Growth Experiments by Cowrywise is a detailed, industry report on experiments and campaigns run by the team to give industry leaders, marketers and start-ups insights and nuggets of wisdom to help them scale and succeed. We believe in transparency and are of the position that knowledge of this nature should be accessible in order to help the industry grow as a whole.

Read this for insights into our referral bonus experiment on Cowrywise.

In this article, we will tell you:

- What inspired the referral bonus experiment on Cowrywise

- What we observed early on

- What we learnt as a result

To other start-ups looking to run or are in the process of running a referral campaign, here are a few insights and nuggets we hope will help you scale and optimize your campaigns. Good luck!

Black Friday Experiment

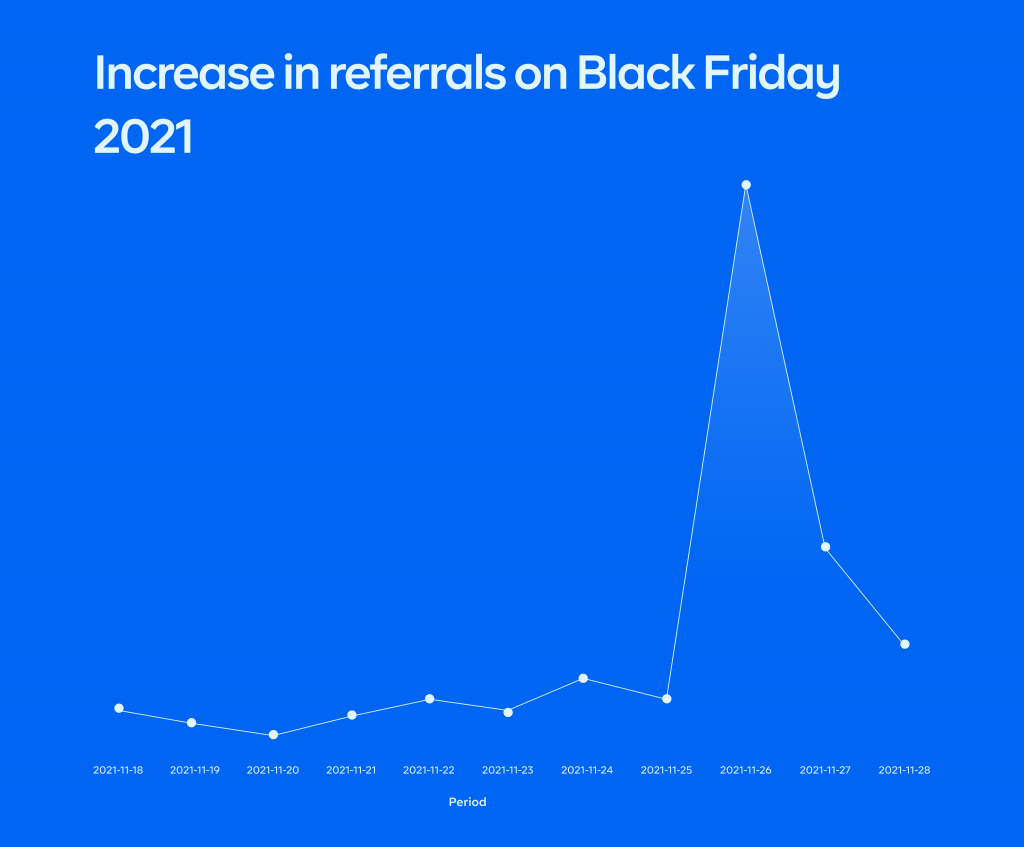

In 2021, Black Friday was held on the 26th of November and we decided to carry out a growth experiment. This was to test which incentive would drive users to refer friends to use the app.

This experiment was only for 24 hours and in that timeframe, users could earn 100% more in referral bonus. It moved from N250 to N500 if they successfully invited friends to signup on Cowrywise.

On that day alone, the experiment generated about 6x more referrals than the previous day. Also, at the time, it was the highest referral count we had ever recorded on a single day. And the possibilities seemed endless.

