Going into the new year, investors across the globe are likely to ponder on the direction of several macroeconomic variables as well as the impact of some geopolitical events on investing in 2024. Much like the trends observed in 2023 and the years before, understanding key investment variables is pivotal for a successful investing journey.

Though the year looks set to be a tough one, opportunities abound for those who comprehend these essential variables and strategically position themselves accordingly.

We end the note with an asset allocation guide and key recommendations for 2024.

Keep reading for the full report or hit download to get a copy.

Download the full report

2023 was a roller coaster year for investors due to the continuous push and pull between macroeconomics and geopolitics. Specifically, a strong and resilient labour market in the USA, coupled with an increased focus on supply chain resilience due to lessons from the pandemic among other things ensured that the Russo-Ukrainian war and the battle against inflation by global central banks did not upturn financial markets.

In Nigeria, the 2023 election ushered in a new set of administrators for the country. Policy reforms like the removal of fuel subsidies and the devaluation of the currency to a more market-reflective rate followed soon after. Though these policies are beneficial to the country’s long-term macroeconomic indicators, the immediate impact was a surge in the price of food and energy with inflation reaching an 18-year high of 28.2% in December 2023. This surge in inflation meant that the purchasing power of Nigerians was reduced as many citizens could now only afford fewer goods and services, with some citizens even reportedly cutting back on some essential items.

“People’s purchasing power has been badly hit by the economy, and a lot of people only have enough to sort out their daily needs”- Bolu, a Twitter user mentioned.

In 2024, an understanding of the key themes in the global economy is crucial for a successful investment journey. In this piece, we spotlight the key investment themes likely to dictate the pace of capital markets in 2024.

Theme 1 – FX: The worst is likely over

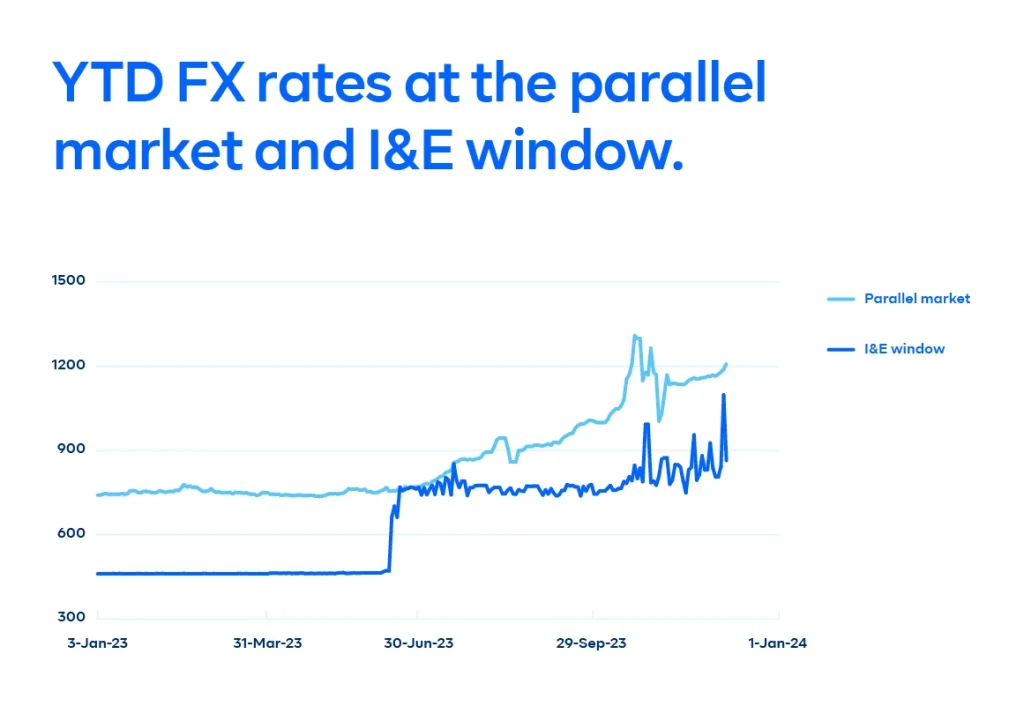

The topsy-turvy nature of the country’s currency has turned all 200 million of its citizens into FX traders, as they are constantly monitoring the exchange rate to ascertain whether their FX position is still tangible, and their purchasing power, intact. In 2023, the local currency began the year at the official window at an exchange rate of N461/$ and currently stands at N865/$. At the parallel market, the exchange rate hasn’t fared any better, falling by 67.5% to N1243/$ at the time of this report.

