Over the past 4 years, Cowrywise has positioned itself as the dominant, digital-first wealth management platform for the young generation of Nigerians and Africans, built to simplify and democratize access to savings and investment products, a mandate we have pursued aggressively. In doing so, we have equipped individuals with financial tools and innovative products, unprecedented in the Nigerian wealth tech space, making personal finance and the road to building wealth easy and seamless.

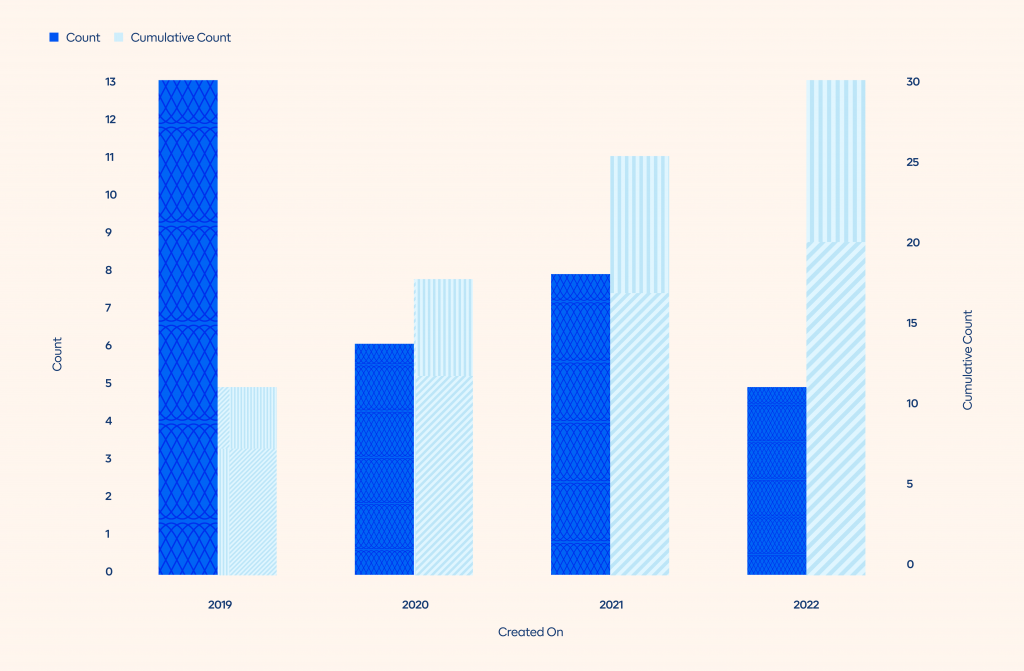

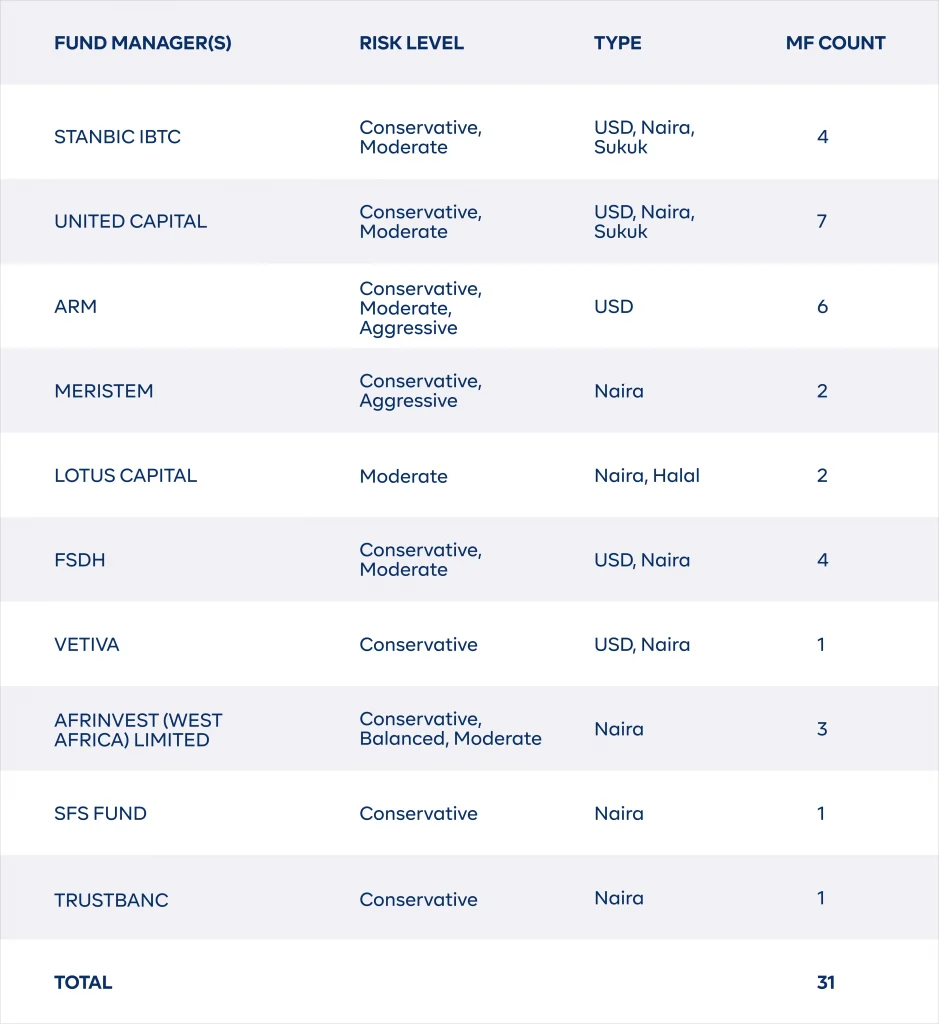

And true to this mandate, and in our continued pursuit of democratizing access to investment opportunities, we recently added mutual funds from Stanbic IBTC, Vetiva Capital, and FSDH to the app, ensuring users enjoy true diversification, security, and safety whenever they invest. This brings the total number of available mutual funds to 31, from top investment management companies, making Cowrywise the largest aggregator of mutual funds in the country.

The implication of this milestone is that of the 127 mutual funds registered with the Securities and Exchange Commission as of July 2022, Cowrywise has ¼ of the total number available on its platform, some of which are held by the biggest fund managers this side of Africa.

What does this mean for the retail investor? On one hand, potential investors are spoilt for choice and are exposed to a large cross-section of mutual fund options, ranging from Naira and USD-denominated mutual funds to halal-compliant investment products, all suitable to meet their investment objectives and conform to their risk appetite. On the other hand, investors can invest in multiple mutual funds, from different fund managers, and watch their wealth grow, while monitoring their performance on one dashboard.

Investing in mutual funds as a driver for financial growth

