Why do you do what you do? Why do you choose the investment options you choose? What makes you an aggressive or conservative investor? Do you make investment decisions solely based on logic: facts and figures? Or do your emotions creep in and influence your money moves? How do your emotions and behaviours influence the financial decisions you make? This is where the subject of behavioural finance comes in.

SECTION ONE

What is Behavioural Finance?

Behavioural finance combines traditional finance with psychology to understand why people make certain investment decisions. The central idea behind this is to explain why people deviate from the principles of traditional finance and how these deviations impact investment outcomes.

Traditionally, finance is based on the assumption that human beings are rational, self-interested, and capable of making unbiased decisions. However, numerous studies have shown that you are more likely to make emotion-based investment decisions than rational decisions backed by facts. Human behaviour is often influenced by emotions, biases, and other factors that can lead to suboptimal investment decisions.

As an investor, by understanding behavioural finance, you can address these limitations by incorporating insights from other non-finance disciplines such as psychology and sociology. This will provide a more comprehensive understanding of how you make investment decisions.

A study by DALBAR, Inc. found that the average investor underperformed the S&P 500 by 4.66% per year between 2006 and 2015. This underperformance was largely due to emotional decision-making, such as selling stocks during market downturns and missing out on subsequent rebounds.

In this article, you will learn:

You will learn about behavioural finance and how you can apply it to investment decision-making. Through a comprehensive examination of the key concepts, real-life case studies, and analysis of the link between psychology and finance, you will gain a deeper understanding of the role of emotions and biases in investment decisions.

Specifically, you will learn about the following:

- The definition of behavioural finance

- The impact of emotions, biases, and other psychological factors on your investment decisions

- Common biases and emotions that impact your investment decisions

- Strategies for mitigating the impact of emotions and biases on investment decisions

- The impact of emotions and biases on the overall market

- The importance of understanding how emotions and biases impact investment decisions and how this knowledge can be used to inform investment decisions

By the end of this article, you will have a deeper understanding of how emotions and biases impact investment decisions, and you will be equipped with the knowledge and strategies needed to make better-informed financial decisions.

How does Behavioral Finance work?

Behavioural finance recognizes that emotions, biases, and other factors can play a significant role in investment decisions and can lead to deviation from traditional finance principles. For example, emotions such as fear and greed often drive people to make impulsive decisions, and biases such as overconfidence can lead people to overestimate their ability to make accurate investment predictions. These deviations from traditional finance principles can have a significant impact on investment outcomes and can result in suboptimal decisions that result in lower returns or increased risk.

One of the key objectives of behavioural finance is to identify and understand these deviations from traditional finance and to develop strategies for mitigating their impact. This includes developing an understanding of how emotions, biases, and other factors can impact investment decisions, and developing methods for mitigating their impact. For example, strategies such as creating a systematic investment plan, seeking out unbiased advice, and being aware of common biases can help reduce the impact of emotions and biases on investment decisions.

Behavioural finance is also concerned with understanding how these deviations impact the overall market. For example, research has shown that the collective behaviour of individuals and institutions can have a significant impact on market behaviour and can result in market bubbles or crashes. Understanding how emotions and biases influence market behaviour is critical for developing effective strategies for managing risk and for improving investment outcomes.

During the oil boom of the 1970s and 1980s, many Nigerians invested heavily in the oil and gas sector without fully researching the underlying companies or market conditions. This led to overvaluation and ultimately, significant losses when the market corrected. This herding behaviour can be attributed to the influence of overconfidence, as investors believed that prices would continue to rise, and the impact of fear, as investors did not want to miss out on the potential returns available in the sector.

Why is it important for you as an investor to understand behavioural finance?

As an investor, understanding behavioural finance is important because emotions and biases can significantly impact your investment decisions. You need to understand why you do the things you do and the psychological and emotional factors that influence your daily financial decisions. Here are a few reasons why it’s important:

- Improved decision-making: Understanding how emotions and biases influence investment decisions can help you make more informed and objective decisions. By recognizing your own biases, you can work to counteract their impact and make investment decisions based on your long-term goals and financial data.