This persistent decline in the exchange rate across the years is mainly due to three main reasons.

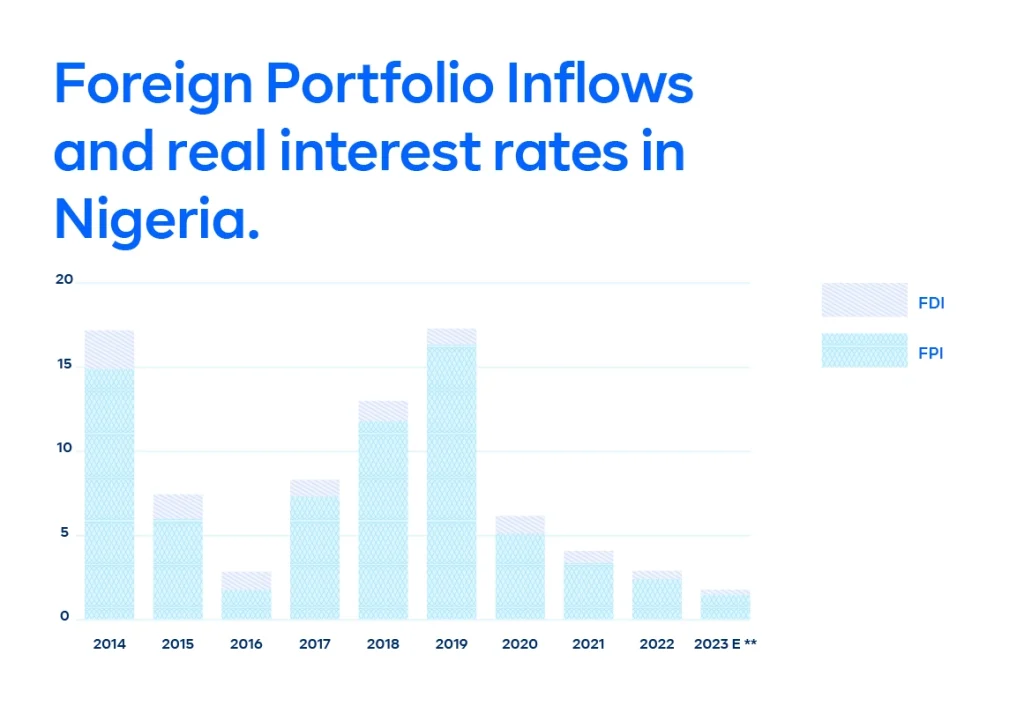

1) Weaker FPI and FDI inflows

The CBN’s financing of the Federal government despite its contractionary policy stance ensured that yields on government instruments were artificially low and with inflation rising unabated real interest rates in Nigeria went below zero. The Impact of this was that FPIs with their $ decided investing in Nigeria wasn’t worth the risk leading in no small part to the severe dollar illiquidity we are currently facing.

Meanwhile, capital controls from the CBN to arrest the capital flight didn’t exactly help and only led to multiple exchange rate systems and FX repatriation issues. With no new dollar coming in from foreign investors and the investors in Nigeria anxious to leave the pressure on the currency continued to build up.

