Which is better: Cowrywise vs Piggyvest?

On Cowrywise, you can immediately become an investor by purchasing units from the over 30 mutual funds available on the platform, which are all regulated by the Securities and Exchange Commission (SEC). Also, there are multiple savings plans that cover your different lifestyle needs.

Piggyvest has different savings features to choose from. Investment opportunities are open periodically and you have to be on the lookout to take advantage of them.

Cowrywise vs Piggyvest: Savings Options

| Cowrywise | Piggyvest |

| Regular savings | Piggybank |

| Emergency plan | Flex Naira |

| Saving circles | Flex Dollar |

| Halal savings | Safelock |

| Money Duo | Targets |

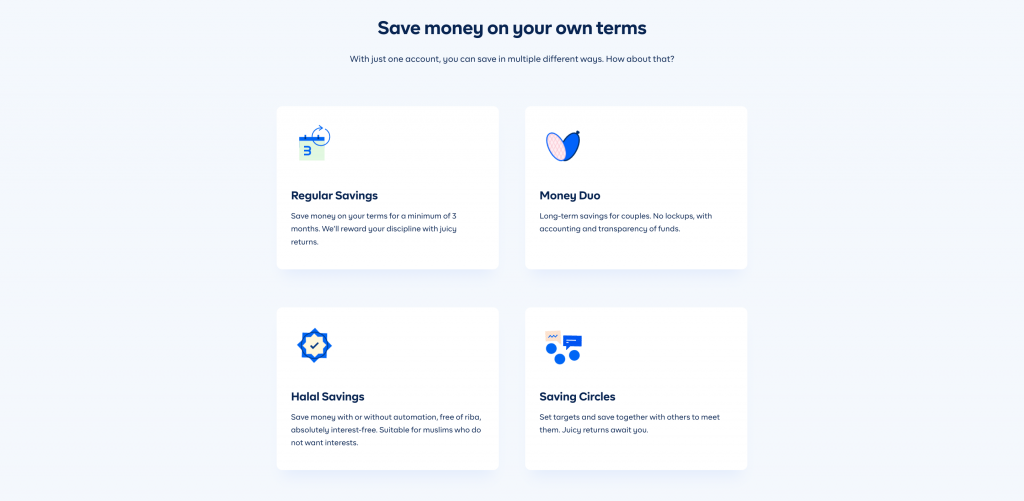

Cowrywise Savings Options

Currently, the savings options on Cowrywise are:

1. Regular savings

Regular savings on Cowrywise are for a minimum of 3 months and you can create multiple regular savings plans which can be for rent, your car, etc. The first major difference between the regular savings plans on Cowrywise and those on Piggyvest is that Cowrywise was built to help you stay disciplined. That’s why you cannot break any savings plans till the maturity date.

We don’t have to be smarter than the rest, we have to be more disciplined than the rest. – Warren Buffet

People often think they’re able to stick to a goal, but how many people are able to stick to just New Year’s resolutions? By February (and that’s even a stretch), many have fallen off the radar. With the regular savings plans on Cowrywise, you have a system that ensures your financial goals come to pass.

My best feature will be the fact that I can’t move my maturity date earlier than the initial date, I can only extend it after maturity. It feels like with Cowrywise you must be disciplined with your savings. ?

— Gloria Onemegba

My best Cowrywise feature is not being able to withdraw my money until the maturity date.

— Emmanuel Olatunji

2. Emergency Plan

We have a robust article on this, but let’s shine some light on this savings plan that everybody (yes, everybody!) needs.

When the pandemic hit in 2020, millions of people lost their jobs and only those who had an Emergency Plan could survive without depending on the government or loans. Universally, it is advised that you have at least 6 months of your regular expenses saved in an Emergency Plan. Therefore, if with budgeting over time, you’ve come to find out that 150k covers all your expenses for one month, then your Emergency Plan should have at least 900k saved in it.

With this feature, you are saving for unforeseen circumstances (which are part of life). Also, you’re ensuring you’re financially covered if anything ever happens unexpectedly. Unlike savings plans with a timeline of at least 3 months, you can remove cash from here anytime. You just need to be true to yourself that you’re really withdrawing for an emergency. The emergency plans on Cowrywise earn returns derived from safe financial instruments.

3. Saving Circles

Saving Circles is one special feature only available on Cowrywise. This feature has some variants under it like Challenges for saving with friends and family in a fun and motivational way. Learn more about Cowrywise Circles.

