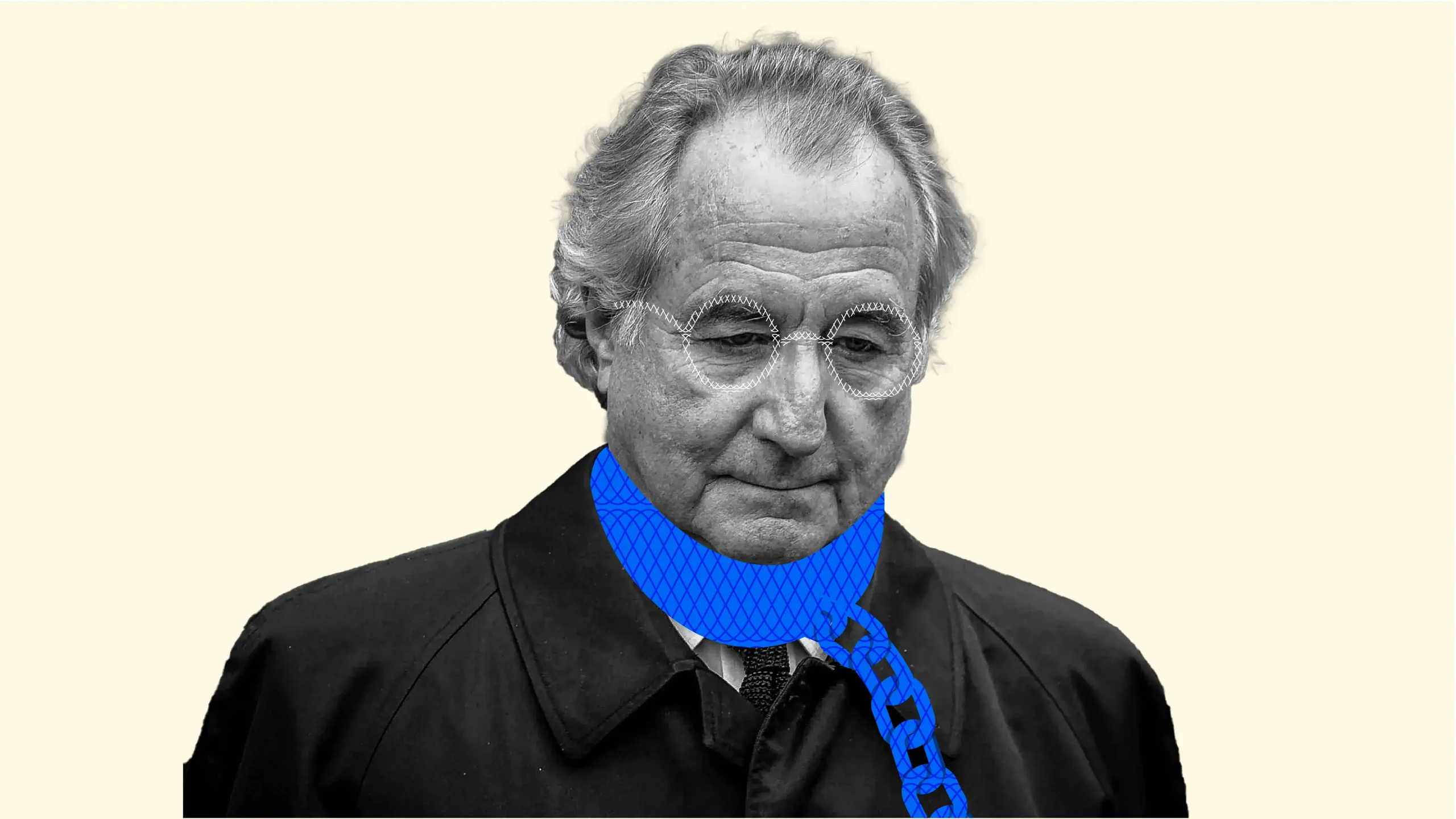

Bernie Madoff’s name is forever etched in history as the mastermind behind one of the biggest Ponzi schemes ever. While his fraudulent activities are well-documented, there are some lesser-known aspects of his life that might surprise you. However, before that, let’s have a little background on who he was.

Who was Bernie Madoff?

Bernie Madoff was an American stockbroker and investment advisor who perpetrated one of the most infamous Ponzi schemes in history. Born on April 29, 1938, Madoff founded his own securities firm, Bernard L. Madoff Investment Securities LLC, in 1960. He gained prominence and trust in the financial industry over the years.

