For ages 5-17

Give your kids a solid

head start

Teach your kids how money works and invest money towards their future.

Keep your kids motivated

and prepared

Set up a profile

For kids aged 5-17, you can create a profile in just a few easy steps. Simply share their name and date of birth to get started.

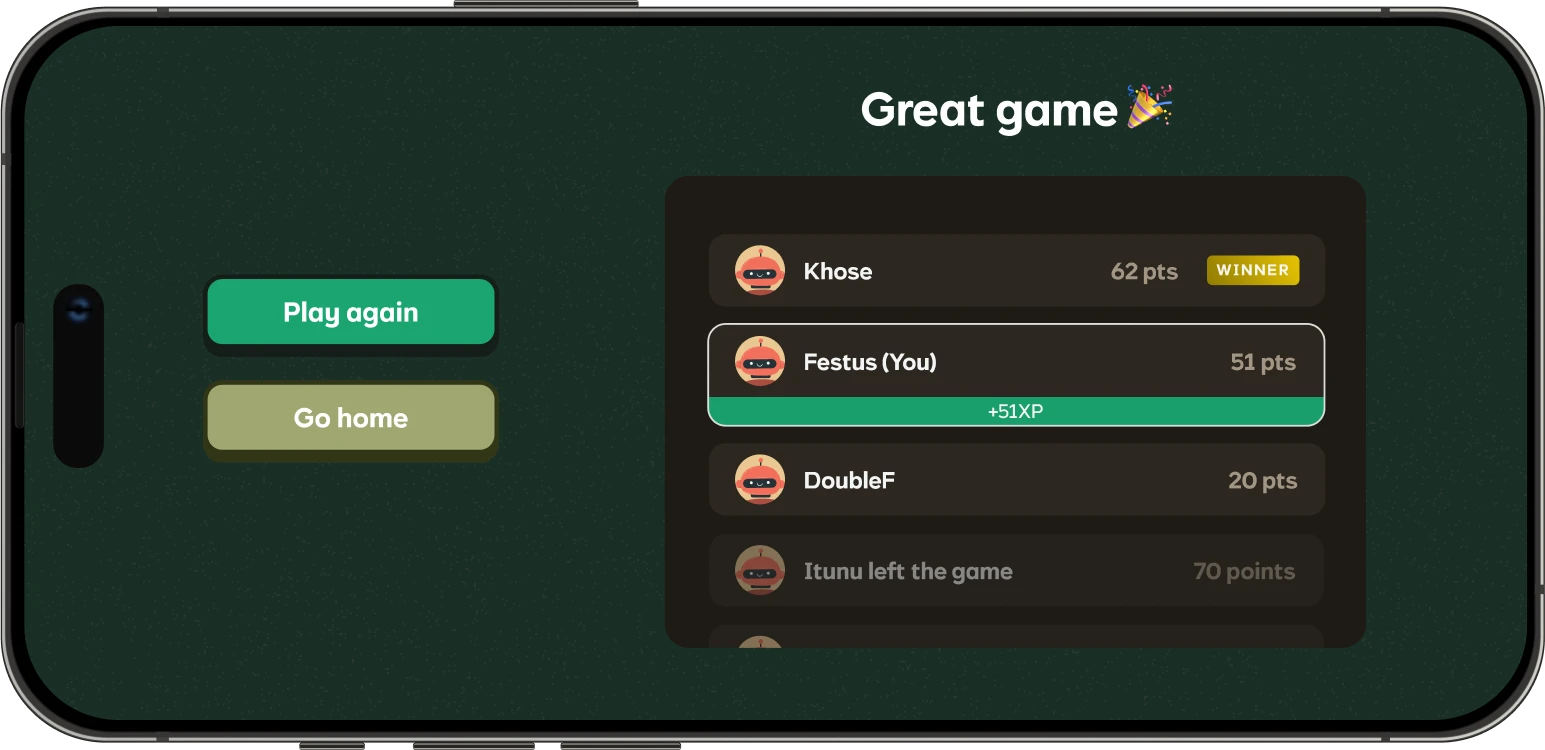

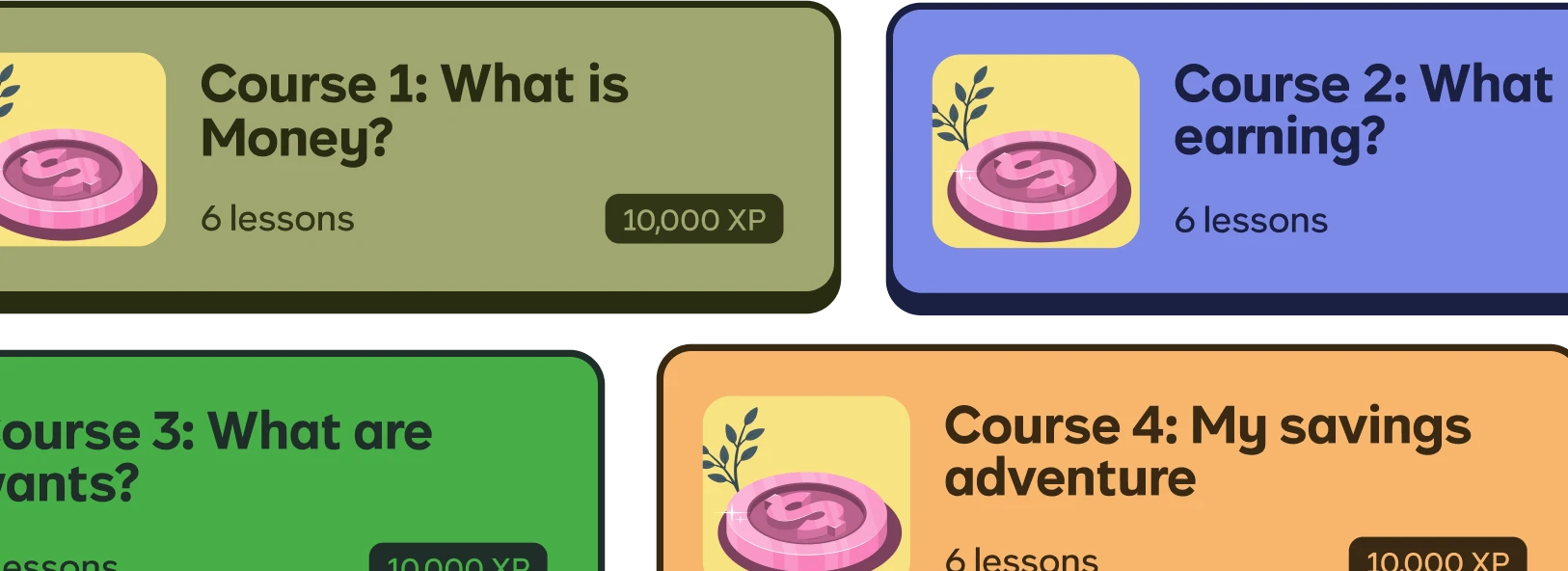

Watch them learn

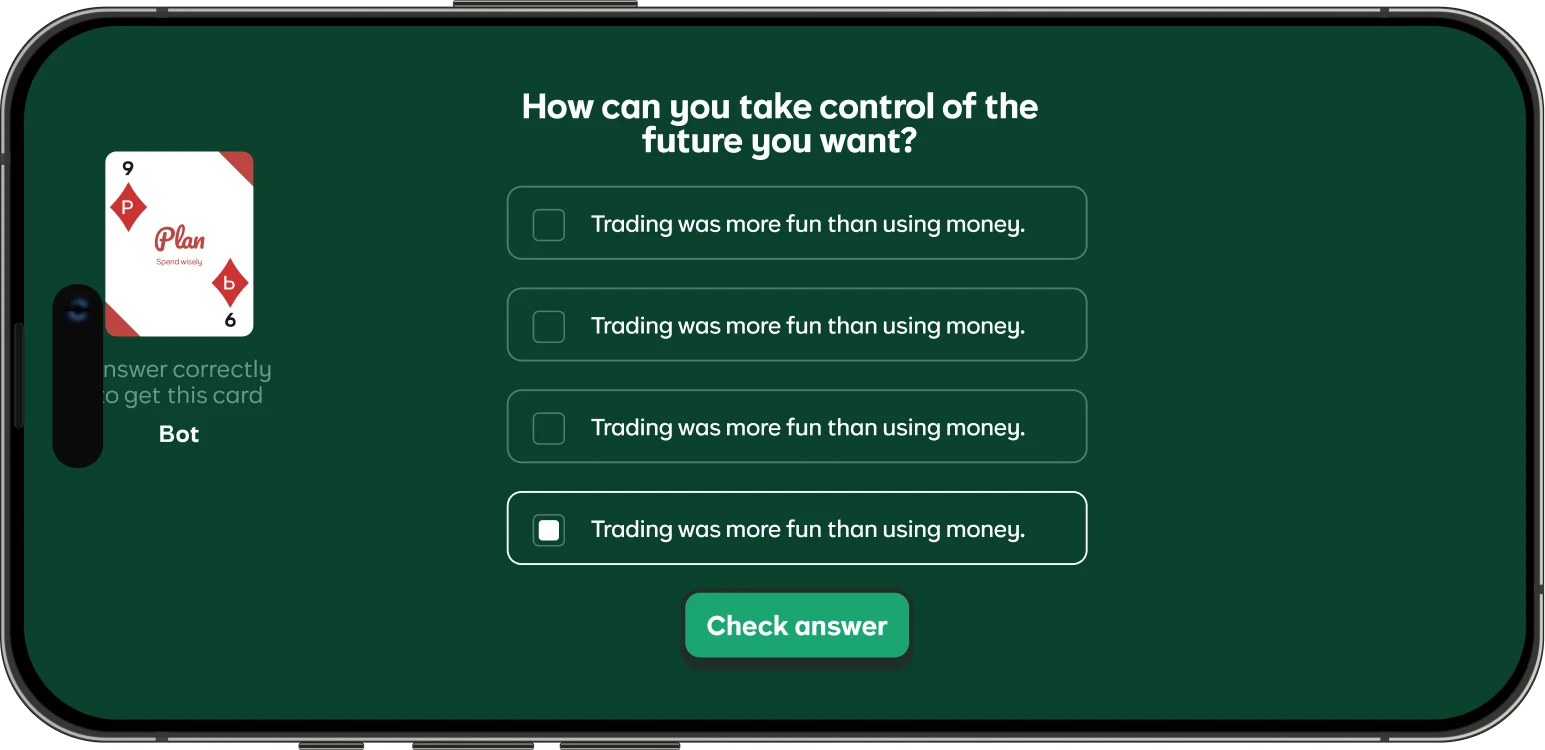

