In a country where financial literacy remains a pressing concern, particularly among Nigerian youths, the quest for economic empowerment and financial security has never been more critical. Among the several challenges faced by Nigerian youths, limited access to financial education resources stands out as a critical barrier to financial literacy. The absence of structured financial education programs in tertiary education curricula further compounds the problem, leaving many youths ill-equipped to make informed financial decisions.

In response to these challenges, the Cowrywise Campus Ambassadors’ Program emerged as a beacon of hope, offering Nigerian students practical experiences and resources to develop essential financial management skills. Through a multifaceted approach encompassing financial education, career growth, personal development, and networking opportunities, the program empowers students of tertiary institutions to navigate the complexities of personal finance, money management, and career growth with confidence and competence.

This simplified report explores the intricacies of financial literacy and uncovers the impact of the Cowrywise Campus Ambassadors’ Program in contributing to the lives of thousands of Nigerian tertiary students and contributing to national development.

Download the full report

Money and Sense: Understanding the Concept of Financial Literacy

Financial literacy is the cognitive understanding of different financial components and skills such as saving, investing, budgeting, borrowing, taxation, and personal financial management. It encompasses not just the practical knowledge of financial tools and concepts, but also the understanding of how these components interact within the broader financial terrain.

It empowers you to effectively manage your finances, build wealth, mitigate financial risks, plan, and build a secure future.

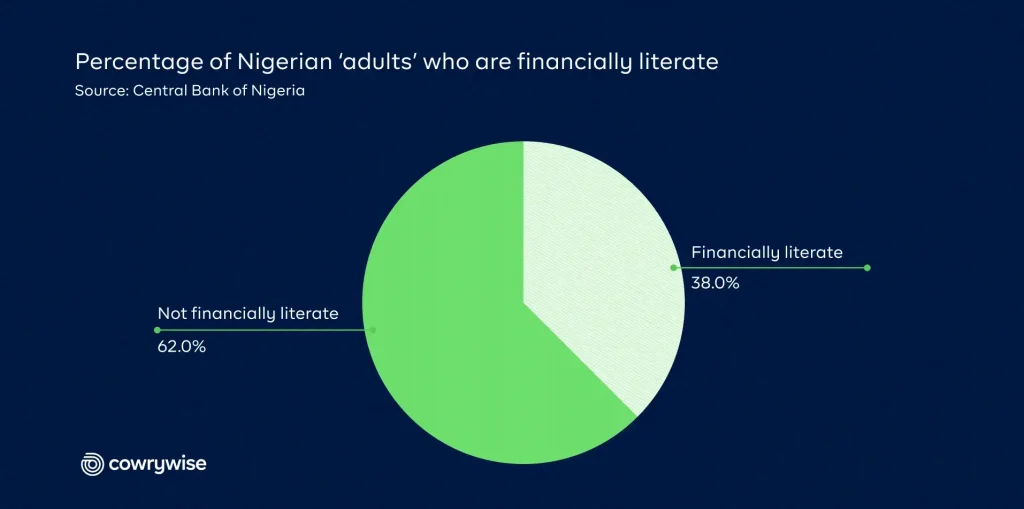

However, in Nigeria, financial literacy levels remain alarmingly low. According to the Central Bank of Nigeria (CBN), only 38% of Nigerian adults are financially literate, highlighting a significant knowledge gap. It is a problem that hinders not only individual well-being but also the nation’s economic progress. Poor financial decisions, missed financial opportunities, and limited social mobility are just some of the consequences of a poor financial foundation.

Cracking the Money Code: Challenges faced by Nigerian youths regarding financial literacy

Limited Access to Financial Education Resources

One of the primary factors contributing to limited access to financial education resources is the lack of integration of financial literacy into formal education curricula. Despite growing recognition of the importance of financial education, many schools and educational institutions in Nigeria do not offer structured programs or courses dedicated to teaching financial literacy skills. As a result, Nigerian youths graduate from secondary and tertiary institutions without the fundamental knowledge and skills needed to manage their finances effectively.

While there are initiatives aimed at promoting financial literacy, such as government-led campaigns like the CBN’s Financial literacy framework and community-based programs, their reach and impact are often limited by resource constraints, inadequate funding, and a lack of coordination among stakeholders.