Trying out the referral bonus experiment for a longer period

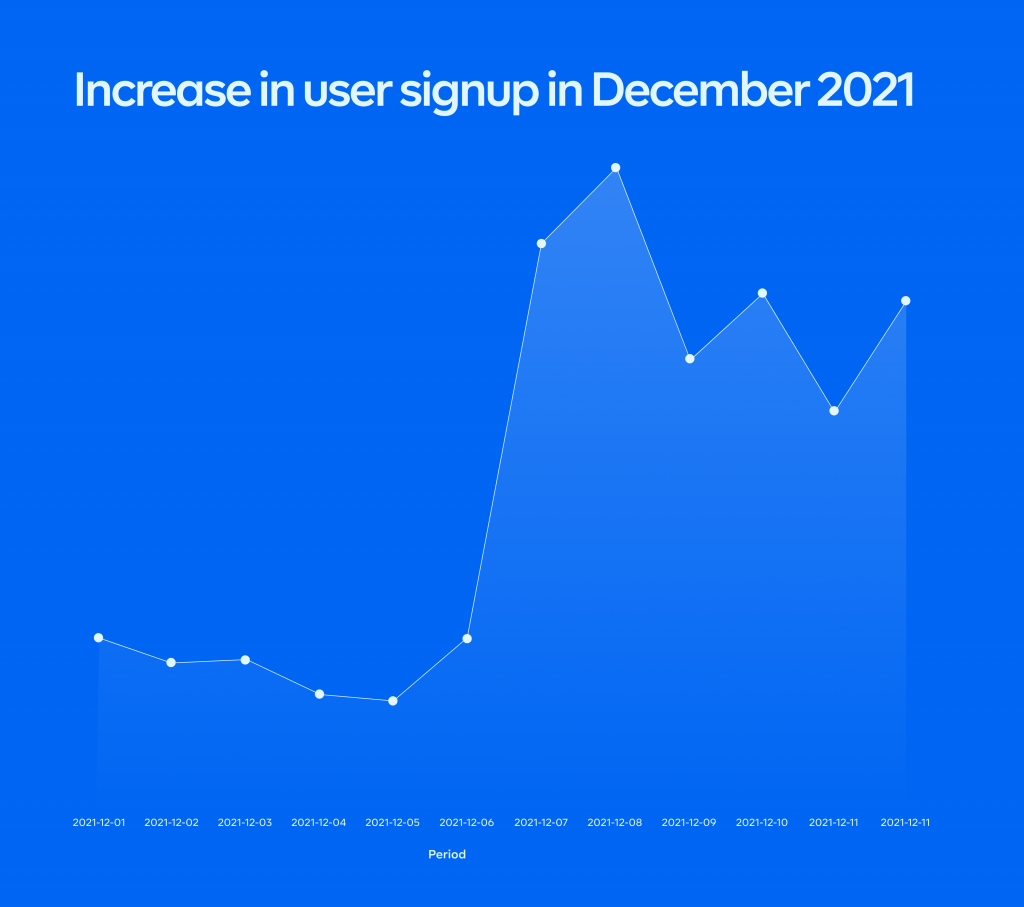

Since the increase in referral bonus led to a considerable number of signups on Black Friday, the team decided to launch it again on the 7th of December 2021 – this time for a longer duration.

For about 2 months, the referral bonus on Cowrywise increased by 400%! It went up from N250 to N1,000.

The goal was to encourage as many users to use their referral code to invite friends and family. From the first day of this experiment, referrals increased exponentially.

This was expected, as the previous experiment was successful albeit on a much smaller scale. And since one of the KPIs of any startup growth team is to increase user signups, it felt like an easy, go-to hack – one experiment to rule them all.

An invaluable lesson about attracting ants with sugar

One surefire way to know if there are ants around? Pour out a heap of sugar – that’s when the ants come out of their hiding place.

The highest user signup since inception was recorded during this period, but it didn’t take long to observe that the campaign wasn’t going as planned.

Daily user signups increased by more than 4x, with the highest user signup since inception being recorded in that period. However, our excitement did not last very long. What quickly became a source of concern was the rapid proliferation of questionable messaging people used to market Cowrywise that did not align with our values.