At Cowrywise, we understand that the true path to building wealth is to make money work for you, by developing a sound investment strategy, and diversifying your portfolio. This is why we are bullish about promoting mutual funds as a safe and secure investment vehicle of choice for young investors. For young investors who have age/time on their side, are upwardly mobile, and are digitally inclined, there’s no better time than now to invest in mutual funds.

And so far, our dedication is paying off. As a brand, we have maintained our position as the top and trusted platform for mutual funds in Nigeria. We have partnered with apex investment management firms in the country, who collectively control up to 66% of the collective investment scheme industry, to make high-performing mutual funds available to retail investors.

Mutual funds being collective investment schemes (CIS) allow different investors with similar investment objectives, to pool their funds together. Thereafter, these funds are invested in a diversified portfolio of securities and other assets such as stocks, treasury bills, fixed-income instruments, bonds, and real estate, to meet their investors’ objectives, spreading your risk, while maximizing your returns.

Mutual funds have several benefits, namely; (1) They are low cost (2) They are managed by professionals who know about financial markets (3) They are easily accessible on the Cowrywise platform and you can start investing with as little as N1000.

“We truly believe mutual funds are a great way for all Nigerians to invest. From the comfort of your home, you have access to professional investment management at a low-cost, and exposure to different assets of your choosing. With our new mutual fund partners, our commitment to democratizing investing continues to grow deeper.”

— Busola Jeje, Portfolio Manager, Cowrywise.

