Monetary policy plays a crucial role in shaping the economic prospects of any country, including Nigeria. Central to this policy is the Monetary Policy Rate (MPR), a key tool used by the apex bank of a country to regulate economic activities and stabilize the financial system. In this article, we will take a look at what the Monetary Policy Rate is, how it works, and its significance for the Nigerian economy.

What is the Monetary Policy Rate?

The Monetary Policy Rate (MPR) is the interest rate at which the Central Bank of Nigeria (CBN) lends to commercial banks. It serves as a guide for commercial banks to determine their interest rates for deposits and loans to their customers or clients.

How does the Monetary Policy Rate work?

Imagine a scenario where you increase the volume of a radio set in your house, this means that there will be increased sound, and when you reduce the volume, the sound will also get reduced. Now, see the MPR as the button on a radio controlling the volume. When the CBN increases the MPR, it’s like turning up the volume of interest rates for lending activities by commercial banks.

Why Does the Central Bank of Nigeria Adjust MPR?

The CBN adjusts the MPR primarily to achieve its monetary policy objectives. Some of those goals are:

Curbing Inflation: When the Central Bank of Nigeria (CBN) raises the Monetary Policy Rate (MPR), it becomes more expensive for commercial banks to borrow money. Consequently, these banks increase the interest rates they charge consumers and businesses for loans. This higher cost of borrowing discourages spending, leading to a decrease in overall demand in the economy.

With reduced demand, there is less pressure on prices to rise, helping to curb inflationary pressures, just according to the law of demand. Therefore, adjusting the MPR acts as a lever to control inflation by influencing the level of borrowing and spending in the economy.

Supporting the Naira: When the CBN increases the Monetary Policy Rate (MPR), it signals to investors that they can earn higher returns on investments denominated in the local currency. This attracts foreign investors, increasing the demand for the Nigerian currency and causing it to appreciate in value relative to other currencies.

However, when the MPR is lowered, investors may seek higher returns elsewhere, leading to a decrease in demand for the local currency and potentially causing it to depreciate.

Economic Growth: The CBN can adjust the MPR in an economic slowdown in order to stimulate the economy. Lowering the MPR reduces the cost of borrowing, making it cheaper for businesses and individuals to access credit. This can stimulate investment, consumption, and overall economic activity, contributing to higher levels of employment and income growth.

Financial Stability: Central banks also consider financial stability when setting monetary policy. Rapid increases in interest rates can create imbalances in the financial system, potentially leading to financial crises. By adjusting the MPR, the CBN can influence the availability and cost of credit, helping to mitigate or correct risks to financial stability.

What Does the Recent MPR Increase Mean for You?

On March 26, 2024, the CBN raised the Monetary Policy Rate to a record high of 24.75%. This significant increase signals the CBN’s focus on fighting inflation, which has been a concern for many Nigerians. Here’s a possible impact:

- Borrowing could get costlier: If you’re planning a loan, expect to pay a higher interest rate. It might be wise to delay non-essential borrowing or shop around for the best rates.

- Savings might be more rewarding: Financial institutions might offer higher interest rates on your savings accounts, encouraging you to save more.

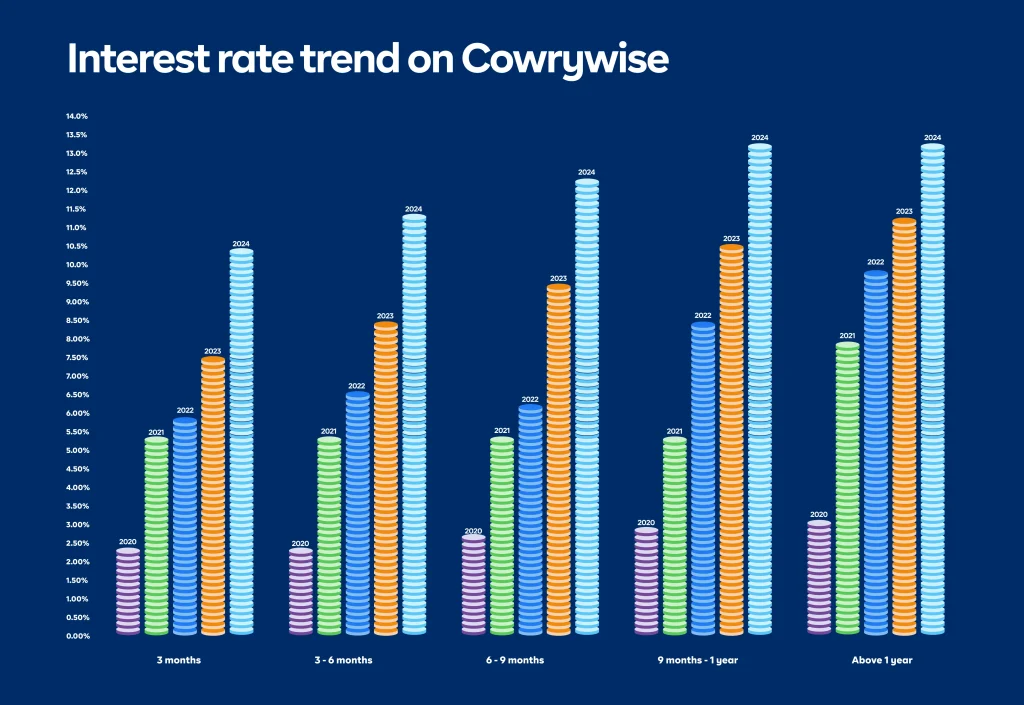

Interest Rate on Cowrywise

At Cowrywise, we recently increased our interest rate to reflect the present economic conditions. You can now earn up to 14% per annum on your savings plan. This is a reflection of our commitment to offering our customers the best possible rates to help them build wealth and achieve their financial goals. You should enjoy these benefits too. Click here to get started.