I still remember what I was doing when I got the email titled “You’ve unlocked a new badge!”

In the body of this email, I was told that I had achieved “The Harvester” badge which meant that I had earned at least ₦10K in investment returns.

Me? Earn ₦10K without actively working for it?

If you know where I’m coming from, you would understand how crazy this achievement is. By the time I earned the next level of the harvester badge and the next level after that, it became more apparent how easily I could earn extra income if I just let my investments grow!

I wish I could share my full story and why passively earning money in the form of returns is such an achievement, but I’ll leave that for another time.

The focus here is on the fact that, if I didn’t leave my investments to keep working for me, I’ll not be here with many more wins since that first email about unlocking The Harvester badge.

Auto Reinvest: How to Make your Investments Work for you

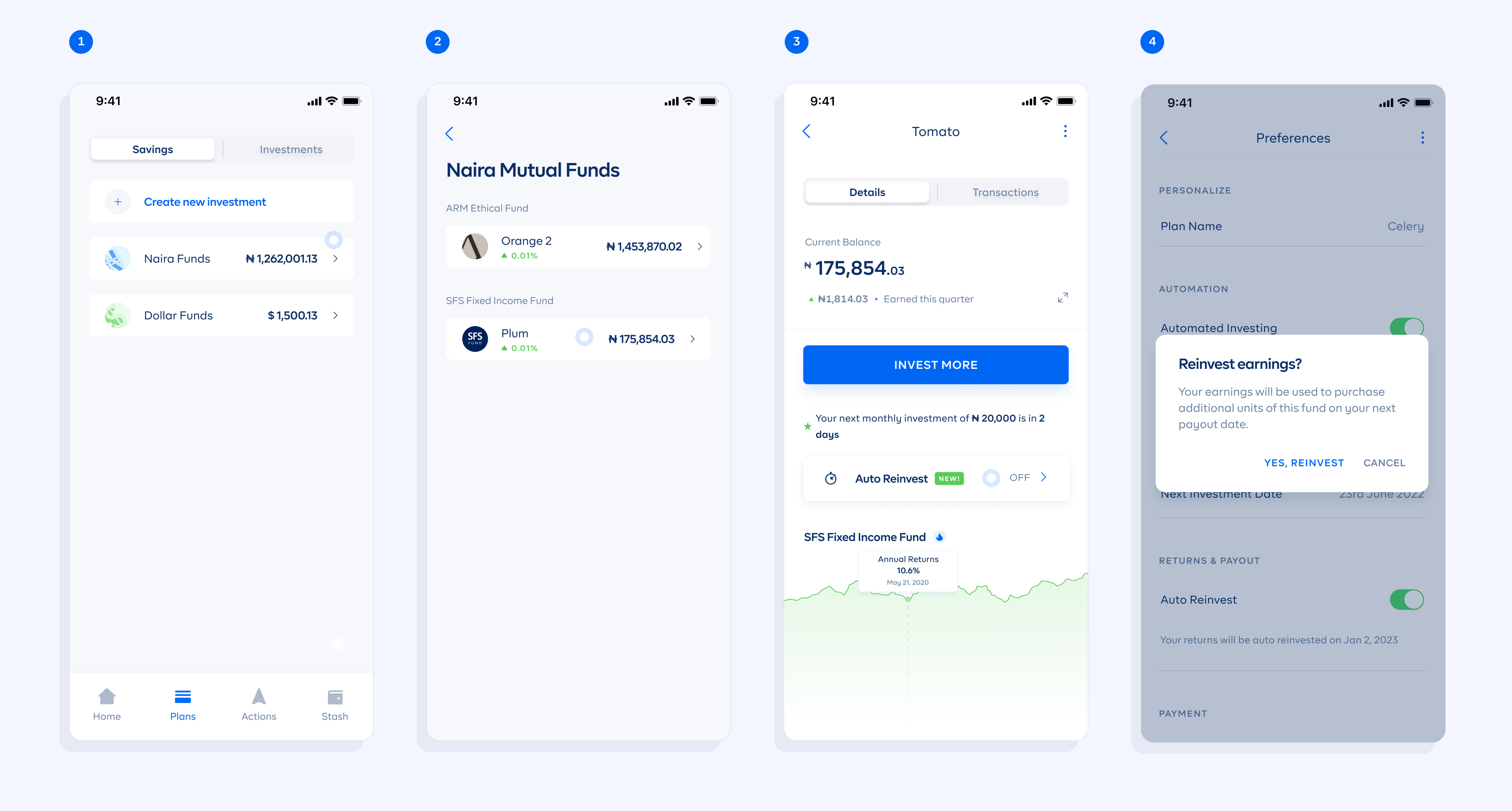

With the new Auto Reinvest feature on Cowrywise, you can automate the process of putting your investments to work even more efficiently. Beyond allowing your funds to grow and earn you returns, this feature ensures that any dividends paid to you can keep working to earn you even more.

Previously, every investor on Cowrywise received their dividends in their Stash whenever a payout was made. This meant that investors who wanted to reinvest returns had to do so manually by buying additional units of the investment.

With Auto Reinvest turned on, you can relax as an investor knowing that additional units of your investment will be automatically purchased on your behalf.

Turn on Auto Reinvest

Note: Some fund managers pay dividends (excluding the original returns you get on your investment), while some do not. It is these dividends that you’re able to Auto Reinvest if fund managers payout.

The Power of Compound Returns

$81.5 billion of Warren Buffett’s $84.5 billion net worth came after his 65th birthday. Our minds are not built to handle such absurdities.

– The Psychology of Money

As they say “money is a terrible master but an excellent employee”. It is dangerous to not master money. However, mastering money and effectively putting it to work results in a lot of benefits. One of those benefits is enjoying the power of compound returns.

Compound Returns is what’s earned on top of returns already earned. It can significantly grow your wealth but only patient investors reap its fruits.

Say you invested ₦100k to earn 10% in one year, at the end of the year, you’ll have ₦110K.

You didn’t actively work for the extra ₦10k but earned it as returns on your original ₦100k investment. That is, ₦100k + ₦10k (returns).

Thanks to compound returns, in the second year, you’ll earn 10% on ₦110k and not just the ₦100K you initially invested.

“Warren Buffet is a phenomenal investor. But you miss a key point if you attach all of his success to investing acumen. The real key to his success is that he’s been a phenomenal investor for three-quarters of a century.

– The Psychology of Money

Three-quarters of a century is enough time to let your compound returns run wild, and that was the real superpower that Warren Buffett had. This is the same superpower that’s now available to you.

Why should you turn on Auto Reinvest on all your Cowrywise investments?

- To enjoy compound returns

- It helps to eliminate the stress of manually reinvesting your dividends

- To limit the temptation of spending your dividends and allow it to earn you more

How to set up Auto Reinvest on all your Cowrywise Investments

- Login to your Cowrywise account. Sign up for free if you don’t have an account yet.

- Click the “Plans” tab, then click “Investments”

- Tap “Naira Funds”, choose any of your plans and turn on Auto Reinvest

Got any questions?

Please leave them in the comments section, I’m more than happy to help.

I perfectly understand mutual funds and auto-investment.

Thank you

Wow, this is so nice and enlightening

Thank you ??

Does auto reinvest still incur brokerage fee ?

I invested 4000 in naira invested but still get same 4000.no interest at all ?