Understanding how individuals make financial decisions, save, invest, and manage debt is important for financial institutions, business owners and the society at large.

In this research article, we conducted a survey on personal finance in Nigeria, asking questions to understand people’s behaviour based on the current state of their finances. We aim to provide insights and help you identify areas that may require attention in your current financial reality.

This survey was conducted online by Cowrywise in December 2022 among 1, 204 Nigerian adults, ages 18 and older.

Data Set

We need to first establish the scope of the dataset we are working with in this study.

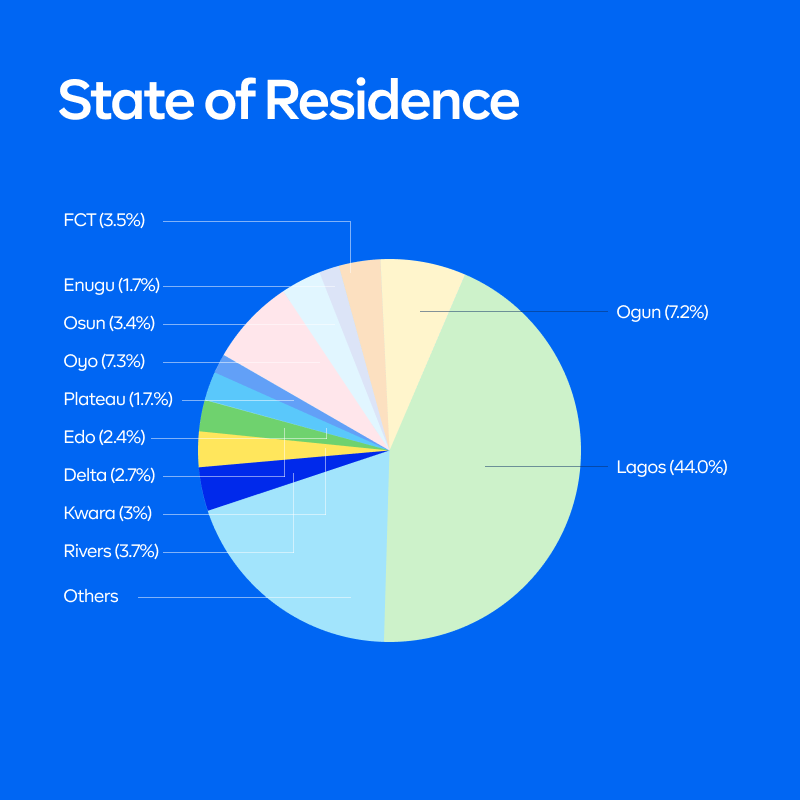

Residence: Out of the 1,204 Nigerians, Lagos is the most represented with 529 i.e. 44% saying they reside in the state.

Gender: The respondents’ gender is fairly distributed equally— Females being 50.2% and Males being 49.8%.