- Reduced risk: By acknowledging the impact of emotions and biases on investment decisions, you can reduce the risk of impulsive or emotional decisions that may result in negative financial outcomes. You can also snap out of fear and greed while making financial decisions.

- Better alignment with financial goals: Understanding the impact of emotions and biases can help you align your investment decisions with your long-term financial goals, rather than being swayed by short-term emotions.

Improved market outcomes: Understanding the impact of emotions and biases on the overall market can provide insight into market trends and potential investment opportunities.

“Behavioral finance is concerned with understanding why individuals make decisions that deviate from the standard assumptions of rationality. Behavioural finance recognizes that there are many psychological factors that can influence [your] investment decisions and therefore impact market prices.” – Richard Thaler, Nobel Prize-winning economist and behavioural finance expert.

By recognizing the impact of emotions and biases on your investment decisions as an investor, you can develop strategies to mitigate their impact. This includes understanding common biases, developing systematic investment plans, seeking out unbiased advice, and being aware of the influence of emotions on decision-making. A good way to start is to understand the difference between traditional finance and behavioural finance – how does the former view investor behaviour compare to the latter?

Traditional Finance vs Behavioural Finance

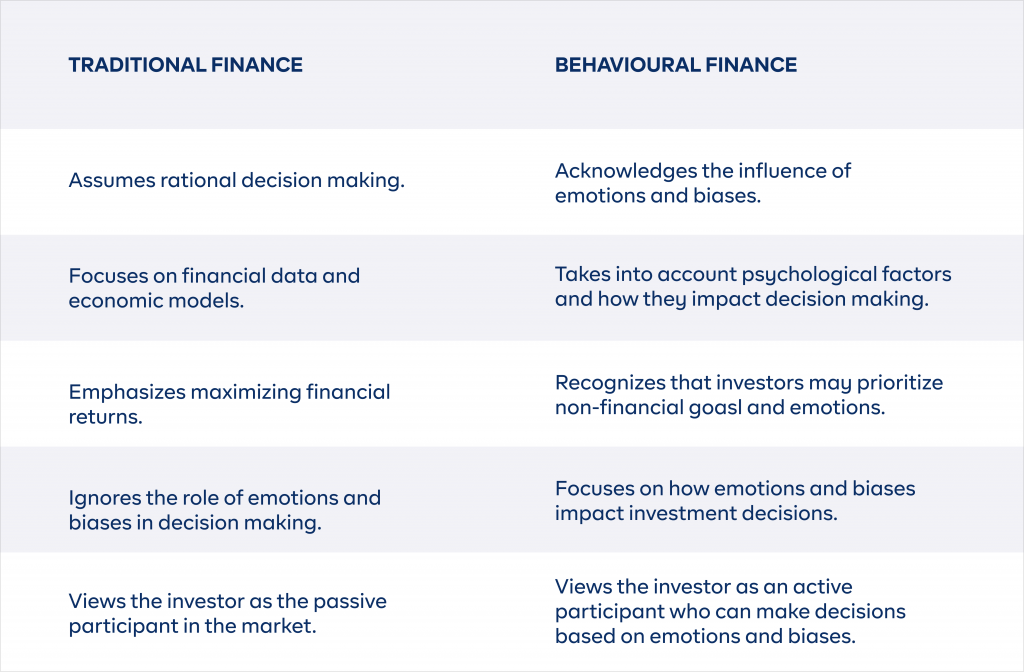

Traditional and behavioural finance are both lenses through which investor behaviour can be viewed and analysed.

Traditional finance views investors as rational decision-makers who base their investment choices solely on financial data, like market trends and stock prices. In contrast, behavioural finance takes into consideration the fact that investors are influenced by their emotions and biases, and that these factors can play a significant role in their investment decisions.

For example, traditional finance might say that if a stock has performed well in the past, it will likely continue to perform well in the future. But behavioural finance would consider the psychological factors that could be driving an investor to invest in that stock, such as the fear of missing out on potential profits or the overconfidence that comes from past success.

