Crafting New Year’s resolutions is easy, but making them stick? That’s the real challenge. Here are some investment don’ts to leave behind in 2023 and 6 practical tips for financial success this year.

Investment Don’ts

Don’t pay yourself last: It is human nature to attend to immediate needs first. But, building wealth depends on you prioritizing your financial future. And to do that, you’ll need to resist the temptation to spend first, and save/invest whatever is left.

Paying yourself first is a reverse budgetary strategy where you save or invest first (pay yourself), before spending the balance on your needs and utilities.

Don’t chase past performance alone: You must have heard this phrase before, “past performance is not an indicator of future success”. What this means is that no one can predict the future, and analyzing past market performances alone is not a reliable way to predict future outcomes. So, what should you do?

For staunch investors in mutual funds, additional indicators alongside past performances can give you better insights. Examining a mutual fund’s asset composition and allocation, rolling returns, etc. can help you make an informed decision on which mutual funds are worth investing in.

Don’t try to time the market: It is better to start investing with what you have today than to wait for the ‘perfect’ time or condition to invest. While it’s easy for young people to put off investing until later, it’s not advisable.

Investing is about playing the long game. The longer you have your money invested, the more likely you are to reap long-term gains. Bottomline, do not procrastinate any longer. Start investing today.

7 practical tips for investing success in 2024

Anyone can have a New Year’s resolution; not everyone can keep it. Last year, you said you’d start saving and investing. This year, you WILL honour your resolution ?. To help you keep your resolution to take your financial health more seriously, here are 7 practical tips to help you build your financial muscles.

Review your past performances: It is easy to fall for the “new year, new me” trap and completely forget the progress you made in 2023. Don’t do it! Take some time out to analyze your past performance, and ask yourself some fundamental questions – where did I fail last year? What do I need to improve on this year? You can still view your roundup if you haven’t done so already to take a closer look at how you fared financially in 2023, as well as detailed areas of improvement.

Start the year with a plan: Goals without a plan are just wishes. Create a roadmap and break down your financial goals for the year into bite-sized steps with a timeframe. Set clear, measurable goals to guide your actions. Vague resolutions often falter as the lack of well-defined criteria for success makes the goals much more difficult to achieve. Ditch “I want to improve my finances” and aim for “I want to save N100,000 every month” instead.

You could also decide to follow the 50-30-20 rule of thumb for personal finance. This strategy can help you allocate your resources to fit your investment goals – 50% on needs, 30% on wants, and 20% on saving and/or investing. This is not a law, so feel free to revise this strategy depending on your financial situation. The most important thing is to start with what you have and remain consistent.

Curb excessive spending habits: A popular proverb says, “a bird in hand is better than two in the bush”. When it comes to money, the reverse is the case for most people. Money that is easily accessible is more likely to be spent, especially if you have just started this journey and are in a constant tug-of-war to stay disciplined and spend less.

You can do three things here:

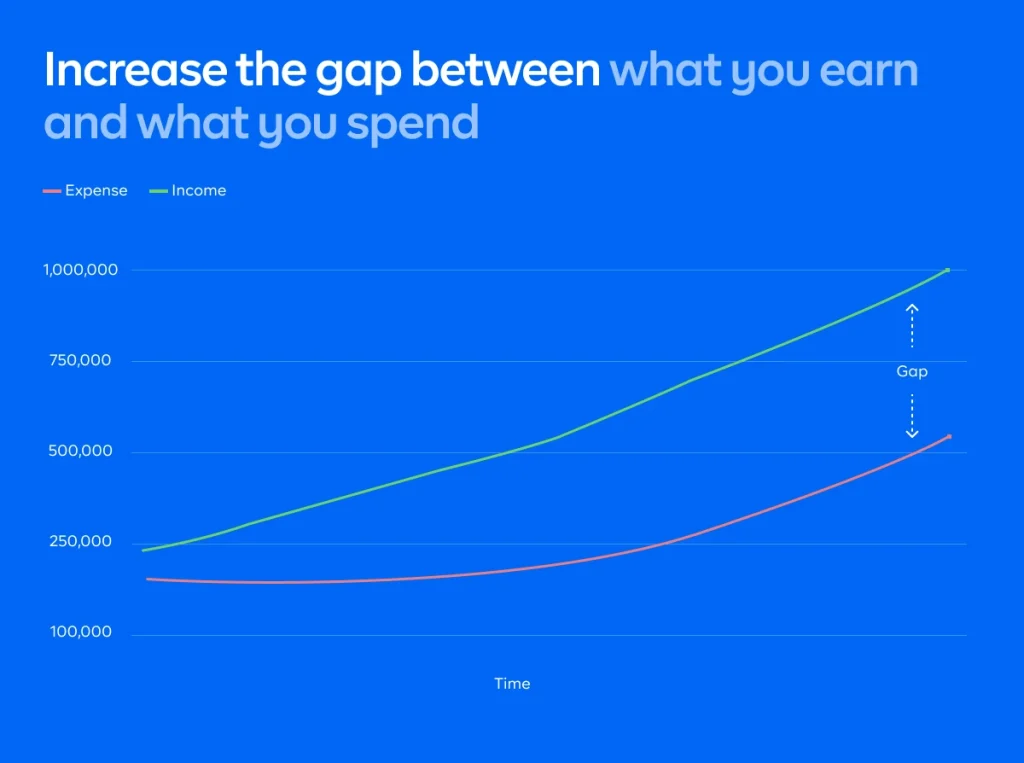

- Increase the gap between how much you spend and how much you earn. The wider the gap, the more funds you’ll have access to for your saving or investing goals. The focus here to maximize this strategy is to spend less over time.