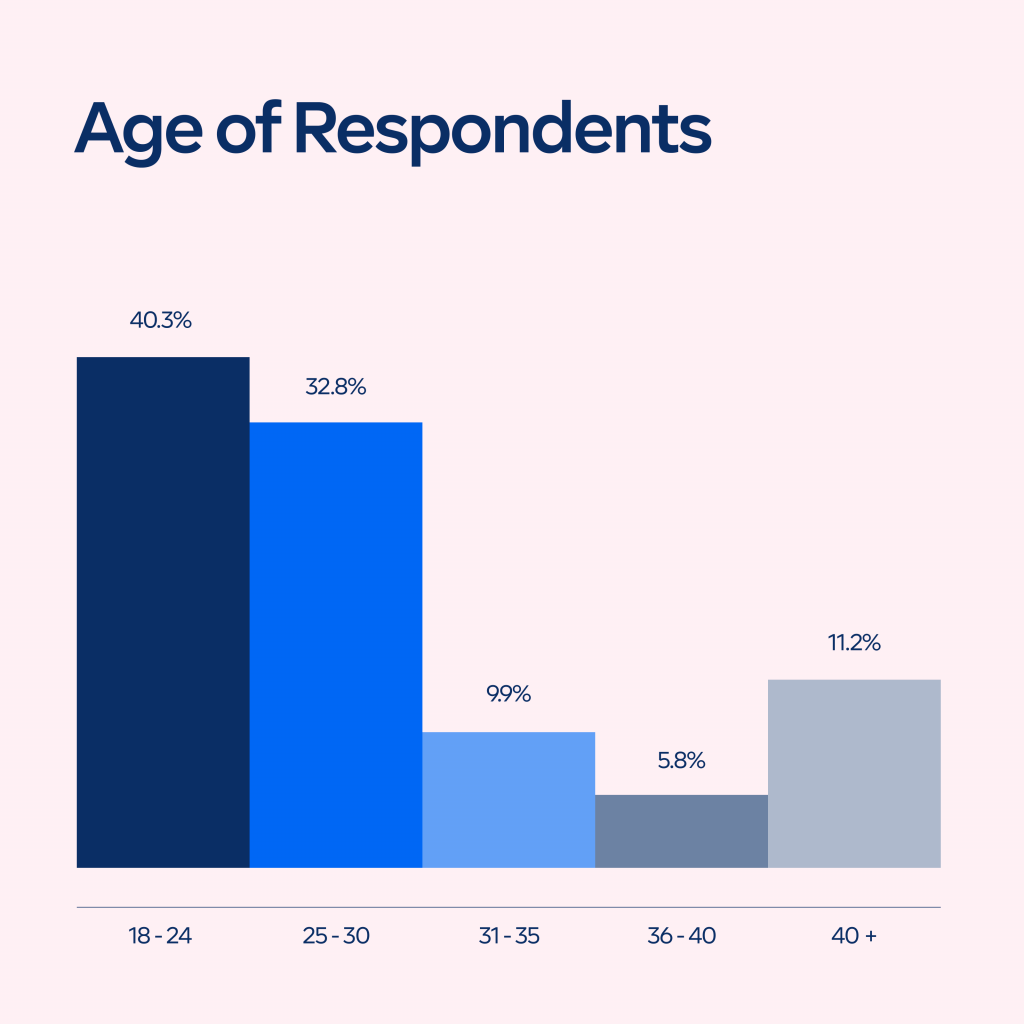

Age: 73% of respondents are aged between 18 to 30

Education: 63% of the respondents are graduates while 37% are still students.