In short, traditional finance assumes that investors make perfectly rational decisions, while behavioural finance acknowledges that emotions and biases can play a role in investment decisions and that these factors can impact investment outcomes.

SECTION TWO

Emotions and Investment Decisions

Emotions play a significant role in shaping investment decisions, and research has shown that they can often lead to impulsive or irrational choices that can negatively impact returns. This is why recent studies on behavioural finance have emerged, which seek to understand the impact of emotions on financial decisions and develop strategies to help investors make more informed choices.

For example, fear of market volatility or fear of missing out on gains can cause investors to make hasty decisions without fully considering all the available information. This is often referred to as the “flight to safety” mentality, where investors sell their investments during market downturns to avoid further losses, even if this means missing out on potential gains in the future. Research has shown that this behaviour can result in lower returns over the long term.

On the other hand, greed and overconfidence can lead investors to take on more risks than they are comfortable with, which can result in significant losses. This is often seen in situations where investors chase after high-performing investments, even if they are not fully understanding the potential risks involved. Overconfidence can also cause investors to make investment decisions without fully considering all the available information, leading to poorly informed choices.

A. The role of fear and greed

A central theme in behavioural finance is the role of fear and greed in investment decisions. These two emotions can have a powerful impact on investor behaviour and decision-making, and often drive individuals to make impulsive or irrational choices.

Fear is an emotional response to perceived risk or uncertainty and is often associated with negative outcomes. In the context of investing, fear can cause individuals to become risk-averse and avoid investments that they perceive to be high-risk, even if they offer the potential for high returns. This can result in missed investment opportunities and lower returns over the long term. For example, during market downturns, individuals may sell their investments out of fear, even if this means missing out on potential gains in the future.

On the other hand, greed is the desire for material wealth or gain and is often associated with taking on excessive risk. In investing, greed can drive individuals to chase after high-performing investments, even if they are not fully understanding the potential risks involved. This behaviour can result in significant losses, as individuals take on more risk than they are comfortable with in an effort to maximize returns. For example, individuals may invest in speculative stocks or engage in market timing, trying to buy low and sell high, which can be a high-risk strategy with potentially negative outcomes.

“Invest for the long haul. Don’t get too greedy and don’t get too scared.” – Shelby M.C. Davis

The role of fear and greed in investment decisions highlights the importance of understanding the impact of emotions on financial choices. By recognizing and managing these emotions, individuals can make more informed investment decisions and achieve better outcomes over the long term. This may involve seeking professional advice, creating a well-thought-out investment strategy, and regularly reviewing investments, as well as practising mindfulness and self-reflection to better understand and manage emotional reactions.

B. The influence of regret, hope, and overconfidence

The influence of regret, hope, and overconfidence on investment decisions is another important aspect of behavioural finance. These emotions can have a significant impact on how individuals approach investments and make decisions that can impact their financial outcomes.

Regret is the feeling of disappointment or dissatisfaction with a past decision. In investing, regret can cause individuals to avoid repeating past mistakes and lead them to make conservative investment choices. This can result in missed investment opportunities, as individuals avoid taking risks that could potentially lead to higher returns. For example, an individual who regretfully sold their stocks during a market downturn may avoid investing in stocks in the future, even if it means missing out on potential gains.

Hope is the feeling of anticipation or optimism about future outcomes. In investing, hope can drive individuals to take on excessive risk in the hopes of achieving high returns. This can result in over-optimism and the taking of large, imprudent risks, leading to potential losses. For example, an individual may invest heavily in a high-growth stock in the hopes of achieving quick returns, without fully considering the potential risks involved.

In addition to this, overconfidence can lead individuals to make impulsive decisions, such as trading frequently or taking on excessive risk. This can result in suboptimal outcomes, as individuals do not take into account the potential consequences of their actions. For example, an individual who is overconfident in their stock-picking abilities may take on excessive risk by investing heavily in a single stock, without fully considering the potential risks involved.

