“How much of my income should go to savings and investments?”

We all love the beautiful sound of SMS alerts at the end of the month. However, how much of that beauty do we keep for ourselves? In other words, how are you spreading the bread (your income)?

Month after month, we receive these notifications from our banks that indicate our salaries have been paid or we have earned some income. As soon as we receive this alert, our mind starts to wonder about all the mounting bills we need to pay, all the things we’d love to buy: Aso-Ebi, new generator, changing car tyres, calling the plumber, sending money home, that dream vacation to Kenya Safari. The list is endless.

For the financially conscious, an additional question often added to the list is how much should I save and invest this month? Periodic savings should be a monthly obligation just as paying your electricity bills or fuelling your car. Periodic savings and investments are the fuel for our financial future. To help you with this, we have created a simple workbook you can use for your budgeting needs.

Click here to download the Budgeting Workbook.

One of the key principles of personal finance is paying yourself first i.e saving first before spending on anything else. In fact, this is a time-tested principle and it applies whether you earn N50,000 or N950,000 per month. How much you decide to save and invest depends on a lot of factors which include your age, family size, income level, overall expense patterns and financial freedom goal.

Taking all these into consideration, a monthly savings of around 20% is good for young income earners. Why 20%? This follows the 50:20:30 personal finance rule of thumb. While this is not a one-cap-fits-all rule, it gives a baseline for cultivating a disciplined financial lifestyle.

The 50:20:30 finance rule

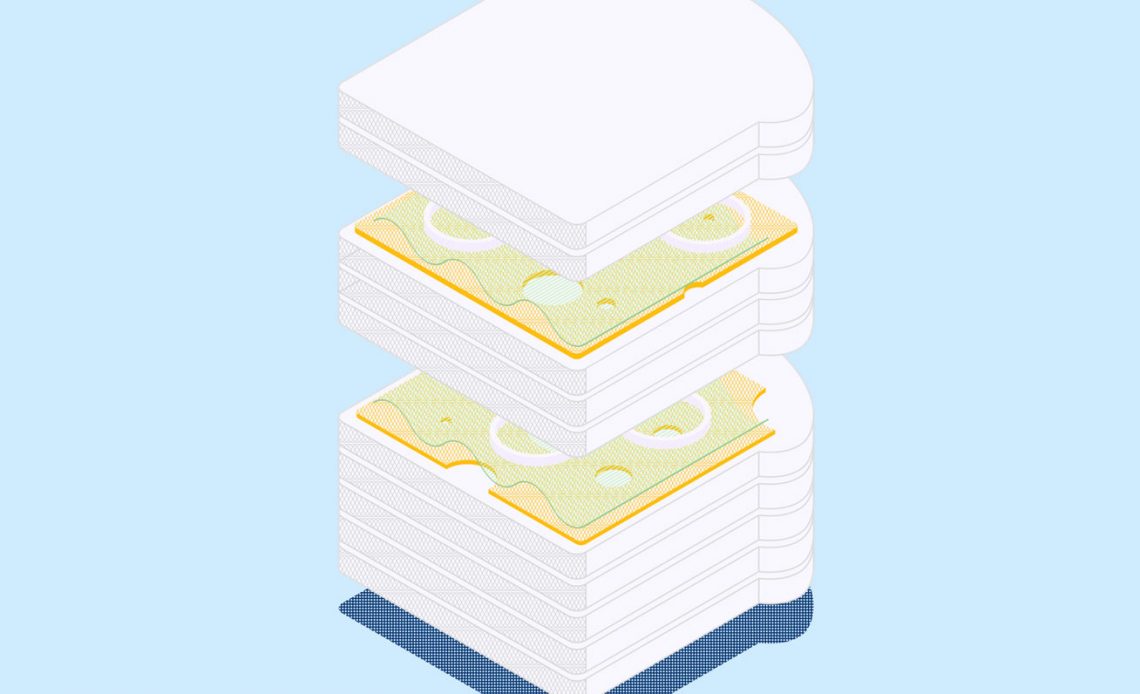

The 50:20:30 finance rule categorizes your budget into three buckets.

1. Necessity Bucket

The first 50% is the “necessity bucket”. This suggests that 50% of your monthly income should be budgeted for necessities such as food, shelter, clothing, and transportation; basically, things you can’t do without. Do you remember Maslow’s hierarchy of needs? If you spend more than 50% of your monthly take-home pay on the combination of the above, your personal financial budget is seen as suboptimal.

2. Financial Priority Bucket

The second 20% is the “financial priority bucket”. This suggests that 20% of your monthly take-home pay should be dedicated to long-term saving and paying down your debt if you have one.

3. Lifestyle Choices Bucket

The third 30% is the “lifestyle choices bucket”. This suggests you spend not more than 30% of your income on consuming items like entertainment, vacation, gym, cell phone recharge, and cable TV. Remember, most of these items are good-to-haves, not must-haves. You can get by your life without them; yes maybe with less glamour.

Hence, having a long-term saving plan of 20% minimum will give you the most balance between meeting your current obligations and achieving financial independence at the earliest possible time.

For middle-aged people with higher incomes, increasing this percentage to around 30% might be ideal, as the retirement period beckons.

However, do note that these are not hard rules. One can be flexible on a month-by-month basis, to cater for other unforeseen obligations. The most important thing in all of this is the discipline to save consistently.

Saving and investing to achieve financial freedom at the earliest time depends largely on the type of lifestyle you keep.

It is important to note that lifestyle inflation is difficult to reverse. It has a ratchet effect. This is what economists call the “relative income hypothesis”.

In simple language, when income falls, most people do not reduce their consumption proportionately to match the fall in income. People try to protect their living standards either by consuming their past savings or wealth or by borrowing.

All these come at a cost. Don’t always see money as a means to buy stuff; rather money should be seen as a means to buy financial freedom.

If you have used our online financial freedom model, you’ll quickly realize that the more of your income you save and invest, and the more the returns you get on your savings and/or investment, the quicker you can achieve financial freedom.

If you’d love to set up automated saving every month, sign up now on Cowrywise, create a saving plan, and choose your saving preferences. We automatically handle periodic savings and investments for you, with attractive rewards.

Download the workbook here

Easily organize your income and expenses on a single sheet and make your finances easier to understand at a glance. The workbook will help you make sense of your finances, and act as a guide on how to allocate your funds.

Yay! Thank you so much! ?

You should receive an email with your download link shortly

RELATED