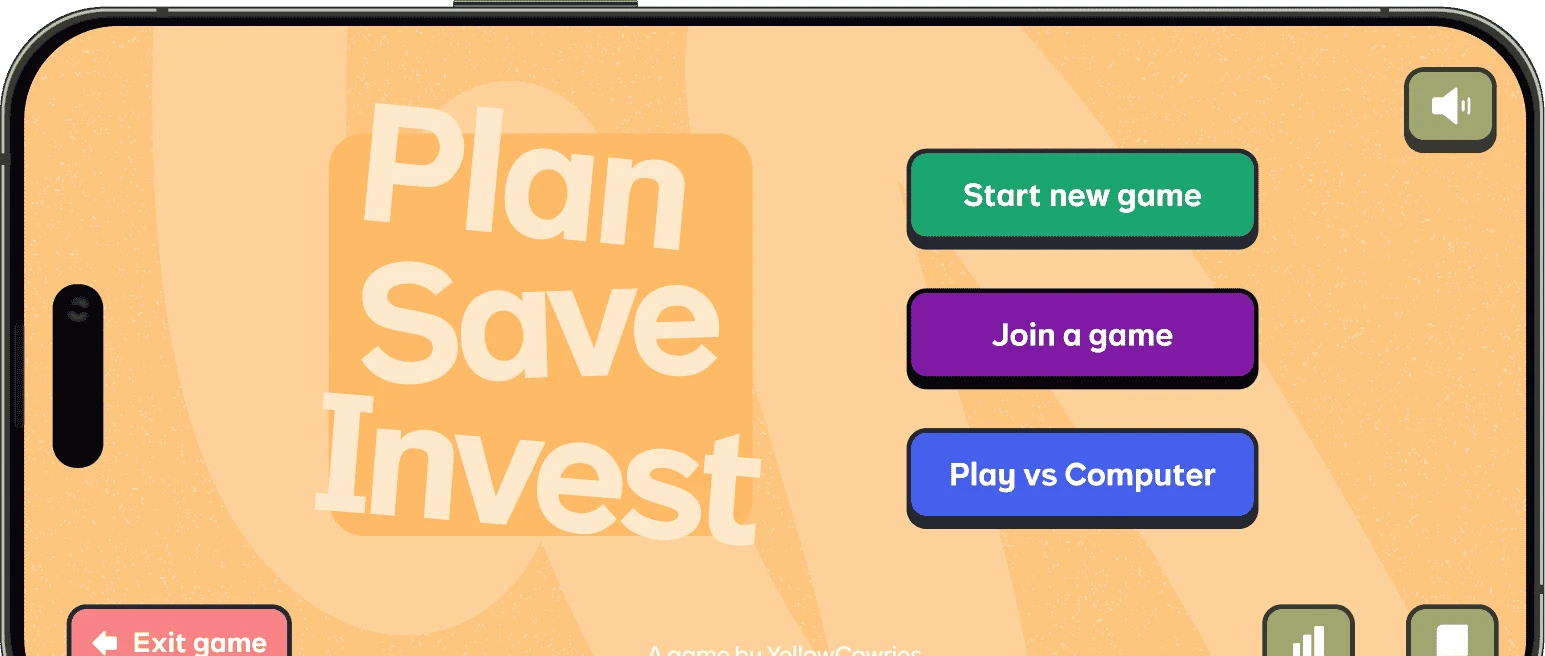

From quick, bite-sized lessons to fun and exciting games, your kids learn how to manage money with confidence - all while playing and exploring.

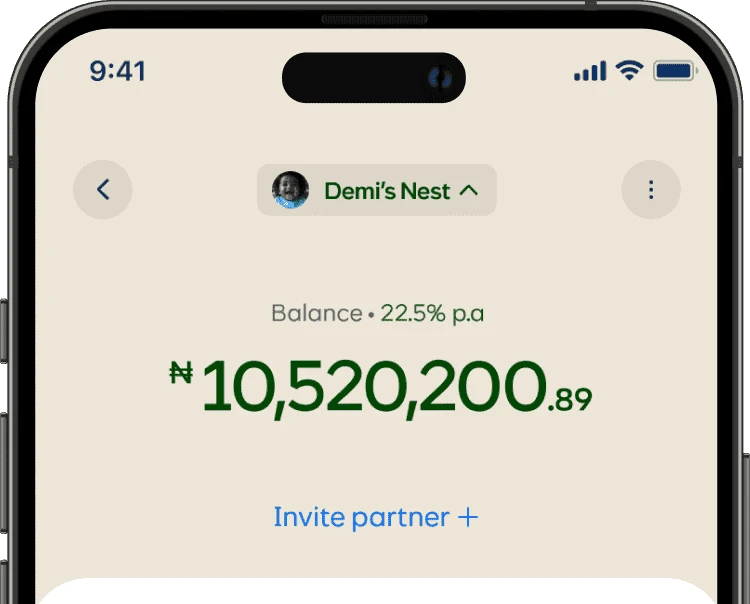

Invest in their future

When you create a profile for your child, we’ll automatically open a Nest - a kiddies investment account in their name that you can keep growing and funding until they turn 18.