The digital divide also exacerbates the challenge of access to financial education resources, particularly those in rural and remote areas with limited internet and mobile penetration and digital skills. While online platforms and mobile applications have the potential to democratize access to financial education, their effectiveness is hampered by barriers such as the affordability of internet-enabled devices, digital courses, and technological infrastructure limitations.

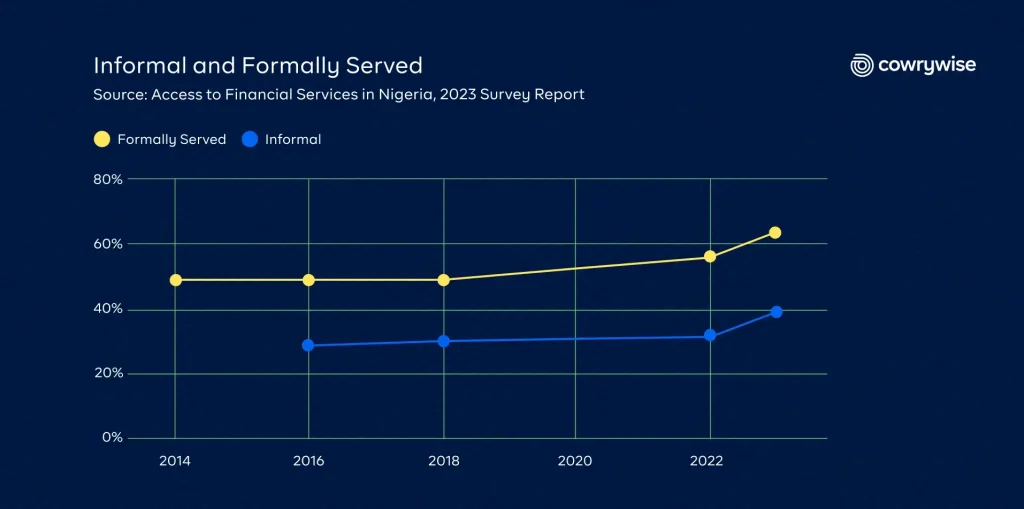

Slow Growth of Financial Inclusion

The slow growth of financial inclusion in Nigeria represents a significant challenge for Nigerian youths, limiting their access to mainstream financial services thereby contributing to financial illiteracy in the country. Despite efforts to promote financial inclusion in Nigeria, a considerable portion of the population remains unbanked or underbanked, impeding youths’ ability to participate fully in the economy and achieve financial security.

As of 2023, approximately 64% of Nigerians are formally financially included in the country, up from 56% in 2020, which is still far from the CBN’s target of 95% by year-end 2024. This means that approximately 40 Million Nigerian adults remain financially excluded. This lack of access to mainstream financial services, such as savings accounts, credit facilities, and insurance products, undermines youths’ ability to manage their finances effectively and plan for the future.

Financial Blunders: Nigerian Youths in Code Red

Below are some adverse effects of financial illiteracy on the lives of Nigerian youths:

- Vulnerability to Financial Exploitation:

Without adequate financial literacy, Nigerian youths are susceptible to various forms of financial exploitation, including fraudulent schemes and predatory lending practices. This vulnerability further underscores the urgent need for comprehensive financial education initiatives.

A report by Norrenberger Financial Investments Scheme estimated that as of 2022, Nigerians had lost over 300 Billion Naira to Ponzi schemes in five years.

According to the Economic and Financial Crimes Commission (EFCC), cases of financial fraud targeting young people, such as Ponzi schemes and investment scams, have increased in recent years. The lack of awareness about basic financial principles and the allure of quick wealth make youths easy targets for fraudsters, leading to significant financial losses and psychological distress.

2. High Level of Indebtedness:

The lack of knowledge of financial concepts, and ideal basic financial practices such as budgeting, savings, investment, and debt management has made several Nigerian youths vulnerable to high levels of indebtedness. There have been reports about the rise in non-performing loans among youth borrowers, which could be attributed to financial illiteracy, inadequate financial risk assessment practices, and of course other macroeconomic conditions.

As a result, many young Nigerians find themselves trapped in cycles of debt, struggling to meet repayment obligations and unable to access credit for productive investments or personal development.