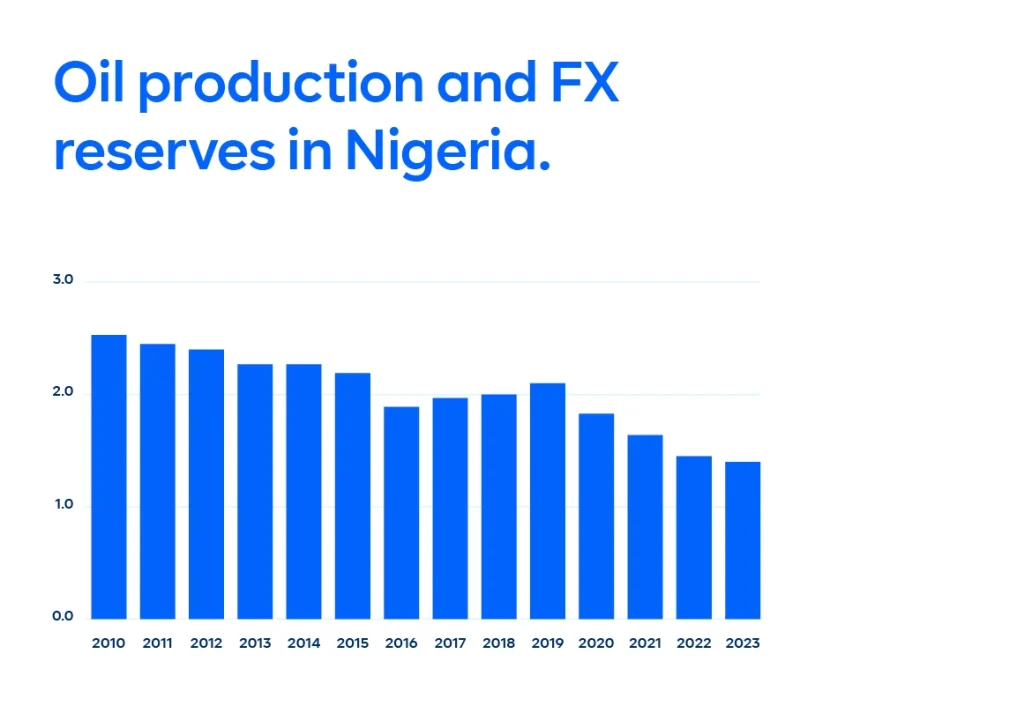

2) Grand theft auto in the Oil and Gas sector

The Oil industry in Nigeria has remained the golden goose, helping the CBN to meet its $ obligations as it accounted for a large chunk of the country’s foreign exchange earnings (82.5% of exports in Q3’23). Persisting cases of oil theft have however meant that the $ taps are currently being hampered and as a result, the CBN has been unable to meet its dollar obligations as when due.

Fig 3: Chart on oil production and FX reserves in Nigeria

3) The new administration has however made moves to address both issues.

On the first point, the new CBN governor Mr Yemi Cardoso announced a return to a more orthodox monetary policy regime and has made moves to strengthen the monetary policy transmission mechanism. In English, this means that the interest rate on government securities is expected to increase. Already, yields on short-term and long-term naira assets are currently elevated above their historical levels and although real interest rates are still below zero, we believe this is a step in the right direction.

The fiscal authorities have also indicated a strong drive to curb oil theft and increase oil production. The Nigerian National Petroleum Company (NNPC) for example recently announced that Nigeria’s oil production could hit 2.2 million barrels per day in 2024. This increased oil production if achieved could support the country’s FX position in the mid to long term.

