A guide to investing in Managed Portfolio

A survey we conducted recently detailed the investing habits of young Nigerians across varying industries. From the survey data, it quickly became clear that a fear of investing looms over the heads of many young Nigerians like a dark cloud – and for good reason.

Aside from a trust deficit that threatens overall investor confidence, 14% of the individuals surveyed have a gripping fear of losing money to bad investments. Another 5% have real concerns about their funds becoming inaccessible, while 11% are afraid to start investing because of its perceived complexity.

The effect of this inherent fear is that a significant number of Nigerians never begin their investment journey when they should, driving a wedge between the individuals they are today, and the investors they would have been tomorrow.

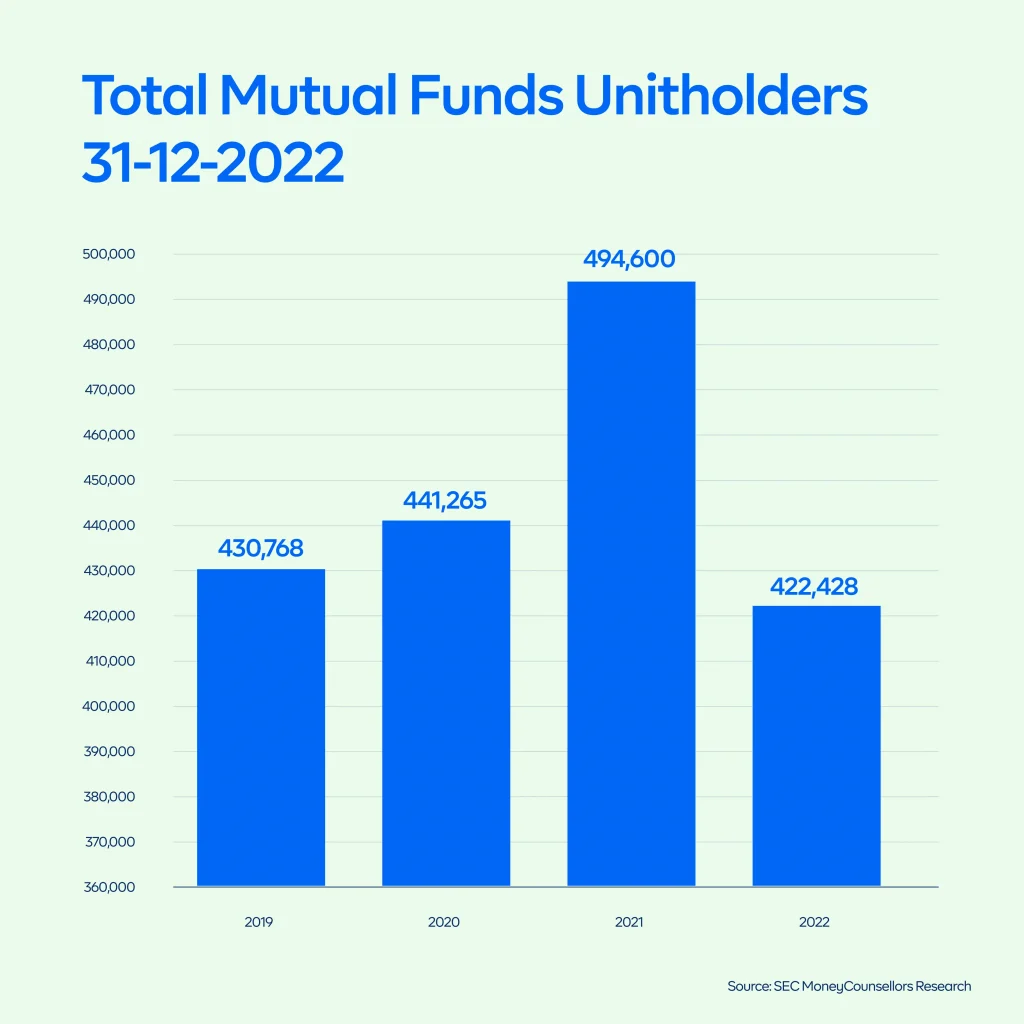

Data from the Nigerian Inter-bank Settlement System (NIBSS), revealed that the number of active bank accounts in Nigeria stood at 133.5 million, as of December 2021. This is in stark contrast to the number of unit holders of mutual funds within the same period – about 457,256 individuals, according to data sourced from Nairametrics. This means that just 0.23 percent of the entire population invests in mutual funds, shedding more light on the meagre penetration of mutual funds in the country.

More recent figures put the number at 422,428 as of 2022.

Not all is bleak and gloom.

To further close the widening gap and relieve investment fears, we built Managed Portfolio – a new investment path to invest in mutual funds. Managed Portfolio is a smart, diversified portfolio built for you with purpose – to simplify investing, manage risk and pursue long-term growth. It is a smart way for a new generation of modern investors to invest in a collection of mutual funds hand-picked to reduce the mental burden of decision-making.

There are so many mutual funds available, that it sometimes becomes difficult to decide on what mutual fund to invest in, as well as having the added responsibility of monitoring the performance of each fund.

Emmanuel Alabi

Investing in a Managed Portfolio means you don’t have to decide which one particular mutual fund to invest in, or which is performing best. We have put together the top-performing mutual funds into 3 distinct portfolios. All you have to do is select a portfolio and invest.

