- There’s a serious need to distinguish between money managed by investment firms or fintech for investors and their own funds.

- An important part of wealth building is ensuring the long-term safety of investments. What happens if a wealth-tech company, directly holding investor assets, inadvertently shuts down?

- Custodians are the legally established gatekeepers between fund managers and investors, ensuring the safety of investor funds, to maintain and increase confidence in financial markets.

Recently, FTX, the second-largest cryptocurrency exchange in the world collapsed, after a liquidation crunch forced them to halt withdrawals. According to bankruptcy filings, over a million people and investors could be owed money, and even more disturbing are reports that FTX reportedly used customer funds to bolster Alameda Research’s (its sister hedge fund company) high-risk trading operations without permission; a turn of events which wouldn’t have been possible if proper regulation and an external custodial structure were in place…

Although the snowball effect on the wider crypto/fintech industry is yet to be seen, one thing is clear. Wealth management companies and other finance-related companies, either tech-oriented or traditional, need a strong governance structure in place when managing investors’ funds.

In this report, you’ll find:

- Reasons why regulation and an external custodial structure is key to the security of your funds

- Why you should understand the investment trinity of mutual funds and their respective roles

- Financial insights on the Collective Investment Scheme Industry

The Ownership – Management conundrum

Behind every reputable wealth manager, or wealth-tech company is an asset custodian whose interests lie in protecting the assets of their investors.

A custodian is a regulated and specialized financial institution that holds assets such as securities for clients, to safeguard these assets from misuse, misappropriation, theft, or loss. Custodians are also there to make sure there’s a clear distinction between assets owned by investors and assets managed by wealth management companies. After all, just like in the business world, ownership and management are two different concepts.

What is the implication of investing with a company that has no custody structure?

It’s simple: Your money can suddenly become “their” money. If there’s no evidence showing that investors’ funds do not belong to an investment company, then we have a problem.

Let’s paint a scenario: A wealth-tech or a wealth management company gets sued and is liable to pay NGN50mn. Imagine all they could pay from their own pocket is NGN5mn, while they are managing NGN45mn worth of investors’ money. In the normal course of business, the creditors cannot lay claim to the NGN45mn, because it is not the company’s money.

But what if the funds had not been kept with a third-party custodian or under a trust? What if it was not held in the name of the clients or the product they invested in? What if the money was going straight into the company’s bank accounts and they were investing in their own name? Now suddenly, the NGN45mn looks like the company’s money, and their creditors might as well have a great payday!

Regulation exists for a strong reason

It is because of these types of risks, that the Securities and Exchange Commission Nigeria (SEC) constantly preaches to retail investors to do their due diligence, and watch out for investment firms or platforms that do not have the necessary structures in place. They also institutionalize regulations and guidelines, with the overarching objective to protect investors.

Last year, the SEC announced the implementation of a 100% custody requirement for all funds and portfolios being managed by investment companies. Whether you invest in a mutual fund or a private fund or you have your own specialized portfolio with a fund manager, all assets must be held with an independent third-party custodian. This way, if an investment manager goes bust, your money is not part of the assets creditors can lay claim to, and there are no sad stories.

