When money is involved, couples have one big question on their hands. Should they pool their resources together, save individually, or have a combination of both? And does pooling resources have an advantage over individual financing?

The concept of pooling resources is not new. For centuries, man has pooled resources together to attain a goal too difficult or daunting for one party to achieve alone. Think of it as divide and conquer. Pre-historic man pooled their collective strengths to overcome big prey by hunting in groups. Nation-states pool resources to combat a common enemy. Scientific organizations pool and share intelligence and findings to solve a common problem.

The same concept is applicable in the world of finance. Pooled funds, otherwise called pooled vehicles (PIV) or managed funds are a fairly common means of investing. They are described as a collective investment scheme in which funds from different investors are pooled to purchase an investment asset. Common examples are mutual funds, hedge funds, or exchange-traded funds (ETFs).

There are other funding ventures that fall within this category. Employees have been known to make monetary contributions in buckets known as Ajo. Organizations set up cooperatives to meet the common and economic goals of their members. Crowdfunding is another typical example. There are many other instances that cut across socio-economic lines on a micro-level – sharing a ride, pooling money together to purchase supplies in bulk, making contributions to throw a friend a surprise party etc. We can go on and on.

What they all have in common is the propensity to relieve individuals of the financial stress of saving for big goals, by distributing the burden among others, maximizing the advantage, minimizing the risk, and making it easier to meet the desired goal.

A joint account is another example of pooled funds, only in this case, it requires just two individuals as opposed to a larger group of strangers. However, the concept and goal remain the same.

So far, we have highlighted several advantages of pooling resources. Now, the big question. If random individuals are willing to pool resources together for a common goal, why is the notion of couples saving together a subject of concern?

Togetherness in an age of individualism

“Your money is our money, and my money is my money”. You must have heard this phrase before – the perspective that the income of the male (the breadwinner in most households), belongs to the couple, while the earnings of the female belong to her alone. Locally, divorce rates are climbing steadily. Trust is low. Prenups are becoming more commonplace. And people would rather save individually. Even couples.

