“Download Joint Account Form” – This was the first thing I saw on a bank’s website when I researched how to start a joint account in Nigeria.

What immediately came to my mind was “I do not want to fill out any forms, I just want a simple process that allows me to save securely with someone else”. Thankfully, Cowrywise has a feature that makes opening a joint account super simple.

This feature allows you to break free from forms, queues and other bottle-neck requirements. However, just before I share the type of Joint Account you should be opening in the 21st century, let’s first break down what a Joint Account is.

What is a Joint Account?

A joint account is a financial account that’s operated by two or more people. Depending on what you instruct your bank when opening the account, only one person or both parties can carry out transactions with the account.

Most couples or close friends who open a joint account do so to achieve mutual financial goals. Although some couples use joint accounts like regular accounts where they deposit and deduct funds often, most people use this to save towards long-term goals instead. ??

How to start a joint account in Nigeria? What are the bank requirements?

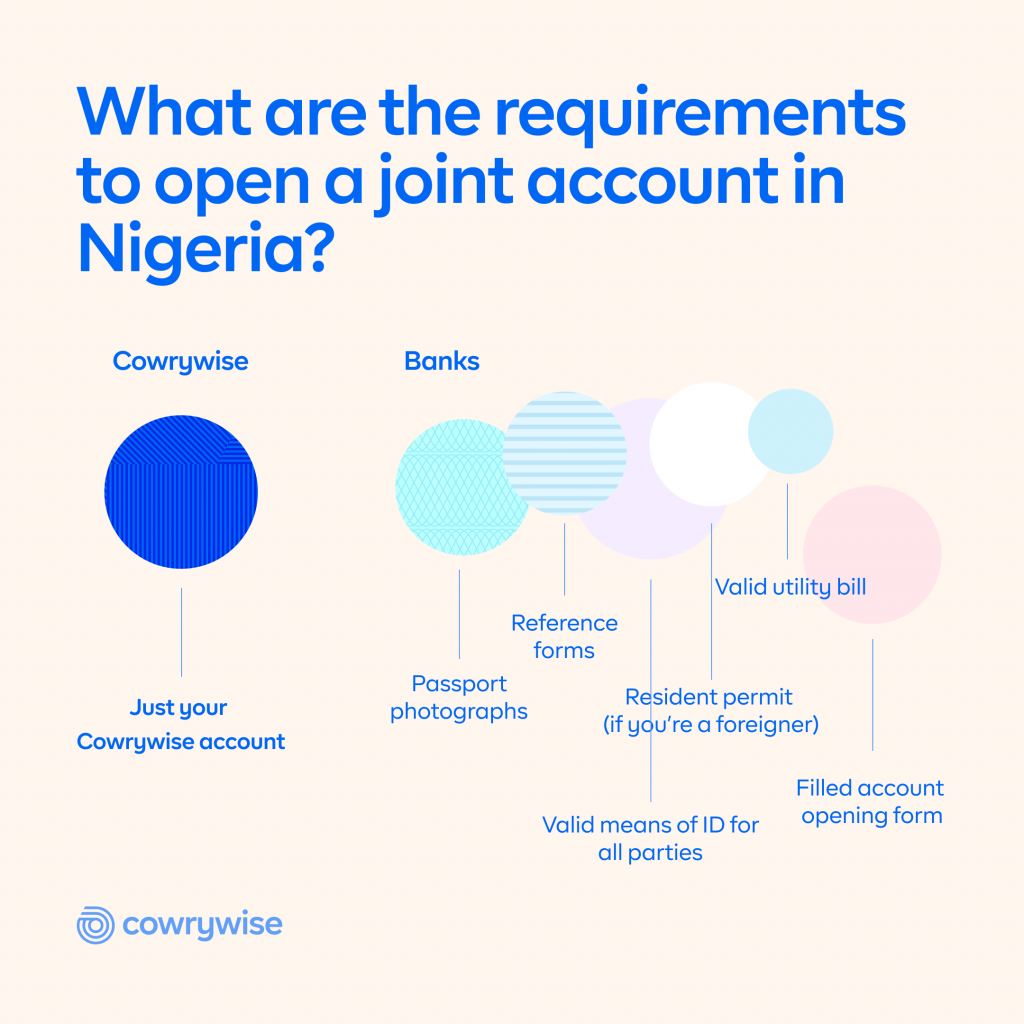

Apart from the regular back and forth that comes with opening a new account at the traditional bank, you need the following requirements to open a joint account:

- Passport photographs of all parties

- Filled account opening form

- Valid means of identification for all parties

- Valid utility bill

- Reference forms

- A biodata form that allows the bank to know more about you

- Resident Permit if you’re a foreigner

7 requirements – that’s a lot!

Regular Joint Accounts lack transparency in transactions

A major frustration you’re likely to experience with regular Joint Accounts is the lack of transparency because all the funds are muddled up. It is difficult to keep track of how much each party has funded the account.

The “How much is mine?” and “How much is yours?” questions are hard to answer. You’ll have to go through the tedious task of checking all your deposits one by one or requesting your account statement to get clarity.

Thankfully, Money Duo easily solves this!

Money Duo: A better way to start Joint Accounts in Nigeria

Read about the updated version of Money Duo: Money Duo 2.0

With Money Duo on Cowrywise, you can seamlessly start a joint account with your partner or friend.

The only requirement is for both parties to have Cowrywise accounts. Once you both have accounts, you can send a Money Duo request and once the other party accepts your invite, your duo account is live.

What’s exciting is that you can have more than one Money Duo account. This is essentially like having different joint accounts with your partner, a friend and a sibling – all with one Cowrywise account.

Imagine having to open three different joint accounts with a bank. That’s a lot of passport photographs! ?

How does Money Duo work?

- It is a locked savings account and the duration is for one year, enough time to meet your goals together.

- The person sending the request sets a minimum monthly deposit. However, you and your partner can top up more than the set amount at any time.

- After the one-year timeline, the individual amount saved is sent to each person’s Stash (your in-app wallet on Cowrywise). One person does not have access to the funds of the other.

- There’s an option to leave the Money Duo plan. If that happens, the plan will become a personal savings plan with the same maturity date set.

How to start a joint account in Nigeria with Money Duo

- Download or Sign up on the Cowrywise app

- Tap “Save”

- Tap “Savings Circle”

- Tap “Join A Savings Circle”

- Tap the “Duo ?” button

- Click on “Start a Duo” and follow the prompts to invite your partner or friend

Ready to start a seamless “joint account”?

Send an invite to your partner or friend.

Read more about Money Duo

Money Duo — An Emotional Bond Over Money

Money Duo: Private Joint Savings Plan for (would-be) Couples

This is cool. Yet, I would like to know, is it possible to jointly withdraw funds before the one year period elapses.

Or

Can we set withdrawal on a shorter time?