Theme 2 – Inflation: All roads point southwards

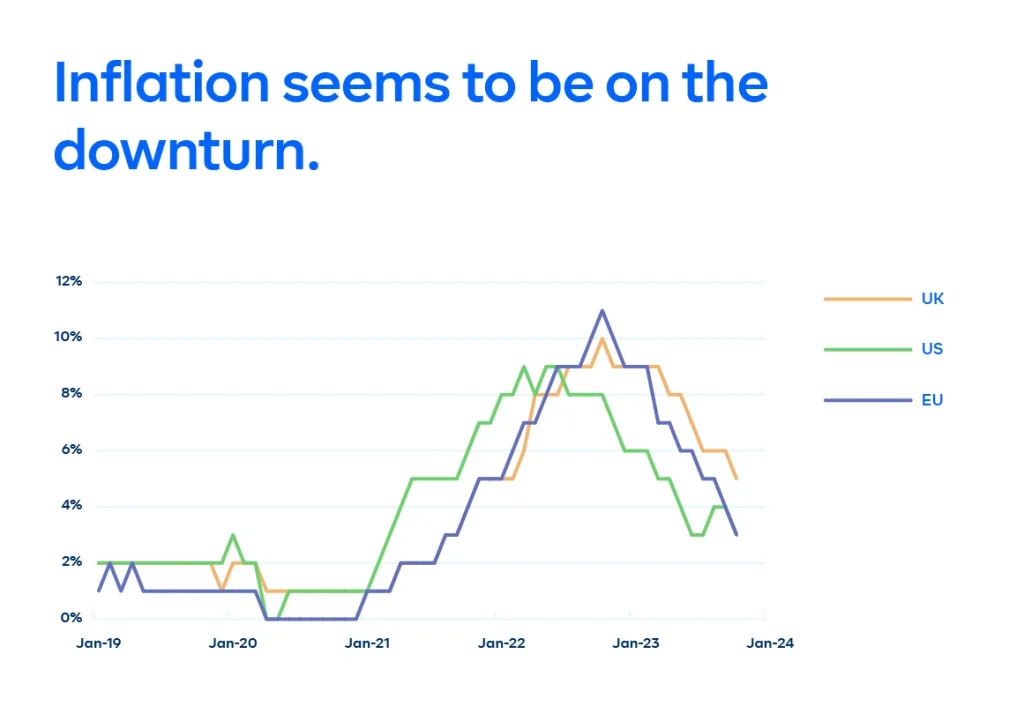

Global Inflation peaked in 2023

In 2023, global investors were mainly concerned about inflation. This was triggered by a combination of a war-driven energy crisis and an oversupply of money from years of expansion policies in developed countries. As a result, the Consumer Price Index (CPI) in many major economies hit multi-year highs. However, as the year progressed the impact of a generally tighter monetary policy stance combined with base effects from the previous year, brought inflation to controllable levels. For example, inflation in the US collapsed from a peak of 9% to under 3.5% currently and is on track for a third consecutive monthly decline In December.

