2022 was an eventful year. However, one particular event stood out – Russia invaded Ukraine. We had hoped that on a global scale, the COVID-19 pandemic would be the last event to rattle the world. Yet, the fight between these two countries caused global growth to slow, inflation to rise and financial markets to collapse. Nigeria was certainly not left out of the mess, as food and energy prices surged.

With a new year already underway, we highlight the key themes, both in the global economy and in Nigeria, we believe are crucial to understand for a successful investment journey in 2023. From elections to interest rate dynamics, we dig deep into the factors that will shape the performance of your investment portfolio and offer our insights as to how you can position profitably.

THEME 1

Global Economy: We will dance to the tune of global central banks

A bit of backstory

From 2020 to 2021, governments around the world tackled the spread of COVID-19 by shutting down activities, restricting movement, and implementing tough rules that hampered growth. In response to the slowdown, central banks cut interest rates and rolled out expansionary policies. At the end of that episode, a lot of money was in people’s hands such that aggregate demand increased, while companies produced more following the easing of restrictions.

Coming into 2022, global policymakers comfortably expected a post-Covid recovery. What they did not budget for, was a war between Russia and Ukraine. With Russia and Ukraine among the largest producers of key commodities like wheat, corn, and crude oil, the destruction, as well as the heavy sanctions imposed on Russia by the U.S., the E.U., and others, caused a severe shortage of many commodities. Remember we had mentioned that a lot of money was in people’s hands?

With too much money chasing a few goods, the result was inflation.

