Dear Startup, your inaction is undermining your finances!

A word of advice to whoever is responsible for your startup’s finances, whether it’s the CEO, CFO, Finance manager or Treasury Lead:

Cash is king, but cash invested is the emperor.

Introduction

Every startup has its own north star metrics. A payment startup is focused on transaction volumes and onboarding merchants; an Insurtech cares about premiums; while a Proptech is concerned with rental and occupancy rates. Clearly, growing these metrics will translate to revenue growth. If not, why else is the startup in business?

That being said, beyond chasing North Star metrics, there are other growth levers, which when pulled with minimal effort, can turbocharge a startup’s income. One of such levers is optimizing available cash balances or reserves. In this article, we identify why sitting on idle funds is costing your startup enormous additional income.

After fundraising, there are new goals to meet

As a startup’s top general (we are zeroing in on finance/treasury folks or whoever manages the startup’s finances), managing your startup’s cash flow efficiently is imperative. It doubles in importance, once your company has raised funding, and more stakeholders, particularly the entities on your cap table, demand evidence that shareholder value is being maximized.

Post capital raise, your organization is likely to have new goals, such as:

- Launching new products with good product-market fit in three months

- Kickstarting a large-scale marketing campaign in six months

- Expanding into other African countries with profitable opportunities in twelve months, and so on.

All these goals will be spread across different timelines and will require different sizes of capital to be deployed. We expect that you have a spending budget and have adequately forecasted your cash flow needs, so you have this covered.

An old habit that needs to die

Now, there is a large tendency for you to leave funds sitting idle in a bank account, and call for those funds when there is an operational need. In our experience, several startups we have engaged with are guilty of this habit. But there are several reasons why this does not make any sense:

- Your startup is sitting on large funds that are not generating any income, whether in USD or NGN.

- Your startup is operating in a climate that is plagued with high inflation, so your purchasing power is depleting by the second.

- The funding market is tougher, and there is even a stronger need to maximize the value of capital you have, to generate additional income that can be ploughed back into funding operations.

The meat of the matter: Analyzing your cash-to-revenue multiple

With this article, our aim is to show you the error of your ways. By using numbers, we show the opportunity costs your startup is incurring, by leaving money on the table due to your inaction. Before we jump into it, we make a few assumptions:

- Your startup is a NGN1bn revenue company called Company Alpha (completely fictitious).

- You can earn an annual return of 10% by investing in the safest, most regulated, most liquid and attractively yielding assets. Our investment products share the same characteristics and yield higher than 10%, but this is just for the purpose of illustrating a point.

- Depending on your startup’s budget and periodic cash flow needs, you have the ability to invest between 5% to 50% of your entire cash balance in a given year.

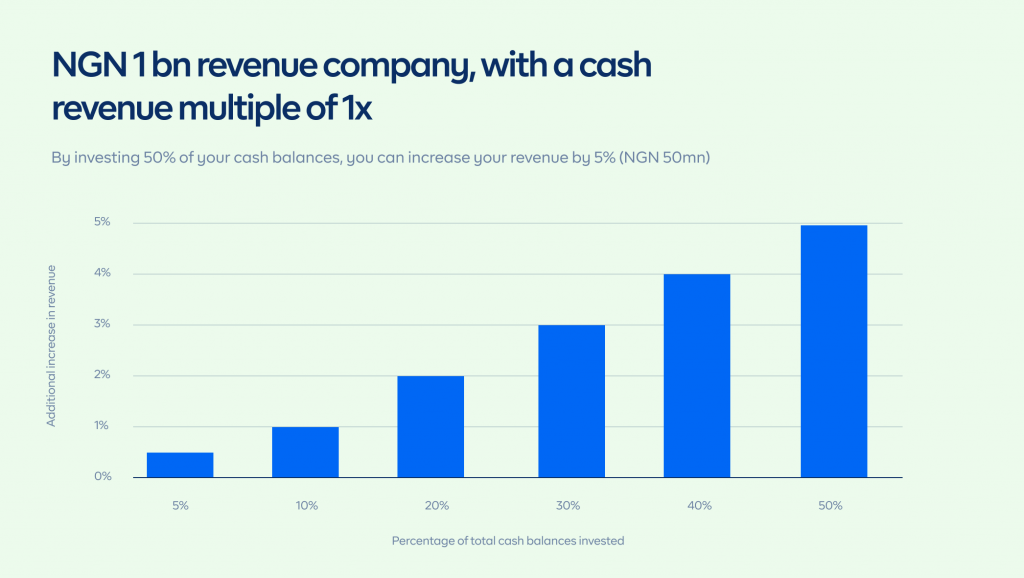

Scenario 1: Having a cash-to-revenue multiple of 1x

What this means, is that Company Alpha has the same value of its cash balances as its revenue. This is usually not the case, as startups typically raise up to 10x or 20x their revenues, but let’s imagine this is the most pessimistic scenario. By investing 10% of your cash balances, you can add 1% to your revenue. If you go further and allocate 50% of your cash balances to investing activities, at a minimum you can add 5% to your revenue, with absolutely no cost. Your gross margin on the investing transaction is technically 100%.

