Idle funds are money without any use or purpose; the money is not used for business or investment and doesn’t appreciate or grow.

Idle funds bring little to no value to a business and should be kept at a bare minimum. And even this bare minimum should be to sort out daily expenses that occur in the business.

An example of idle funds is money sitting in the bank; money kept in traditional savings accounts where it gradually loses value to inflation. The cash has not been invested and isn’t earning interest or generating profit.

Having too much cash on hand when you can put it into low-risk investment opportunities does not make financial sense. However, knowing how to manage your idle cash effectively will positively impact your business. Too much idle cash could be a red flag for a business and is often called “wasted money”.

Having too much idle cash could be a red flag for a business and is often called “wasted money”.

Why idle cash is wasted money

Idle cash is wasted money because it could have gone into purchasing productive assets, mutual funds, stocks and bonds etc. where it has the potential to multiply.

To avoid this, you can start by putting it in a savings plan with high interest. This is especially helpful if you are not big on investments. Money in high-interest savings will still earn you interest, although low. You can try other means like investing in mutual funds, stocks and bonds etc.

If you are not looking at something long-term, then there are other short-term investment options for your idle cash that you can choose from.

Though idle cash brings little value to a business, this doesn’t mean it isn’t useful. Also, you cannot invest all your idle cash because you still need some for daily upkeep and unplanned expenses.

Apart from investing idle cash, you can also use it to pay back loans, or put into an asset that will generate more money. Apart from idle funds, there are also idle assets.

Idle assets are valuable properties or equipment that could also be put to good use but aren’t. This could include machinery, an unused building, fixtures, furniture etc.

How to put your idle business cash to work

Many institutions have idle funds from small businesses to large companies, but knowing how to get rid of them, is what sets the financially comfortable business apart.

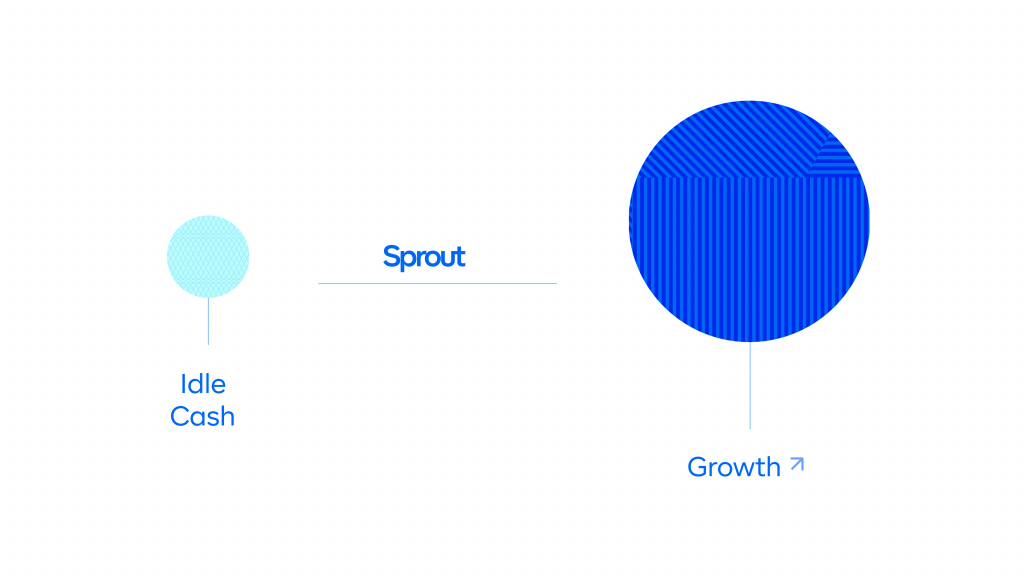

With Sprout by Cowrywise, you can invest your idle business cash and create an additional income stream for your business. We’ve got you covered with a range of low-risk investment options with attractive yields.

Got questions? Reach out to us or leave a comment below.

ALSO READ