Every day, users talk about Cowrywise on their social media with a lot of admiration. However, during this experiment, a number of people (who we soon realized only signed up for the bonus) painted Cowrywise to be a “money-making venture”.

Data pulled from Google Analytics also showed that sites like “owo daily” which translates to “money daily” was one of the sites that drove a significant amount of traffic to Cowrywise.com during the campaign. Unlike genuine users who willingly talk about the brand, this set of people painted Cowrywise as what it is not – a money-generating app and this became a serious source of concern.

The referral bonus on Cowrywise was implemented to incentivise genuine users who already used the app to grow their wealth. But like sugar to ants, the increased bonus attracted two categories of users, a sign that the campaign needed to be re-evaluated quickly.

Users with ulterior motives

The nature of the incentive by default mostly attracted the attention of users who were looking to make a quick buck (remember the sugar and the ant). Since birds of a feather flock together, there was a higher probability that such a user would most likely refer another user like them – and no business can sustainably grow and thrive with these kinds of users in large numbers.

Taking into consideration the operating costs accrued on servicing and attending to customers in general, hiring CX personnel, growing costs of subscription services and tools to manage the data pipeline such as Metabase, Customer.io etc (the higher the number of users, the higher the cost), the ROI is not worth the effort and the expense.

The gamers

These are the main antagonists in this report. They successfully transformed the referral bonus into a money-making scheme (referral fraud). They are known globally as referral gamers or as we called them at the time, referral swindlers (yeah, it’s a thing!).

Frauds trying to game the system

The referral bonus during the initial experiment was pegged at N250, and a number of people tried to game the system. But, when the bonus was increased to N1,000, the number of fraud cases increased rapidly.

Users began using the term “Affiliate Marketing” for Cowrywise referrals. Reports of users utilizing ‘BVN farms’ to generate fake BVNs to register on the app revealed the gravity and sophistication of the scheme.

We found several users who created as many as 25 emails turned out to be the most dangerous cohort of fraudsters, taking advantage of the referral by creating a simple framework. To better understand this, here’s how a typical referral fraudster did it (hereafter called User A):

1) User A opens 10 emails using different aliases or similar naming conventions

(name.surname@gmail.com, name.surname1@gmail.com, name.surname2@gmail.com etc.)

2) User A uses these accounts to sign up with one referral code

3) User A deposits N500 in each of the accounts which was the condition to receive the referral bonus of N1,000/referral

4) User A requests for the’ agreed’ referral bonus of N10,000 for activating 10 ‘new’ users for crediting a total of N5,000 in 10 fake accounts

This was the modus operandi of the referral swindlers. Left unchecked, the scam could easily have multiplied in a short period of time.

Measuring Vanity Metrics

Though there was an exponential increase in signups, there was no corresponding growth in our Asset Under Management (AUM), as one would expect. Rather, we recorded a dip during this period, also exacerbated by a significant amount of outflows that typically occur during the ember months.

Success for us as a wealth management company goes beyond user signups. Activation and Retention are more important metrics to track.

AUM growth is one of the indications that a wealth management company is helping users tangibly grow wealth. Therefore, focusing on only signups without considering AUM growth at all is simply a vanity metric.

And this is a lesson for every marketing team – in creating experiments or campaigns, measuring what moves the needle is critical. Otherwise, a campaign can look successful but actually be hurting the business.

Falling into a ‘growth trap’

The literal implication of falling into a trap is that you don’t see it ahead. This is simply because of its unforeseen and spontaneous nature. In this context, the ‘growth trap’ describes a scenario where the consequences of a growth idea or experiment leads you into a trap further down the line.

Following the initial findings, the data and CX team dedicated time and effort to root out and flag the accounts of referral swindlers for suspicious activity. Within this period, we were able to erase their data and thought the worst was behind us. But, what we weren’t prepared for, was a corresponding amount of churn that took place during the referral period and months later. The churn rate was troubling at first until we connected the dots and were able to establish a relationship between the increasing churn rate and the referral swindlers.

