Recently, we conducted a poll with the intention of assessing the value people place on the interest rate or return they earn on their savings and investment over time. The poll, targeted largely at tech-empowered young Nigerians, had 858 voters and the engagement level was nothing short of impressive. Unfortunately, that is where the excitement ends. The poll outcome is shown below:

Efe is 24 yrs old. At 10% interest rate p.a., what monthly #savings will make him hit a financial goal of ₦100M at age 60?#PersonalFinance

— Cowrywise (@cowrywise) May 7, 2017

What does this poll outcome say?

81% of voters grossly underestimate the long-term value-creating power of interest rate on their savings or investment.

About 40% of voters considered interest rate as having zero impact on long-term savings or investment.

Let us break down this poll. Really, to get the exact answer you might need to do some number crunching but we will not bother you with such. That is not the objective. This is not an ACCA or CFA Class. The most important finance awareness is that when you save or invest consistently over time with a return such as 10% per annum, you get a value that is multiple of what you actually saved or invested.

Option A (₦231,000) is wrong because it has not considered the 10% interest Efe will earn over the 36 years. Without this interest, Efe would have to slave through saving ₦231,000 monthly in order to hit ₦100Million by the time he is 60 years old.

However, with the 10% annual return considered, he needs to save only ₦24,000 monthly to achieve a financial goal of ₦100Million by age 60. Yes, you read that correctly. Just ₦24,000.

It is also important to note that the higher you flip the interest rate, the lower the amount Efe would need to save monthly. This is how the actual outcome works out over the 36 years period with our 10% interest rate per annum.

Amount actually saved by Efe: ₦10.3Million

Value created from returns: ₦89.8Million

This here is the magic of compound interest over a long period. In simple terms, over the years, the returns on Efe’s savings start to earn returns, the second wave of returns combine forces with the first wave to produce the third wave of return and the returns continue to spiral (compound). Got it?

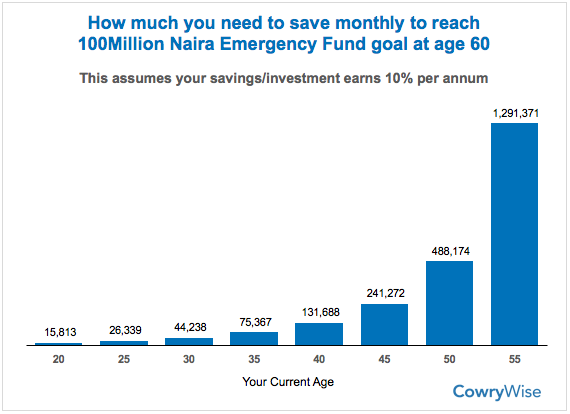

So our reference saver here Efe is 24 years. Ibrahim is 20 years old. And Uncle Lekan is 40 years old while my sister Jane is 30 years old. How much does each person need to save/invest monthly at 10% return to reach a financial goal of ₦100Million by age 60? We have a simple tool you can reference to determine that magic number.

Still confusing? Ok, let us interpret the numbers and how this fits into personal finance.

Ibrahim.

Age: 20 years. If Ibrahim set the goal of achieving ₦100Million when he turns 60, he will need to save ₦15,813 monthly from age 20 to achieve that financial goal. He basically has more time (40 years) for his returns to compound over time and take him to his financial target.

Jane.

Age: 30 years. For Jane to achieve the same financial goal, she needs to save ₦44,238 monthly between now and when she turns 60 years old.

Uncle Lekan.

Age: 40 years old. If uncle Lekan, now 40 years old, set the same financial goal of achieving ₦100Million when he turns 60, he will need to save ₦131,688 monthly to achieve that goal.

You can simply see your age bracket and how much you need to save/invest to achieve the same financial goal.

Key Takeaways for Personal Finance

There are 3 major drivers of the magic of such return as seen above:

1. Start saving and investing early in life:

It is never late to start but the earlier the better. Compare what Ibrahim and Godwin need to save to achieve the same objective. The difference is explained by the starting time.

2. Consistency of saving and investment:

The more consistent you are with your saving and investment programme the better. It is advisable to make saving and investing a regular culture by saving and investing daily, weekly or monthly.

3. A good and modest return:

The more the returns, the better. It is, however, important to understand what modest returns look like and not cross to the realm of a Ponzi scheme. More often than not, real and genuine investment programmes will not double your money overnight. Starting early, consistency and modest return do that for you over time.

What if there was a platform that allows you to save and invest regularly (tick 2) and earn a modest return (tick 3) with ease? Add to that, the flexibility to personalise your saving goals e.g to build a house, to pay for children’s school fees (this is an investment actually) and much more. This is what Cowrywise offers.

Cowrywise is a savings automation platform that helps you automate your periodic savings towards meeting your set financial goals. You specify an amount and date and Cowrywise will automatically save an amount away from your bank account into your Cowrywise account. Your savings currently earn a minimum return of 10% per annum.

If you haven’t done so, go ahead and start saving today by signing up at www.cowrywise.com. No fees, no fines, no penalties.

RELATED: