Time waits for no one…

You must have heard this statement before – either in passing, from a friend, or even from a motivational speaker. It comes from a school of thought that believes time is an unstoppable law of nature, and that it will continue to march on regardless of what we do.

The statement is evergreen and applies to anything of significance. Luckily, it is also a law we advise you to take advantage of, especially regarding your financial future.

If you are young, of working age, gainfully employed, running a business or side hustle, and earning an income, this report is for you.

Tomorrow is a bad time to invest

The best time to have started investing was yesterday – that’s the old law. Investing tomorrow? Wrong move! The best time to have started investing, depending on your age, was at least 10 years ago. But, before we dive into it, let’s give you some perspective.

By the time you finish reading this report, depending on how fast you read, and how many times you read it to digest it, 5-10 minutes would have gone by. You have probably spent a couple of hours in traffic today, and a few more in pointless or hopefully productive meetings.

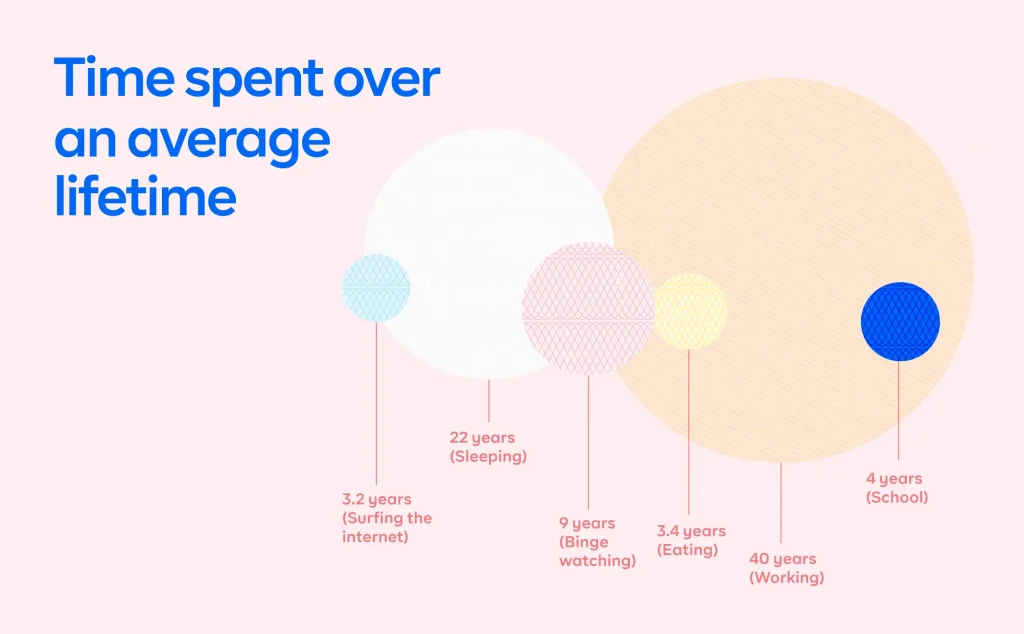

You have most likely spent four years (or more depending on ASUU) in University; plus countless hours studying, reading, and hustling in between. There’s a high chance you entered the workforce in your early to mid-twenties (or you are about to) and will spend the next 90,000 hours or about 40 years of your adult life working to make a living (if all goes well and you retire at 60). This doesn’t take into account the 3.4 years you will spend eating, 22 years sleeping (which is typically 1/3 of the avg. lifetime), 3.2 years you will spend online, and 9 years that will pass by while you watch your favourite series. This is assuming you live till you are 70 or 80, even though the current life expectancy in Nigeria is 55.75 years.

By now, you are beginning to see the bigger picture and draw a similar conclusion, which is that we are literally spending time like a tangible commodity because we actually are.

The question is: What has your money been doing all this time?

The takeout: Live your life, and do the things you love while your money works for you

Time is money. Literally.

Time is money is another phrase you are most likely familiar with. But, the idiom has always been used to discourage one person from wasting someone else’s time. Or to encourage people to actively spend their time pursuing ventures that could earn them money. The interesting thing about investing and the beauty of compounding is that you can convert your time to returns by investing early.