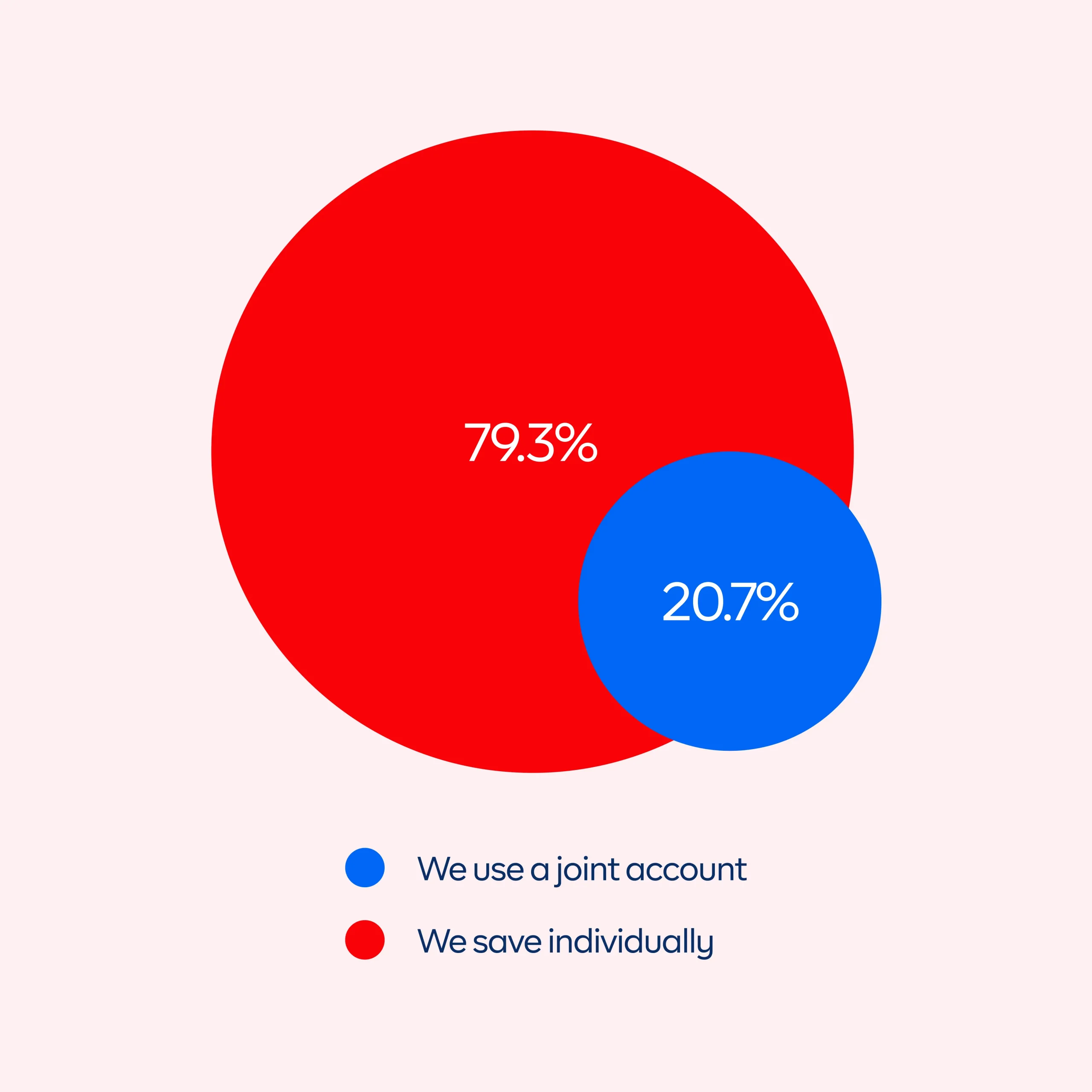

In a survey we conducted among couples recently, 79.3% prefer to save individually, compared to the 20.7% who save with their partners. Why does such a huge margin exist?