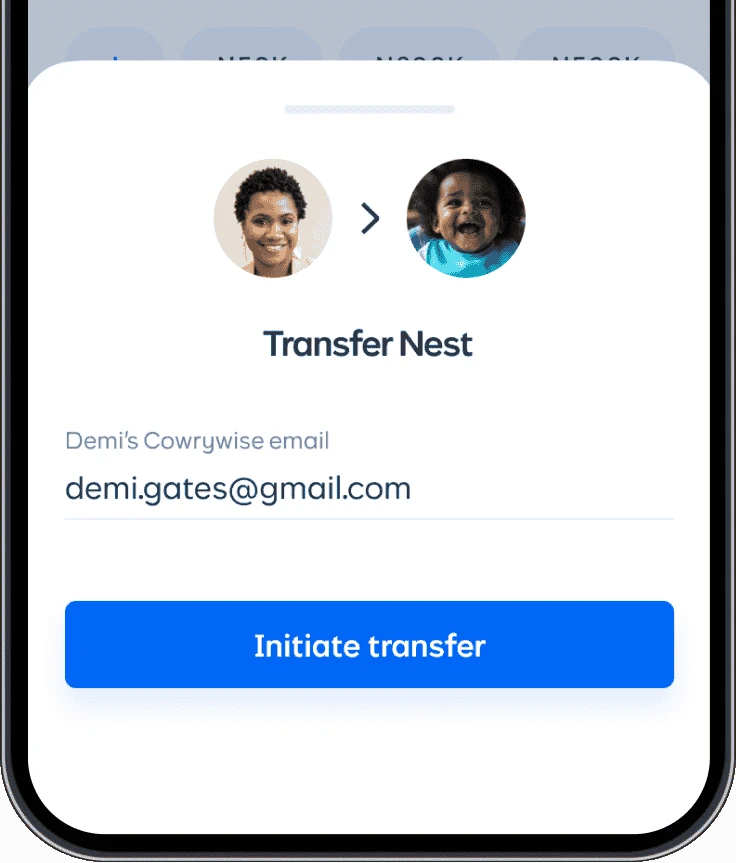

Transfer wealth

Transfer the funds to your kids when they clock 18, or when they are good and ready. Give them wings to fund their dreams.

A place where kids learn,

play and grow

Your kids build confidence, curiosity, and real-world money skills that last a lifetime.

FAQs

What is Nest?

Nest is an investment account set up by a parent to invest money on behalf of a child. The funds are locked until the child turns 18, giving the investment ample time to grow. This way, when your child comes of age, you can give them a solid financial foundation - helping them fund their tuition, start a business, get their first car, or even their first apartment - whatever their dreams may be.

How can I set up a Nest account for my child?

That's easy!

- Sign up on Cowrywise with your personal details or login if you have an account.

- Tap the 'Create a Nest' card.

- Follow the steps to create a Nest account for your kids.

Who controls the account?

You do! As the parent, you manage the account until your child reaches the age of 18. After that, you can transfer ownership to them.

Can my spouse contribute if I create the account?