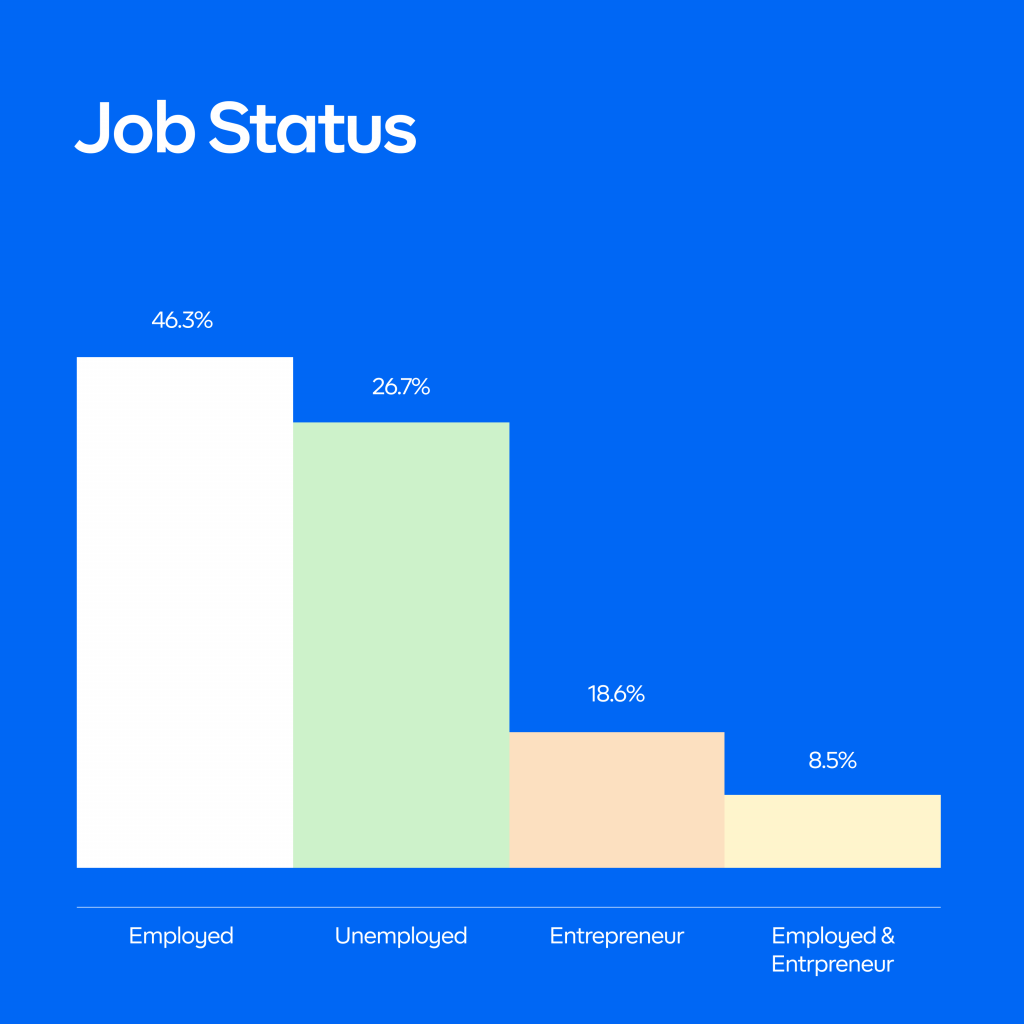

Source of income: 73.3% have at least one source of income.

Monthly income: 64% of respondents said they make less than N100,000 in a month while only about 11% make more than N300,000.

Let’s dive into the survey.

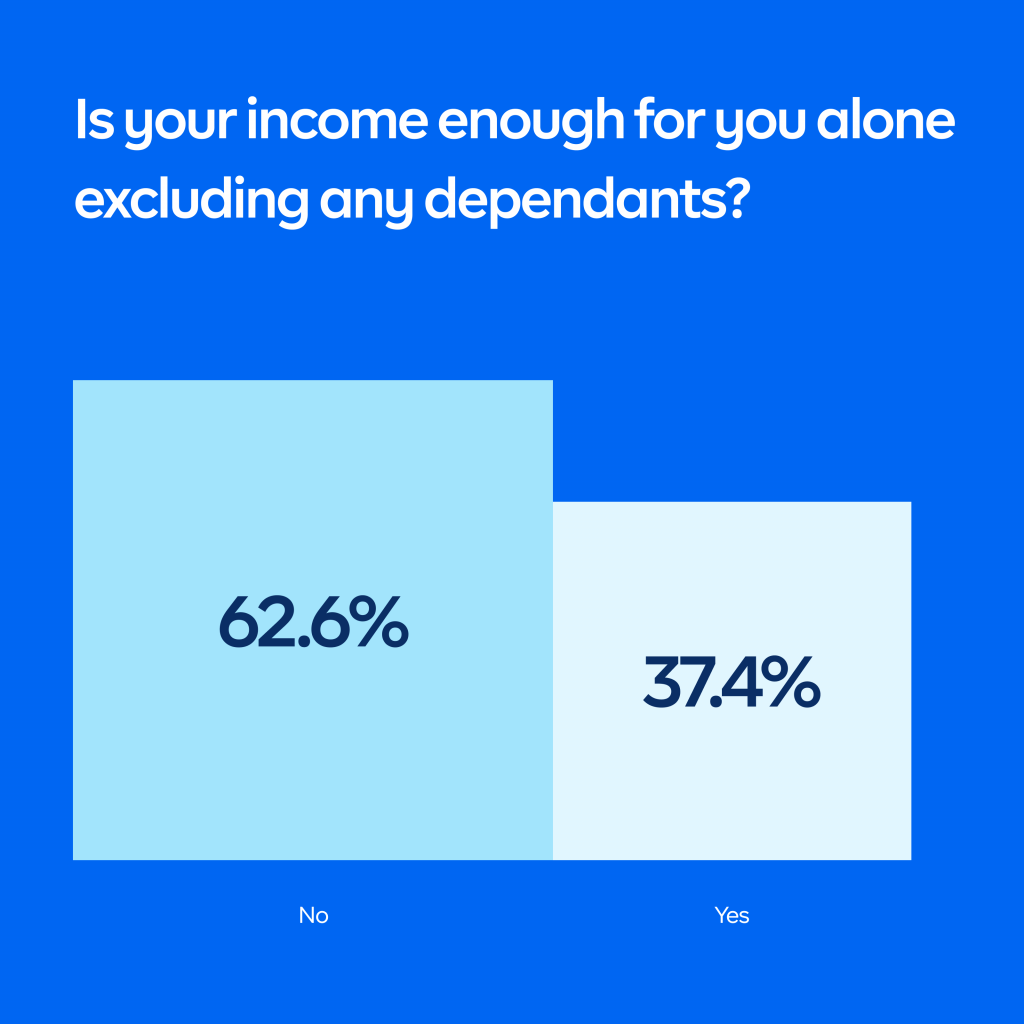

1. 63% of Nigerians report their income is not enough for them let alone with dependants

There are several possible reasons someone’s income may not be enough to cover their own expenses, not to talk of others.