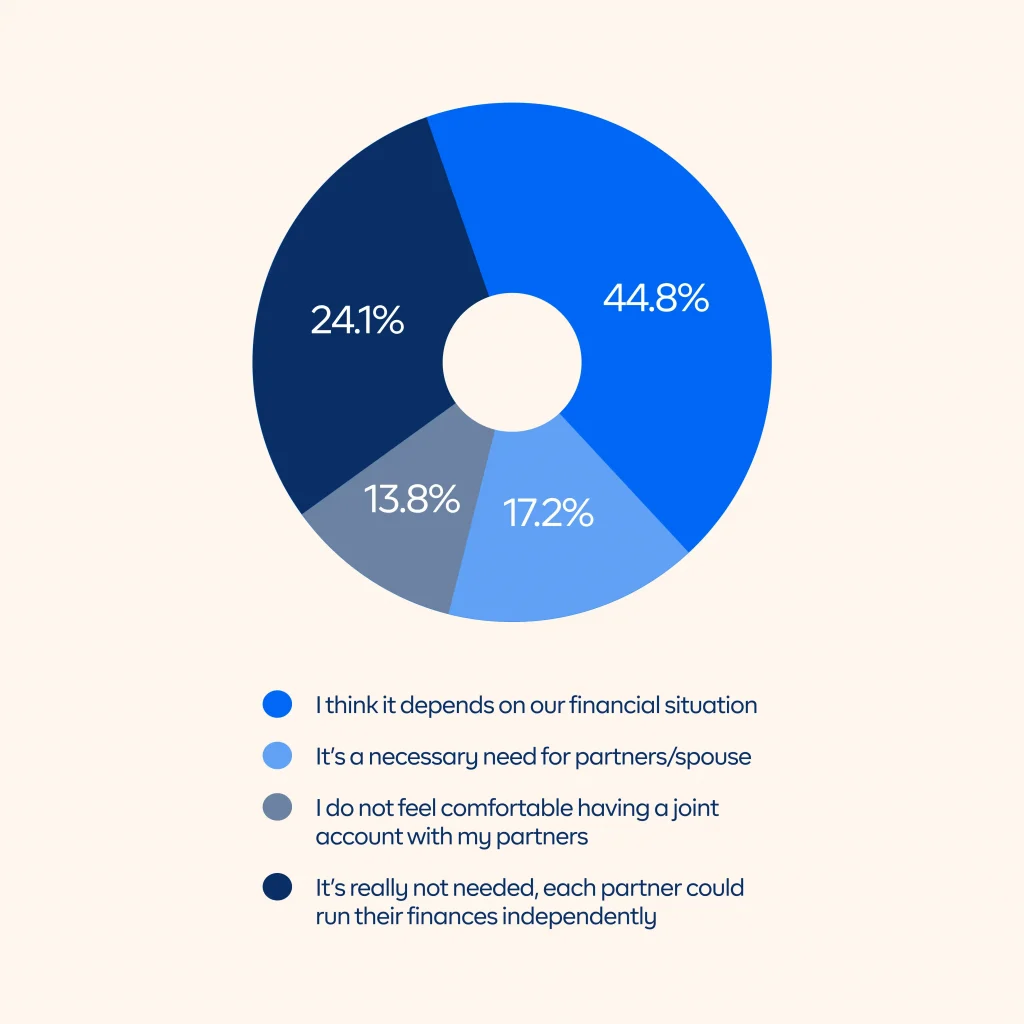

Here’s what we found out – of the individuals who are saving individually, 24.1% do not think it is necessary to save together, 13.8% do not feel comfortable with the idea, and 44.8% think it depends on the financial circumstance. Only 17.2% think it is necessary.

Additional feedback from the survey reveals that a subset of the respondents highlights a prior negative experience with joint savings as a reason for saving individually. Another category believes their unequal financial status is also a clear disincentive.

These cultural nuances capture some of the sentiments around joint savings, predicated on the basis of individualism – a societal theory that favours freedom of the individual over cooperation within a group. In this case, freedom to have complete control of one’s own finance. To withdraw, and deposit as one pleases, even if their partners are aware. These are the times we live in.

Clearly, there’s a challenge. But, there is also a corresponding solution.

The underlying thread here is that most couples are not keen on relinquishing their control over their own money or contributions – in other words, they may not want their monies muddled up with their partner’s. This begs the question – can couples save individually, yet together?

Money Duo offers a dynamic mix of individualism, control, and togetherness, giving you the freedom to save on your own terms and with your significant other simultaneously.

Individualism, togetherness, and Money Duo – the perfect mix couples need to build wealth together.