Now, before we lose you, get this: When your startup generates revenue, there is usually an underlying cost of service you incur which eats part of your revenue. However, when you invest your cash balances, particularly through our treasury platform Sprout, the underlying costs are virtually nil relative to the income you generate, so it’s a profitable and high-margin transaction. This is assuming your source of cash funding is equity, and not debt funding that attracts an interest cost.

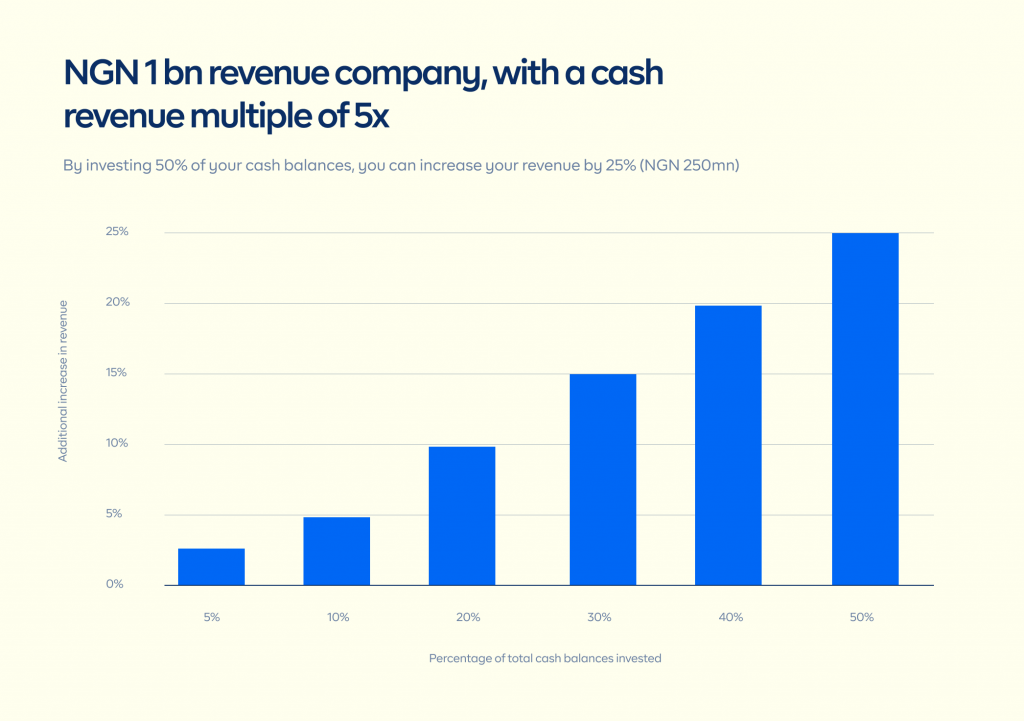

Scenario 2: Having a cash-to-revenue multiple of 5x

If your cash balances are 5x your revenue, the value you can add just by investing explodes. By investing 50% of your cash balances and earning an annual return of 10% in safe and liquid assets, you can create 25% additional revenue.

Let’s raise the stakes even higher!