If you invest NGN100,000 to earn 10% in 1 year, you’ll have NGN110,000 in total. That is, NGN100,000 + NGN10,000 (interest). With compound interest, in the second year, you’ll earn 10% on NGN110,000 and not just the NGN100,000. You get the picture, right?

Compounding is basically getting returns on your returns.

While it’s easy for young people to put off investing till a later time, it’s not advisable. Waiting till you become financially buoyant is likely not going to provide any meaningful benefit. Investing is about playing the long game. The longer you have your money invested, the more likely you are to reap long-term gains.

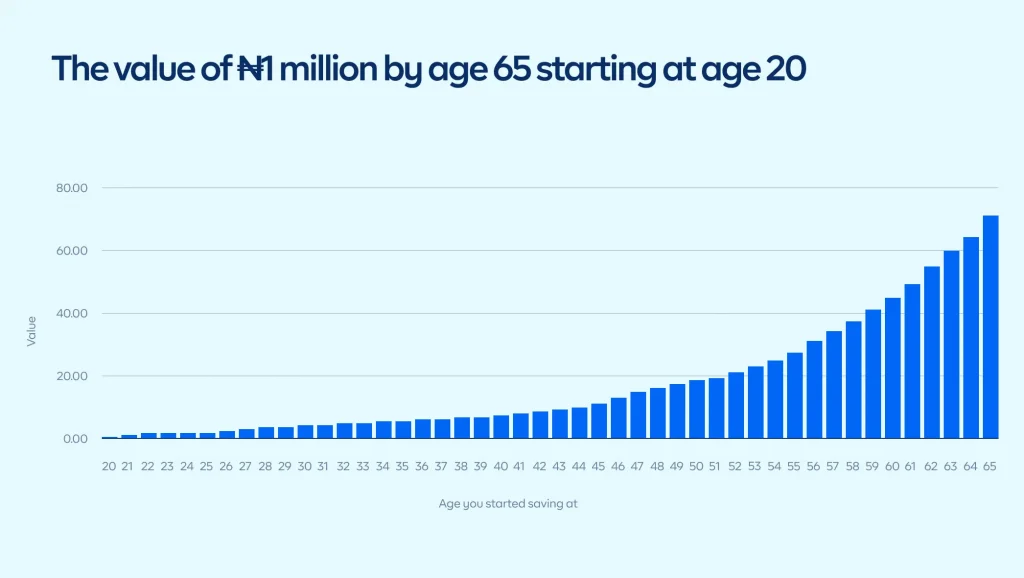

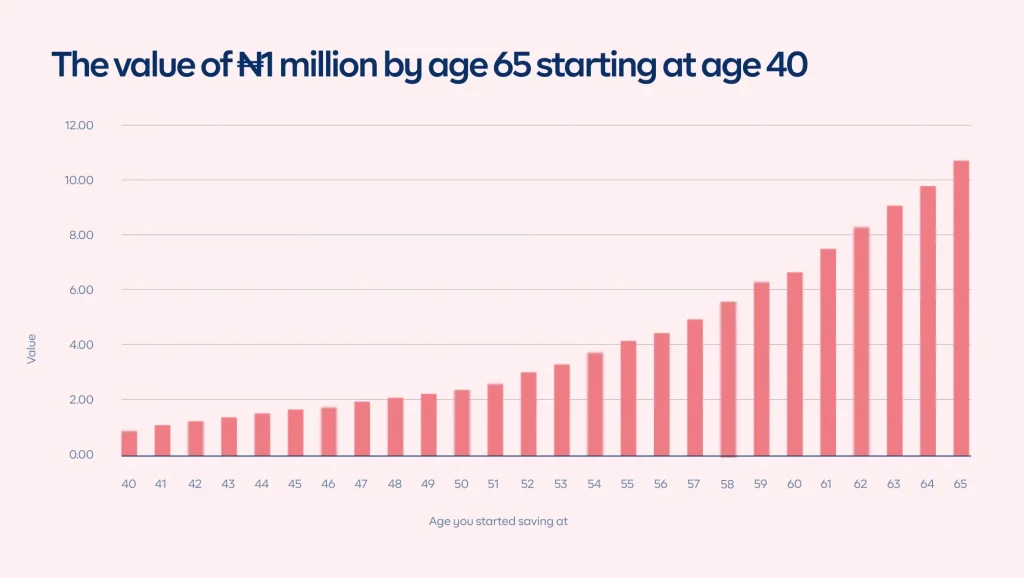

The benefits and returns on your investments will differ depending on your capital and when you started investing. Let’s look at this from 3 different scenarios to give you a better picture. Each scenario has similar characteristics – the age of retirement, the initial investment, and an interest rate of 10% per annum. The difference is the age they started investing which will impact the returns as you are about to see.