4. Halal Savings

Halal Savings are for the Muslim faithful who want to save with no interest. Everyone’s faith is respected and there’s an option for you to choose from, regardless of your beliefs. Additionally, as a Muslim, you can simply set your Cowrywise account as halal. Find out more about halal accounts.

5. Money Duo

Money Duo is a savings plan to build wealth with someone you love. It is perfect for lovers setting long-term financial goals together. Learn more about Money Duo.

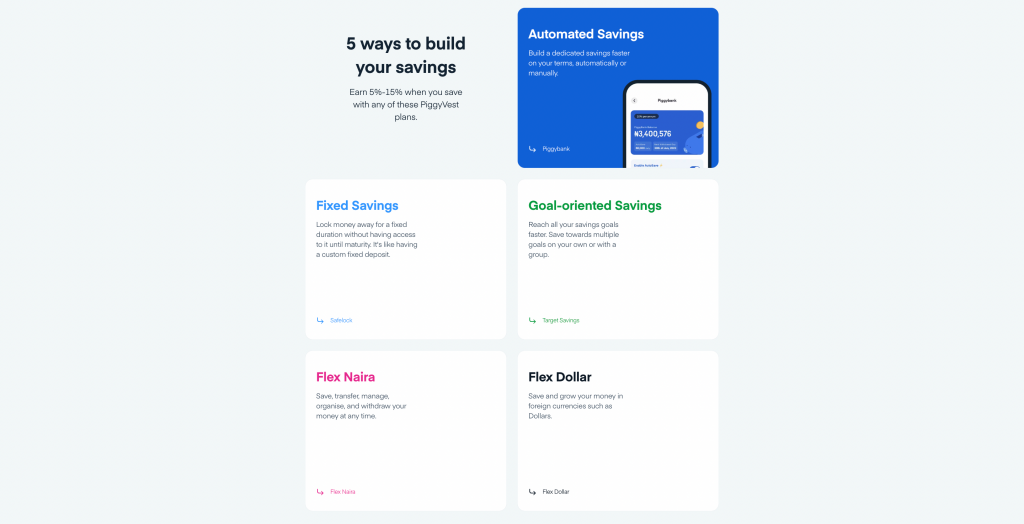

Piggyvest Savings Options

As of the time of writing this, the available savings options on Piggyvest are

- Piggybank

- Flex Naira

- Flex Dollar

- Safelock

- Target Savings

1. Piggybank

Piggybank is the feature that allows you to save daily, weekly or monthly. With this feature, you can turn on automated savings and can top up whenever you want. When you put money here, Piggyvest picks an automated withdrawal date for you. However, you’re allowed to break this plan whenever you want and a small percentage of what you withdraw will be debited.

2. Flex Naira

Flex Naira on the other hand is more flexible, just as the name implies. You can keep cash there without a set withdrawal date and you’ll not be debited when you make a withdrawal as there’s no strict withdrawal date set.

3. Flex Dollar

Here, you can keep your cash in Dollars.

4. Safelock

Safelock is a feature that’s not breakable. You choose your withdrawal date yourself and no crying can unlock this feature once the padlock is set.

5. Target Savings

Target Savings is a feature created to help you target different savings goals.