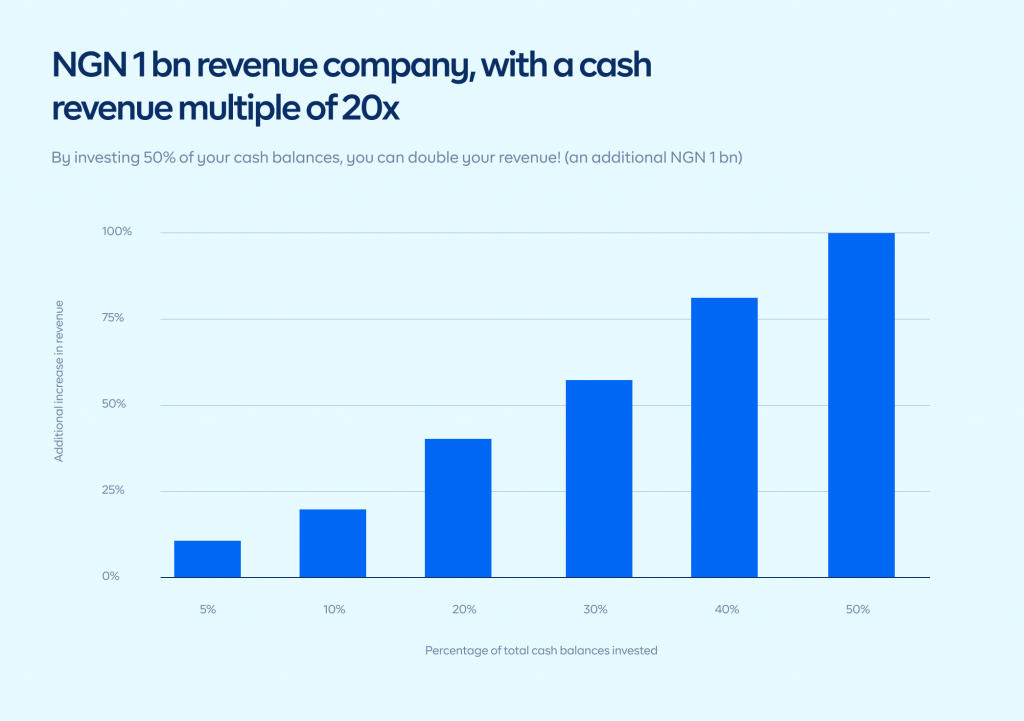

Scenario 3: Having a cash-to-revenue multiple of 20x

With a cash-to-revenue multiple of 20x, and investing 50% of your cash in a given year, you have successfully doubled your revenue size, with minimal effort, just by employing the services of an SEC-licensed investment manager, such as Cowrywise.

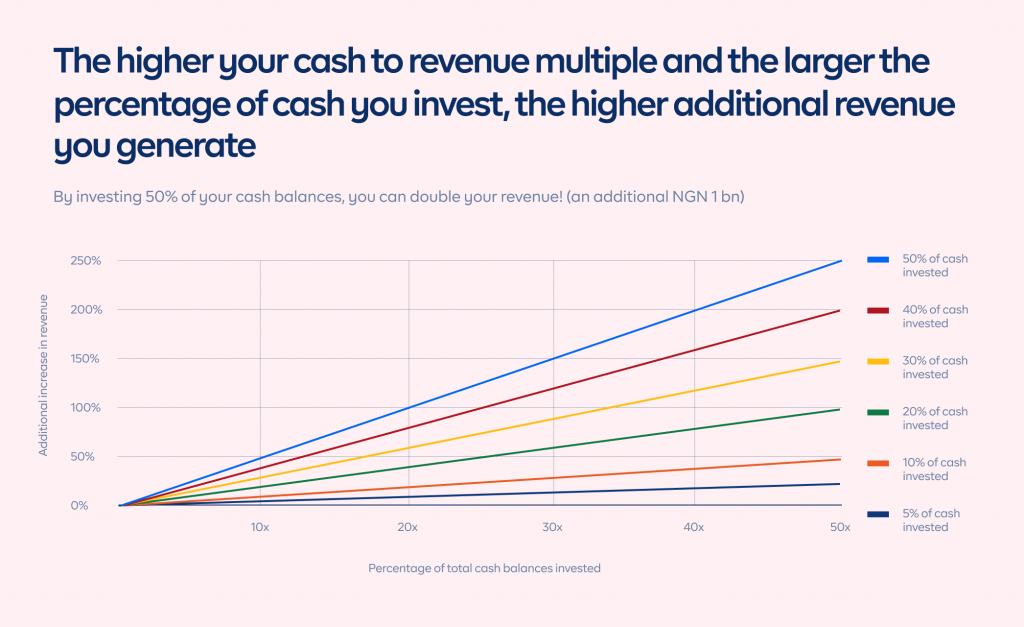

When all is said and done, numbers do not lie

As you will have deduced by now, the higher your cash-to-revenue multiple and the higher the percentage of your cash balances allocated to investing, the higher your total income soars. For startups that raise capital beyond 20x their revenues, the upside potential is ridiculously enormous.

As evidenced by the scenarios explored, we have proved with numbers, why sitting on cash balances with no clear investing plan is an inefficient move. Whatever cash you commit to investing activities, will be value accretive to your income, and is a small lever you can pull with minimal effort to turbocharge your total earnings.

To start benefiting from this requires that you calculate your cash-to-revenue multiple and run several scenarios to see how investing a proportion of your cash can improve your revenue. For USD cash balances, try running scenarios with a 5% annual return and incorporate exchange rate gains from a possible 20% to 40% naira devaluation at the official window, given that the new government’s aim is to unify exchange rates in the near term. You will see that the case for optimizing and investing your cash balances will be much more compelling.

A few words of advice before we depart

Before you embark on the journey of generating additional income through optimizing your cash balances, there are a few thoughts that need to shape your approach:

- You need a clear strategy with timelines for the different projects your startup needs to execute or the different obligations your startup needs to fulfil. This will tie into your burn rate and also your runway. When there is clarity on those fronts, you can now easily develop your cash flow management and investment strategy.

- If your burn rate is high, you should prioritize short-term investments, possibly between 30 to 60 days to maintain your liquidity, should the need to deploy cash arise. If your burn rate is low, you can choose to invest for a longer tenure. It is worthy of note that in the investing market, larger amounts and longer investment horizons attract better returns.

- Return of capital will forever be better than return on capital. Resist the urge to chase high returns that are unsustainable, particularly if your core operating activity is not financial intermediation. The higher the return, the higher the risk involved. As an organization, your first investment objective is capital preservation over anything else.

Ready to optimize your cash holdings?

Our treasury management product, Sprout is a game changer for your investment and treasury operations. Start investing your NGN and USD balances in SEC-regulated investment products and watch your income soar.

Need a copy? Get the report here:

Please check your email for the download link.

RELATED