On October 4th, 2020, Laura, a twenty-one-year-old lady shared a picture on Twitter. This was, however, a very unusual picture. She was bent beside a fridge and her words “My very own fridge…” got more attention than she envisioned.

There were a number of harsh comments about how little her accomplishment was but thankfully, most people were kind. Some even went out of their way to purchase other items for her and now her home is set up with other appliances.

Her story is not only inspiring but is a testament that young people are more determined to gradually build a better life for themselves. It doesn’t matter if it begins with a fridge.

A Strategic Youth

A comment on one of our posts strengthens this belief.

I have worked for the same company, JPS, since March 2018 and that is three months after my youth service. And I have enjoyed my time here. There are opportunities for progress and I agree with all that is said in this post.

I was promoted and moved to a different unit after a year of work. It is really interesting how much I have achieved in my two and a half years here. I have moved out of my parents’ place to rent an apartment, and I’m working on a few investment opportunities which I believe will move me closer to an HNWI in the nearest future.

Adebayo

Why are young people becoming more responsible?

There are a number of reasons why people in their twenties are learning how to save and invest their money. Young people becoming more financially responsible might be because they want to do better than their parents in terms of planning for the future. Unlike what it used to be, they’re arming themselves with relevant information that helps break down how money works and then implementing the relevant actions.

Wealth creation seems possible when you start early, no matter how little. The special “phone pressing” generation does not intend to use their children or family as a retirement or money plan.

They thrive in freedom and that includes financial freedom. Though not everyone is where they want to be yet, a lot of people are planning so that there will be no stories that touch when they become elderly.

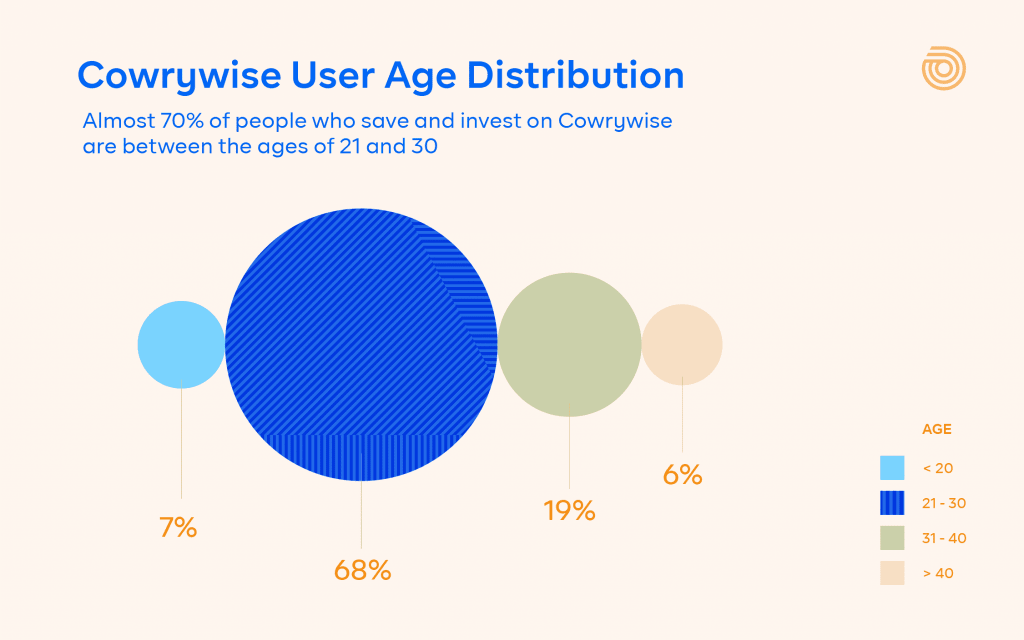

Cowrywise Data to support our belief

Almost 70% of people who save and invest on Cowrywise are between the ages of twenty-one and thirty.

This is proof that young people are adulting and taking charge of their finances as much as they can. At Cowrywise, we want even more young people to imbibe the right money habits that will lead to financial stability and the freedom they so desire.