Let’s delve into some of them:

High Cost of Living

If the cost of living in a particular state is very high, it can be difficult for someone to make ends meet with their income. This may be due to high housing costs amongst other factors. According to Nigerian Finder, the 5 most expensive states to live in Nigeria are Lagos, Abuja, Rivers, Imo and Cross River. In this survey, out of the above 63% (754) that said their income was not enough, 586 lived on less than N100,000 a month. Out of these 586, 286 live in these expensive states (223 live in Lagos, 18 in FCT, 33 in Rivers, 6 in Imo and 6 in Cross River.)

Debt

Out of these 754, 43% (322) said they are currently repaying a debt. If someone has a lot of debt, it truly can eat up a significant portion of their income and leave them with little left over for other expenses.

Medical Expenses

Medical emergencies are a thing. If someone has a chronic health condition or needs expensive medical treatments, it can be difficult to cover these costs with their income especially if they do not also have health insurance. Of the 754 that said their income was not enough, only 80 claimed to have health insurance.

Unexpected Expenses

Emergencies can quickly drain one’s savings and make it difficult to make ends meet. 301 of the 754 (40%) claimed they do not save for emergencies which is not so surprising keeping in mind their income range.

Unemployment

If someone is unemployed, they may not have enough to cover their expenses. More than one-third in this category (264 out of the 754) are unemployed, which is understandable for their reason of not being able to take care of dependants.

Lifestyle Choices

An additional point to learn here is people’s lifestyle choices. If you live in an expensive neighbourhood or frequently eat out, and you don’t really have the income to back it up, it won’t be a surprise if your income is not enough for you.

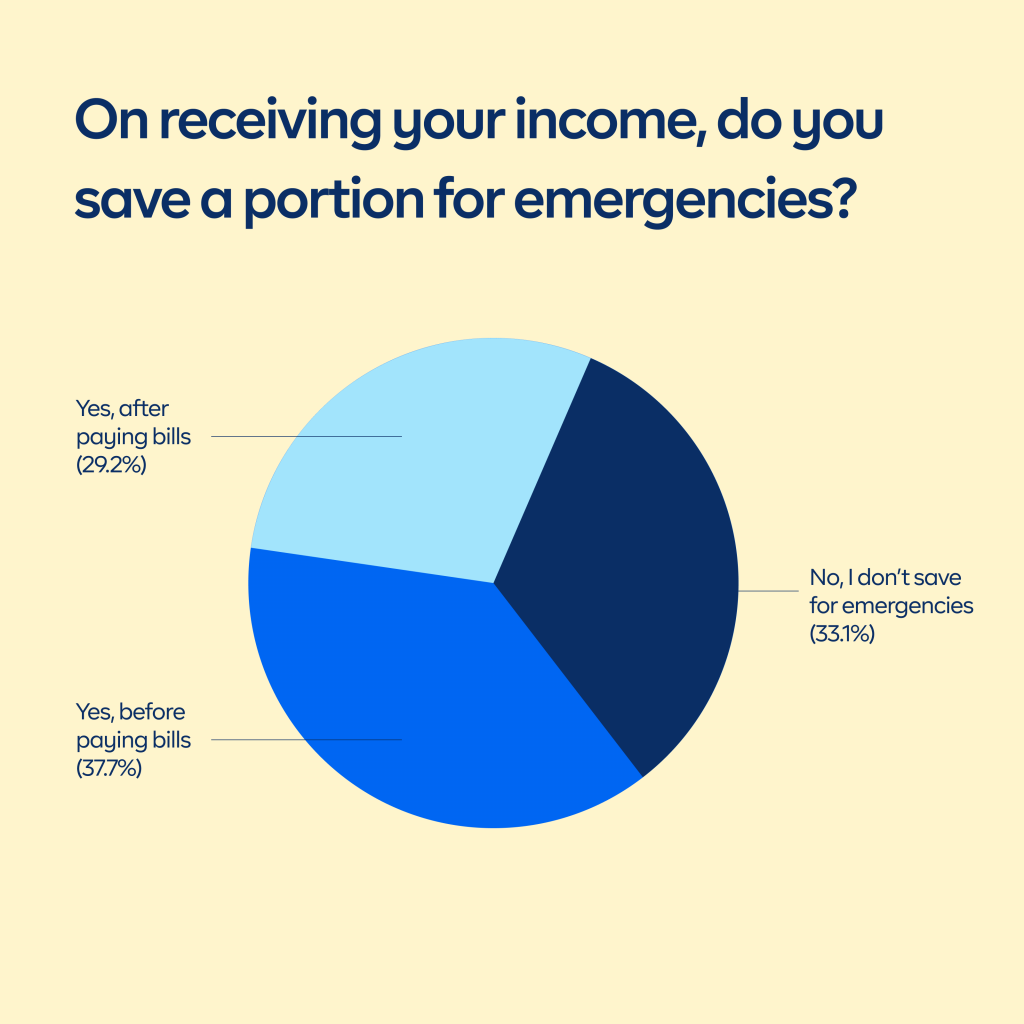

2. 67% of Nigerians save a portion of their income for emergencies

Subjectively, this is quite impressive that 67% of respondents are taking action to prepare for financial emergencies.