As an investor, the influence of regret, hope, and overconfidence highlights the need for you to understand the impact of emotions on your financial decisions. By recognizing and managing these emotions, you can make more informed investment decisions and achieve better outcomes over the long term. This may involve seeking professional advice, creating a well-thought-out investment strategy, and regularly reviewing investments, as well as practising mindfulness and self-reflection to better understand and manage emotional reactions.

SECTION THREE

Behavioural Biases and Investment Decisions

Behavioural biases are systematic errors in thinking and decision-making that can lead to suboptimal financial outcomes. Understanding these biases and their impact on investment decisions is an important aspect of behavioural finance.

Some common behavioural biases in investment decision-making include:

- Confirmation bias: The tendency to seek information that confirms pre-existing beliefs and ignore information that contradicts those beliefs. This can lead individuals to hold on to losing investments and avoid selling, even when it would be in their best interest.

- Hindsight bias: The belief that events were predictable after they have occurred. This can trigger investors to make investment decisions based on past performance, rather than considering the underlying risks and potential future outcomes.

- Anchoring bias: Relying too heavily on the first piece of information encountered when making decisions. This results in individuals disregarding important information and making investment decisions solely based on their initial perception, rather than taking into account the full spectrum of available data.

- Herding behaviour: The practice of conforming to the choices of others instead of exercising independent judgment. This can result in individuals making investment choices that are based on the actions of others instead of taking into account their own financial objectives and level of risk tolerance.

- Overconfidence bias: The proclivity to have an inflated sense of one’s forecasting accuracy and control over outcomes. This can result in investors engaging in excessive risk-taking, making hasty investment decisions, and disregarding potential red flags.

It’s important to understand and recognize these biases, as they can have a significant impact on investment decisions and financial outcomes. By becoming aware of these biases, individuals can make more informed investment decisions and avoid making costly mistakes. This may involve seeking professional advice, developing a well-thought-out investment strategy, regularly reviewing investments, and practising mindfulness and self-reflection to better understand and manage emotional reactions.

The impact of biases on investment outcomes

The impact of biases on investment outcomes can be significant, leading to suboptimal financial results and potentially putting hard-earned savings at risk. Some of the ways in which biases can impact investment outcomes include:

- Overvaluing investments: Bias can lead individuals to overvalue investments, leading them to hold onto losing investments for too long or to pay too much for investments that may not perform as expected.

- Taking on excessive risk: Overconfidence can result in individuals becoming overly bold and taking on risks beyond their means, resulting in financial losses and potentially putting their future stability at risk.

- Missing out on investment opportunities: Fear and regret can cause individuals to refrain from making investment moves, such as divesting underperforming investments or putting money into new opportunities.

- Chasing returns: Herding behaviour and anchoring bias can lead individuals to chase returns, investing in popular investments without considering the risks and potential outcomes.

- Making impulsive investment decisions: Overconfidence and hope sometimes trigger individuals to make impulsive investment decisions, such as buying high-risk investments without proper consideration or selling winning investments too soon.

Strategies for mitigating behavioural biases in investment decisions

There are several strategies that individuals can use to mitigate behavioural biases in their investment decisions and help ensure that their investments align with their goals and risk tolerance:

- Educate yourself: Gain a thorough understanding of behavioural finance and how biases can impact investment decisions. This can involve reading books, articles, and other resources, as well as taking courses or attending seminars on the topic.

- Develop a written investment plan: Having a written investment plan can help you stay focused on your goals and avoid making impulsive investment decisions based on emotions. Your plan should include your goals, risk tolerance, investment time horizon, and a strategy for achieving your goals.

- Seek professional advice: Working with a financial advisor or investment professional can provide you with an objective perspective and help you avoid making decisions based on biases.

- Use tools to track your emotions: There are tools available, such as journaling or using emotional tracking software, that can help you understand and manage your emotional reactions to investment events.

- Diversify your portfolio: Diversifying your investments can help you avoid over-concentrating in a single stock or sector and reduce the impact of individual biases.