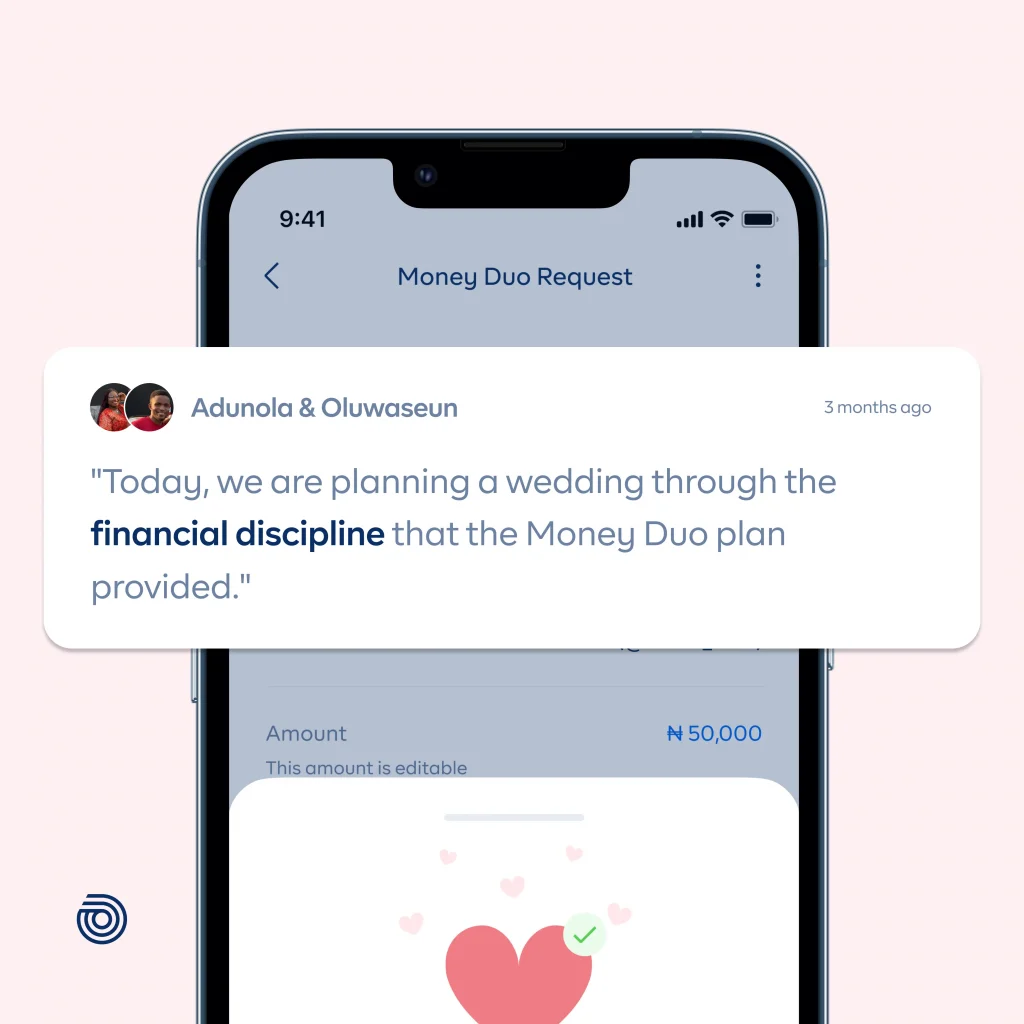

A 2022 study in the Journal of Personality and Social Psychology has shown that whether a couple decides to save together or not could make or break the relationship. They also found that couples who pool their resources together are more likely to experience greater relationship satisfaction. Some of our existing Money Duo couples feel the same way.

Here are some of the things couples have said about Money Duo.

“I believe joint savings brought us closer because where your money is, your heart is too”. – Lisa, 24 on joint savings

“The journey so far has been great as it has brought out a healthy competition between us seeking to outdo each other.” – Adegboyega

Is this purely a coincidence? We beg to differ. But, one thing we know for certain is that financial intimacy and well-being are important recipes for a healthy relationship. We built Money Duo to ensure couples maintain that dash of individuality, spark of togetherness with a sprinkle of love to help them on their financial journey.

A brief history of Money Duo

Money Duo has undergone several changes over the years. Since we shipped Money Duo in 2021, we have made significant updates to the product to address the culturally and psychologically daunting barriers to entry for couples. The 2021 launch offered couples a simple product with a unique value proposition – an easier, more user-friendly way to manage a joint savings plan with your spouse. This was fundamentally different from what was obtainable at the time, negating the need to join long queues or fill needless forms simply to open a joint account with a traditional bank.

Moreso, Money Duo captured the true essence of individualism and togetherness. Though couples saved together, they still had absolute control over their savings. No one couple could withdraw funds saved by the other. And no couple needed the permission or consent of their partner to make a withdrawal, an attribute that comes with owning a dual signatory account – typical of joint savings.

This is why we built Money Duo – a savings product for couples made with both individualism and togetherness in mind.