What did we observe about this 67%?

There is no specific type of person who should save money for emergencies. Anyone can choose to save for emergencies, regardless of their income level, job, or other factors.

That being said, you would agree that people who have financial stability are more likely to build up an emergency fund. However, this does not mean that people with lower incomes cannot save for emergencies; it may just require more planning and prioritization.

In fact, an interesting finding from the survey is this: Out of the above 67% (807), we observed that 469 (58%) earn less than N100,000 a month and still manage to have emergency savings.

If you do not have emergency savings, what excuse do you have?

Ultimately, saving for emergencies is a wise financial decision that can benefit anyone, regardless of their background or circumstances.

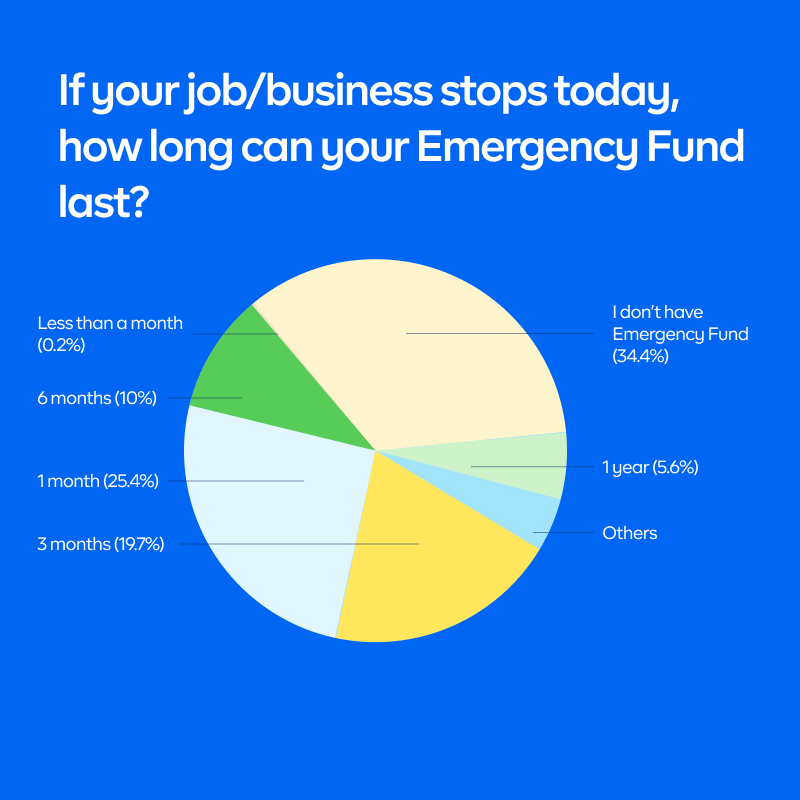

3. Only 36% of Nigerians have at least 3 months’ worth of emergency funds

Generally, financial experts recommend having between 3 to 6 months’ worth of living expenses in an emergency fund. The actual amount may vary from person to person but that’s generally the idea.

Having an emergency fund this way helps provide a financial safety net in case of unexpected events such as job loss, medical emergencies, or unexpected bills. Someone with a higher income or a more stable job may be able to get by with a smaller emergency fund, while someone with a lower income or more financial responsibilities may need to save more.

What did we observe about this 36%?

- Income: People with higher incomes may have more disposable income to put towards their emergency fund, allowing them to build up a larger cushion. 230 out of the 425 that have at least three months’ worth of emergency funds earn more than N100,000.

- Number of dependants: 280 out of the 425 (66%) have 2 or more dependants. People with dependants, such as children or elderly family members, may need to have a larger emergency fund.

Related: How Do Emergency Savings Funds Work?