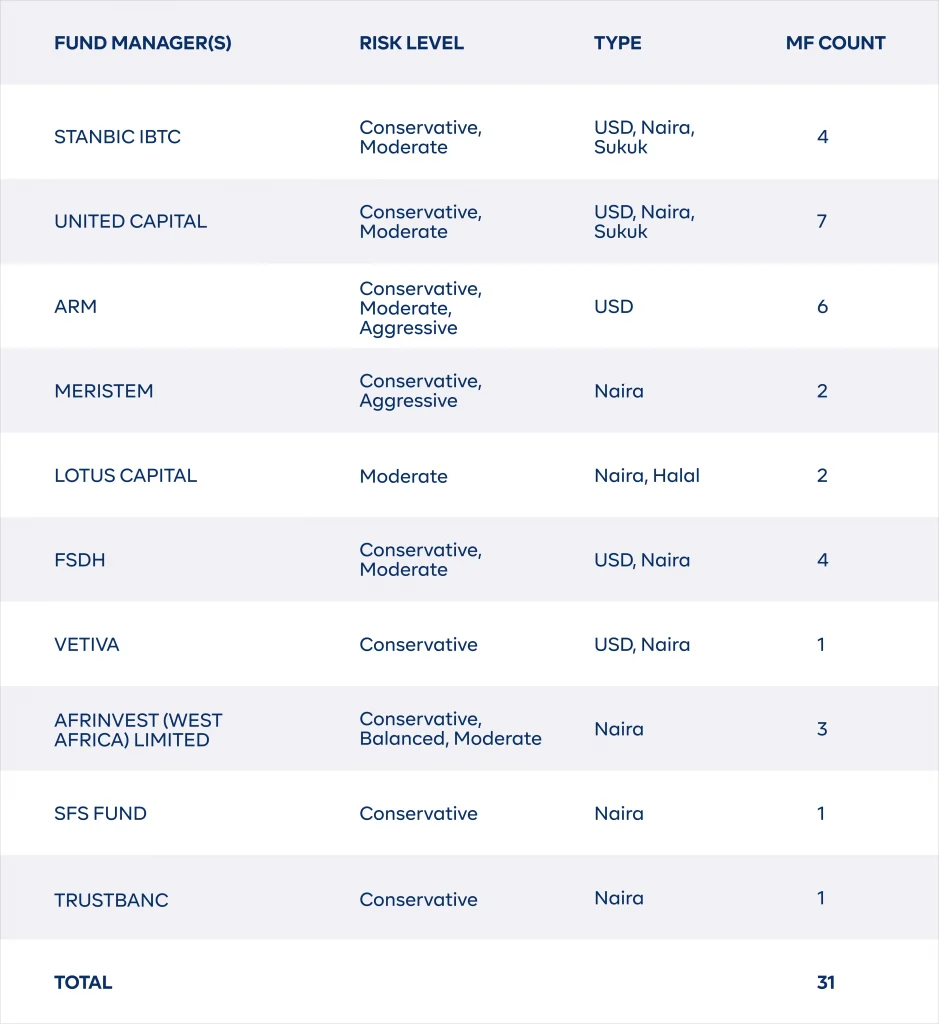

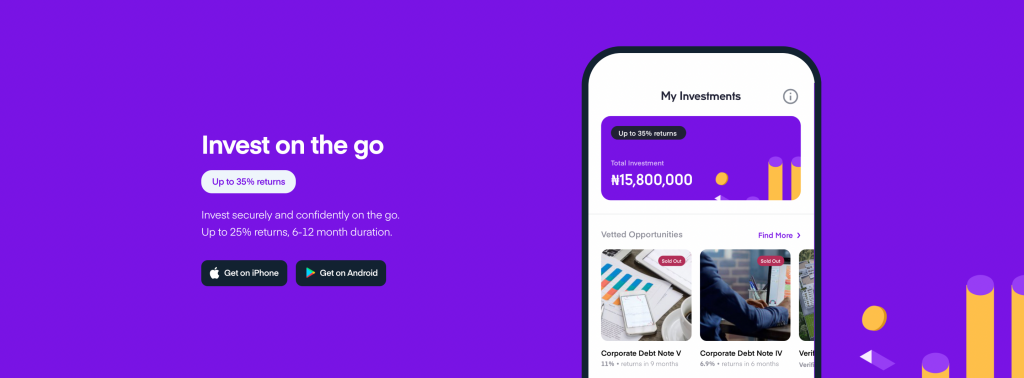

Cowrywise Investment Options

Cowrywise has the largest collection of mutual funds in Nigeria, and all the funds are registered with and regulated by the Securities and Exchange Commission (SEC). We are the first fintech company in Nigeria with an SEC license in the fund/portfolio management category. If we were to compare, it will be “the CBN” for investments. The SEC regulates the operations of investment companies, just as the Central Bank of Nigeria (CBN) regulates banks. As an investor, the SEC ensures your funds are safe.

Mutual Funds on Cowrywise

Mutual funds are a mix of diverse types of assets, so investing in one mutual fund often means you’re investing in many assets at once. They are excellent for first-time and retail investors in general.

A major advantage here is that you have to take a short assessment before investing to help you know what type of investor you are. The three categories of investors are conservative (low-risk), moderate (medium-risk) and aggressive (high-risk).

After the assessment, you’re then shown the best types of investments to choose from based on your risk tolerance. If you’re the type of investor who likes to ensure your capital is always safe, there’s something for you. It’s ok if you don’t mind a little adventure, there’s something for you. If you’re an OG and have built a high-risk appetite over time, there’s also something for you!

