Investing is a great way to grow your savings, but it can be quite intimidating if you’re just starting out. What if you lose all your money? What if the market crashes? These are all valid questions, and this is why you need to read this article. I’m going to show you how to start investing early and why doing so is actually one of the best things for your financial future.

What does investing early mean?

Investing early is important because it allows you to take advantage of compound interest. Compound interest means that your investment earns interest, and the principal of that investment also earns interest. This means the amount you have invested will grow faster than if you were to let it sit in a savings account.

Early investors can afford to take more risks without worrying about their retirement accounts. They are able to invest in riskier investments like stocks, and real estate. Though not all investments will be profitable, having several options will help them build wealth over time so they can retire rich and comfortably later on in life.

Here are more benefits of investing early:

Time is your biggest asset.

“Time is the best teacher, but unfortunately it kills all its students.”

Louis Hector Berlioz

The most important factor in investing and building wealth is time. Time allows your investment to grow over time, which is crucial to reaching your financial goals. Unfortunately, time also works against you if you don’t have enough of it or if you waste it by procrastinating on key financial decisions.

You’ll have more money in the long run.

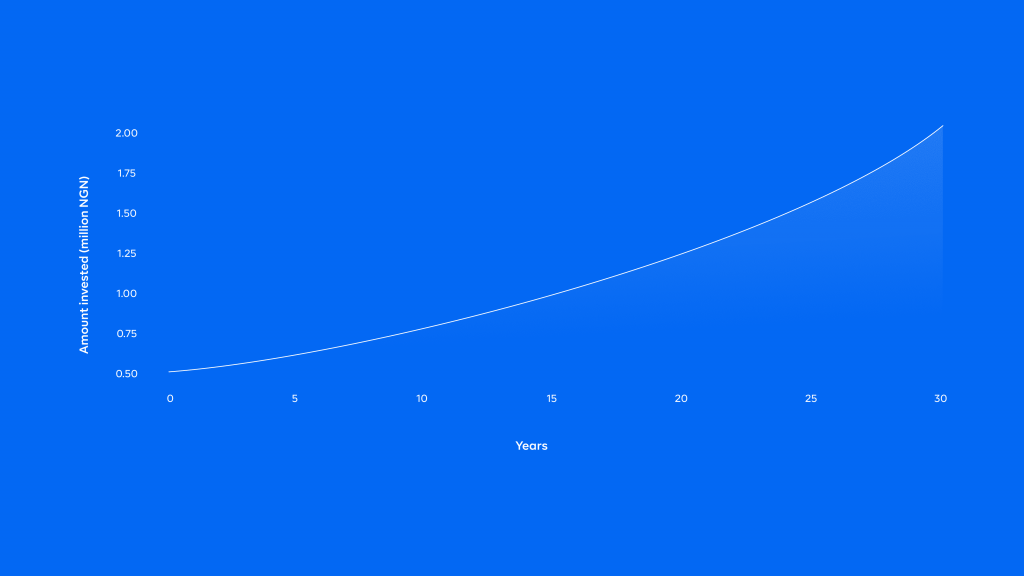

If you invest N500,000, your money will grow at different rates over time depending on how long you leave it invested. In the chart below, we’ve used an average annual return of 5% and a starting value of N500,000.

If You Invested…

From the graph, how much would you have after 20 years? 30 years?

You can afford to take risks early on.

As you begin your investment journey, you’ll need to ask yourself one important question: what is my risk tolerance level? Risk tolerance is the ability to withstand volatility in the market and still remain invested. If you’re like me and don’t want to lose any money on a bad investment, discover your risk tolerance by taking this risk tolerance test.

There are ways for investors to go about taking risks early on without losing any money or sanity. The easiest of these methods involves dollar cost averaging, which is investing small amounts at regular intervals in order to smooth out returns over time.

Another method involves purchasing shares in a fund that matches your desired asset allocation. This way, you can control how risky your portfolio gets over time without having to worry about timing the market or knowing when exactly it’s best not just financially but emotionally as well.

The earlier you start investing, the less you’ll have to save.

The earlier you start investing, the less you’ll have to save.

The earlier you start investing, the lower your risk will be.

The earlier you invest, the less time you’ll need to wait before seeing results!

It’s that simple.

You can take advantage of compounding.

Compounding is a powerful force. As we’ve seen earlier in the graph, it makes your money grow faster than you think, which means that investing early brings a huge impact on your future finances than it might first appear.

Imagine that you invest $1,000 at a 5% interest rate in the stock market. After one year, you’ll earn $50 from interest on your investment—which sounds great! Now imagine what that would be over 10 or 20 years (while you kept earning 5% interest). It would be magical.

The earlier you start investing, the more likely it is that you’re going to have an easy time in retirement and that you won’t be living paycheck to paycheck until then.

Five years ago, I began saving for retirement at age 23. At this point in my life, I think back on all the times my parents told me to spend less and save more money. They advised me to put away a certain amount a month into a savings account so that someday I could afford things like cars and houses when they were no longer around to support me financially. The one thing my parents never mentioned was investing—but if they had, maybe I would have started sooner!

Bottom line

Investing is the key to a secure financial future. If you start early, the odds are in your favour that you’ll be able to retire comfortably someday. You’ll have more money than if you wait until later in life, which will allow for more freedom and comfort during retirement. Plus, investing early allows for compound interest over time so that each naira or dollar is worth more than it would be otherwise.

Ready to get started? Begin your investing journey here.

RELATED

How To Build Wealth In Your 20s

Why Mutual Fund Investing is a Good Idea For Retirement

The Power of Compound Returns on Long-term Investment Growth

Financial Calculator