Love is a word many must have heard a few too many times, but even amidst grand gestures and stolen kisses, finances inevitably creep into the equation. This Valentine’s Day, let’s explore the intricate dance between love and money. With inflation continuing to hammer the purchasing power of lovers (and single pringles) we offer tips to maintain financial health in a romantic relationship.

“Love is sweet o, When money enter Love is sweeter”

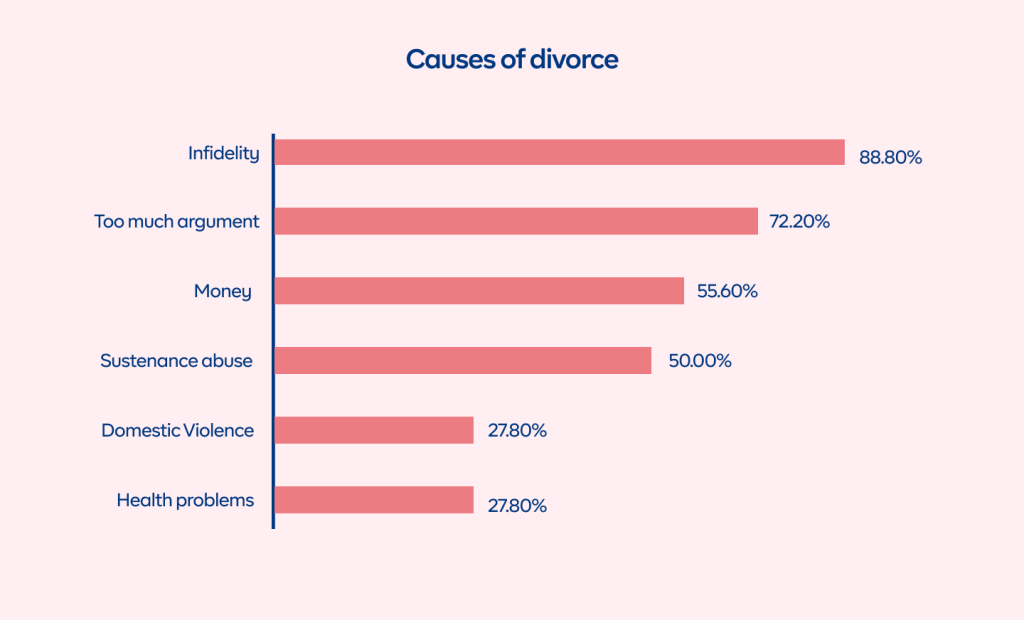

Money is the number one issue couples fight about, and it’s also a leading cause of divorce. This is because financial considerations are woven into the fabric of romantic partnerships, influencing everything from daily decisions like gift-giving and romantic gestures to long-term goals like career aspirations.

Source: 113 Divorce Statistics On The Divorce Rate In America – The Hive Law

While love shouldn’t be conditional on material things, money plays a significant role in our lives, impacting relationships in many ways. Some of these include;

Shared finances and economic partnership

According to research, married individuals tend to have higher household incomes compared to unmarried individuals. This is because of the shared finances and economic partnership that romantic relationships afford their participants. In romantic relationships, couples often find themselves navigating joint financial responsibilities, such as managing household expenses, planning for the future, and making significant purchases together. These financial decisions not only reflect the practical aspects of cohabitation but also serve as a testament to the trust, commitment, and mutual investment inherent in romantic partnerships.

When done properly, the concept of sharing in romantic relationships could help improve the finances of both partners making the sum greater than the individual parts. In a time when everyone is feeling the pinch of a cost of living crisis, pooling resources can provide stability. Couples can also rely on each other for financial support during significant life transitions, such as parenthood, or periods of illness.

Gift-giving and romantic gestures

One of the most apparent intersections between love and money lies in gift-giving and romantic gestures. As Joyce Connolly fondly phrased it, “Love is an action word”. This means that the emotion must be acted upon. This call to action is a call to “show workings”, to let your loved ones know that you care about them.

Gift-giving and romantic gestures play a significant role in strengthening relationships by fostering emotional connections, expressing appreciation, creating lasting memories, and showing thoughtfulness, generosity, and a willingness to go above and beyond to make your partner feel cherished and appreciated. However, buying a gift for your partner not only symbolizes love and devotion. It also carries significant financial implications, often requiring individuals to reconsider spending plans in the pursuit of romantic expression.

Career and Aspirations

Romantic relationships play a significant role in shaping career growth and aspirations, often embodying the principle that “two heads are better than one”. Partnerships founded on mutual support, trust, and shared goals can provide invaluable emotional support, fostering resilience and confidence in pursuing professional endeavours. A supportive partner can offer encouragement during challenging times, serving as a steadfast source of motivation and reassurance.

Shared financial goals and aspirations can be a driving force behind career success in romantic relationships. Couples who align their financial objectives and work together to achieve them can build a solid foundation for future prosperity. By pooling resources and making strategic investments, partners can create opportunities for wealth accumulation and long-term financial security.

How can you maintain your financial health in a romantic relationship?

Managing money as an individual can be challenging enough on its own, but when you add love to the equation, it becomes even more complex. Maintaining your financial “A game” in a relationship requires not only individual discipline and financial savvy but also effective communication, shared goals, and mutual respect. In this guide, we offer some financial dos and don’ts to ensure financial success in your relationship.

Dos

Communicate: Research studies and surveys have consistently shown that open communication about finances is correlated with relationship satisfaction and stability. Open and honest communication is essential for addressing differences in spending habits and financial values. Take the time to discuss your perspectives on money, including your attitudes toward saving, investing, and discretionary spending. For example, communicating about a budget for romantic gestures allows couples to express love without compromising financial well-being.

