A Tug of War

The present self is always on the lookout to maximise pleasure right now, while the future self is the one setting up goals and who helps to maintain long term happiness. As these two perspectives are often conflicting, the two selves are fighting an eternal (and often uneven) battle.- Simon Bugge

The Dilemma of the Present Self

Interestingly, if the present self — let’s call him Jide — could exist as a being set apart from the future self, it will definitely feel terrible that we consistently describe him as a dominant player in leading people through destructive paths. The simple truth is that most times, it is complex for him to process the benefits of future plans. This is because Jide is similar to a child whom you are forcefully trying to make understand adult stuff; which is actually how the future self thinks — let’s call her Amaka.

Sadly, despite the innocent choices of Jide; they are still hurtful to Amaka’s big dreams. Hence, there is a crucial need to train his thoughts so they fall in line with Amaka’s. To help with this, psychologist, Daniel Goldstein has a brilliant suggestion. He suggests that we view will-power as a muscle which can be trained. What your present self lacks is strong will-power, so how do we fix that?

Training your Will-power

To train the will-power muscle, we must set up commitment devices. Commitment devices are arrangements that help sustain the will-power to make important decisions work out. In this case, they are quite simple:

1. A visualization tactic,

2. Locked-up automated savings; and

3. Simple financial planning.

For the scope of this article, we will focus more on the visualization tactic, this will be explained shortly.

Using the new interest tool from Cowrywise, you can visualize the future value of transactions you consider as misspending. That way, you get to have a clear insight that can guide you on how much you should save so as to improve the success rate of future plans. After this, an automated savings plan on Cowrywise is definitely the next step — you agree with this right?

Visualizing the Future Costs

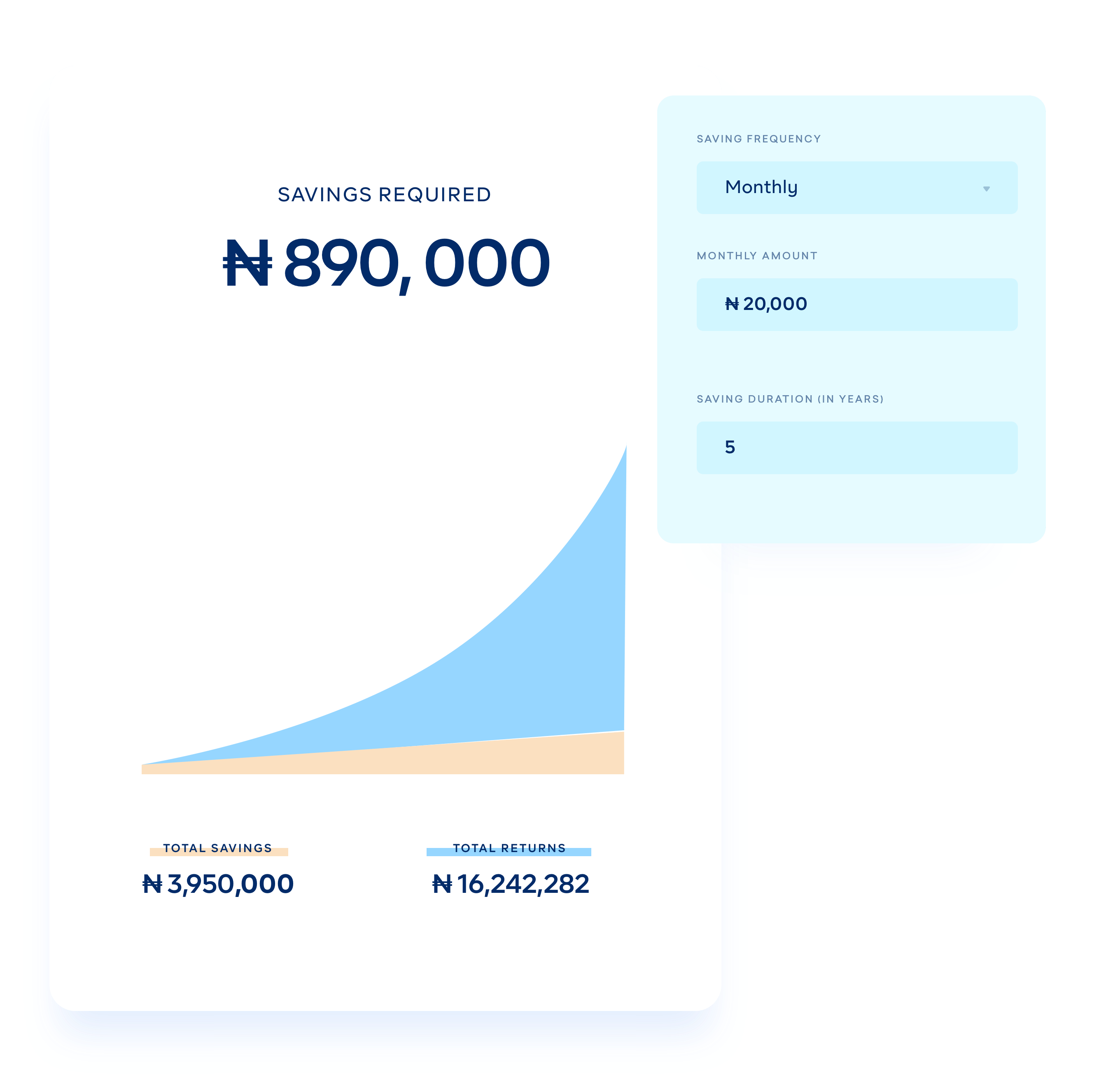

So, let us explain how this works. Write down the amount you misspend regularly over a certain period; for example, NGN20,000 monthly.

1. Select the savings frequency as monthly, input NGN20,000 as the monthly amount

2. Select a preferred saving duration — in our example, we used 10 years.

The findings? If you choose to save this amount, monthly, over 10 years with 10% per annum as interest, you will have a total of NGN3,610,000; this is the equivalent of the amount you will lose if you keep on with this misspending choice.

Do you feel you are misspending? You should try out the tool here to check out how much your Jide is costing Amaka, and then go on to set a savings plan built around that. With our lock-up feature, the commitment device for discipline is set up for you at no cost. Fair deal right?

RELATED:

I do not totally agree with you. Retirement is not all about financial freedom. There are aspects of retirement which are non financial and if not properly planned or taken off, irrespective of your income status, you will still live a very unhappy later life.

You have a great point. I love it!