Scenario 1 – Mr. Cowrywise

Mr. Cowrywise, as he is fondly called, is an 18-year-old, 200L student of Finance. His peers say he’s a money whiz and is wise beyond his years. His father is a businessman and he’s learnt the fundamentals of building wealth from him. He had saved his first million by the time he clocked 20 and decided to invest it.

He invested the entire sum in a mutual fund, (a low-risk investment vehicle that earns you returns over time), for a 45-year period, ensuring the dividends were reinvested. At a 10% interest rate per annum, and thanks to compounding, Mr. Cowrywise’s initial 1 million Naira investment would have grown in value to about ₦72.89 million by the time he retires at 65; enough to take care of himself and sip margaritas on the beach.

Let’s take a look at how Mrs. Moneywise is faring in our next scenario.

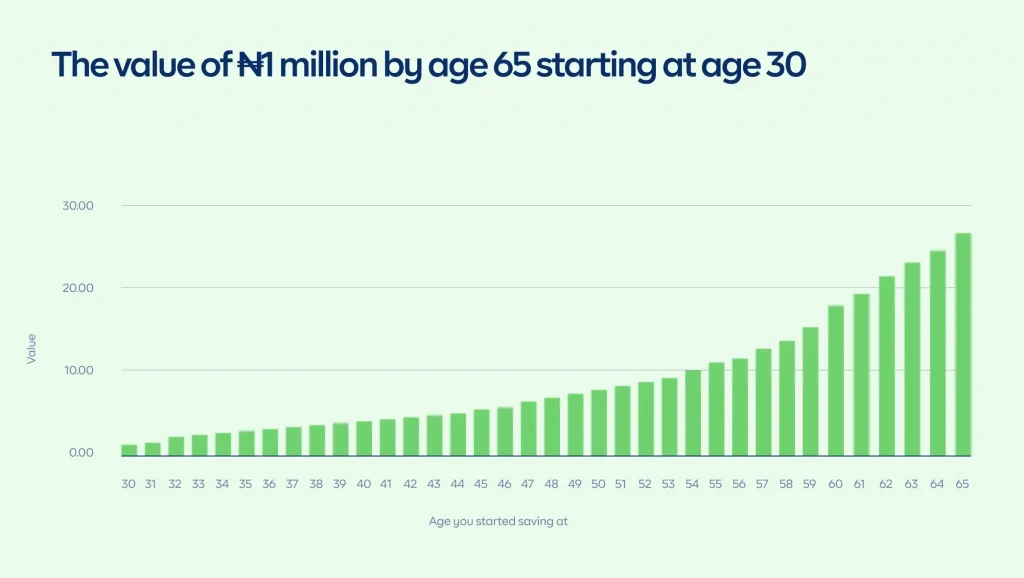

Scenario 2 – Mrs. Moneywise

Mrs Moneywise just celebrated her 30th birthday a couple of days ago, and it gave her time to reflect on her life and accomplishments. She has worked at one of the top FMCG firms since she graduated a few years ago, and got married the year before. Mrs. Moneywise combined ₦500,000 which she had saved up, with a ₦500,000 cash gift which she received from a few friends for her birthday.

She invested the entire sum at a 10% interest rate per annum, with instructions to reinvest the dividends. By the time Mrs. Moneywise retires at 65, her ₦1 million investment would have grown to about ₦28 million. Not bad for passive income!

Hang on, Mr. Overwise is next.

Scenario 3 – Mr. Overwise

Mr. Overwise has always been told he looks younger than his age, even though he’s 40 years old. He’s been a Managing Director for an Oil and Gas Company for a few months and has amassed a small fortune for himself, even though he made sure he didn’t spoil his kids. His daughter, Nifemi’s graduation is coming up and he’s been thinking about what gift to give her. He made up his mind after he had a conversation with a friend of his, who worked with a popular wealth tech company.

