diversification, effective regulation, reduced leverage, and transparency in reducing the risks associated with financial crises and preserving wealth in times of market recessions. By incorporating these lessons into investment strategies, investors and financial institutions can help protect themselves from the impacts of future financial crises.

The Impact of Diversification on Portfolio Performance

Portfolios with a diverse mix of investments

Investors who had portfolios with a diverse mix of investments experienced a lesser impact during the 2008 financial crisis compared to those who had portfolios heavily invested in the financial sector. Portfolios with a mix of investments in different asset classes, such as stocks, bonds, and real estate, were less affected by the crisis as the losses in one asset class were offset by gains in others.

For example, during the 2008 financial crisis, many investors who held a mix of bonds and stocks were able to weather the storm as the bond component of their portfolio held up relatively well while stocks suffered significant losses. This shows the benefit of diversifying investments across different asset classes and sectors, as it reduces exposure to sector-specific risks and improves portfolio performance.

Here are some examples of real-world investors who had portfolios with a diverse mix of investments during the 2008 financial crisis:

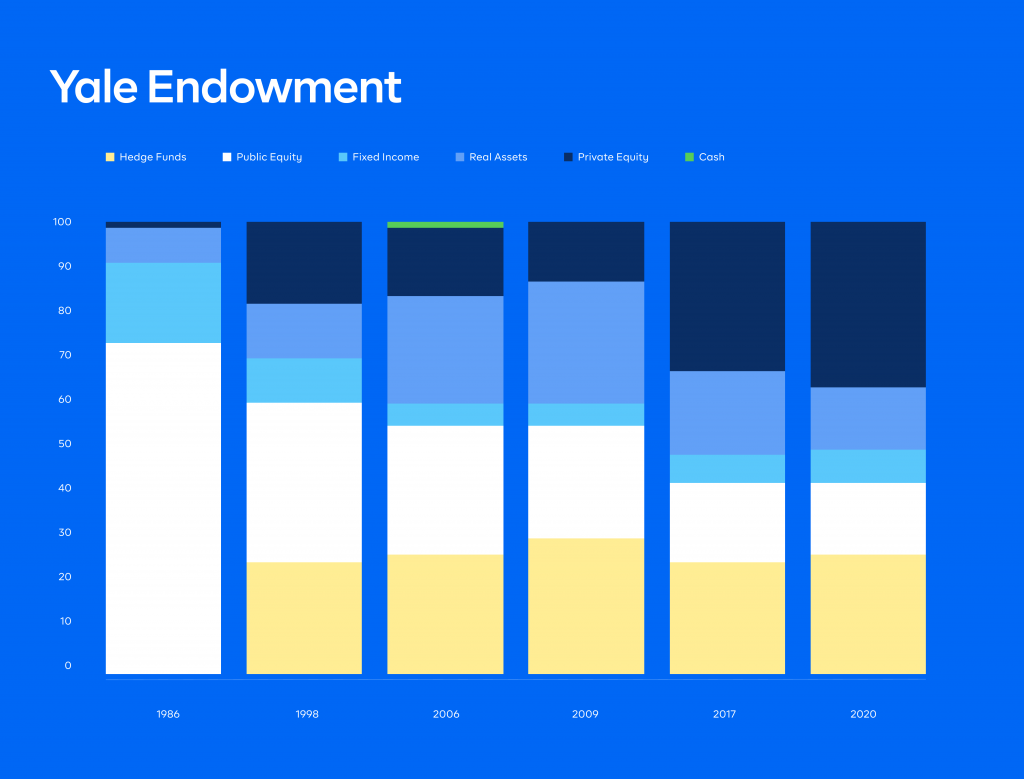

Yale University Endowment

During the financial crisis, the Yale University Endowment had a well-diversified investment portfolio that included a mix of domestic and international stocks, bonds, real estate, private equity, and natural resources. This diversification helped to mitigate the impact of the crisis on the endowment’s performance and allowed it to weather the storm relatively well.