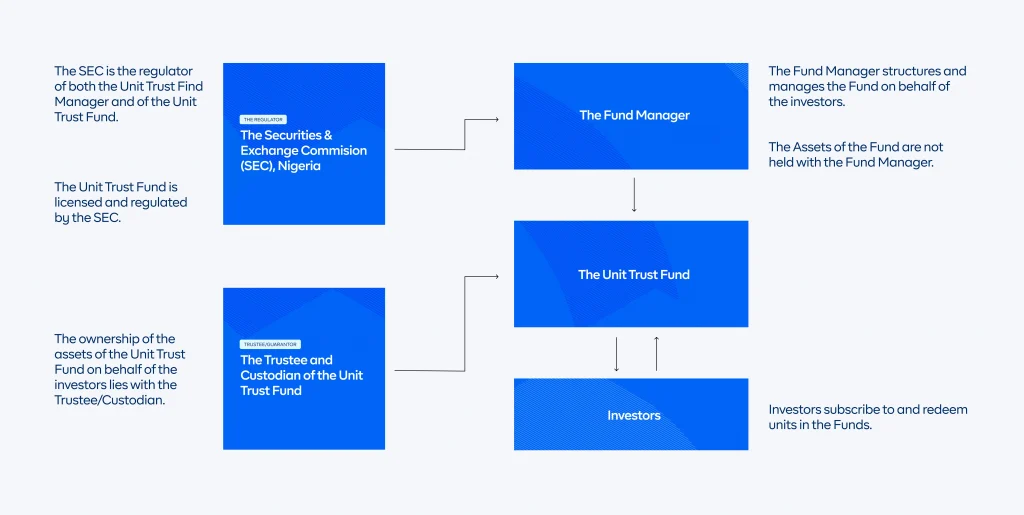

The investment trinity for mutual funds – A Custodian, Trustee and Registrar

At Cowrywise, we have been very intentional about promoting mutual funds as a go-to investment option for young investors. We have over 30 mutual funds on our platform from top investment management companies in the country. Mutual funds are collective investment schemes that allow different investors with similar investment objectives, to pool their funds together. Thereafter, these funds invest in a diversified portfolio of securities and other assets such as stocks, bonds, and real estate, to meet their investors’ objectives.

There are multiple benefits of mutual funds; (1) They are low cost (2) They are managed by professionals who know a lot about financial markets (3) They are easily accessible on our platform with as little as N1000. But for the focus of this article, we highlight a very important benefit: They are regulated and well structured.

These funds have the full governance structure; custodians and trustees, and even registrars, and all these parties carry out a function that is important to protecting your interests as an investor.

Let’s breakdown the parties for you:

- A mutual fund unit holder: You, the investor purchasing units in the mutual fund.

- Fund Manager: The investment manager is responsible for investing the money according to the objectives and guidelines of the fund.

- Trustee: There to make sure the fund manager and other parties to the mutual fund adhere to the guidelines and terms of the Trust Deed of the fund. They have a fiduciary duty to you!

- Registrar: They maintain the register of all unit holders, as well as handle the processing of distributions (like dividends) to all unit holders.

- Custodian: They hold the assets of the fund in favour of the unitholders (you, again).

The whole structure literally exists to protect you, the investor, from any funny business by the entity in charge of managing your money. In the event that none of these parties is involved in any “investment offering” you get, then you need to RUN.

The case for wealth-techs and custodians to partner

For any fintech looking to build a wealth management business that is sustainable and fully in line with the regulatory authorities, a partnership with a custodian is beneficial in the following ways:

- Custodians will maintain proper documentation of ownership, accounting, valuation, and reporting of assets owned by your users.

- Custodians keep assets and ensure they are under your users’ names or product or fund’s names. The core pillar of the investment industry is trust, this, having that separation between who owns and manages investors’ money will deepen that trust.

- They are able to process trades and investment transactions on your instruction. You still have autonomy over your investment decision-making, they just help you execute the operational side of things.

Choosing a custodian – what wealth-techs should know

Choosing a custodian is a very important decision for any wealth-tech. Your users need to know the level of due diligence and scrutiny you have applied in selecting your partner custodian. From our experience, these are the points we think are most helpful:

1. Industry experience

Size and experience matter. It will be best to narrow down your choices to custodians with proven and tested track records in the investment industry. Your custodian should also be duly registered with and licensed by the SEC.

2. Comprehensive custody and clearing services

With the growing types of assets that wealth techs are offering to the mass market, It is essential that your custodian has the ability to hold both local and international financial instruments. For Nigerian investments, it’s important for your custodian to have existing depository accounts with key houses like the FMDQ and CSCS.