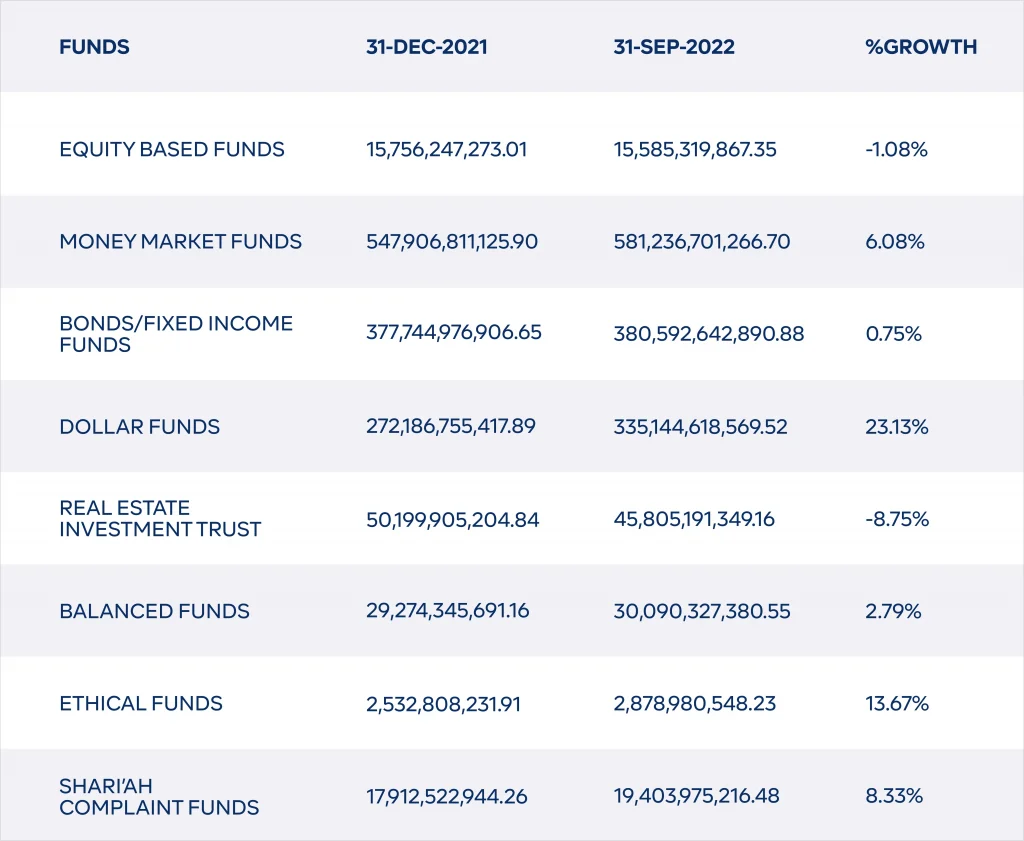

What the market is saying – Mutual Fund Performance YTD

In the last 9 months, there’s been a 7.40% growth in the overall size of mutual funds as of 30 September 2022, growing from N1.313 to N1.410 trillion.

Dollar funds have experienced a 23.13% growth rate, growing by N62 billion between December 2021 and September 2022, this was followed by ethical funds which grew by 13.67%.

Shari’ah-compliant funds also grew by 8.33%. While other asset classes experienced varying degrees of growth, the overall assets of Real Estate Funds experienced the sharpest decline, falling 8.75%.

Mutual Fund Performance – September 2022

The compound growth rate and collective increase in the number of available mutual funds is an indication that mutual funds are an optimal investment choice for building wealth, as it offers investors better prospects for their investment in the midst of heightened market volatility.

It also raises the possibility that Nigerian savers are gradually migrating from saving with traditional institutions to adopting a culture of investing with mutual funds. Time will tell.

One platform. Many opportunities.

Cowrywise offers investors a wide range of mutual funds, which are tailored to their preferences and aggregated on the app. Ordinarily, investment opportunities of this nature would be difficult to access, requiring retail investors to approach each of the fund managers to purchase units of their respective funds. What Cowrywise has done is to create a first-of-its-kind, end-to-end digital experience for retail investors to

- Discover diverse mutual fund options depending on their investment goals or beliefs. Investors can now decide what investments interest them. As a retail investor looking to invest in naira or dollar-denominated assets or a Muslim faithful seeking investment opportunities in line with their faith, we have a mutual fund for you.