However, in 2008, Madoff’s scheme unravelled when he confessed to his sons that his investment operations were, in fact, a massive Ponzi scheme.

A Ponzi scheme is a fraudulent investment scheme where returns to earlier investors are paid using the capital of newer investors, rather than actual profits.

Madoff’s scheme defrauded thousands of investors, including celebrities, charities, and individuals of billions of dollars.

His investors believed they were earning consistent high returns, but in reality, the returns were fabricated, and no actual investments were being made. The scheme collapsed when investors tried to withdraw a significant amount of money during the financial crisis of 2008.

In 2009, Bernie Madoff pleaded guilty to 11 federal felonies, including securities fraud, wire fraud, money laundering, and perjury. He was sentenced to 150 years in federal prison, one of the longest sentences ever given for financial fraud. He was also ordered to forfeit billions of dollars.

Madoff’s scheme had far-reaching financial and personal impacts, ruining lives and causing immense financial losses for many. He passed away in prison on April 14, 2021, at the age of 82, due to natural causes. His name remains synonymous with one of the most notorious financial frauds in history.

8 lesser-known facts about Bernie Madoff

While Bernie Madoff’s name will forever be associated with one of the biggest financial frauds in history, these points shed light on the intricate details earlier summarised of his life and actions.

- Early Innovations: Before his downfall, Madoff was considered a pioneer in the electronic trading of stocks. He played a significant role in the development of the NASDAQ stock exchange, helping to transition from traditional floor trading to electronic trading systems.

- Nascent Beginnings: Madoff’s fraudulent activities didn’t start with a grand scheme. His early years as a broker were legitimate, but financial troubles and mounting pressures eventually led him down a dark path.

- Family Ties: Bernie’s younger brother, Peter Madoff, was also involved in the family business. Although Peter claimed innocence, he pleaded guilty to various charges related to the scheme and was sentenced to 10 years in prison.

- Selective Scamming: While Madoff’s investors came from various walks of life, he seemed to prefer wealthy and exclusive clients. Many of his victims were high-net-worth individuals, celebrities, and charitable organizations.

- Feigned Returns: Madoff’s consistent, high returns were too good to be true. He often provided clients with falsified account statements, fooling even sophisticated investors into believing their investments were thriving.

- Personal Motives: Some experts believe that Madoff’s initial intention might not have been to defraud investors on such a massive scale. It’s theorized that he might have started by “borrowing” money from new investors to cover withdrawals by earlier investors, gradually snowballing into a full-blown Ponzi scheme.

- Art of Manipulation: Madoff was known for his charismatic personality and ability to charm clients. This social skill likely played a role in convincing people to invest large sums of money with him.

- Whistleblower Warnings: Over the years, suspicions were raised about Madoff’s operations, but regulatory bodies failed to act on the warnings. Harry Markopolos, a financial analyst, repeatedly attempted to alert the SEC about the scheme, but his concerns were largely ignored.

Finally, the 2008 financial crisis came, clients rushed to withdraw funds and the entire operation was unravelled.

What lessons can we learn about wealth building from Bernie Madoff?

- Ethics over Greed: Madoff’s downfall illustrates the dangers of prioritizing personal gain over ethical behavior. His greed led him to commit massive fraud, causing harm to countless individuals. It’s crucial to remember that wealth built on dishonesty and deception is unsustainable and carries severe consequences.

- Due Diligence: Many of Madoff’s victims were swayed by his reputation and charismatic personality, failing to do thorough due diligence. This serves as a reminder that blind trust without proper research can lead to disastrous outcomes. When it comes to investing or financial decisions, it’s essential to investigate and verify the legitimacy of opportunities presented before you.

- Skepticism and Vigilance: Madoff’s fraudulent activities were suspected by some, but regulatory bodies failed to act effectively on those suspicions. This highlights the importance of being vigilant and skeptical, especially in the financial space. Questioning inconsistencies and seeking transparency can help prevent falling victim to scams.

- Long-Term Sustainability: Madoff’s scheme was unsustainable from the start, as it relied on a constant influx of new investor funds to pay returns to earlier investors. This teaches us that true wealth is built on sustainable, well-founded principles and investments rather than shortcuts and quick gains.

- Diversification: Madoff’s investors were heavily concentrated in his scheme, leading to massive losses when it collapsed. Diversifying investments across various assets can help mitigate risk and protect against the impact of a single investment failure.