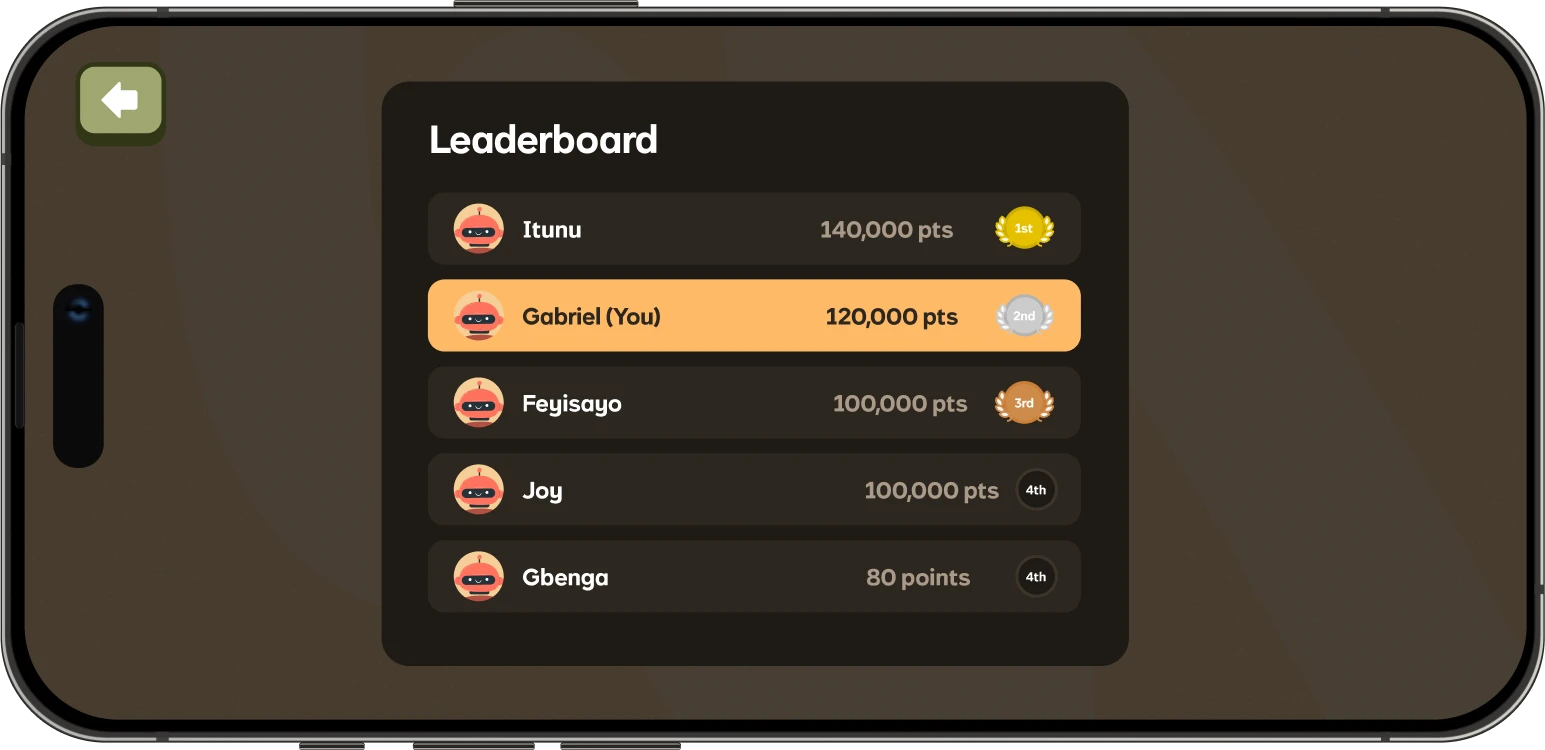

Yes! You can invite your spouse or partner as a co-manager! You will both be able to monitor activity on the account and make contributions to build your child's portfolio.

Is there a minimum to start investing?

The minimum amount to start investing in Nest is ₦10,000. A small price to pay for your child, don't you think?

Why should I automate contributions?

Automating helps you stay consistent. A little every month adds up, thanks to the magic of compounding. Plus, it's one less thing to remember in your busy life.

Can I withdraw the money anytime?

The account will only become accessible when your child is 18 years old. For example, if you create an account for your child born in 2025, the account will only become accessible in 2043.

Will Cowrywise be here when my child turns 18?

We will be here as long as it takes. We have been in operation for close to a decade already. We are duly licensed by the Securities and Exchange Commission of Nigeria (SEC), and work with other partners to ensure the safety of your funds. Rest assured, we WILL be here when your child comes of age - whenever that is.

Is it risky to invest for my child?

All investing involves risk, but time is on your child's side. Starting young gives their investments time to ride out market ups and downs. With this account type, compounding is their friend.

What if I have more than one child?

No problem! You can open separate Nest accounts for each child and manage them all in one place.