Let’s break this down…

New users who sign up on Cowrywise typically create a savings plan that matures in 3 months. After this time frame, they can make a withdrawal. What we observed was that a number of the referees who created savings plans during the referral campaign, (who weren’t deleted or flagged) were uninstalling the app 3 months later (when the plan matured and they could make withdrawals).

The users in this category had no real use for the product, leading to the high churn rate we experienced at the time. In the event you are running a referral campaign, watch out for the numbers down the line.

Is Nigeria a different climate? Are referral campaigns doomed to fail?

Most people around the world seek the same things out of life – survival, comfort, and shelter. But Nigerians have peculiar needs. And according to Abraham Maslow’s Hierarchy of needs, an individual’s most prevalent need will influence their actions.

During the campaign, the number of people trying to game the system increased. However, at the end of the month (when referral bonuses are usually paid), many users didn’t receive this bonus. Instead, their accounts were subsequently flagged as the team picked up on any suspicious action.

This caused a lot of backlash as some angry “referrers” took to social media to accuse the team. Some of these people threatened our support team with death threats at some point.

To optimize or scrap the referral bonus experiment?

While this experiment lasted, the team continually optimized. However, after 60 days, there was enough data to conclude that the best decision was to stop the referral campaign.

We’ve now set up the Cowrywise referral program to encourage users to take deliberate action in building wealth for the long term. Users who refer friends enjoy fee waivers when they buy investment units.

Customers can not go wrong with investing and encouraging this action in-app helps keep the habit loop of wealth building.

Final lessons on this referral bonus experiment

Lesson 1: Fraudsters will always live among us

There will always be clever people trying to take advantage of the system; be it a referral campaign or otherwise. As the possibilities technology offers continue to improve, there will always be a loophole or chink in the armour. Unfortunately, fraudsters are waiting to take advantage of it. In the first few days of running a referral campaign, watch out for unusual activity or behaviours, unusual inflows, and spikes in your growth charts and metrics.

Lesson 2: Avoid monetary incentives

Depending on your core audience, monetary incentives seem to be an easy fix, a sort of magnet that attracts users to your product. The challenge with monetary incentives is that they tend to attract users who will not use the app the way it was designed to be used, and who may not be ideal for long-term growth. So, what are the alternatives?

We believe the magic lies in giving users pleasant experiences with your product (user delight) and experiential engagements with your brand. Chances are a happy user is more likely to refer your product to others, with or without an incentive, and from a marketing perspective, word of mouth is king.

Lesson 3: Measure and analyze

There’s possibly no need to overemphasize this lesson. A growth marketer should measure and analyze data frequently to make better data-driven deductions and as a result, better decisions to optimize and improve expected results. But, beyond just measuring, it’s important to be able to connect the dots. In the case of this experiment, the ability to observe a correlation between the massive acquisition numbers and the number of duplicate emails existing in our data pipeline was the catalyst to identifying the fraudsters early on.

Lesson 4: Security is key

Fraudsters and scammers never sleep. Neither should we. Our goal is to keep money working for our users; not just round the clock, but safely and securely. It’s critical that businesses (particularly those in the fintech industry), invest in up-to-date cyber-security software and tools, effective flagging conditions, and most importantly, obtain the necessary license(s) required to safely manage customer wealth.

Lesson 5: Know when to pull the plug

This is possibly the most important nugget for any team running a growth experiment; expect to fail. It’s not a curse, it’s a statement of fact. By popular accounts, Thomas Edison made up to 1000 unsuccessful attempts (in 14 months) in his bid to power a light bulb; with a success rate of 0.1%. The mindset of a growth marketer requires that you are willing to fail fast, and try again! If and when you notice an experiment is not going as planned, there’s absolutely no shame in pulling the plug.

Building an invaluable brand

The Cowrywise brand has grown formidably over the years. It is an asset that is excellent and hard to replicate. That’s why all our campaigns, from ideation to implementation protect our brand.

Have any questions? We’re happy to answer.

Ask us in the comments.

This is very enriching

Good financial content.

Tell me why I won’t let you be Cowrywise??

Thank you for this writeup

Great Content! ?