Set Financial Goals: Setting shared financial goals can help you and your partner stay focused and motivated. For couples, it isn’t just about numbers, it’s about weaving a shared vision for the future. It fosters clarity and focus, guiding your financial decisions toward building a life you both desire. Shared goals strengthen communication and collaboration, creating a sense of teamwork and mutual support. Whether it’s saving for a home, or investing for retirement, having common objectives strengthens commitment.

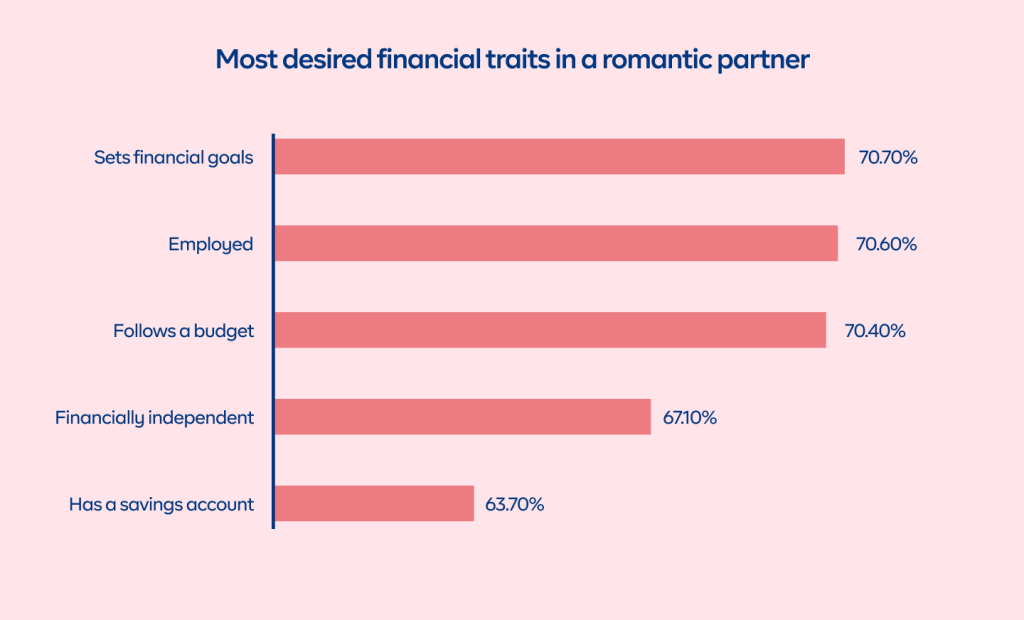

Strive towards financial independence: According to a survey, 67% of respondents financial independence was key for a happy relationship. And though this seems to go against the logic of 1+1 = 1, striving towards financial independence could make your romantic journey less arduous. This is because Financial independence fosters individual responsibility and respect, eliminating burdens of dependence and promoting healthy boundaries. Striving for financial independence within a relationship isn’t a race to individual wealth. Instead, it is a collaborative effort to build a future grounded in stability, respect, and empowered love.

Source: The Financial Timeline of Relationships – The Motley Fool

Don’t’s

Living beyond your means: While the excitement of splurging and living large might initially bring a spark to a relationship, living beyond your means is unsustainable in the long term. Keeping up with appearances or escaping reality through material things quickly leads to mounting debt and hidden financial stress. This creates a breeding ground for arguments, and resentment, and erodes the sense of security essential for a healthy relationship. Finding the balance between splurging and budgeting in romantic gestures and living life in general requires communication, understanding, and compromise.

Lack of savings: Lack of savings in a relationship can be a source of significant stress and strain. Without a safety net, couples may find themselves unprepared for emergencies, leading to feelings of insecurity and anxiety. Moreover, the absence of savings can hinder progress toward long-term financial goals, such as buying a home or retiring comfortably. While love transcends material aspects, financial stability provides a foundation for shared security, reduces stress, and empowers couples to focus on nurturing their connection and building a fulfilling future together. Building a healthy savings habit isn’t only about depriving yourself. But instead about making conscious choices today that your future selves would be proud of. You can start saving towards a financial goal as a couple here.

Personal Debt: Personal debts in a relationship can pose significant challenges, impacting both partners’ financial well-being and the stability of the relationship. Addressing personal debts requires transparency, honesty, and a willingness to work together to develop a repayment plan. As Will Rogers fondly stated, “If you find yourself in a hole the first thing you need to do is to stop digging”. This means that you might want to stay away from taking on additional debt. Until you both have a repayment plan in place.

True love compliments

True love in its purest form enhances and enriches the lives of both partners in a relationship. It offers both parties the opportunity to collaborate, to align their goals, dreams, and aspirations. By working together towards common objectives, couples can build a solid foundation for their relationship while achieving financial security.

Complementary relationships even have the added advantage of greater relationship satisfaction. Numerous studies have found that individuals in mutually complementary relationships tend to report higher levels of satisfaction and well-being. For example, research published in the Journal of Personality and Social Psychology has shown that couples who perceive their partner as supportive and responsive experience greater relationship satisfaction and intimacy.

Money need not be a source of mistrust, it can instead serve as a tool for strengthening relationships. Couples can through Open communication and transparency, leverage each other’s strengths, expertise, and perspectives to develop a comprehensive financial plan. They can allocate resources strategically, and maximize savings potential, all while supporting each other’s aspirations and ambitions.

Though money can be a tool for expressing love it is important to find a balance between splurging and budgeting. Couples can express their love in meaningful ways without compromising their financial well-being.

With love from all of us at Cowrywise.