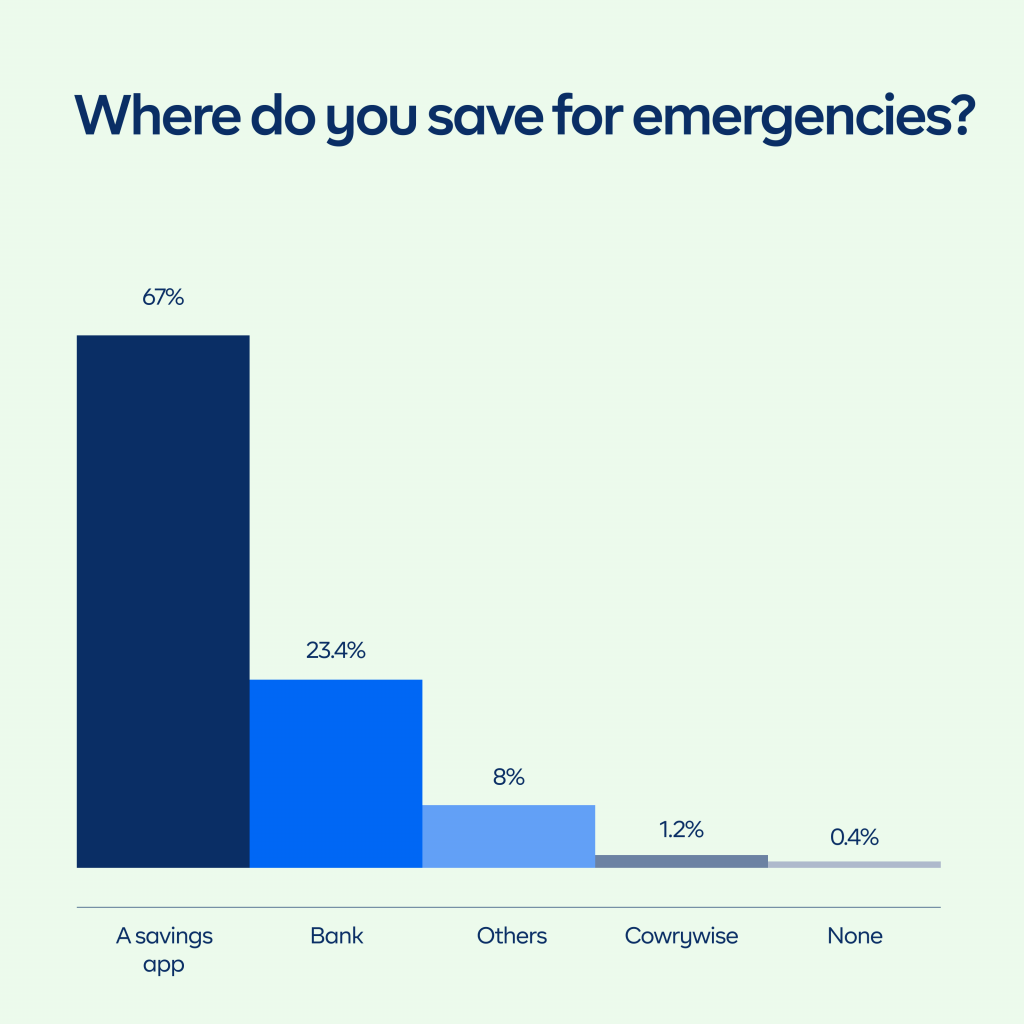

4. 68% of Nigerians report they save money in a savings app

NB: We did not put names of savings apps but 1.2% stated Cowrywise specifically.

68% of Nigerians report they save money in a savings app. This is followed closely by Bank savings at 23%.

83% of respondents are young people with ages falling between 18 and 35. Hence, young people saving in a savings app instead of the bank is pretty much unsurprising.

Why do people use savings apps?

- Convenience: Online saving apps like Cowrywise make it easy to save money from anywhere, anytime. Users can set up automatic transfers from their bank accounts, set savings goals, and track their progress all in one place.

- Higher Interest Rates: Many online saving apps offer higher interest rates on savings than traditional banks. No wonder more young people put money in them rather than in banks.

- Low Fees: They often have lower transactional fees than traditional banks, making them a cost-effective option for those who want to save money.

- Goal-Oriented: Many saving apps allow users to set specific savings goals. This can help users stay on track with their savings.

Overall, online saving apps offer a convenient and cost-effective way for people to save money and reach their financial goals.

Related: Why you should save with Cowrywise

Other interesting places people claimed they save money include Cooperative societies, Susu, Ajo, piggy bank, Thrift collections, etc.