3. Look for value-added services

A number of custodians provide value-added services and expertise that give them a competitive advantage. In Nigeria, most asset custodians are subsidiaries of a bank or belong to a banking group, and can offer some integrated banking products. This could include access to traditional banking products, such as savings accounts, fixed deposit accounts, and other types of products and services that can be cross-sold.

4. Innovative Technology

As growing tech companies, we are all constantly innovating, so there’s a need to have a custodian committed to innovation and stays up-to-date with the latest cutting-edge technology, especially regarding security. They should be able to give access to real-time reports, provide automated ways to transfer trade data, automate mandate execution and give instant access to portfolio holdings information.

5. Positioning in the age of virtual/digital assets

The SEC recently released rules on digital asset offerings, initial coin offerings and other distributed ledger technology offers of digital assets. According to those rules, a digital asset custodian is required to provide custody of virtual assets/digital tokens for the account of another person. A wealth-tech with digital assets in its offering should definitely be on the lookout for a custodian that can offer this service.

6. Flexible pricing and fee transparency

Custody fees could sometimes eat into returns. Although low pricing is appealing, it is critical that wealth-techs don’t turn a blind eye to other details of a custodian’s pricing structure, and instead, embrace a pricing structure that is transparent, clearly defined, and easy to understand.

Custodians are not the ‘run-off-the-mill’ kind of institution, which is why they are also subject to scrutiny by key regulatory bodies such as the SEC, and the CBN depending on the industry they serve. To truly understand the level of protection placed on your funds by your wealth manager, find out who their custodian is, and if they are regulated by the appropriate body.

For investors, when all is said and done…

The reality is that investing comes with several types of risk. However, one risk you should successfully eliminate is the risk of dealing with untrustworthy investment platforms that have no clear governance structure. If you currently invest with a fintech that does have a custodian partner and is not registered with the SEC, you have a lot to worry about.

In general, there are necessary questions you should ask before putting your money in any investment company or investment app:

- Are they registered with the appropriate regulatory body?

- Do they have the required license to operate?

- What type of governance body or higher power oversees their operations?

- Do the CEO, Founders or Investment Personnel have the required investment experience and knowledge to manage investor funds?

- Are the assets of investors secured with a registered custodian?

If the answer to any of these questions is no, our advice: turn the other way and run.

Regulatory licensing: Is the company or fund manager making the offering licensed by the SEC or is the issuing company a member of the Fund Manager Association of Nigeria? If this isn’t the case, our advice: take your money elsewhere. You can find Cowrywise here.

Documentation: Any mutual fund you invest in should contain a prospectus which contains critical details pertaining to the fund such as the trust deed (an agreement between the issuer of the fund and the trustee), and other critical information such as investment objectives, policies, rights of unit holders, redemption and transfer of units, etc.

Read between the lines: it is critical you ensure you look beyond the hype of testimonials and stories of investors reaping returns and look closer at the inner workings of the investment company where you invest your hard-earned money. If it fails to highlight the existence and operations of a custodian, trustee, and registrar in its operations, our advice: invest in a wealth-tech company that has this structure in place.

Why Cowrywise is different

We have a custodian

All our users’ financial assets are held with Zenith Nominees Limited, (duly licensed by the CBN & SEC as an asset custodian, and is a subsidiary of Zenith Bank Plc).

We abide by regulation

Before we became a licensed fund manager, we were the first fintech to implement the trustee structure, with our partnership with Meristem Trustees Limited. Now, we are the only fintech with a fund management license from the SEC. The license from the SEC, (the highest regulatory authority on financial securities and the capital market in Nigeria), gives Cowrywise the authority to offer investment products to different classes of investors. We’ve always been pro-regulation to ensure we solidify trust in our capabilities.

Our investments are registered

All investments on our platform, including savings plans and mutual funds, are registered and approved by the SEC.

