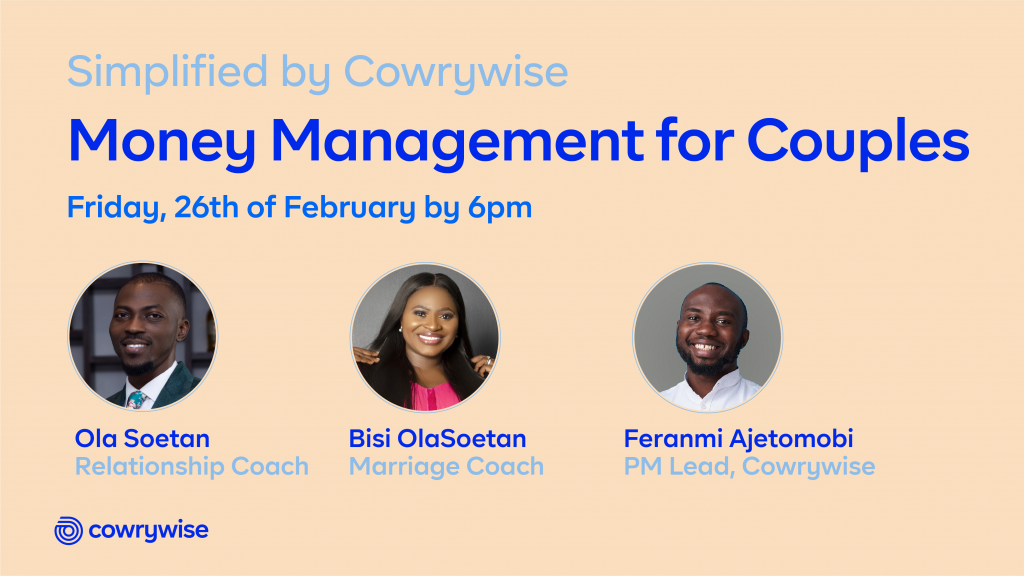

At our recent Simplified by Cowrywise event on money management for couples, Bisi Soetan, a Marriage Coach and her husband Ola Soetan, a Relationship Coach as well as the Product Marketing Lead at Cowrywise, Feranmi Ajetomobi shared practical tips for managing your finance with your significant other. Simplified by Cowrywise events are periodically held to help break down how money works for everyday people. Want to effectively manage money with your partner? Then this is for you!

Feranmi’s Tips for Couples in Committed Relationships

Money is a great decider for any relationship so don’t figure out everything else in your relationship but ignore money matters. There are many compatibility angles and money is an important one. Discussing money with someone you’re not married to can sometimes be uncomfortable because it feels like a private topic. So you can practice the tips below to handle this “tricky” subject.

Have Weekly Budgets

Begin by creating individual and periodic budgets that you discuss with your partner. Here, you can view their expenses. This helps to ease you both into more serious money conversations. Starting with this ensures you ask questions and have follow-up conversations about what’s working and what’s not.

Have Review Dates

You know how you need regular date nights to keep the “flame” alive in your relationship? Yeah. You also need regular money review dates if you want to enjoy financial intimacy with your partner. See the budget discussion we mentioned in the point above as a talking point and decide on how to get better in the coming months. It helps you bond while staying accountable. Talk about how you’re spending your individual funds. That way, you’re inviting the person into your life and they are doing the same. You can then progress to asking more specific questions like how much they earn.

Pick Up Joint Money Goals and Start Saving Towards Those Goals

It doesn’t have to be for a wedding or house. It can be for a new gadget or a vacation together. After becoming transparent and comfortable with your partner, having joint goals is like the “climax” of your financial intimacy. This is where you now work as a team.

Money Management for Couples by Ola Soetan (SecretPlaceHusband) and Bisi Soetan (SecretPlaceWife)

Money Mismanagement among Couples

One of the things that make money a big deal is that people bring in emotions and sentiments. These are responsible for the way couples talk about finances. It can be uncomfortable becoming totally open and honest about your finances, especially if you’ve made some bad choices, but you should work towards having a transparent relationship. If transparency is one of your core values as a married couple, then opening up about your current financial state should not be a problem.

However, as much as you love your partner, there’s still a way you like them to see you – as prudent, smart, and reliable and you probably don’t want anything to spoil your rep. Still, it is important to bring everything to the table. For example, if you tell your partner you only owe 50k when you owe 100k, it will cause a problem in your relationship. So even though you don’t want to be seen as a debtor, it is better to be truthful about past money mistakes.

Handling Money in your Relationship

There’s no one way to teach money management to couples. What is important is communication and striving to remove any form of awkwardness.

Awkwardness is usually a problem caused by ego and past experiences, where you’re thinking more about your image and what the other person is thinking about you. First, remove the awkwardness.

Use the Right Keywords

Learn how to ask the right questions and use the right keywords like “I will not judge”, “You can tell me anything”, and “I am not trying to escape”. These make your partner comfortable and will encourage more openness.

Ways to Manage Funds in your Relationship

- Joint account – Here, you put most of your income together and plan on how it is disbursed or used. A pro of this is that it allows you to put your portfolio together instead of trying to do it all on your own. You can also have a joint account and then allocate funds for individual needs.

- Individual account – With this, you run individual accounts but you both still have responsibilities like rent, food, and school fees that have to be covered. You can do whatever you like with your funds as long as the bills are paid.

- Hybrid account – You can put money in a joint account which can be a savings account or even an investment account. Here, you merge a part of your individual funds for projects, bills, joint savings or investments.

Understand your personalities and individual spending habits, then choose a plan that best suits your relationship.

Question 1

What are tips to help independent people who struggle to “bring everything to the table” after they commit to a relationship? Since it’s something they’re not used to.

First, ensure the relationship is one where you feel safe. That way, even though there may be frictions at first, you both can work towards resolving them together. Independent people find it hard because of insecurity but you should strive for a love where there is security and assurance. Once this is taken care of, it will be organic because your visions have merged.

Question 2

What do you do when your partner is reluctant to support you financially and believes you should take up all the responsibilities as a man?

Money mindsets are usually tied to family origins, so have a conversation about where your spouse is coming from and decide on what is best for your “new” family. Financial responsibilities should be based on income. It will be unfair to leave one person to cover all finances only based on their gender.

Get professional help or counselling if she’s not willing to help at all after your conversation.

Question 3

How do you deal with a partner who is resentful because you earn more?

There are two possibilities – Sometimes people are resentful because they feel stuck or that they deserve what you have. It’s not about you. It’s caused by the pain from the inadequacy they feel. It can also be that they are resentful because they have been made to feel less or are constantly reminded that they earn less and do not “pull their weight” in the relationship.

Beyond having a joint account, have a joint mindset.

Question 4

Can you give tips on how to get around the awkwardness of talking about money?

It is first of all about how you both feel when you’re not talking about money…

The priority is your relationship so don’t make it just about money. Make each other feel comfortable and build a deep connection with your partner so that talking about money will be easier. People become defensive when they think it is personal so watch the person’s emotions before you proceed with conversations.

For Singles

Remember that you are sort of auditioning the person to fill a “role”. So check your mindset and theirs while interacting with them. This will help you understand their money mindset and if their money values align with yours.

For Married People

Be patient and observant. Conversations that require you to be vulnerable are what make you feel awkward, not money itself. Things that make you feel shy or ashamed are usually caused by deeper issues so work together to fix those issues. Money management will become easier after that.

What tips have you used with your partner?

Share with us in the comments.

To watch the full session, please click the link below and subscribe!

RELATED: