Market slice is a monthly summary of mutual funds on Cowrywise and key money news. This jargon-free report is shared on the 3rd of every month. Share lessons on Mutual Funds in May 2021 using the hashtag: #MarketSlice.

Hello there ?

May was the month of many big investment stories. Beyond the sterling performance of money market mutual funds in May, and rolling in the dip, there was a $44 billion story. It got me asking, “God when?”. I mean, with such net-worth there’s so much you have under your control. And that my friend, is true retirement–the ability to gain control of your time. So you don’t get confused, this is the story of Zhang Yiming; the founder of ByteDance (owners of TikTok). At the end of the year, he’ll step down as CEO to spend time reading and daydreaming. God when? ??

Mutual Funds in May 2021

50% More for Money Market Mutual Funds

November 2020 was the month Nigerians paid the government to borrow money from them. That is, they were willing to earn negative rates to buy treasury bills. However, as we have seen since February, the treasury bills have been singing a new song of profits. In May 2021, the average return on money market funds (which invest majorly in treasury bills) grew their annual returns from 4% to 6%. ?

The good news doesn’t end there. At Cowrywise, we invest savings primarily in a mix of treasury bills and government bonds. With this current rise, interest rates on savings grew by over 100%! In essence, while some markets dipped returns rose for our community of investors.

Equity Mutual Funds in May 2021

May came with a lot of greens for investors in the Nigerian stock market. That is, they made more gains than losses. In turn, mutual funds that invest in equities (equity funds) rewarded investors with sweet returns. Are you still lost about equity funds? Check here.

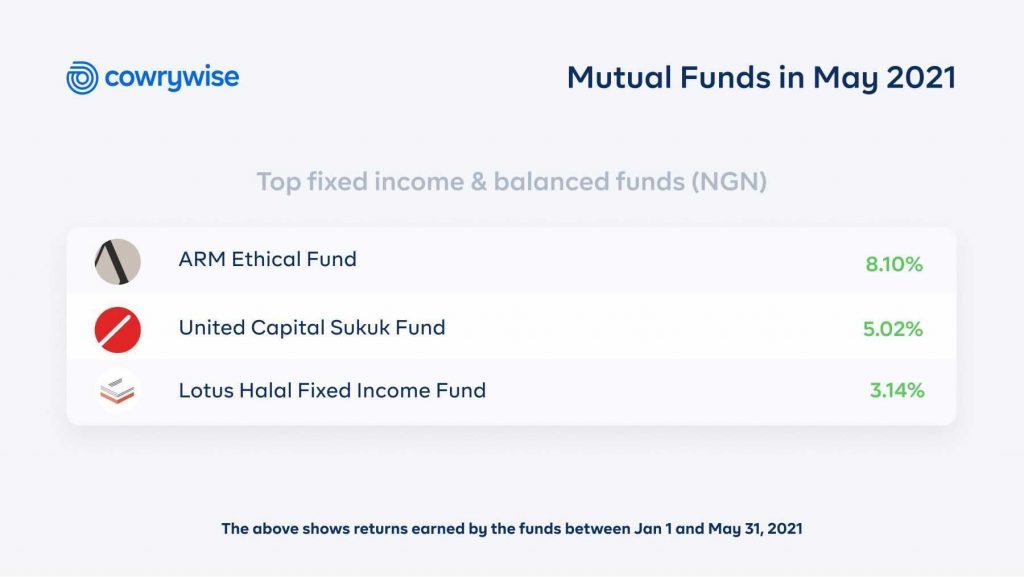

Fixed Income Mutual Funds

These funds include bond and balanced funds. A fund that commonly invests in a mix of equity and bonds is know as a balanced fund. Here’s how they performed in May 2021:

Rolling in the dip ??

After an impressive bullish run for cryptocurrencies from 2020, they finally came crashing in May. Some attributed this to Elon Musk, while others have described it as a market correction. However, the big question on everyone’s lips has been: “Should I buy the dip?” and “How do I diversify my investments?”. In an interesting YouTube explainer, we shared our thoughts ??

What does a dip mean?

Take a practical example of car sellers; in this case, the assets are the cars they sell. In March, let’s assume the price of cars was $5,000. If that drops to $4,500 a dip is said to have occurred.

These sellers can choose to hold on to their cars and wait for a price jump, sell-off at the lower price, or even buy more at that price with the expectation of an increase. The act of buying assets at a lower price is known as buying the dip. However, the expectation of prices to increase after a dip is not valid. In this thread, we outlined a strategy of how to buy the dip. Check it here.

What is market correction?

Every day, people trade stocks and other assets like cryptocurrencies. As expected, this is done through various markets like the stock market. Further, in some periods, prices of such assets are inflated due to a rush or some endorsement/news. After a while, the market naturally adjusts to cancel out such artificial jumps. A number of crypto experts describe this dip as a correction.

Once again, on cryptocurrencies, we are open-minded. Do your research before you invest anywhere. But remember, always bring your gains home where there is security. Cowrywise is home.

? Data Snap of the Month

On the second of June, 2021, an Italian artist sold an invisible structure for $18,000. The art apparently exists in his head.

Quite interesting analysis, I must say your report is an eye opener to those who knows little about the world of investment. Please keep it coming

Quite interesting analysis, I must say your reports are intriguing. Please keep them coming