- High Returns: Madoff promised consistent high returns regardless of market conditions, which should have raised red flags. Unrealistic promises of wealth should be met with skepticism. As an investor, always understand that investment returns come with risks and fluctuations.

- Transparency: Madoff’s clients were kept in the dark about the true nature of his operations. This underscores the importance of transparency in financial dealings. Open communication and clear disclosure of information are crucial for maintaining trust and integrity in wealth management.

- Professional Oversight: Regulatory bodies and institutions failed to adequately monitor Madoff’s activities, contributing to the prolonged duration of his scheme. This emphasizes the need for strong regulatory frameworks to always be on their A-game to prevent fraudulent activities and protect investors.

- Avoiding Unchecked Ego: Madoff’s success in the early years might have fueled his ego and emboldened his fraudulent activities. Staying grounded and humble in the face of success can help prevent irrational decision-making and unethical behavior.

- Prioritizing Relationships: Madoff’s actions definitely shattered trust among his family, friends, and investors. At the end of the day, building and maintaining strong relationships based on honesty, empathy, and respect are far more valuable than accumulating wealth at any cost.

Why do people fall for Ponzi schemes?

Ponzi schemes are designed to exploit basic human psychology. Therefore, anyone can be susceptible.

In fact, we wrote an article on how Ponzi messes up people’s psychology about money: How Ponzi Schemes Messed Up How Nigerians Think About Investments

People fall for Ponzi schemes for a variety of reasons, some are part of what we already mentioned and they often stem from a combination of psychological, and emotional factors.

Some of the main reasons include:

- Promise of High Returns: Ponzi schemes typically promise extremely high returns on investment within a short period. Greed and the desire to make quick profits can cloud people’s judgment, making them overlook the unrealistic nature of these promises.

- Social Proof: When individuals see others apparently profiting from the scheme, they may feel a sense of FOMO (fear of missing out) and believe that they too should participate to avoid being left behind.

- Lack of Information: Ponzi schemes often provide limited information about how they generate profits. Investors might not fully understand the underlying investment strategy but choose to trust the scheme’s operators, especially if they appear credible or knowledgeable.

- Trust and Familiarity: Many Ponzi schemes are presented as legitimate investment opportunities by people who are known or trusted within the community. This familiarity can create a false sense of security and lead people to invest without conducting proper due diligence.

- Confusing Financial Jargon: Ponzi schemes may use complex financial language or concepts that are difficult for the average person to understand. This can make potential investors feel less inclined to question the scheme’s legitimacy.

- Pressure from Friends and Family: People often hear about Ponzi schemes from friends, family members, or colleagues who are already involved. The pressure to join from those close to them can influence their decision-making.

- Lack of Regulation: Ponzi schemes often thrive in regions with weak or inadequate regulatory oversight. This absence of official scrutiny can create an environment where fraudulent schemes can operate unchecked.

- Desperation or Financial Need: Individuals facing financial difficulties, debts, or other challenges might be more susceptible to schemes promising quick financial relief.

- Overconfidence Bias: Some individuals believe that they can outsmart the system or “cash out” before the scheme collapses, underestimating the risks involved.

- Limited Investment Opportunities: In areas with limited legitimate investment options, people may be more willing to take risks with unconventional opportunities, even if they seem too good to be true.

- Lack of Investment Education: A lack of understanding about how legitimate investments work can leave individuals vulnerable to fraudulent schemes, as they might not be able to differentiate between legitimate opportunities and scams.

- Emotional Manipulation: Ponzi scheme operators may manipulate emotions by appealing to a person’s desire for financial security, independence, or a better future for themselves and their families.

Bottom Line

Bernie Madoff’s life highlights for us the destructive consequences of pursuing wealth through dishonest means. The lessons from his story emphasize the importance of ethical behavior, due diligence, transparency, and a balanced approach to seeking financial success.

True wealth is not just about monetary gains but also about integrity, responsibility, and the well-being of oneself and others.

Get Access to Secure Investments on Cowrywise

ALSO READ

The Psychology of Greed: Why People Pursue Money at Any Cost

Financial Contentment: Will you ever have enough money?

On Ponzi and Pyramid Schemes: Is Affiliate Marketing a Scam?

How Ponzi Schemes Messed Up How Nigerians Think About Investments

Behavioural Finance in Action: How Emotions Affect Your Investment Decisions

How to Break Away from Addiction to Ponzi Schemes Like Loom and MMM