“How much of my income should go to savings and investments?”

We all love the beautiful sound of SMS alerts at the end of the month. However, how much of that beauty do we keep for ourselves? In other words, how are you spreading the bread (your income)?

Month after month, we receive these notifications from our banks that indicate our salaries have been paid or we have earned some income. As soon as we receive this alert, our mind starts to wonder about all the mounting bills we need to pay, all the things we’d love to buy: Aso-Ebi, new generator, changing car tyres, calling the plumber, sending money home, that dream vacation to Kenya Safari. The list is endless.

For the financially conscious, an additional question often added to the list is how much should I save and invest this month? Periodic savings should be a monthly obligation just as paying your electricity bills or fuelling your car. Periodic savings and investments are the fuel for our financial future.

One of the key principles of personal finance is paying yourself first i.e saving first before spending on anything else. In fact, this is a time-tested principle and it applies whether you earn N50,000 or N950,000 per month. How much you decide to save and invest depends on a lot of factors which include your age, family size, income level, overall expense patterns and financial freedom goal.

Taking all these into consideration, a monthly savings of around 20% is good for young income earners. Why 20%? This follows the 50:20:30 personal finance rule of thumb. While this is not a one-cap-fits-all rule, it gives a baseline for cultivating a disciplined financial lifestyle.

The 50:20:30 finance rule

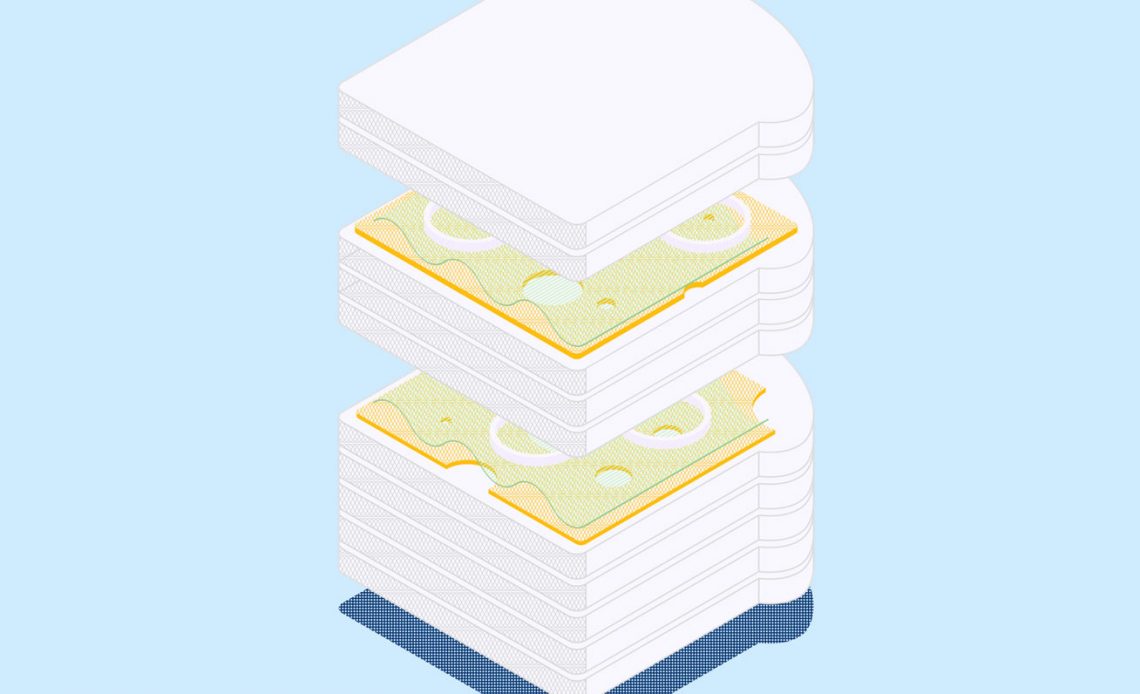

The 50:20:30 finance rule categorizes your budget into three buckets.

1. Necessity Bucket

The first 50% is the “necessity bucket”. This suggests that 50% of your monthly income should be budgeted for necessities such as food, shelter, clothing, and transportation; basically, things you can’t do without. Do you remember Maslow’s hierarchy of needs? If you spend more than 50% of your monthly take-home pay on the combination of the above, your personal financial budget is seen as suboptimal.

2. Financial Priority Bucket

The second 20% is the “financial priority bucket”. This suggests that 20% of your monthly take-home pay should be dedicated to long-term saving and paying down your debt if you have one.

3. Lifestyle Choices Bucket

The third 30% is the “lifestyle choices bucket”. This suggests you spend not more than 30% of your income on consuming items like entertainment, vacation, gym, cell phone recharge, and cable TV. Remember, most of these items are good-to-haves, not must-haves. You can get by your life without them; yes maybe with less glamour.