In addition to signing up on Cowrywise and creating savings and investment plans, we curated strategic questions that any young person can answer as a way of measuring where they are right now and how they intend to get to financial freedom.

These questions were first asked in an article on how to build wealth as an employee. However, here we’ll expand the questions to aid your understanding of how to save and invest as a young person.

Relevant Questions to Measure your Personal Finances Awareness

What do you currently earn monthly?

If you’re an employee, this might go beyond what you earn monthly.

Document all the places money comes from. Side-hustles, upkeep (if you still get this) and monetary gifts should be included.

This helps you get a clear picture of your total income per month. This will be dynamic for full-time entrepreneurs but it helps when you at least have an idea.

Do you create a budget and do you stick to it?

Now that you’re clear on what you earn per month, it’s time to go the extra mile.

Budget: An estimate of income and expenditure for a set period of time.

Budgeting is one of the most basic and efficient ways of managing your money.

There is a personal finance rule of thumb that states that you should spread your funds into three parts.

These three parts follow a 50:30:20 ratio. Where 50% is budgeted for your necessities, 30% is set aside for your lifestyle choices and the final 20% is for your short and long-term financial plans. Though this may not fit all circumstances, it serves as a starting point for cultivating a disciplined financial game plan.

The trick is to first note what you spend your money on and then create a budget that fits your lifestyle. Taking note of how you spend your money will help you know what to cut down on or increase in your budget.

Say you spend way more than you realized on fast food, you can create a budget that only allows you to spend a limited amount of money on fast food. While you increase the amount spent on foodstuff for home-cooked meals.

You should create your budget before and not after your money comes in and a simple one can have items like:

- Debt repayment

- Savings

- Emergency fund

- Monetary support to parents

- Foodstuff

- Purchased food

- Professional dues

- Transportation to work

- Transportation elsewhere

- Groceries

- Airtime

- Data

- Entertainment (e.g. Apple Music/Spotify, DSTV/GOTV)

- Social (time out with friends)

Make it as realistic as possible so that you can actually stick to it.

One important thing a budget also does for you is that it helps you to be able to say “I can’t afford it” unashamedly. When something impromptu comes up that doesn’t add to your bottom line, you’re able to move it to your next budget or do away with it altogether.

Want to really hack how to save and invest? Begin here!

Your budget teaches you to say no to certain things, which is actually a very good habit to imbibe as a young person.

It will also help you say goodbye to peer pressure.

Do you save at least 10% of your income regularly?

In the classic personal finance book, The Richest Man in Babylon, George Samuel Clason advises that you save at least 10% of your monthly income.

A number of people think that saving is hard because “the money is not enough, why then should I be removing from it again?”

However, you should see saving 10% of your income as paying yourself or paying your future self, if that is more encouraging.

If you don’t save, what it means is that you pay everyone else apart from yourself.

You pay the cab man for transiting you from one place to the other.

You pay the cashier for your groceries.

For your airtime and data, you pay the telcos.

You pay…you get the point.

Although you’re the constant factor in all these cases, you’re actually not paying yourself.

Saving your money safely and consistently allows you to decide what you want to do with it when it compounds. It is yours and not anyone else’s.

To get your money to produce more, do you invest?

With a Cowrywise account, saving your money is a kind of investment – much better than when you leave it at the bank.

However, in the long run, you will want to go beyond saving to investing and Cowrywise has investment options you can get started with.

Best part? You don’t need to have a lot of money before you can have access to investments. Opportunities are now much more easily accessible.

Invest: to put (money) into financial schemes, shares, property, or a commercial venture with the expectation of achieving a profit.

Do you educate yourself about the different investment opportunities?

There are many investment opportunities to pick from.

The good thing with investing with Cowrywise is that you can choose from different mutual funds investment options like:

- Fixed Income Fund

- Money Market Fund

- Eurobond (Dollar) Fund

- Equity Funds

- Balanced Fund

- Ethical Fund

You no longer need to worry about finding these opportunities individually as you can simply choose which ones are best for you at different times.