Bill Miller

The former Legg Mason fund manager is known for his investment strategy that emphasizes a diverse mix of investments. During the 2008 financial crisis, Miller’s portfolio included investments in a variety of sectors, including financials, technology, and healthcare. This diversification helped to reduce the impact of the crisis on his portfolio and allowed him to also weather the storm relatively well.

TIAA-CREF

The financial services organization, TIAA-CREF, had a diversified investment portfolio during the 2008 financial crisis that included a mix of domestic and international stocks, bonds, real estate, and other asset classes. This diversification also helped to mitigate the impact of the crisis on the company’s performance and allowed it to continue to provide investment services to its clients throughout the crisis.

Portfolios heavily invested in the financial sector

In contrast, investors who had portfolios heavily invested in the financial sector experienced significant losses during the 2008 financial crisis. This was due to the fact that the financial sector was one of the hardest hit during the crisis, as the global credit markets seized up and many financial institutions faced losses and failures.

For example, many investors who had portfolios heavily invested in financial sector stocks suffered significant losses as these stocks lost value during the crisis. This highlights the risks of investing heavily in a single sector, as sector-specific risks can have a significant impact on portfolio performance.

Here are some examples of real-world investors who had portfolios heavily invested in the financial sector during the 2008 financial crisis:

Bear Stearns

The investment bank was heavily invested in the mortgage and real estate sectors, which were among the hardest hit during the 2008 financial crisis. The company’s exposure to these sectors, combined with a lack of diversification in its portfolio, led to significant losses and ultimately resulted in its acquisition by JPMorgan Chase.

Lehman Brothers

The 2008 financial crisis also had a significant impact on Lehman Brothers, a large investment bank based in the United States. Lehman Brothers was one of the largest players in the subprime mortgage market and held a large portfolio of risky mortgage-backed securities. The company’s exposure to these sectors, combined with a lack of diversification in its portfolio, led to significant losses and ultimately resulted in its bankruptcy.

Freddie Mac and Fannie Mae

Fannie Mae and Freddie Mac, a government-sponsored enterprise (GSE) was also heavily invested in the mortgage sector, which was hit hard during the 2008 financial crisis. The GSE’s exposure to this sector, combined with a lack of diversification in their portfolios, led to significant losses and ultimately resulted in their government takeover.

These examples show that heavily investing in a single sector, particularly during a financial crisis, can lead to significant losses and can put the stability of an investment portfolio at risk. In contrast, portfolios with a diverse mix of investments can help to reduce the impact of market downturns and provide a more stable long-term performance.

Comparison of performance during the crisis

Studies have shown that portfolios with a diverse mix of investments outperformed those heavily invested in the financial sector during the 2008 financial crisis. According to a report by Morningstar, during the height of the crisis in 2008, portfolios with a mix of stocks and bonds outperformed portfolios heavily invested in the financial sector by several percentage points.

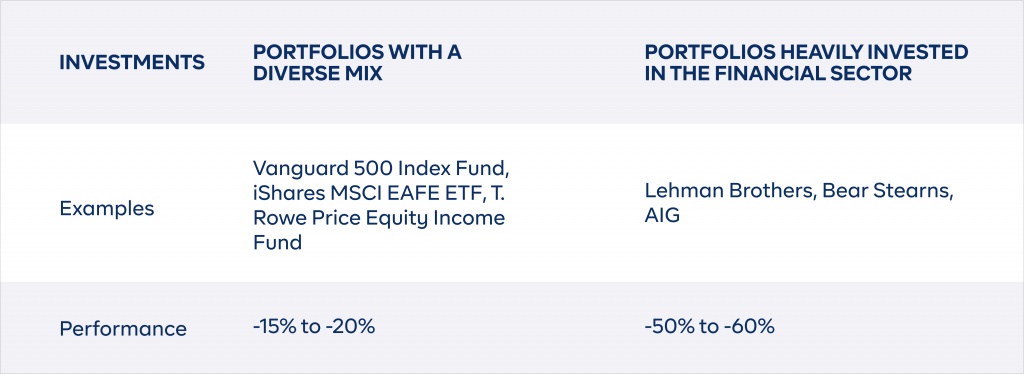

Here’s a comparison of the performance during the 2008 financial crisis between portfolios with a diverse mix of investments and portfolios heavily invested in the financial sector:

