Usually, when you open an investment platform, a lot of options are introduced to you and you get confused.

On Cowrywise, for example, you’re spoiled for choice. There are many (best) mutual funds to invest in. In fact, it’s the largest collection of mutual funds in Nigeria! So, how do you get started with investing given the beautiful choices you have? This is where knowing about the various types of investment for investors comes in.

In this guide, we will cover:

1. Who are the common types of investors?

2. How to determine your investor type

Or you can skip to quickly check your risk tolerance and get immediate access to investments tailored for you,

Who are the common types of investors?

The first step to investing is understanding your risk tolerance. This is what helps determine what type of investor you are. Drawing from this, we have three broad categories of investors:

1. Low-risk investors

2. Medium-risk investors

3. High-risk investors

1. Low-risk investors

These are investors who are not willing to take risks with their capital. The priority for low-risk investors is to preserve their capital regardless of potential returns. Hence, they go after low-risk investment offers. If you’re a beginner investor, you’ll most likely fall into this category of investors.

Get low-risk investments on Cowrywise with our money market funds.

These funds are professionally managed by fund managers licensed by the Securities and Exchange Commission (SEC). They invest in financial instruments like treasury bills, commercial papers and bank deposits. These financial instruments ensure that the chances of losing the principal capital invested are very low. Similarly, the investments are usually liquid, meaning that you can have access to the investment anytime you want.

A good example of how to utilize the money market fund is to build an emergency fund with it.

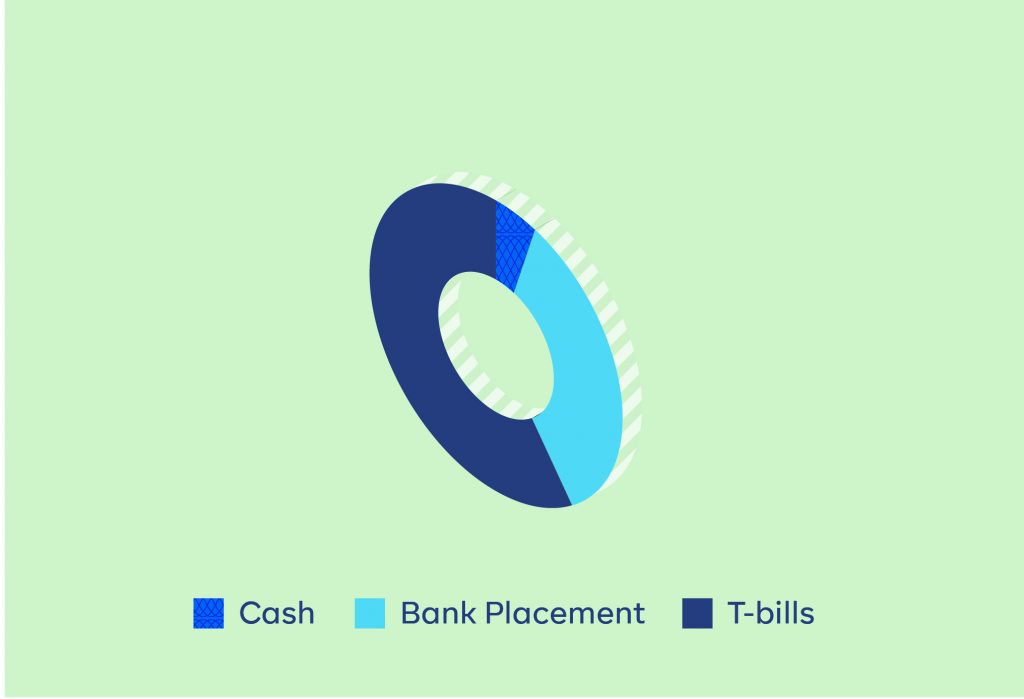

A typical money market fund is invested in treasury bills and bank instruments. Below is an example of a particular mutual fund on Cowrywise.

2. Medium-risk investors

When approaching investments, medium-risk investors are much more confident than low-risk investors. They are open to taking a few risks with their capital. However, they are also careful to ensure that while their capital may be impacted, it does not result in very high losses.

Usually, medium-risk investments like balanced mutual funds and our dollar fund are invested in a mix of high-risk and low-risk financial instruments. These include stocks, bonds and treasury bills (money market). This type of composition ensures that the low-risk components of the fund balance out the high-risk components.

Hence, the chances of losing capital are lower than what is obtainable for high-risk investments. Here is an example of the composition of a typical medium-risk (balanced) mutual fund:

3. High-risk investors

High-risk investors have the appetite to take risks. This simply means that they have the capacity to lose the invested capital if the investment expectations are not met. They are open to taking high-level risks with the expectation of high returns. Bear in mind that we are focusing on professionally managed and regulated investments. So investing in a Ponzi scheme doesn’t qualify.

Typical high-risk investments like equity mutual funds invest predominantly in stocks of selected companies. For example, there are a couple of equity mutual funds on Cowrywise that are managed by different fund managers licensed by the SEC.

These equity funds invest in stocks of the largest publicly listed companies in Nigeria including Dangote Cement, GTCO, MTN, Nestle, Total, Access Bank, among others.

These equity funds invest in stocks of the largest publicly listed companies in Nigeria including Dangote Cement, GTCO, MTN, Nestle, Total, Access Bank, among others

The primary attraction of high-risk investment is the possibility of high returns over time. However, there is also the possibility of losing the invested capital due to the up-and-down movement in the prices of stocks. Hence, we usually recommend that you take a long-term perspective while investing in equity mutual funds. Here is a typical composition of an equity mutual fund:

How do you determine the type of investor you are?

We’ve understood the types of investors, here is how you can determine what type of investor you are. We have developed a simple risk assessment tool that allows you to establish fairly accurately what type of investor you are, at every point in time.

Why do we ask you these questions? Let’s break down just 3 out of the questions we ask you in our risk assessment test.

Marital status

Your marital status can have a lot of impact on what level of risk you can take. Being married often means having significantly more financial responsibilities. The rent is more, much more food is eaten and utility bills can easily double. This leaves a married person with less money to spend while also making that reduced investable money more sensitive. As a married person, you probably don’t want to hear stories that touch on your investments. Therefore, all things considered, a married person is less of a risk-taker than an unmarried person.

Age

Helen Keller says “Life is either a daring adventure or nothing”. You’d agree with me that our propensity to dare and get on an adventure is inversely related to your age. The younger you are, the more years you have ahead of you to recover from a bad investment. Therefore, your risk appetite goes down slightly for every birthday you celebrate.

Net-worth

The more money you have, the more money you have to put on the line to make more money. Was that confusing? This is one of the critical reasons why savings come before investments in the financial alphabet. Individuals with higher net worth have a larger and softer cushion to bounce back from a bad investment, which makes them comfortable enough to make high-risk investments.

Once you finish interacting with this tool, you will be classified as either a conservative investor (low-risk), moderate investor (medium-risk) or aggressive investor (high-risk). On this basis, we will automatically recommend different mutual funds that match your risk profile. That way, you are not just investing blindly. Isn’t that cool?

To know your investor type and get immediate access to investments that match your type, follow these steps:

1. Take a brief Risk Assessment to know your investor type.

2. Check out the investment options tailored to you.

3. Start investing.

We made sure that your journey to building your wealth is super easy and seamless. Start investing today.

ALSO READ