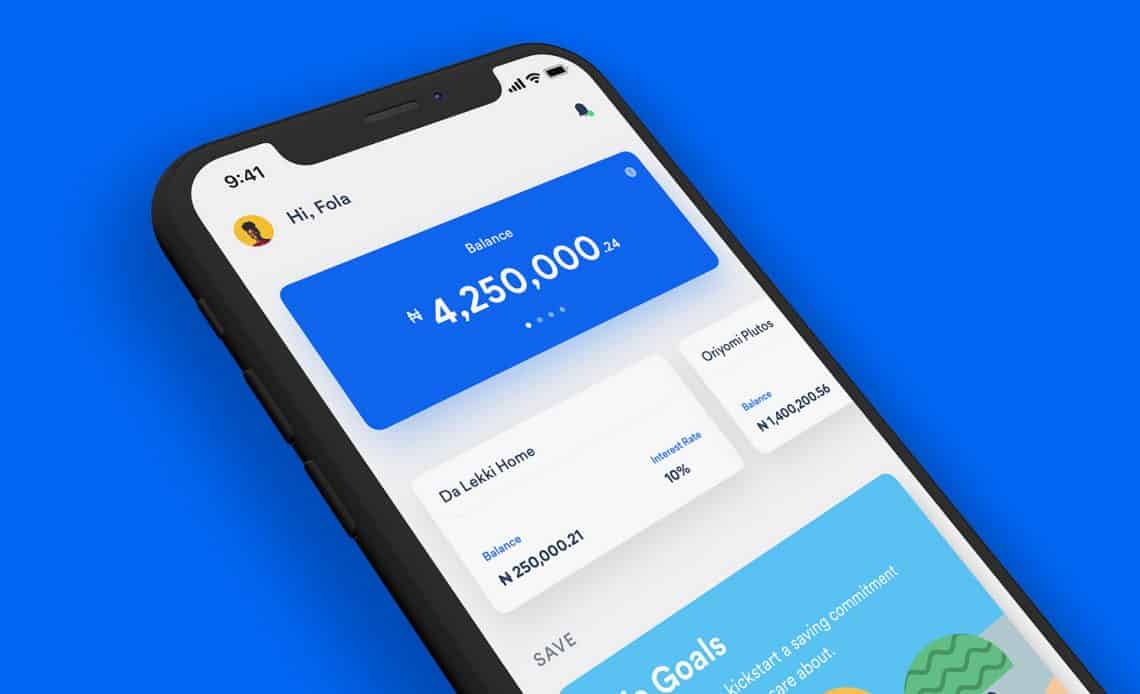

Introducing Cowrywise: A digital-first wealth management platform

Over the past years, Cowrywise has positioned itself as the dominant, digital-first wealth management platform for the young generation of Nigerians and Africans, built to simplify and democratize access to savings and investment products.

One universal truth about personal finance is that it is worthwhile to save and invest: for the proverbial rainy days, our own education, children’s education, emergencies or just for a planned holiday.

However, saving and investing in the conventional sense of the word can be anything from being difficult to an outright harrowing endeavour, especially when you have immediate access to your cash to quench tempting desires. Our needs and wants most times take the first claims on our hard-earned money. This soon becomes a vicious cycle, hard to break from.

What is Cowrywise?

Cowrywise is a savings and investment platform developed to equip individuals with the required tools to make personal financial management a lifestyle. Also, it is built not only to make periodic savings and investments easy and automatic but also to enable monitoring of savings, investments and net worth.

Cultivating a saving and investment culture is a game of gradual behavioural changes that require time and consistent baby steps to take root. This important fact is the rationale behind the birth of this blog. Cowrywise will serve as an educational platform for the dissemination of personal finance tips and available investment opportunities in Nigeria.

Sprout by Cowrywise

Sprout is a modern treasury management for businesses. In addition to making investments easy for individuals, Sprout is a central platform focused on helping businesses invest their spare cash easily and earn better returns. You get easy access to secure, flexible, low-risk, business-friendly investments from top fund managers.

Triggers by Cowrywise

Triggers is a smart, revolutionary, and automated way to save and invest. Currently, with Triggers, you can save/invest when your football club or favourite player scores a goal. Every time you take a predetermined action, you’ll be saving or investing, depending on the condition you set. It is the future of embedded finance; a simple, automated way to build wealth while doing the things you love.

What is our goal?

It is our mission to build a savings and investment platform that will allow individuals and businesses to enjoy a personalized financial management experience as we believe the concept of wealth is broader than the amount of money in bank accounts. A deep sense of financial security comes from knowing where you stand financially across all aspects of your life and business.

Welcome to Cowrywise Blog where we help you understand your money better. The blog focus is on the following:

We look forward to a blissful experience as we build together for the long term!