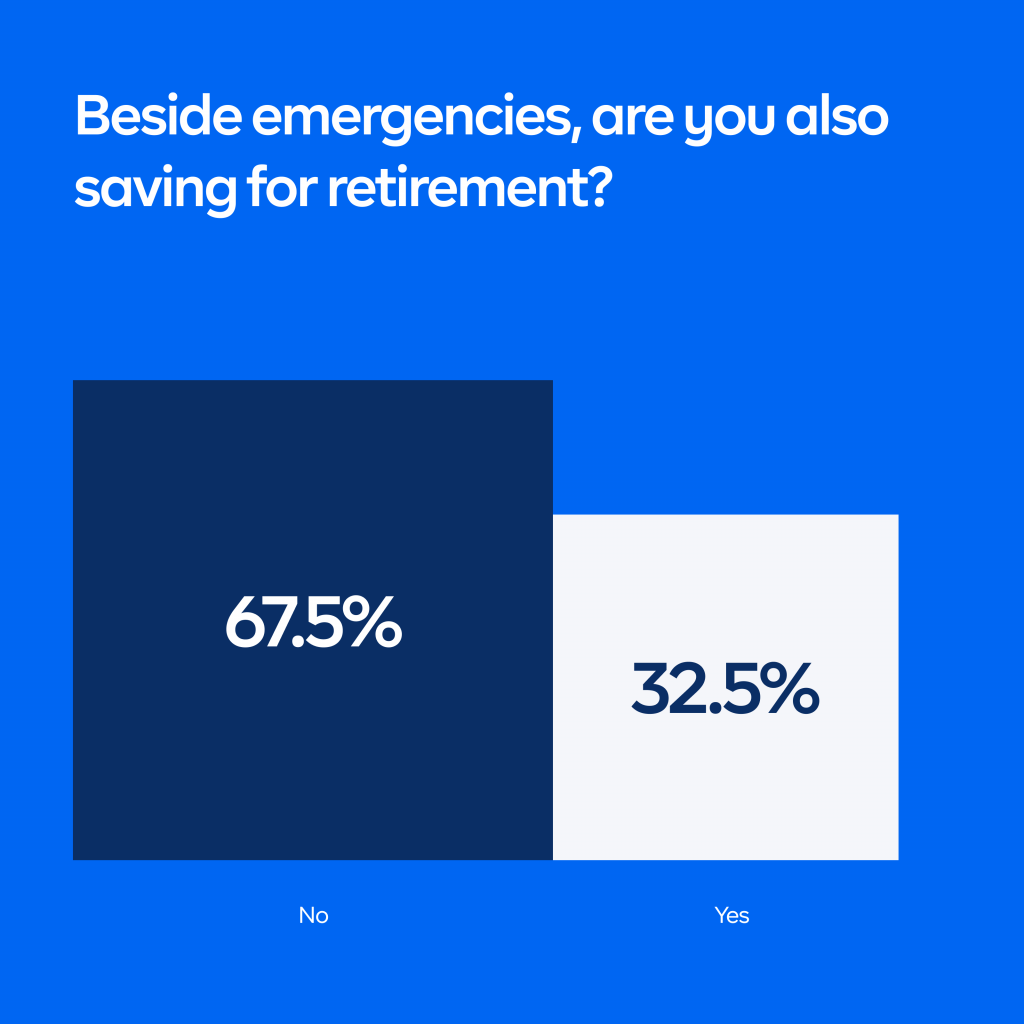

5. 32.5% of Nigerians are saving for retirement

How is this distributed among the two genders?

It is insightful to note that out of the 32.5% (391), 165 (42%) are females. This shows that women are almost equally planning for retirement as much as men.

What else did we observe about this 32.5%?

Gen X and Millennials: 81 of the 391 (21%) saving for retirement are above 40 years old. This is not entirely unusual as people of this age are nearing retirement. However, we see retirement savings also becoming a priority for the millennial demographic — a whopping 57% i.e. 222 of the 391 are millennials.