3. Inadequate Savings and Retirement Planning:

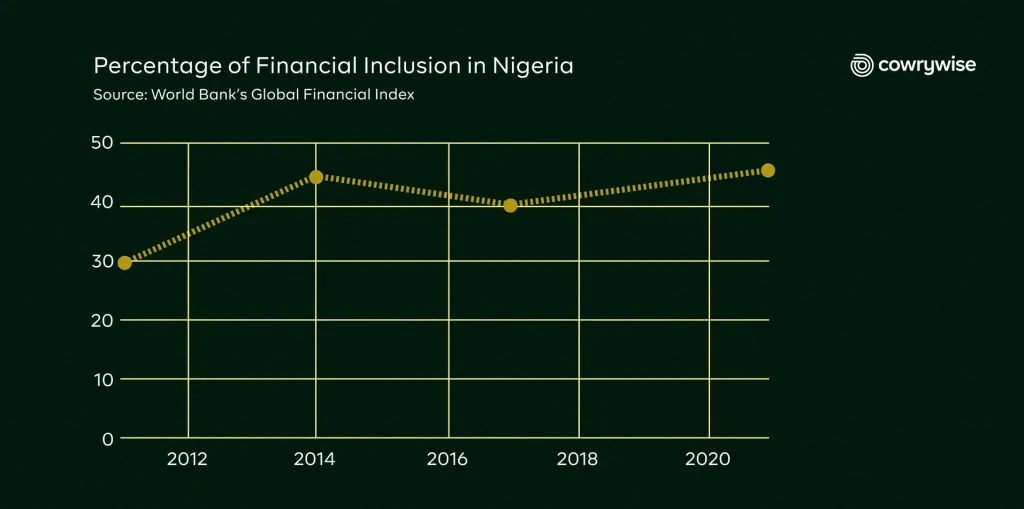

Without the knowledge and skills to effectively manage their finances, many Nigerian youths struggle to save for the future and plan for retirement. The World Bank’s Global Financial Index Database reported that only 45.32% of Nigerian adults have a formal savings account in 2021, indicating a low level of financial preparedness for emergencies and long-term financial goals. Financial illiteracy contributes to this trend by inhibiting youths’ ability to develop saving habits, set realistic financial goals, and invest in retirement planning instruments such as pension schemes and annuities.

Money-Smart Degrees: The Financial Literacy Imperative for Nigerian Tertiary Institutions

While financial education should ideally begin early in life, tertiary institutions in Nigeria currently fail to equip students with these crucial skills. Overpacked curriculums and the lack of qualified financial educators leave a significant knowledge gap. This necessitates integrating financial literacy programs into the tertiary education system to empower young adults entering the workforce and making critical financial decisions, as it would help in the following:

- Economic Empowerment: Financial education empowers individuals to take control of their financial futures, enabling them to build wealth, achieve financial independence, and contribute to economic growth.

- Poverty Alleviation: By equipping Nigerian students with the necessary financial skills, financial education has the potential to alleviate poverty and reduce income inequality by enabling individuals to access economic opportunities and effectively utilize financial resources.

- Enhanced Financial Resilience: In an increasingly volatile economic environment, financial education will serve as a vital tool for enhancing financial resilience. By teaching individuals how to manage risks and plan for unforeseen circumstances, financial education can help mitigate the impact of economic shocks and downturns.

- Long-term Prosperity: Investing in financial education today lays the foundation for long-term prosperity and sustainable development in Nigeria. By fostering a culture of financial literacy and responsibility, financial education creates a pathway to a brighter future for generations to come.

Cowrywise Campus Ambassadors’: Young Money Masters in Training

The Cowrywise Ambassadors’ program is designed as a nationwide initiative aimed at providing students of tertiary institutions with practical experiences to develop essential financial management skills from an early stage.

Through this program, students are equipped with the necessary tools to learn and apply personal finance principles, setting them on a path toward financial independence and success beyond their academic years.

At the heart of this initiative lies Cowrywise’s vision to make savings and investment opportunities accessible to everyone, regardless of their background, or economic status. Doing this on a sustainable basis requires investment in financial education. Hence, our focus on campuses is strategic – as they house the next generation of savers and investors, making them ideal grounds for nurturing lifelong financial literacy and competence.