- Consider using automated investment services: Automated investment services, such as Cowrywise Triggers, use algorithms to make investment decisions, helping to reduce the impact of biases.

- Practice mindfulness and self-reflection: Engaging in mindfulness practices, such as meditation or journaling, can help you gain insight into your emotional reactions and improve your ability to manage them.

By implementing these strategies and being mindful of the impact of biases, investors can take control of their investment decisions and improve their investment outcomes.

SECTION FOUR

Real-life examples of how emotions and biases affect investment decisions

- The Nigerian stock market boom and bust of the late 1990s and early 2000s: In the late 1990s and early 2000s, the Nigerian stock market experienced a period of rapid growth, with many individuals and institutions investing in the market. However, this growth was not sustainable, and prices eventually began to fall. The market’s rapid growth was driven by a combination of greed and overconfidence, as many investors believed that prices would continue to rise. When prices began to fall, many investors were left with significant losses, which were compounded by the fear that prices would continue to drop.

- The Nigerian banking sector crisis of 2009: The banking sector crisis of 2009 was driven by the impact of fear and greed. Many banks made impulsive decisions to invest in high-risk, high-return assets, without fully understanding the underlying risks. This resulted in significant losses for the banks and instability in the sector. The crisis was driven by a combination of fear, as banks rushed to invest in these assets in order to maintain competitiveness, and greed, as banks sought to maximize returns.

- The influence of regret in the Nigerian real estate market: Following the 2008 global financial crisis, many Nigerian investors held onto underperforming real estate investments, driven by the hope that the market would eventually recover. This resulted in missed opportunities, as these investors continued to hold onto these assets, which were not performing as well as other investments. The influence of regret also played a role, as many investors were hesitant to sell their investments and take a loss, even though it was in their best interest to do so.

- Herding behaviour in the Nigerian oil and gas sector: During the oil boom of the 1970s and 1980s, many Nigerians invested heavily in the oil and gas sector without fully researching the underlying companies or market conditions. This led to overvaluation and ultimately, significant losses when the market corrected. This herding behaviour can be attributed to the influence of overconfidence, as investors believed that prices would continue to rise, and the impact of fear, as investors did not want to miss out on the potential returns available in the sector.

These examples demonstrate the important role that emotions and biases play in investment decisions and highlight the importance of understanding and mitigating their impact. By recognizing and managing these biases, individuals can make investment decisions that align with their goals and risk tolerance.

What Next?

Now you know all there is to know about behavioural finance and how your emotions may be influencing your investment decisions. What next?

- Reflect on your personal biases and emotions that may influence investment decisions.

- Consider seeking professional advice from a financial advisor or investment manager before you invest

- Develop a comprehensive investment strategy that incorporates insights from behavioural finance, such as taking a long-term perspective, diversifying investments, and avoiding impulsive decisions driven by emotions.

- Practice mindfulness and self-awareness to mitigate the impact of emotions and biases on investment decisions.

- Keep a record of investment decisions, including the reasons behind them, to help identify patterns and improve decision-making over time.

- Join forums and discussion groups dedicated to behavioural finance to engage with like-minded individuals and share insights and experiences.

- Educate yourself on investments and general personal finance.

Conclusion

Behavioural finance offers a comprehensive understanding of how emotions, biases, and other non-rational factors impact investment decisions. This article has shown that emotions, such as fear and greed, play a significant role in shaping investors’ preferences and behaviours. Furthermore, biases such as overconfidence, regret, and hope can lead to suboptimal investment outcomes.

By understanding the influence of these emotional and behavioural factors, you can develop strategies to mitigate their impact and make more informed investment decisions. Prior to now, you may not know why you do the things you do; you may not know why you’re a conservative and aggressive investor but with an understanding of behavioural finance, you can probe your investment decisions and take the necessary steps to combat emotion-based investing.

Happy investing!

ALSO READ

Survey on Personal Finance in Nigeria

New Studies on Saving Money in 2023