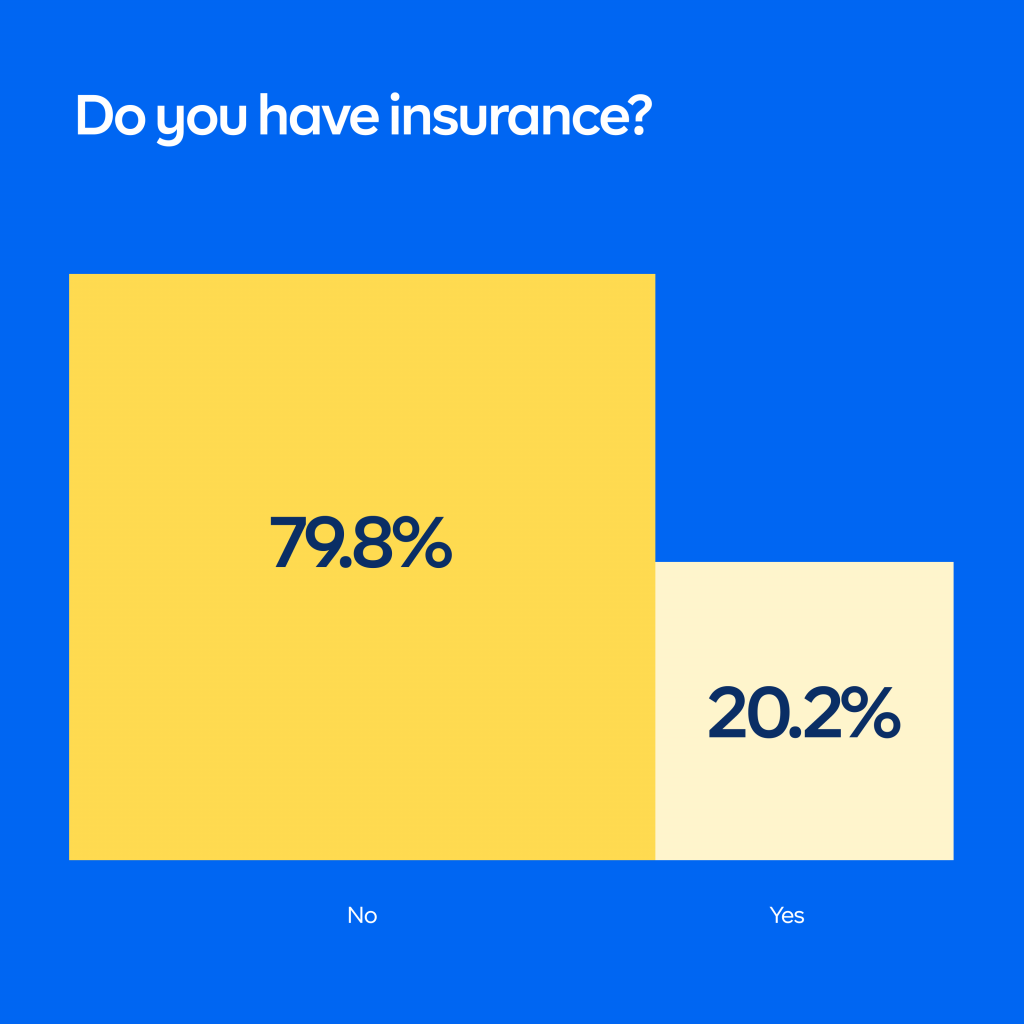

6. 80% of Nigerians do not have insurance

Why do people not have insurance?

- Affordability: One of the main reasons people do not have insurance is that they cannot afford it. Health insurance, in particular, can be expensive, especially for people who do not have access to employer-sponsored plans. 72% i.e. 694 out of the 961 that do not have insurance earn less than N100,000 a month.

- Age and Level of Awareness: 436 out of the 961 (45%) are aged between 18 – 24. This could be saying something about young people not yet seeing the need to protect themselves and their families from financial hardship perhaps because they themselves are just trying to be independent at that age.

Other reasons outside the scope of this survey may include:

- Mistrust: Some people may be hesitant to purchase insurance because they do not trust insurance companies

- Personal Beliefs: Some people may choose not to have insurance due to their religious or cultural beliefs.

While there are many reasons why people may not have insurance, it’s important to note that having insurance can provide financial protection and peace of mind. People should explore their options and consider the benefits of having insurance when making decisions about their healthcare and financial well-being.

Related: Do you need Life Insurance?

Bottom line

The findings of this survey on personal finance in Nigeria highlight several challenges and opportunities both for individuals and the country’s financial sector.

The survey revealed that a significant portion of Nigerians struggles with their finances even without dependants. Additionally, many people are just one bad event from being in a huge financial problem due to not having any form of insurance or emergency funds that can last them.

On the other hand, the survey also found that many young Nigerians are prioritizing retirement savings and also use savings apps where their savings can grow with a higher interest rate than traditional banks.

To address some of these challenges, policymakers and financial institutions must work to increase financial literacy, expand access to financial services, and promote savings and investment culture among the population.

With the right policies and initiatives, Nigeria has the potential to become a more financially inclusive and prosperous nation.

RELATED

Is the fear of investing hindering your financial growth? – Cowrywise survey

Financial Inclusion in Nigeria

Behavioural Finance in Action: How Emotions Affect Your Investment Decisions

The Impact of Diversification on Portfolio Performance: A Case Study of The 2008 Financial Crisis