The Cowrywise Ambassadors’ program is structured around three key objectives, each aimed at empowering students with the skills and resources they need for success both during and after their academic journey. These objectives include:

- Financial Literacy & Financial Education: This is a core pillar that focuses on equipping students with the knowledge and understanding of financial concepts they need to thrive, such as budgeting, saving, investing, and the principles of building wealth.

- Career Growth and Personal Development: This objective aims to foster the personal and professional growth of students by providing them with opportunities to upskill, mentorship, and career guidance. Participants engage in workshops, networking events, and hands-on experiences that help them explore their interests, develop their strengths, and prepare for the transition from academia to the workforce.

- Quality Networking Opportunities: Networking plays a crucial role in career advancement and personal growth. This pillar of the program focuses on creating an environment where students can connect with industry professionals, alumni, and peers which has been helping participants have the chance to build valuable relationships, exchange ideas, and expand their professional networks.

The Meat of the Matter: How the Ambassadors’ Program is closing the financial education gap

Having recognized the challenge with financial literacy amongst Nigerian youths, and the prevalent lack of adequate financial education in academic curricula, we saw the need to take responsibility as a concerned investment management company.

It was in this regard that we launched the campus ambassadors’ program, providing students with comprehensive resources and opportunities to enhance their knowledge of finance, and money management.

- Every month, we facilitate financial literacy sessions across all our active campus communities, covering fundamental financial topics such as budgeting, saving, investing, and debt management. These sessions are often led by finance professionals like Doyinsola Toye, Basirat Adebiyi, Temitayo Ogunlade, and many others who provide practical insights and real-world applications.

- To reinforce theoretical knowledge, we also incorporate practical activities and financial simulations in our periodic engagements.

Exercises like these allow students to apply what they’ve learned in a controlled, risk-free environment, develop peer learning and teamwork skills, and foster networking amongst community members.

In fact, lessons from these activities have been very helpful in helping campus ambassadors scale through interview and assessment stages at different big financial institutions in Nigeria, and global investment firms across the world, like United Capital, Merristem, FMDQ, GTCO, Access Holdings, PwC, KPMG, Ernst and Young, Deloitte, Bank of America, and many more.

- Campus ambassadors are encouraged to organize and lead financial literacy campaigns on their campuses. These campaigns aim to raise awareness about the importance of financial education and provide students with valuable resources.

Most recently, campus ambassadors at Redeemers University, Ede organized a week-long financial literacy campaign featuring activities aimed at creating awareness about the concept of personal finance, and money management across the entire Redeemers University campus community, encouraging a savings and investments culture amongst their fellow students. This campaign was recognized and applauded by the Redeemers University students council.