- Easily navigate the app from sign-up to investing in a few minutes. The app is filled with resources, articles, and educational content that can help first-time, and even experienced investors, navigate the platform to make better investment choices.

As a result, Cowrywise has successfully democratized access to investment opportunities, further deepening market penetration and availability of mutual funds, thereby increasing the number of individuals investing in mutual funds per time.

The partnership with the top investment management companies is a strategic move and an enabler, set to redefine investment offerings for investors, by removing previously existing barriers to investing, ensuring retail investors are not short of opportunities, choices, or the information they need to make well-informed investment decisions.

Mutual Funds Offerings on Cowrywise

Where you invest matters

As a business, we observed that the majority of our users tend to favour saving over investing, which from empirical evidence, is a reflection of our socio-economic reality. Nigerians have become acclimatized to saving money in traditional banks, which were (and in some regions, still are) the only available means of safeguarding funds for a prolonged period of time, which suggests that this behaviour also reflects in how Nigerians use fintech products.

According to our recent survey on consumer investment behaviour, about 14% of respondents are afraid of losing money, 11% feel investing is complicated, 30% believe they currently do not have enough money to invest, while others prefer the security of traditional banks, or don’t trust any investment company at all.

“In a survey conducted recently, we discovered that respondents have a fear of losing money to investing; a term we coined as Investophobia”

– Grillo Adebiyi – Head of Growth, Cowrywise

From the data gathered, their reluctance to invest is not outlandish, spanning several familiar reasons, from ignorance to lack of funds and for some others, previous fraudulent experiences. Regardless of the reason(s), their decision to save rather than invest can be pruned down to a rational fear of investing, a condition we have coined “investophobia”.

Investophobia is simply the fear of investing or the fear of losing money to investing; which is arguably a rational fear. The “Where you invest matters” campaign is an awareness and financial education drive, designed to educate users on the benefits of investing, and more importantly, the advantages of investing in the right assets, and with the right fintech. By recommending industry-tested approaches through the campaign, we are able to help investors who fall into this category overcome their fear of investing and begin their journey to financial freedom.

Follow the campaign on Instagram, Twitter, and LinkedIn, to get investment tips and advice at invest o’clock throughout the month of November.

Why Cowrywise

We have a custodian

All our users’ financial assets are held with Zenith Nominees Limited, (duly licensed by the CBN & SEC as an asset custodian, and is a subsidiary of Zenith Bank Plc). At no time, is Cowrywise in possession of our client’s investments.

We abide by regulation

Before we became a licensed fund manager, we were the first fintech to implement the trustee structure, with our partnership with Meristem Trustees Limited. Now, we are the only fintech with a fund management license from the SEC. The license from the SEC, (the highest regulatory authority on financial securities and the capital market in Nigeria), gives Cowrywise the authority to offer investment products to different classes of investors. We’ve always been pro-regulation to ensure we solidify trust in our capabilities.

Our investments are registered

All investments on our platform, including savings plans and mutual funds, are registered and approved by the SEC.

We are pro-transparency

Investors have access to the necessary information and details of the respective mutual funds they want to purchase on our platform. We took great care to provide our users with details such as the size of all our funds, prospectus, historical fund performance, fund composition, and risk level of the fund, as well as the identities of the trustee, custodian, registrar, and management fees. All this information is there to help customers identify, compare and ultimately, make better investment decisions.

Industry-leading security

In addition to our SEC licensing, we employ superior security and technical structures, covering measures such as bank-grade encryption and two-factor authentication, as an extra layer of protection (beyond just a username and password), to keep your account safe and secure.

Best-in-class assets

All the investment options listed on Cowrywise, are carefully screened, and managed by professional fund managers. All the diverse mutual funds are SEC-authorized, with a standard third-party custodian structure.

Our mutual funds are managed by our fund management partners and made available to our clients through our web and mobile applications. The fund manager for each mutual fund is disclosed on every mutual fund’s profile page. Please note that past return performance is not a guarantee of future results.

For more information, see our Mutual funds collection.

RELATED

The Impact of Diversification on Portfolio Performance: A Case Study of The 2008 Financial Crisis

Great report?

This is good news!