Why are mutual funds exciting?

Because they continue to grow and as a long-term investor, that’s the type of asset you want to invest in, one that’s steady.

Mutual funds offerings on Cowrywise

Unlike Piggyvest where the least amount you can invest is 5k, on Cowrywise, you can begin investing with even less. Also, investments on Cowrywise allow everyone to have a slice, no matter what time of day it is. Whenever you log into the app, you will always have an option to invest in.

First come, first serve. Come anytime and you’ll be served with more than enough.

Moreover, Dollar Mutual Funds are also available and these allow you to expand your portfolio beyond Nigeria.

Piggyvest Investment Options

Piggyvest has four categories of investments which are Fixed Income, Real Estate, Agriculture and Transportation. However, as of the time of writing this guide, none of these investments is available for you because they are all sold out.

Most of the investments on Piggyvest are agricultural-based and might not be suitable for conservative investors who want the option of low-risk assets. Though they show a fixed interest rate on the agricultural and transportation investment options on the app, it is widely known that with both of these sectors, anything can happen.

Investments being sold out gives the notion that investments are still available for a select few, which defeats the whole purpose of encouraging more and more people to become retail investors. Piggyvest investments are available for those who can “quickly” buy-in before it gets filled up and this is a major difference with investment options on Cowrywise that you can buy anytime.

If people are to use investments to break poverty and build generational wealth, then the investments have to be easily accessible and convenient.

Cowrywise vs Piggyvest: Which one should you use to build wealth?

Cowrywise is your best bet if you want an app that caters to both your savings and investment needs. If you really want an app that keeps you disciplined, we are your perfect accountability partner.

More from Cowrywise

Embed for developers

Taking things a notch up, Cowrywise is making APIs public to help fund managers across the world access diverse services and open up more investment options to serve customers in Nigeria better.

These APIs do not just apply to fintech companies; any company can embed investment features in their products as these investment APIs simplify regulatory, compliance and technical hurdles. The APIs are open for early access and if you’d love to be part of this, check Embed API.

Cowrywise is not just enabling retail investors to have access to credible investments. We are building an investment management infrastructure to enable any company to embed investment features into their services.

Also, you get exclusive access to:

- Money Health: In the Cowrywise app, you can see your savings score and how you’re doing in terms of finances. You earn a badge after every milestone. You also get constant encouragement to choose consistency because just as physical health is important, money health is too!

- Our network of partners: Some of the top fund managers in Nigeria include ARM, United Capital, Lotus Capital, Meristem, Afrinvest and SFS, and they all have assets on Cowrywise. Many more will also come on board.

- Halal Investments: One of our core values is inclusivity and Halal investing is investing in companies that are in line with Islamic principles. Your faith matters to you so it matters to us too.

- Investors: Some of the best companies in the world are backing Cowrywise, companies like Microtraction, YCombinator (YC), Quona Capital, K50 Ventures, Catalyst Fund, Venture Souq, and SHL Capital have all invested in Cowrywise.

- Financial education for Nigerian students: The Cowrywise Campus Ambassadors are a strong community of University students. Cowrywise trains and guides them towards financial freedom. We believe that like Warren Buffet, the earlier you begin your journey to financial freedom, the better!

- The Cowrywise Blog: Cowrywise currently has over 400 financial education guides and explainers that continue to change people’s understanding of how money works.

Bottom Line

If you’ve ever searched for the term “Cowrywise vs Piggyvest” then this guide is for you.

Do you want a “love at first sight” experience? Log in to Cowrywise for a sleek user interface and a warm + dedicated team working to make your experience 10 times better. Ready to steadily and comfortably grow your wealth? Sign up on Cowrywise now in under a minute.

Someone is sitting in the shade of a tree today because someone planted a tree a long time ago.

— Warren Buffet

If generational wealth is your goal, plant your tree now.

ALSO READ

I love cowrywise such for been one of the investment platform which I have been enjoying for some times now and their quick response to issues especially withdrawal.

?

Ah so they do av withdrawal issues? Thank u for banking with us_ money is not easy to com by

Thanks a lot.

I’m going to sign up now.

Energyyyyy ???

Why’s it difficult to withdraw money ?

I opened my cowrywise a long time ago, due to inactive use the account was closed, I tried logging in someone days back and they requested i contact their costumer care. till today no feedback on how to access my account. I’ve called, sent emails and even tried using the live chat still no customer feedback. I’m very disappointed!!!