It is evident that portfolios with a diverse mix of investments that included stocks, bonds, and other assets, generally saw a decline in performance, but the losses were limited to around -15% to -20%. For example, the Vanguard 500 Index Fund, which tracks the performance of the S&P 500 Index, saw a decline of 18.3% from the end of 2007 to the end of 2008. The iShares MSCI EAFE ETF, which invests in developed market stocks outside the US, saw a decline of 26.2% over the same period. The T. Rowe Price Equity Income Fund, which invests in large-cap stocks with a focus on dividend income, saw a decline of 19.7% over the same period.

On the other hand, portfolios heavily invested in the financial sector saw much larger losses during the crisis. For instance, Lehman Brothers, one of the largest investment banks in the world, filed for bankruptcy in September 2008, leading to significant losses for investors who had invested in the company’s stocks and bonds. Bear Stearns, another major investment bank, was also impacted severely by the crisis and was eventually acquired by JPMorgan Chase at a fraction of its previous market value. The insurance giant AIG also faced significant losses, leading to its eventual bailout by the US government.

It is important to note that these figures are close generalizations and the performance of individual portfolios may vary.

However, this comparison provides clear evidence of the benefits of portfolio diversification and the importance of having a well-diversified mix of investments in times of market volatility and economic uncertainty.

Conclusion

This case study highlights the importance of having a well-diversified investment portfolio to help reduce the impact of market downturns and provide a more stable long-term performance.

The 2008 financial crisis demonstrated the importance of portfolio diversification. Prior to the crisis, many investment portfolios were heavily invested in the financial sector, which suffered significant losses during the crisis. In contrast, portfolios with a diverse mix of investments experienced less impact and had a more stable performance.

Recommendations for future investment strategies

Based on the findings of this case study, it is recommended that future investment strategies should place a strong emphasis on portfolio diversification. This includes investing in a mix of different asset classes, such as stocks, bonds, and real estate, as well as investing in a mix of different sectors and industries.

Here are some recommendations for future investment strategies that can be considered based on the findings of this case study:

- Diversification of investments: It is recommended to have a diverse mix of investments in the portfolio, including stocks, bonds, real estate, commodities, and other asset classes. This can help spread the risk and minimize the impact of any one sector in case of a market downturn.

- Avoid concentration in a single sector: Avoiding over-concentration in a single sector, such as the financial sector, can help mitigate the impact of any sector-specific crisis.

- Regular review and adjustment of the portfolio: Regularly reviewing and adjusting the portfolio can help ensure that the investments align with the investor’s goals and risk tolerance.

- Active management of the portfolio: Active management of the portfolio, including monitoring the market trends, and adjusting investments as needed, can help improve the overall performance of the portfolio.

- Consider alternative investment options: Investing in alternative investment options, such as hedge funds and private equity, can provide an additional layer of diversification and help improve the overall performance of the portfolio.

- Seek professional advice: Seeking the advice of a professional financial advisor can help investors make informed investment decisions and implement effective investment strategies.

Additionally, investors should consider implementing a strategic asset allocation plan that regularly rebalances their portfolio to maintain an optimal level of diversification. By following these recommendations, investors can help to reduce the impact of market downturns and improve their overall investment returns.

ADDITIONAL SOURCES

ALSO READ

The Power of Compound Returns on Long-term Investment Growth

Behavioural Finance in Action: How Emotions Affect Your Investment Decisions

Survey on Personal Finance in Nigeria

Cash Flow Management for Startups and Hyper-growth Companies

Financial Abuse: Recognizing the Signs and How to protect yourself