The 50-30-20 budget rule is a practical rule to help you cultivate and maintain a savings culture and ultimately achieve your financial goals. Though it has been around for a while, it is still one of the best rules to follow if you’re not good with money and find it difficult to track your spending.

This article discusses this simple and easy-to-implement rule and how to get the most out of it.

What is the 50/30/20 Rule of Thumb?

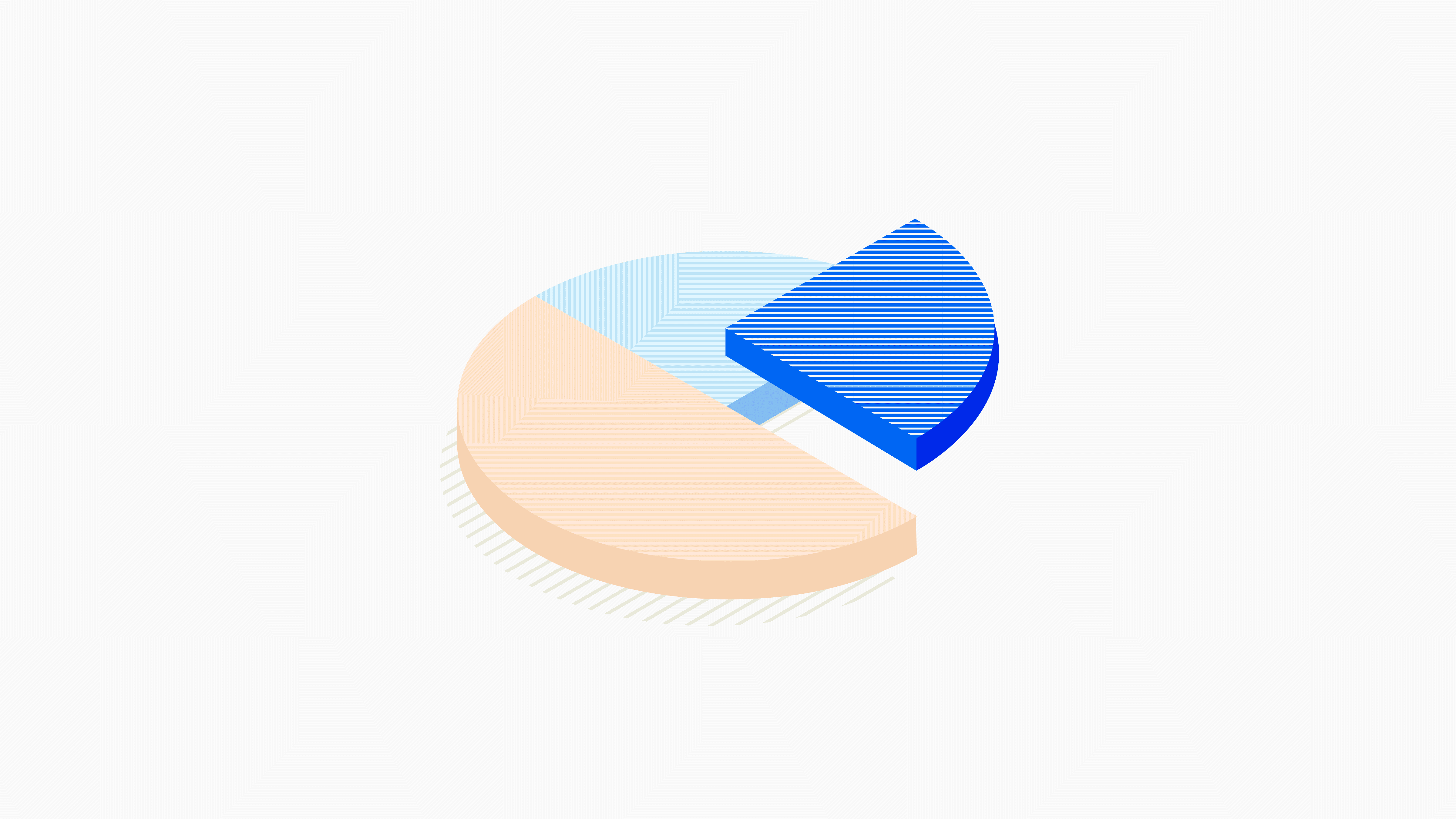

The 50/30/20 rule of thumb is a budget rule that helps you divide your expenditures into just three categories: Needs, Wants, and Savings.

The rule was popularised by American senator Elizabeth Warren in All Your Worth: The Ultimate Lifetime Money Plan. It breaks down necessary expenses, leisure expenses, and a savings plan from a percentage of your salary. Let’s look into each segment.

50% for Needs

Half of your take-home salary should be dedicated to this category. 50% should go towards necessities alone, things you can’t do without or will make life easier for you. This means rent, gas, transportation, feeding and groceries, healthcare, utilities and debts if you have one, etc.

Note that this should not exceed half of your income because if it is, it looks like you might have needs above your earnings, and you need to cut these costs for a little while until you can adjust accordingly.

30% for Wants

30% goes into your leisure spending. Money that you spend on yourself. This category will mainly include things like data plans, maintenance and repairs or may go into something fancy or anything that entertains you. Like gym memberships, buying a new outfit, Netflix subscriptions, travelling, spas or eating an expensive craving, so you’re not just saving without enjoying life. It’s best you don’t spend more than this 30% either because it might mean you are living a life you can’t maintain.

20% for Savings

The final 20% will go into your savings. You can also use this money as an emergency fund, investment or retirement plan. It’s up to you to decide. The good thing about this rule is that you are guaranteed to have some money saved at the end of the day, and you’re not just spending. It’s helpful for people who want to prioritize savings to set money aside for future purposes.

You can start automating your savings with Cowrywise today to make the process faster.

The 50/30/20 Rule of Thumb vs Other Budgeting Methods

You may have encountered other budgeting rules such as Zero-based budget, Pay yourself-budget, Envelope Budget, and the 80/20 rule. Here’s a summary of them.

Zero-based budgeting

Zero-based budgeting ensures that your income minus your spending equals zero by the end of the month. It divides all of your money into expenses, savings and debt payments.

Pay yourself first

Pay yourself first is a reverse budgeting strategy where you basically save first before any other expenses. It prioritizes savings, but not at the expense of needs like rent and utilities.

Envelope budgeting

Here, you first divide your income into spending categories like transportation, groceries, subscriptions, etc. Then you assign a certain amount to each category and put that amount in cash in an envelope. You are only allowed to spend what’s in the envelope for each category. No overspending.

80/20 rule of thumb for budgeting

The 80/20 rule is a simplified version of the 50/30/20 rule. You spend 80% of your income and save 20%.

However, the 50-30-20 has been proven to be more effective because it helps you set more precise goals and categorises needs over wants, cuts down unnecessary spending, and you are sure to always have money at the end of the month. It’s one of the most common methods financial experts recommend if you are just getting started on personal finance.

Bottom line

The 50-30-20 rule works best for people with the minimum or average wage or who are trying to get their finances back on track. Remember, you can always tweak the rules; you can decide to put 30% into saving and 20% into leisure. It is not a rigid pattern. Having three categories just helps you with the structure and focus to better manage your money.

Start saving on Cowrywise ??????

RELATED

10 Psychological Tricks To Save Money

Can’t Save Money Because of Bills? How to Navigate Wisely

How to Budget with an Unstable Income

GLOSSARY

Thanks guys,your 50-30-20 is a good advice on my side.