Hence, having a long-term saving plan of 20% minimum will give you the most balance between meeting your current obligations and achieving financial independence at the earliest possible time.

For middle-aged people with higher incomes, increasing this percentage to around 30% might be ideal, as the retirement period beckons.

However, do note that these are not hard rules. One can be flexible on a month-by-month basis, to cater for other unforeseen obligations. The most important thing in all of this is the discipline to save consistently.

Saving and investing to achieve financial freedom at the earliest time depends largely on the type of lifestyle you keep.

It is important to note that lifestyle inflation is difficult to reverse. It has a ratchet effect. This is what economists call the “relative income hypothesis”.

In simple language, when income falls, most people do not reduce their consumption proportionately to match the fall in income. People try to protect their living standards either by consuming their past savings or wealth or by borrowing.

All these come at a cost. Don’t always see money as a means to buy stuff; rather money should be seen as a means to buy financial freedom.

If you have used our online financial freedom model, you’ll quickly realize that the more of your income you save and invest, and the more the returns you get on your savings and/or investment, the quicker you can achieve financial freedom.

If you’d love to set up automated saving every month, sign up now on Cowrywise, create a saving plan and choose your saving preferences. We automatically handle periodic savings and investments for you, with attractive rewards.

RELATED

I have been saved times without number from my 20% savings on my salary earned and this I enjoyed using cowrywise application.

I simply want to applaud the initiatives behind cowrywise, and God bless the day I downloaded this app, seamless transactions and activities, this is a one stop shop for investors and planners alike.

Oluwadamilare Akinola.

(Dee3concepts Travels)

A+ for financial literacy.

Thank you Cowrywise!

🙌🏽

So happy to have you on board 🎉

I love saving with cowry wise. I have no regret… i have also learnt some things on their blogs concerning savings and investment

So glad to hear that, Blessing. Thanks!

Yayyy 🎉

I’m a student. Although there are other saving app buh i love cowrywise moreee… So straightforward

Thanks Omowunmi! 👏🏽

💙

As a student who uses both PiggyVest and Cowrywise, I prefer Cowrywise because it is waaayy simpler. And has more options.

Always teaching its users something. Thank you!

Thank you, Omolola.

Among all other sites and companies, I have been investing I still choose cowrywise as the best . Because,its simple, straightforward, and attend to their customers,thanks to cowrywise we are still looking up to you,

for more development.

I love CowryWise for their regular financial education

I love cowrywise

And introduced it to my friends

Great initiative from Cowrywise

Now i would love to ask where the 10% tithe comes to play in

Well, you get to play around with the percentages when it comes to the 50-20-30 rule. I include my tithe by lowering my necessities to 40%, and also included black tax @ 9%. Just make sure all your categories add up to 100% and adjust where only necessary.

Specially want to thank OPE he’s/she’s been great! Thank you for all the financial advices!

Overall best in financial literacy

I so much love cowrywise especially because they have a plan for Muslims who do not want interest on their savings and I also love their automation

I am always happy and always look forward to when cowrywise will remove my money

Them say debit alert no dey give person joy but whenever it’s from cowrywise am always happy

Please I need your advice on how to get debt free with my income how to spend and Dave to pay up the loans

I always look forward to Ope’s email because their is always something to learn.

I invitatied one thousand I did not see the money or income

Awesome! I loved this app because any time I logged in,it gives me future assurance.

Kudos to you guys (expecially ope) your quote motivated me a lot ❤️❤️ cowrywise

I wanna know about cowrywise investment…I only know about her savings

With little responsibilities, I stay with my parents , my main expenses are usually transport and internet subscription, I’m able to save up to save up to 50% of my salary

Cowry wise is the Best

I love cowrywise and I’ll introduce anyone to it.

I wish to know more about Cowrywise investment

I wish to know more about Cowrywise investment. I have interest in investing. How can I go about it

Cowrywise is very nice ,they do great job

Wow really loved this

A very nice article thanks

Thank you for yet another insightful post🙏🏿

I have no regrets since I joined cowrywise, since 4years ago, I love it and have introduced many people, God bless you all Amen

The first 200k I was able to save was because Cowrywise made it possible 💃🏻💃🏻.

I love the fact that once a saving plan is set you can never break it till it’s due date.

I remember rushing down to my app to withdraw my money just for me to realize it’s a one year saving plan😰🥺 I was heartbroken at then but guess what one year later I was immensely grateful that the money was safe locked without me accessing it.

I have a lot to learn from using this app as I journey to financial freedom, I haven’t officially utilized the investment options but I will definitely give it a good try someday.

Thank you Cowrywise for this awesome opportunity ❤️🔥

Thanks for always educating me ❤️🔥

Thank you cowrywise..Thank you Ope

Thanks so much my favourite Savings adviser, Ope, this 50-20-30 plan is an eye opener. I will put into use immediately so that I can be consistent in my savings. Thanks

Lovely write-up as usual, always happy to see cowrywise content