Feedback we received from couples helped us gather actionable data and insights needed to make further improvements. In February 2023, we launched Money Duo 2.0, a far more transparent version. With Money Duo 2.0, we addressed 2 pertinent issues as captured in the survey above – improved transparency to help couples become more comfortable with the idea, and a feature to help them save flexibly, regardless of one’s financial standing.

Improved transparency: The updated interface clearly distinguished between the collective and individual contributions, ensuring funds aren’t muddled up. The couples have a clear view of their individual contributions toward their goal, and have complete control over their funds.

Individualized savings: couples can now save together regardless of their financial position. With the update, users can edit their savings amount to accommodate their financial capacity. Regardless of how much you or your partner earns, Money Duo levels the playing field so that no one is left out on their financial journey.

Open plan: With Money Duo 2.0, couples can save for shorter periods and their funds are open for withdrawals anytime it is needed.

Is it possible for couples save together and still maintain a semblance of individualism? With Money Duo, they definitely can! Money Duo is fundamentally bridging the gap between the individual, the couple, and their savings needs.

Now, we have made another update to Money Duo called Pods. But, before we dive into this, a little backstory.

How a personal experience birthed a more flexible product update

As the Product Manager for Money Duo, one of my KPIs is to drive its acquisition and adoption. To increase user adoption rate over the course of H2 2023, it became clear we had to make bold changes to the way couples interacted with the product. Luckily, we have since learnt that ideas sometimes come from unexpected places, and a personal experience was just the inspiration we needed to move ahead quickly.

Just before my wedding, my partner and I wanted to start saving towards our new home, and we decided to use Money Duo on Cowrywise. We noticed 2 issues right away. First, we built Money Duo for long-term saving. The implication being that the funds credited to a Money Duo plan would be locked for a year. With our wedding barely 6 months away, it didn’t seem quite optimal to save with Money Duo, so we had to save with Circles, a group savings product on Cowrywise. We optimized the product to address the first problem with the update in February 2023, making Duo an open plan. This meant that couples could now save at any time towards any goal and withdraw whenever they wanted to. See more details here.

The second issue we noticed was that we couldn’t save for our home separately from our general savings, which just meant it would be difficult to allocate funds to a particular goal. This gap presented itself as a great opportunity to offer additional value to couples.

Using my experience as a case study, the design team took up the challenge. We discussed the problem statement at length and after brainstorming numerous ideas; we came up with the idea of buckets, to increase user engagement by giving them more opportunities to keep building wealth.

We designed buckets with treasure chests in mind; a box filled with valuable treasure that the owners hold dear. In this case, couples would be able to save together for the things that matter the most to them; separately.

We called these buckets, Pods.

Pods – the inspiration behind the name

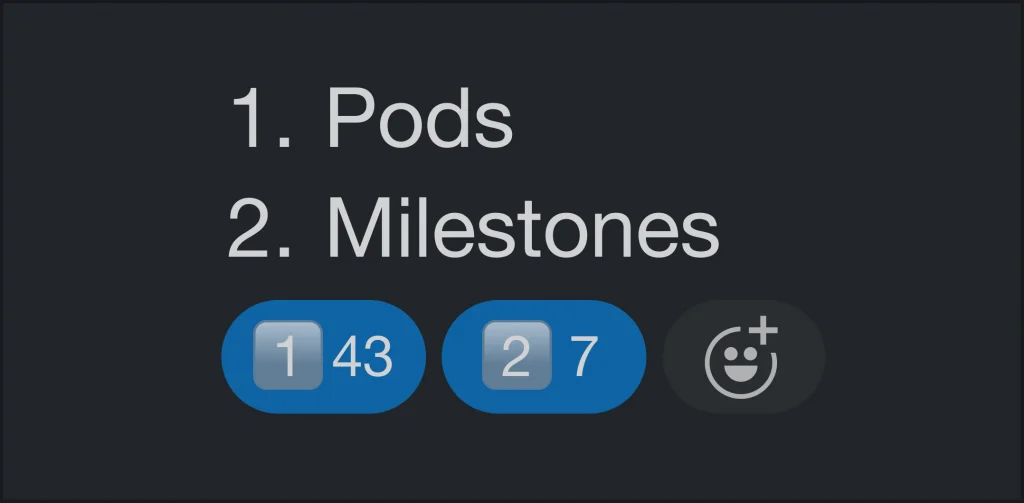

During one of the several design review sessions, we decided to come up with other name options, aside from Buckets. Two other name ideas came up: Milestones, and Pods, which was suggested by Khose, one of our product managers. Pods resonated a lot more and stuck; just like two peas in a pod (pun intended).