- Create a savings plan to lock away your savings for a fixed tenure until it matures. During this time, you won’t be able to access the funds.

- Take advantage of Triggers. When you connect Triggers to any of your plans, you save a specified amount anytime your football or basketball team/player scores. Save when Haaland or Salah scores. Or when Lebron James or Kevin Durant scores a free throw. Replace excessive spending habits by saving while doing the things you love.

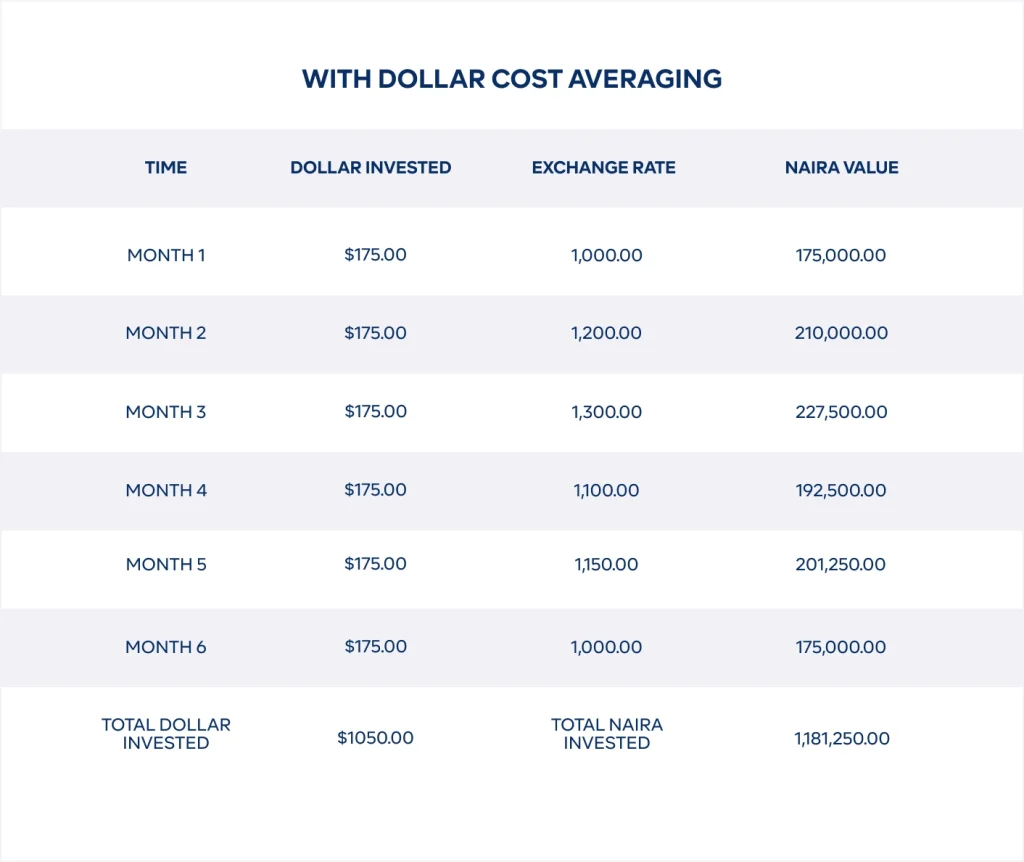

Invest in dollar-denominated mutual funds: The FX market is turbulent and unpredictable. But, that shouldn’t stop you from investing in dollar mutual funds. A great strategy to invest in dollars without breaking the bank is to maximize dollar-cost averaging. Dollar-cost averaging is the process of investing a fixed dollar amount regularly, making it easier to manage how much you invest over time amid market volatility.

The tables below show the impact of investing with dollar-cost averaging in mind, saving you a total of N12,500 for the same dollar value invested over a 6 month period – enough to get you movie tickets for two.

That’s smart thinking.

Summarily, it helps you spread your investments over time, so the amount invested is less affected by market timing.

You can start investing in dollar mutual funds here.

Beef up your Emergency Fund: The generally accepted amount you should save in your Emergency Plan is six months of living expenses. This is based on suggestions from top advisors globally. You should work towards gathering up an amount that can cater to your living expenses for six months in case you run into an emergency that disrupts your income flow.

In the event you haven’t met this goal, it’s time you beef up your Emergency Fund, and get ahead of unforeseen occurrences. Create an Emergency Plan here.

Embrace accountability: Share your goals with someone who can provide support and encouragement. Sharing your struggles and celebrating milestones doubles the fun (and results!). You can do this the old-fashioned way, or join a savings circle with your friends. Better still, create a money duo plan with your spouse.

If you want to go fast, go alone. If you want to go far, go together!

Be patient with yourself: If setbacks happen, don’t declare failure. Acknowledge them as temporary setbacks and refocus on your positive progress. Failing at something doesn’t make you a failure. Forgive yourself, pick up, and keep going.

From all of us at Cowrywise, Happy New Year again. Whatever you do this year, make sure you plan, save, and invest.

We are rooting for you. Always! ?

ALSO READ