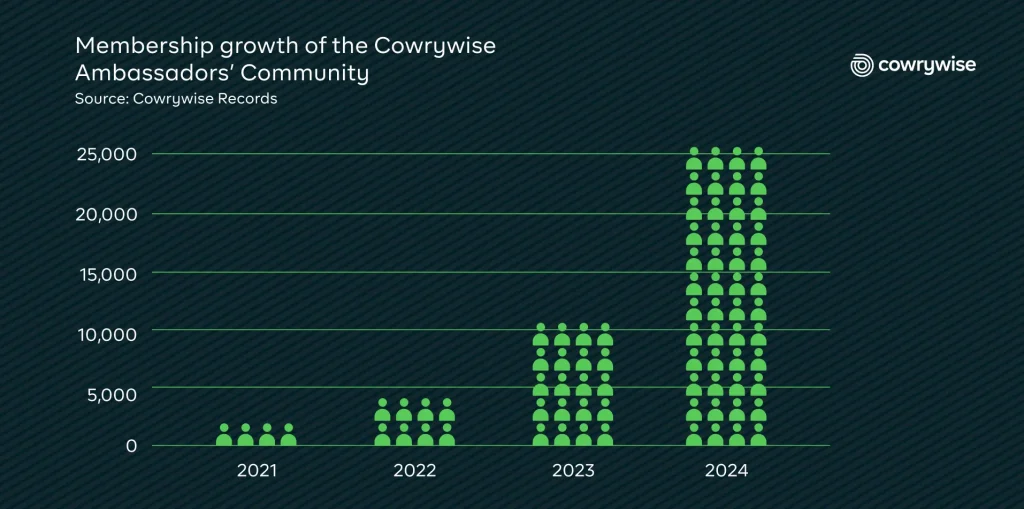

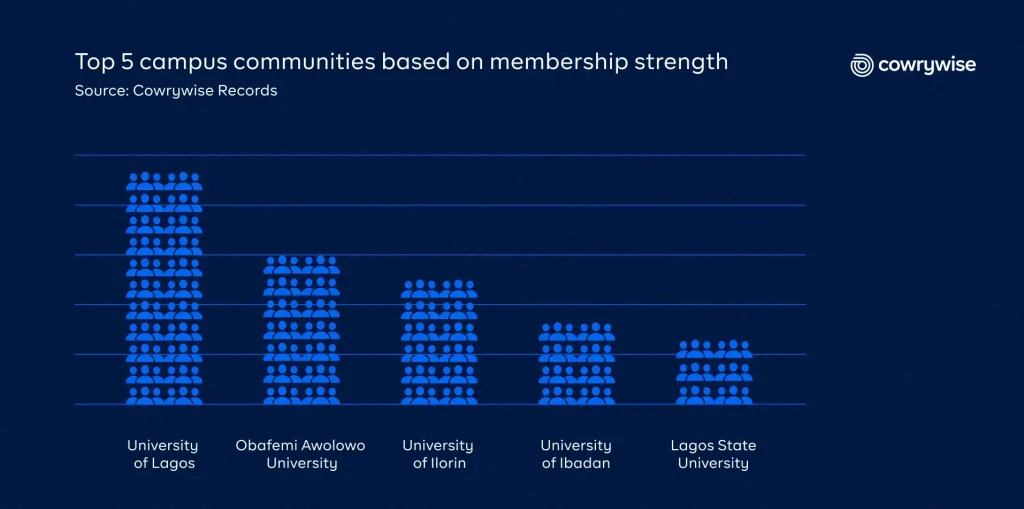

We currently have 25,000 participants in over 200 tertiary institutions across all the states of the federation, enabling us to spread our wings of impact and the gospel of financial literacy. We have received amazing feedback from participants over the years about how the activities in the community have helped them improve their knowledge of personal finance, and money management significantly. Here’s what some of our members have to say:

Cowrywise’s Two Cent to National Development

The Cowrywise Ambassadors’ Program contributes significantly to national development by empowering the next generation of leaders with essential financial literacy and personal development skills. Here’s how:

- Advancing Sustainable Development Goals (SDGs): The program aligns with various Sustainable Development Goals (SDGs), as seen below:

By promoting financial literacy, education and academic excellence, and economic empowerment, the program contributes to the achievement of these global goals.

2. Human Capital Development: Through career growth and personal development initiatives, the program enhances the human capital of participants, preparing them for the challenges of the modern workforce. By investing in the development of future business leaders, innovators, and entrepreneurs, the program fosters a skilled and productive workforce critical for national development.

3. Economic Empowerment: Equipping students with financial education and money management skills enables them to make sound financial decisions throughout their lives. As these individuals enter the workforce and become financially independent, they contribute to economic growth by driving consumption, and quality investment.

4. Reducing Financial Burden: By teaching students how to budget effectively, save wisely, and invest prudently, the program helps to alleviate the financial burden on families and individuals. This can lead to improved financial stability and resilience at both the household and national levels.

5. Quality Networking and Collaboration: The program facilitates networking opportunities between students, industry professionals, and alumni, fostering collaboration and knowledge exchange. These connections can lead to partnerships, mentorship opportunities, and innovative initiatives that drive economic and social progress.

If you’re an undergraduate, a Corper, or a recent graduate we invite you to be a part of this impact-driven community, with proven results, and quality testimonies all around. Visit cowrywise.com/ambassadors today to be a part of the community.

If you are not in any of the categories above, but you know anyone who is, be kind enough to share this valuable opportunity with them: cowrywise.com/ambassadors.

If you’d like to play a voluntary contributory role or partner with us in achieving the objectives of the community, you can shoot an email to ambassadors@cowrywise.com, and we’d be glad to speak with you.

This is very detailed! Thank you and well done, Timi!