If you are familiar with the phrase, you have a good idea of how Pods works. On one hand, the concept of two peas in a pod describes how similar two people or things are. On the other, the design of a pod (an elongated vessel with seeds) is an apt depiction of the feature. Pods typically contain anywhere between 2 – 10 seeds. One pod, multiple seeds. These qualities made Pods the perfect name for the feature.

We also put up a poll in-house to validate the name, and the majority of the team agreed!

Building Pods – initial ideas and development

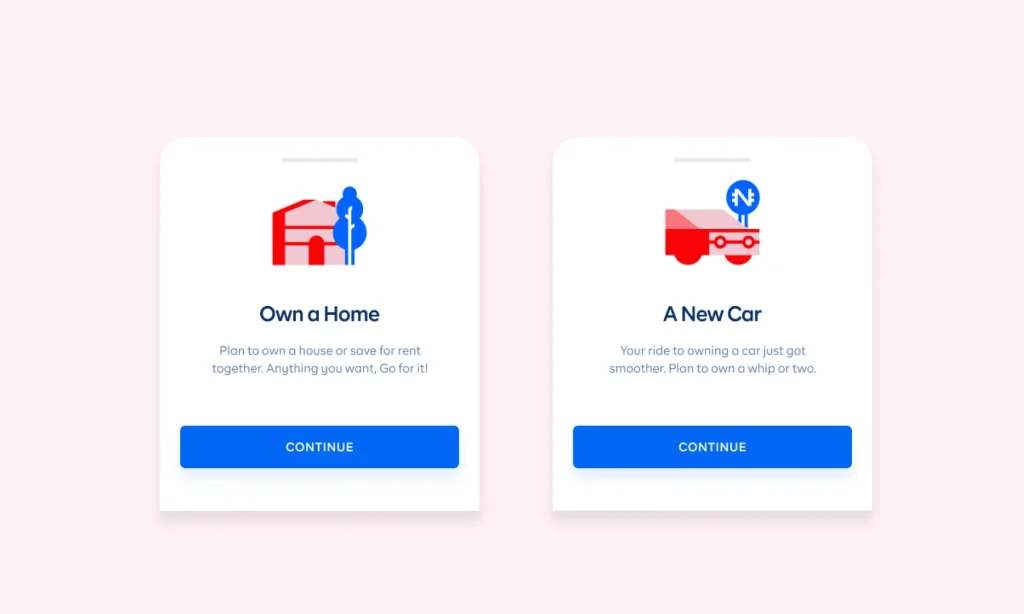

To decide on what Pod to develop, we had a theory. We hypothesized that couples would generally pursue similar universally accepted milestones. To validate this, we interacted with our users and gathered insights that helped us confirm and select the milestones. Couples can now plan and save in the following Pods based on these insights:

- A General Pod

- Owning a home

- Owning a car

- Having a baby

- Their child’s education, or/and

- A Vacation

We believe Pods will help couples work closer together, using them as a clear roadmap toward their shared financial goals.