No experience required – A portfolio for modern investors

Investing in a Managed Portfolio helps you spread your funds across a diversified collection of assets. This means if you invest N100,000 in a Managed Portfolio, you are in effect allocating a fraction of your investment to assets like Treasury Bills, Fixed Income Funds, Money Market Funds, or even stocks at the same time.

Think of it this way

You walk into a store to buy a gift during the yuletide season. After walking up and down the aisle, you are unable to make up your mind on what to purchase. Luckily, you stumble on a Christmas hamper with a moderate price tag. Perfect! The hamper contains a bunch of gifts (some bigger than others), specifically put together by the vendor to match your taste and preferences. You proceed to the checkout point to make payment – you pay with your card, pick up your receipt, say your thanks to the cashier, and exit the store with the basket in hand. Mission accomplished! All you had to do was pick and pay!

Investing in a Managed Portfolio is as simple and intuitive as picking a hamper in a store; except this time, you are making a selection on the app.

To invest in a Managed Portfolio, what you need isn’t experience. It’s trust!

Trust is the one currency that counts

At its core, a Managed Portfolio is a ‘smart portfolio’. Just the same way a smart device like a smart watch, speaker or even a smart home for example, has been built to make living simpler, a Managed Portfolio makes investing easier to manage and more rewarding. There are three major reasons why this is the case.

- A diversified and customized portfolio: We have put the top-performing funds into different portfolios. Currently, there are 3 portfolio types you can invest in depending on your risk appetite and goals.

- Rebalancing: The purpose of rebalancing is to reallocate assets in your portfolio based on their current performance and your initial investment goal.

Here’s an example of how rebalancing works:

You have N100,000, which was invested equally in a portfolio with a 50/50 allocation. N50,000 is invested in stocks, and the other N50,000 in bonds. If after a year, the stocks outperform the bonds and are now valued at N70,000, while the bond is now valued at N40,000, you would have more concentration in stocks compared to bonds – a deviation from the initial 50/50 allocation. Rebalancing will require reallocation of the investments in each asset – in this case, selling some stocks and purchasing some bonds until the value of each asset is N55,000.

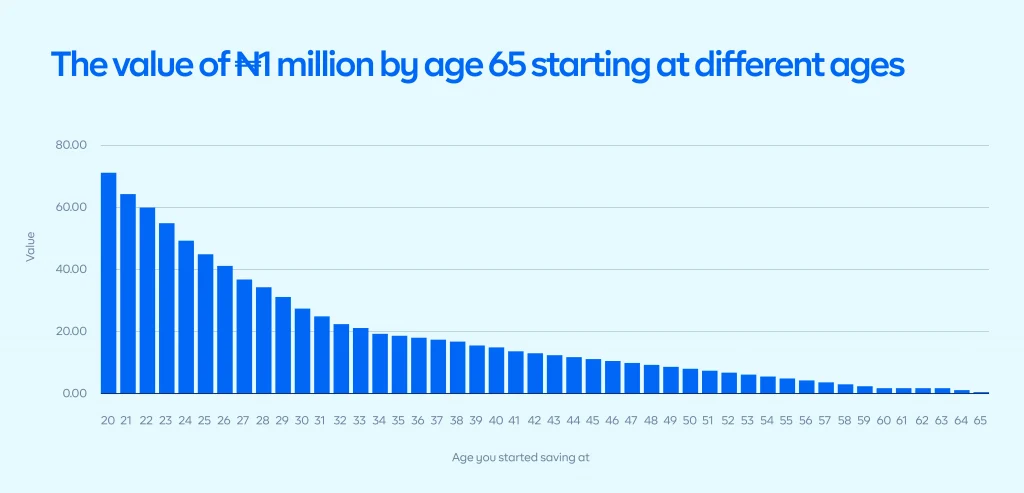

- Compounding: Your investment earnings and dividend are automatically reinvested or added to your principal, increasing your total investment, and earning potential by generating additional interest over time. Compounding is a smart and powerful investment strategy that relies on the power of time to grow your initial investment exponentially. The earlier you invest in a Managed Portfolio, and the longer you hold your investments, the more you stand to gain.

The basic premise of a Managed Portfolio is that all the hard work has been done for you. Your major task as an investor is simply to understand the asset composition of the portfolio, invest and trust that the portfolio will be professionally managed for your long-term benefit.

How to Invest in a Managed Portfolio

You can invest in a Managed Portfolio in a few steps:

- Log in to the Cowrywise App

- Tap Invest

- Tap Managed Portfolio

- Select your Portfolio preference

- Preview your Portfolio composition

- Select the amount and payment method

- Invest

Congratulations! You just made your first investment in a Managed Portfolio.

Conclusion

The current state of the economy is forcing Nigerians to tighten their belts, as household income is under extreme pressure from high inflationary conditions. The cost of PMS has continued to drive up transportation costs, just as the National Electricity Regulatory Commission (NERC) reviewed the prices of their single and three-phase meters by 39.7% and 31.1% respectively. Sporadic fluctuations in the FX market have also had a snowball effect on the consumer prices of food, goods, and services. It seems like a bad time to invest. But, it never is!

As the famous investor once said:

“The investor of today, doesn’t benefit from the growth of yesterday”.

Warren buffet

The market is difficult to predict, but you have control over your investment journey, particularly when to start. Investing early helps you unlock the advantage of time and manage risks adequately. Overall, your time in the market is a lot more important than timing the market, and Managed Portfolio makes it easier to get started.

Ready to invest in a diversified portfolio built for long-term growth?

Additional Sources

How Pods is revolutionizing the concept of joint savings in an age of individualism