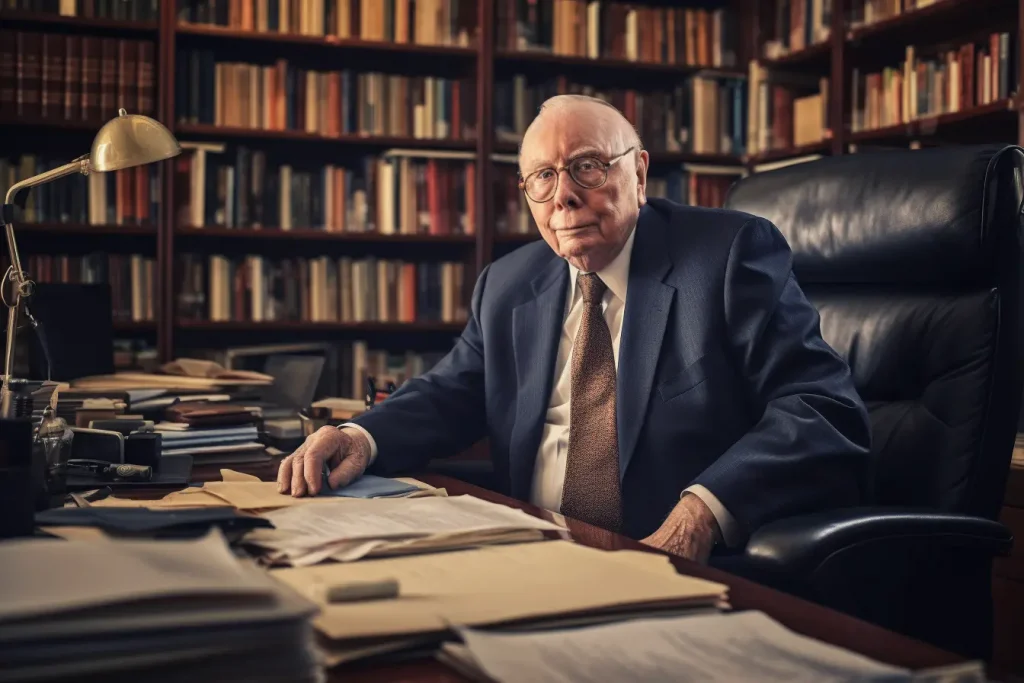

Charlie Munger, often referred to as Warren Buffet’s right-hand man is an American businessman, investor, and philanthropist. He is the vice president of Berkshire Hathaway and is worth $2.7B.

His name might not seem as popular as Warren’s but here are 5 things to learn about the personality of the billionaire.

Charlie Munger is an Avid Reader

You must have heard of the famous phrase “Readers are Leaders”. It might sound cliché but it is evergreen!

As an avid reader, Munger firmly believes in the power of learning from books.

He often advises people to read widely and has even shared a list of his favourite books, which includes titles on a wide range of subjects; from psychology to history and science. He says his long attention span as a result of his reading habit has contributed significantly to his success.

It is no news that if you want to attain greater heights, consistent reading should be a habit to emulate. We see its impact on Munger’s life. The same goes for your finances too.

If you want to move from your current financial status to a higher one, you should embrace the culture of reading financial books. A good book to start from is Ope’s Diary.

Charlie Munger is a Trusted Partner

Munger’s partnership with Warren Buffet is evidence of the importance of working with a reliable and compatible business partner.

He has been the vice president of Berkshire Hathaway since 1978 and played a key role in its development into the massive holding corporation it is today.

Their complementary skills, shared principles, and ability to work well together and adapt to changing market conditions have contributed significantly to their success in the world of finance and investing.

This is a valuable lesson for anyone looking for a trustworthy partner to build a successful business with.

Charlie Munger is a man of Wit and Wisdom

Charlie Munger is famous for his sharp wit and straightforward wisdom. When he talks about investing and life, it’s like attending a master class in both subjects.

His speeches and writings are full of insightful quotes that stay with you. One of the best places to experience his wisdom is at the annual Berkshire shareholder meetings.

One of his known quotes is:

“If you want to be a good investor, you have to have a long-term perspective. You have to be willing to be very patient and wait for the right pitch. And when you get the right pitch, you have to be ready to swing hard. You can’t just take a little teeny tiny swing. You have to swing with all your might.”

charlie munger

With this, you can tell that Munger’s insights are valuable nuggets of knowledge, whether you are interested in making smart financial decisions or simply navigating life.

Charlie Munger has a Long-Term Perspective

Having a long-term perspective is one that cannot be overemphasized when it comes to investing and this is evident in Charlie Munger’s investment decisions.

One scenario that highlights this is Berkshire Hathaway’s investment in Coca-Cola.

In the 1980s, Munger recognized the enduring popularity of the Coca-Cola brand and the company’s strong competitive advantage in the beverage industry.

Instead of chasing quick gains, he and Warren Buffet invested heavily in Coca-Cola stock, holding onto it for decades.

This patient approach allowed them to benefit from the company’s consistent growth and dividend over time, turning their initial investment into a massive long-term success.

Charlie Munger is Humble

Despite achieving great success, Charlie Munger maintains a strong sense of humility. He emphasizes the importance of not being arrogant and believes that humble people are more likely to be successful in the long run.

This quality encourages self-awareness and a willingness to change and get better. In simpler terms, it means that even though he is successful, he never thinks he knows everything and is always open to learning and improving.

Conclusion

Attaining financial independence and building successful businesses goes beyond accumulating money via selling a product, offering a service, or investing in valuable assets. These are very valid but there are certain traits you need to imbibe to foster your growth—some of which we have examined from Warren Buffet’s right-hand man.

If you are deliberate about having lasting financial success, you should take a cue from this. Only then can investing make more sense.

Begin your journey to financial independence on Cowrywise

ALSO READ

Top 10 Richest Men In The World

Top 10 Richest Women in the World

7 Habits of Highly Profitable Investors

John C. Bogle: 20 things you didn’t know about the Father of Index Funds