He invested the sum of ₦1 million in her name. The same rate at 10% per annum. Same instruction to reinvest the dividends. By the time Mr. Overwise retires at 65 (25 years later), his daughter will have about ₦11 million; the gift that keeps on giving!

Time makes all the difference

3 different investors. 3 different outcomes. Time is the only difference. According to Warren Buffett, “Successful investing takes time, discipline, and patience”. We agree.

There’s a world of difference between investing early and investing later in life. Starting your investment journey at 20 automatically gives your money a 10-20 year head start over someone who starts at 30 or 40 years old with the same amount. The longer you put your money to work, the more wealth it can generate over time.

The gap between the return on investment for Mr. Cowrywise and Mr. Overwise is wide – a whopping ₦62 million.

I hear you saying, “What about Naira devaluation?”, “Why should I invest in Naira?”, “I don’t want to lose money”, and “the market is volatile”…some of these are forces you cannot control. What you can control is your time and how you spend it. You can spend it by investing early starting today, or waiting till the time is right. We’d advise you do the former. From an investment standpoint, there is no ‘right’ time and there are numerous options available to you to help you navigate the market.

Start with mutual funds

You can start by investing in low-risk investment vehicles like mutual funds, categorized into conservative, moderate, and aggressive risk buckets, making it easier for you to invest. You will find mutual funds from 9 of the biggest fund managers in the country spread across the risk buckets from Stanbic IBTC to United Capital, ARM, Meristem, Lotus Capital, FSDH, Vetiva, Afrinvest, SFS, and Trustbanc.

Not sure what your risk appetite is? Check our risk assessment calculator.

If you are concerned about the devaluation of the Naira, you can invest in dollar mutual funds which some of the aforementioned fund managers provide.

By now, the importance of investing early should be pretty clear. Now, what should you do?

Time is of the essence

Start early: We would advise that you start with what you have and invest often. Allocate at least 20% of your income towards your saving and investment needs on a monthly basis. Investing early is a financial superpower, and it’s no longer enough to wait till you are financially buoyant.

If you haven’t started investing already, start today. In fact, start right now! Log in to the Cowrywise app, and purchase a mutual fund from any of our fund manager partners.

If you don’t have the app, you can download it here.

Take advantage of compounding: If starting early is a superpower, compounding is the superhero formula or steroid. Compounding turbocharges your investment, allowing you to generate more wealth over time. Starting early helps you harness the three key ingredients – initial capital, reinvested earnings, and time – to keep your investments on a growth trajectory.

Capital appreciation: This occurs when the value of an asset that you own increases over time. For example, if you purchased 100 units of a mutual fund at N10/unit, and sold it 3 years later at N30/unit, you would have gained an additional N20/unit on all the units you own.

Maximize diversification: Any wise investor would advise you not to put all your eggs in one basket. And they would be right. Adopt a diversification strategy to minimize portfolio risk and volatility by investing in Naira and dollar mutual funds.

Take risks: Starting your investment journey early means you have the capacity to cushion more risks. Any investment advisor will recommend and allocate investment vehicles depending on your objective, but also your age. Aggressive, high risk – high reward, growth assets for younger investors vs low-risk, conservative assets for older investors.

Final words

There’s never a bad time to invest, but there’s a best time to do so. The impact of subsidy removal, inflation, and the rising cost of living may mean money is harder to come by. Again, these are largely outside your control. But, time isn’t, and investing early gives you an edge and the capacity to manage risks. Overall, time in the market is a lot more important than trying to time the market.

“I love the fact that with Cowrywise I can move on with my life and still invest without moving a finger. I also love the fact that I can watch my money grow every day.“

– Babajide Olushola, Investing made easy.

Time is money, and the key to unlocking wealth is to start investing early, and there’s no better time than right now!

Yay! Thank you so much! ?

You should receive an email with your download link shortly

Ready to start investing? Get started.

ALSO READ

Why Investing Early Is Important

The Power of Compound Returns on Long-term Investment Growth

10 Common Investing Mistakes To Avoid