We are pro-transparency

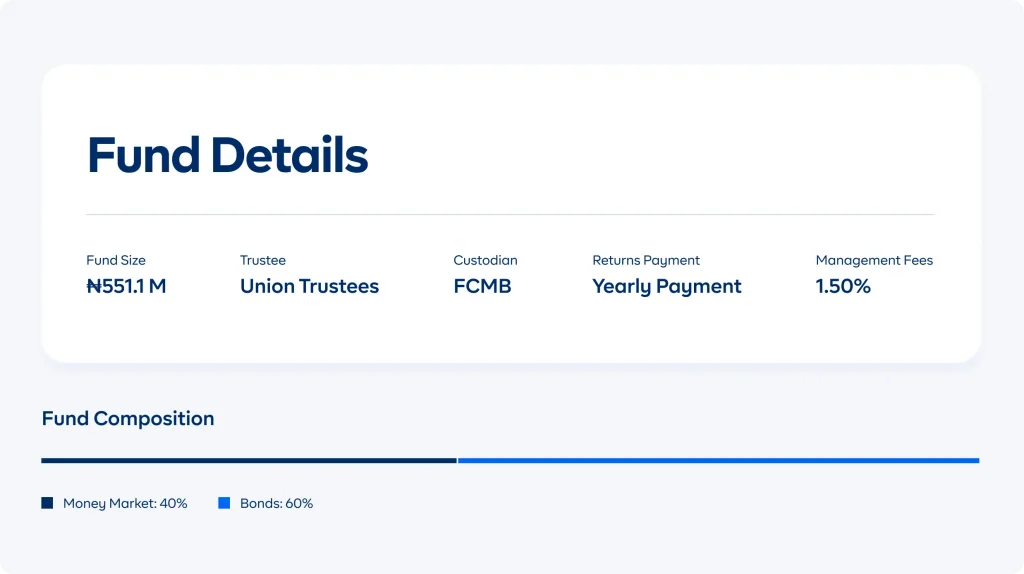

Investors have access to the necessary information and details of the respective mutual funds they want to purchase on our platform. We took great care to provide our users with details such as the size of all our funds, prospectus, historical fund performance, fund composition, and risk level of the fund, as well as the identities of the trustee, custodian, registrar, and management fees. All this information is there to help customers make better investment decisions.

Industry-leading security

In addition to our SEC licensing, we employ superior security and technical structures, covering measures such as bank-grade encryption and two-factor authentication, as an extra layer of protection, to keep your account safe and secure.

Best-in-class assets

All the investment options listed on Cowrywise, are carefully screened, and managed by professional fund managers. All the diverse mutual funds are SEC-authorized, with a standard third-party custodian structure.

Required knowledge base and financial expertise

Cowrywise has a team of outstanding investment professionals, with solid experience in wealth management, investment analysis and advisory. Members of our team also have solid qualifications such as the CFA Charter, ACCA and ICAN.

Our final advice: It’s your money – ask questions and acquire knowledge

Investors should:

- Have an acute understanding of the regulations, regulatory bodies, and licenses required to successfully operate a fintech company

- Be aware of the risks associated with investing with a company without a custodian

- KYF: Know your Fintech. Do their own due diligence/investigations and ask the right questions. Acquire an above-average understanding of the sector and where you are putting your money.

Need a copy? Get the report here:

Please check your email for the download link.

Additional Sources

This is brilliant, thanks to cowry wise and ope, am now a proud investor in mutual funds and it’s nice learning new stuffs everyday. Going to break the cycle of poverty. Kudos to the whole cowry wise team, I love you guys so much?

WOW. I must confess it’s so explanatory. Keep the good work cowrywise and Ope

Education is indeed cheap compared to ignorance when fund management and investment is involved.

Sharing this has not only enlightened cowrywise investors but when shared widely on different social media networks and newspaper print platforms would go a longer way in educating the ignorant many and help fight Ponzi schemes that leeches people of their hard-earned money.

Thanks @ Cowrywise for this write-up.

Information is important to us in life. Thanks for sharing, keep the flag flying.