Locally: Policy rejig might support a decline in H2

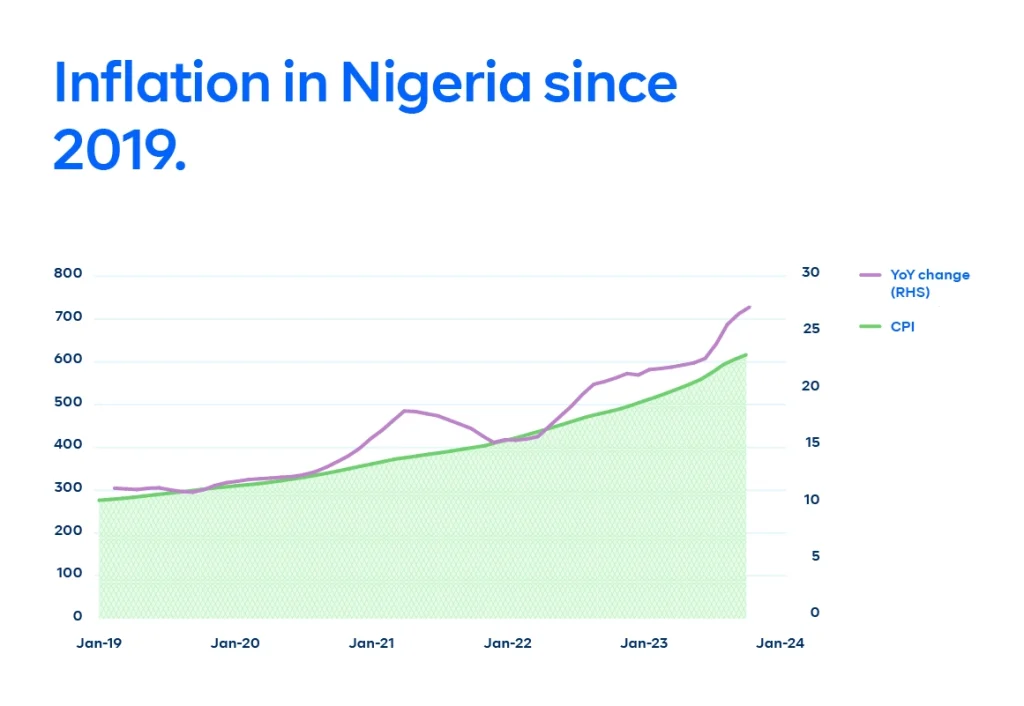

Inflation in Nigeria has been on an upward trajectory since 2019 due to security-related disruptions in food production and distribution in Nigeria’s food-producing regions and a depreciation of the Naira – which in turn is making imported goods more expensive. This situation was further compounded in 2023 with the removal of the subsidy in May and a unification to a more market-reflective exchange rate in June. Going into the new year, inflation is likely to continue to be a drag on consumer wallets in Nigeria particularly in the first half of the year. We however see legroom for improvement in H2’23 due to 1) the lagged impact of the recently commenced tighter monetary policy framework of the CBN. 2) the impact of a higher base from H2’23.

Fig 5: Inflation in Nigeria since 2019

Theme 3 – Central Banks and Monetary Policy: Prepare for a dovish year

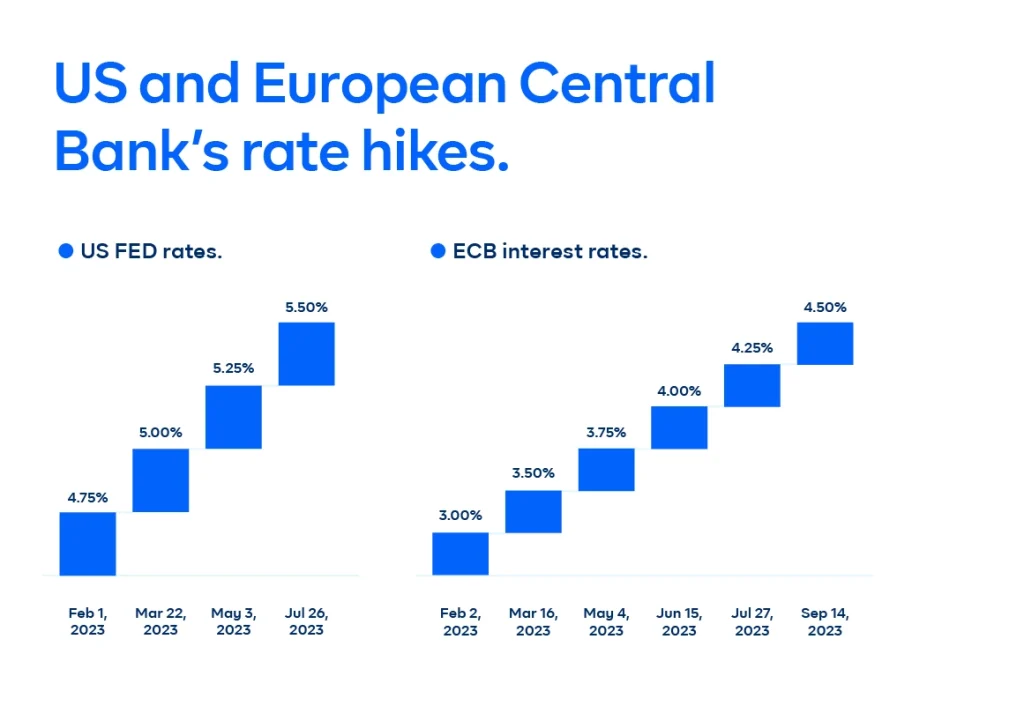

As earlier mentioned, global central banks successfully waged a war against inflation in 2023 as they shifted to a more hawkish monetary policy stance. The US FED for example raised its monetary policy rates a total of four times in 2023, taking its federal fund rate from 4.25% to 4.50% in January to currently 5.25% to 5.50% as of the time of writing this report. The ECB in its bid to fight inflation raised its policy rate a total of 6 times in 2023.

With the inflation in major developed economies on the decline, central banks are unlikely to sustain the same level of tightness in their monetary policy in the new year, however, we expect central bankers to adopt a wait-and-see approach in early 2024 as they try to avoid a premature loosening which could reignite inflation. We expect the US FED to stand pat on its monetary rate for most of H1’24. In the second half of the year, we could however see a reduction in monetary policy rates if the prognosis of lower inflation turns out to be true.

Emerging markets could benefit from flat to falling interest rates.