A great way to begin is to make your decision based on your risk appetite. On Cowrywise, you take a simple test that shows if you’re a Conservative, Balanced or Aggressive investor. Your result then influences the investment types that are recommended. You are, however, able to still choose from all the options on the app.

The next step is very crucial because we’re about you multiplying your money, but not in schemes that are out to cheat you.

Are you aware of the danger of Ponzi schemes that promise to grow your money like grass?

As you learn how to save and invest, you should also learn how not to save and invest!

When you see “opportunities” that will “grow your money like grass”, run.

At Cowrywise, we are never ashamed to say that we do not “double your money” in a few days. The returns on our savings plans always reflect the current market performance for considerably low-risk instruments in order to secure your funds.

We’re also constantly looking at ways to increase your access to assets that can help you reach your money goals. This is what you should look out for when choosing investment options. Be mindful not to jump at investments with get-rich-quick “returns”. Instead, focus on the long term and consider security and sustainability too.

How do you intend to increase your income?

In other words, how do you plan on making more than your current income? Will you get high-valued skills to increase your market value in the corporate world?

LinkedIn listed Creativity, Persuasion, Collaboration, Adaptability, and Emotional Intelligence as the top five soft skills for 2020. While Blockchain, Cloud Computing, Analytical Reasoning, Artificial Intelligence, UX Design, Business Analysis, Affiliate Marketing, Sales, Scientific Computing, and Video Production are the top ten hard skills for 2020.

The world keeps evolving and certain skills continue to rise in demand. A simple trick is to merge something you enjoy doing with a high-valued skill so that it feels like you’re making a profit from your passion. ?

In summary, your skill is the currency of the 21st century.

Will you diversify in business in order to boost sales?

If you’re a full-time entrepreneur and you have only one line of business, you should think about diversifying. You can do this by adding additional products or services to your business offerings. Or you can sell your expertise by training/coaching newbies on how to start and scale in your industry. Remember that the sky is big enough for every bird to fly and there will be people who want to learn from you. That’s a source of extra income in business.

Increasing your income requires you to take strategic actions. You can’t grow your money if you do not intend to deliberately increase your income.

Are you planning for retirement?

Should you plan for retirement right now that you’re still living the baby-girl or baby-boy life? The answer is a big YES!

Planning for retirement is a lifelong endeavour and the best way to go about it is to start early. Arm yourself with proper information now that you’re young. This is so that you can continue to fend for yourself even when you’re old and grey.

In your twenties, you should have at least 1x of your annual salary as your retirement savings. So say you make ₦1,500,000 annually (₦125,000 per month), you should then have that annual income saved for retirement.

The numbers increase as you get older but this is a simple and practical savings guide you can use to plan for retirement. Our Retirement Life Goal also gives you the opportunity to begin your retirement plan so that you can remain a baby girl or baby boy for life.

In Conclusion

These questions are not exhaustive. They can, however, serve as a guide to help you understand how to save and invest as a young person. We also want you to start with much clarity so we broke down what you should look out for when choosing from different investment options.

We truly hope that with these few points of ours, we’ve been able to convince you and not confuse you that now is the time to learn how to save and invest. You should make hay while the sun shines.

—

If you’re in your twenties, what are the current steps you are taking to become more financially responsible?

Are there any topics you will like us to cover to help make the process easier?

Share with us in the comments! Oh, and remember to share this guide with your friends in their twenties. ?

ALSO READ:

I love cowry wise

Cowrywise is the best. With this app am able to save more,which is of support to me. I wish to continue when am rendering out service. May God hlp me

I love the cowrywise

How can I save 3,6 and 12 months in dollars instead of naira

I so much love Cowrywise. But I want to invest in Dollars with the money i already saved into my account… How can I do that?

Cowrywise is truly the best!

I have not been able to login my Cowrywise account since yesterday pls what’s going on about that???

What a great write up… thanks to cowrywise

Is it possible for me to invest in mutual dollar?

How do I do it since I don’t have a dollar account?

Thank you.

This tips is helpful and is present at the right time