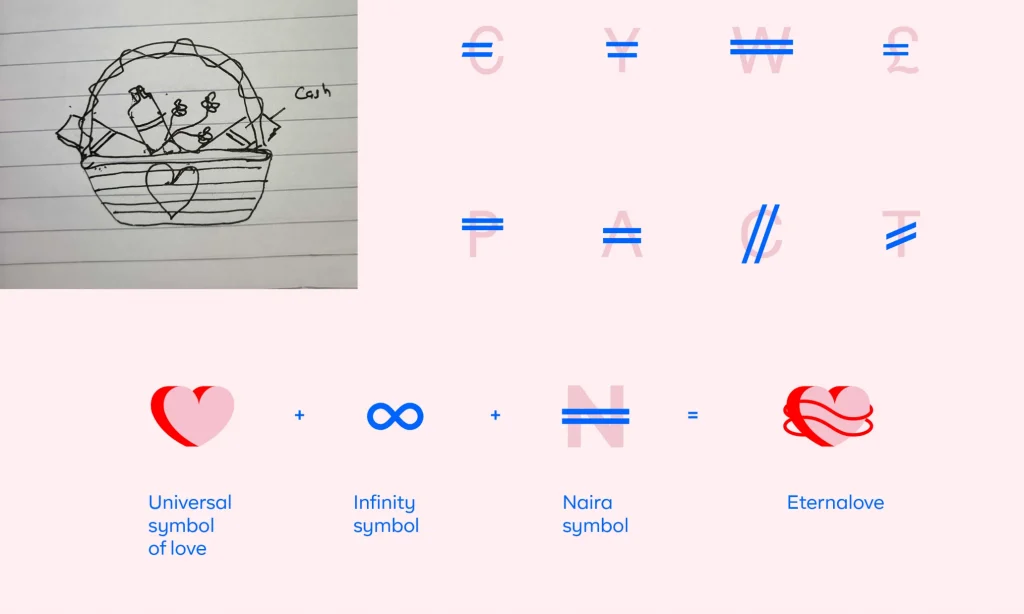

Idea sketches, designs, and iconography

Since, it was a design-led feature, the product designer, Dara Fakoya, worked on the low and high-fidelity design for the idea, as well as initial sketches for the Pods icons, before refining the idea further.

We developed two sets of icons. One to serve as a visual representation for Pods itself – we called this iconic symbol, Eternalove. The other to illustrate the individual Pods.

To design Eternalove, we combined a unique characteristic of most currency symbols (the double horizontal lines) with a heart. The two lines being a representation of the two individuals who have come together to meet a goal.

With the design finalized, work commenced on reviewing the product and tech spec, ensuring it was extremely detailed. The design handoff session, and several meetings with the devs took place within the same time frame to discuss several edge cases that we hadn’t fully taken into consideration during ideation, as well as the overall user experience.

We also needed to allow for backward compatibility, especially as this feature would change the normal Duo behavior, ensuring a smooth migration of existing users.

Test & ship

Once development was done, the team tested the build, checking off key actions and events highlighted in the test guide. Members of the team created several staging accounts, to ensure that we tested almost, if not all possible use cases.

We released the update a couple of weeks ago, and we are so excited about the possibilities Pods will bring to couples.

Two is better than one

At Cowrywise, we place a bet on the financial transparency and intimacy of couples and have armed them with a savings product to match their individuality and their promise to be together forever. It’s much easier for two people to save towards a goal than one!

If you are in a committed relationship, have serious plans for the future, and are not afraid of big goals and dreams, Money Duo is for you. And Pods has made it 10x better.

Here’s how to start your Money Duo

- Sign up or log in

- From the homepage, tap “Save”

- Tap “Money Duo”

- Click on “Start a Duo ?” and follow the prompts to invite your partner

Click here to start saving with Pods.

ALSO READ

Money Chronicles – We wanted to save up 50m

If there’s anything I love about Cowrywise, it is the thought process behind every of your product feature. Cowrywise clearly thinks through the process and designs something practicable and usable for its users.

You did great with Money Duo as a feature, and now with the idea of pods, it gets better. There is no limit to what a couple can achieve together using your platform. Cowrywise is truly innovative.

I love this idea so much! Good job the team! The idea, the design and the motive make me feel mushy. I know the ability to open different savings plans is the single people’s version but I’m jealous ?☺️. Well-done guys!♥️