Emerging market economies Like Nigeria most of which recently commenced their hiking campaign could potentially benefit from a relatively dovish stance in developed markets as higher interest rates in developing economies can make emerging markets more attractive to foreign investors leading to an increase in capital inflows, boosting economic growth and development.

Theme 4 – E is for Energy: We might see some improvement

The price of crude oil is arguably one of the single most important economic variables in Nigeria as it has a direct impact on various sectors like government revenue, foreign exchange availability, and liquidity of the price of manufactured goods and services (Diesel is a common source of energy for manufacturers in Nigeria) because oil accounts for a large chunk of government revenues and foreign exchange earnings.

This reliance implies that when crude oil prices are high, the government generates significantly more income from oil exports. This can boost fiscal spending on infrastructure, education, healthcare, and other critical areas. Higher oil revenues can also lead to a stronger naira as earlier mentioned, making imports cheaper and potentially boosting consumer spending and businesses’ competitiveness. However, the deregulation of the downstream oil sector could mean the price of Automotive Gas Oil (Diesel) and Premium Motor Spirits (Petrol) is likely to go up and put some pressure on consumer wallets. When oil prices fall, the government also generates less revenue for its use, and the currency runs the risk of devaluation though there is a likelihood of cheaper AGO and PMS.

Indicators suggest weaker crude oil prices in 2024

Across the globe, oil demand growth appears to be decelerating due to:

- Tighter financial conditions.

- Economic weakness in the world’s largest energy importer (Spelt China). There is also the ever-lingering risk of an economic downturn in the US in the upcoming year.

Already, economic forecasters like the U.S. Energy Information Administration (EIA), Goldman Sachs, and the World Bank have announced reductions in their oil price forecast for the new year. The implication of this could be a reduction in government revenue though the forecasted increase in oil production could provide a respite. On the flip side, AGO and PMS prices might improve in the coming year.

Geopolitics: Russo-Ukraine and Gaza pose downside risks

In the modern interconnected global village, in which we all live, the influence of global geopolitics on investment has become more important as events in seemingly obscure corners of the globe increasingly continue to shape the economic landscape. The Russian invasion of Ukraine for example had ripple effects on global investment as it sent shockwaves across global supply chains which in turn led to an energy crisis and spiraling inflation the world over. Going into 2024, there are four key geopolitical themes worth keeping an eye on.

Russia and Ukraine

The war in Ukraine is still ongoing after two years with no clear end in sight, with both sides continuing to suffer heavy losses. Diplomatic efforts have largely stalled, with no viable peace agreement in sight. Going into the new year, the war’s economic impact could potentially intensify and lead to further supply chain disruptions and energy price volatility. It could also lead to increased risk aversion as the uncertainty and instability could lead investors to become more risk-averse, decreasing investments in emerging markets like Nigeria.

Israel and Gaza

Despite recent ceasefires, the underlying tensions between Israel and Hamas, the Palestinian militant group controlling Gaza, haven’t disappeared. Flare-ups and violence continue sporadically, while negotiations for a lasting peace agreement have been stalled, leaving no clear path forward. Though the conflict is in its early phase, it has the potential of spilling over and destabilizing peace in the entire region this could affect countries like Lebanon, Syria, Jordan, Egypt, Saudi Arabia, and Iraq with dire consequences for oil production.

Finding Calm in Turbulence: 2024 Asset Allocation Guide

2024 looks set to be filled with both economic and geopolitical uncertainties for investors and as always, we believe the key to a successful investment strategy this year is to ensure a well-diversified portfolio to enable you well weather the storm that lies ahead. For our 2024 asset allocation, we increase our allocation to money market funds (35% vs 30% last year) considering their improved yields and the liquidity profile which could come in handy during periods of high volatility. We retain bond funds at 20%, which is important for regular income generation.

Though we advise a focus on short-duration papers due to the possibility of higher yields in 2024 for FGN securities, we also increased our allocation to equity mutual funds (25% vs 20% last year). Our increased optimism for stocks is based on the impact of tamer inflation on consumer wallets which could bode well for corporate earnings. We retain our 20% allocation to dollar mutual funds and 10% allocation to cash.

Happy investing in 2024!