I’m one of those people who loops a song a thousand times when I hear a new song I like.

I even joke sometimes that if we were in the days of CD players, most of my CDs would have “cracked” from me overplaying them.

I love how the loop feature on YouTube and the repeat icon on apple music make my life easy. Once those are in place, I do not need to manually replay a song since they automatically get that done for me.

Even when friends complain that I need to change a song because it has been overplayed, I remind them of my why – that I am doing this because the song means a lot to me.

Do you often think of your why?

Many people take various actions every day without thinking about their why.

You get up from bed to leave for work five out of seven days, do you know why?

You open Instagram to quickly post a selfie of yourself, but end up scrolling for three hours, ever wondered why?

I truly believe that answering the why question is a powerful means to becoming more self-aware. It helps you question a lot of habits or thought patterns and when used positively, can be the best driving force for success!

Saving to splurge or are you a savings to investment kind of person?

This is one of my why’s for what we do at Cowrywise.

Waking up daily, knowing that our product is tangibly helping people take control of their finances is one of our whys.

Now, enough about me.

Why do you save?

People save for numerous reasons; goals, targets, and emergencies. If you take a moment right now to look through all your savings plans on Cowrywise, do you have a defined reason for why those plans exist?

Well, it’s ok if you can’t think of a defined reason for your savings plans right now; because the new Savings to Investment feature on Cowrywise helps you figure that out.

The best progression should be that you save so you can invest.

Introducing Savings to Investment on Cowrywise

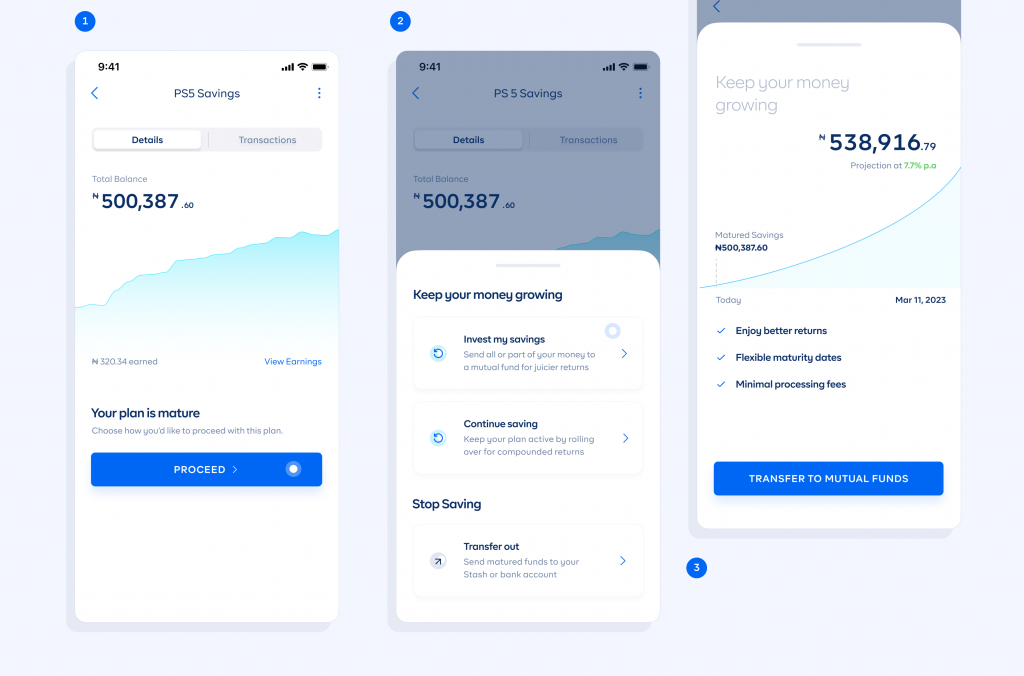

Previously, once your savings plan matures on Cowrywise, the only available option was to withdraw it to your Stash (in-app wallet) or bank account.

Now, when your plan matures, you can send a part or all of your savings to an investment plan on Cowrywise – with reduced processing fees.

Our motto at Cowrywise is Plan.Save.Invest.

This means that if your whys for growing money stops at Planning and Saving, wealth creation is limited. But if you’re saving to grow your wealth over time, and to put your money to work consistently, this new feature will help you do just that.

What do you need to do?

You simply need to wait for your savings plans to mature. When it does:

- Click on “Invest my savings”

- Tap “transfer to mutual funds”

- Complete the process of investing a part or all of your savings

And you’re done!

Instead of splurging your savings, this feature helps you to double charge your savings – through investments.

RELATED

Auto Reinvest: How To Make Your Investments Work For You

Kizz Daniel’s “Too Busy to Be Bae”: Are you busy building Wealth or Romance?

This indeed will be a great one…at least one will not ‘splurge’ all of his saving. Growing our (little) fund over time through this feature will be very helpful. “Plan, Save and Invest.” is my new motto for financial freedom. Thank you Ope!