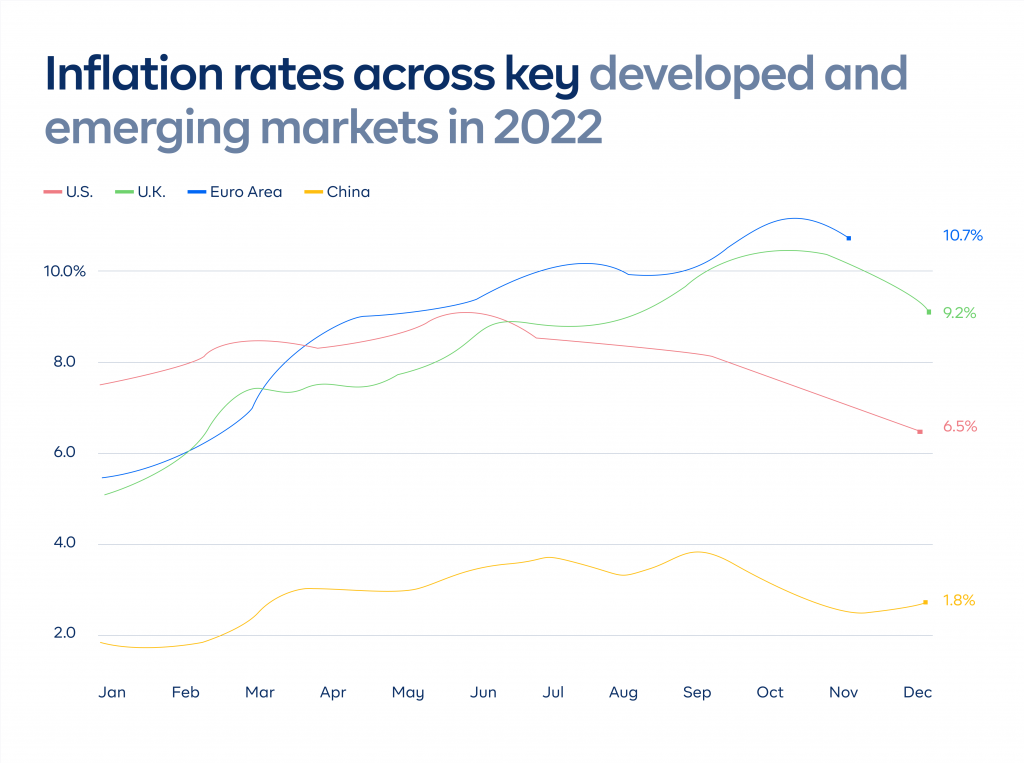

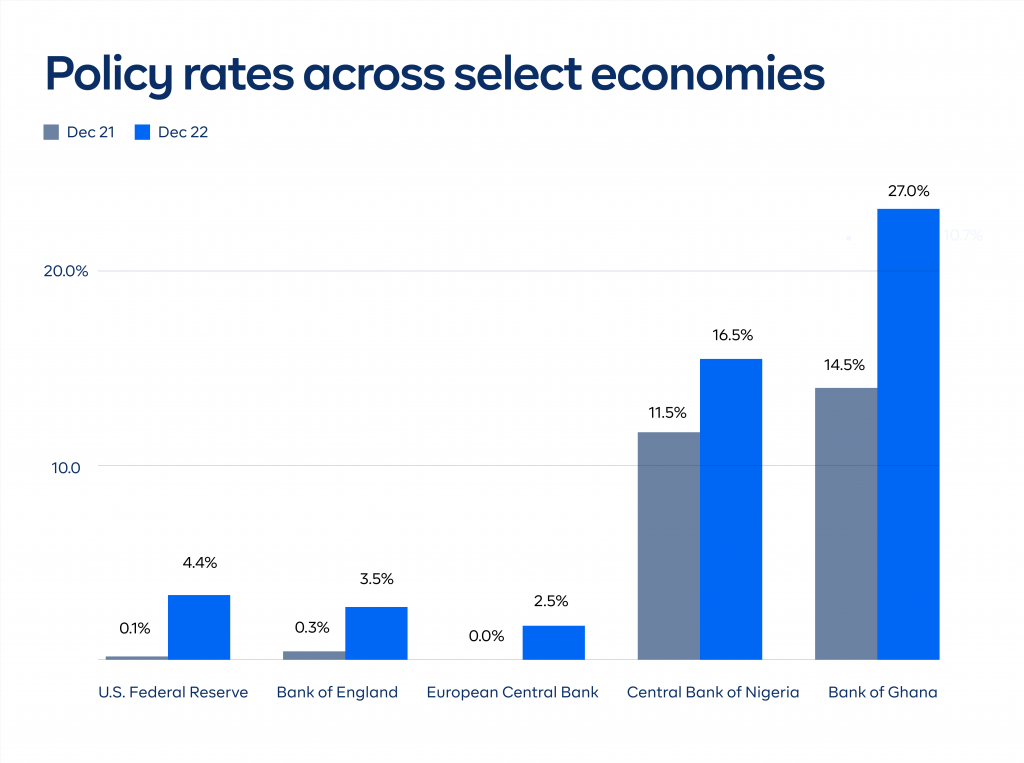

Inflation in the U.S. climbed aggressively, peaking at 9.06% in June 2022, the highest since 1981. Inflation in the U.K. and Euro Area also hit double digits, given their intricate links to Russia. When it was clear that inflation was not transitory, central banks swung into action by raising interest rates. The Federal Reserve raised rates seven times, bringing the midpoint of the federal funds rate to 4.375%, a 40-year high.

With interest rates higher in the U.S., the demand for the US dollar ballooned, causing currencies like the Ghana cedi (-65%), Kenyan shilling (-9%), South African rand (-6%), and Nigerian naira (Official: -7%, Parallel: -32%), to depreciate significantly. At one point, the value of the euro declined significantly and traded 1:1 with the dollar, for the first time in 20 years. U.S. stocks were also not spared from the destruction, as the S&P 500 fell 19% in 2022.

Emerging markets will gain from the slowdown in rate hikes

Thankfully, early signs are showing that inflation has either peaked or is declining in major advanced economies. Monthly inflation in the U.S. has been dropping consistently from the 9.06% peak in June 2022, to 6.5% in December. It is still above the Federal Reserve’s target of 2%, but the slowing trend will cause the Federal Reserve to reduce the magnitude and pace of future rate hikes, and stop them entirely towards H2 2023.

Emerging and Frontier markets are thus positioned for a good year, and we expect capital to flow back into these economies, specifically those with attractive fundamentals (like undervalued currencies, low debt profiles, and fiscal prudence). However, there are still risks to this outlook, should a global recession crystallise or further disruptions emanate from the war.

To that end, we believe as part of your investment journey, it is integral to have exposure to dollar-denominated securities issued by select countries in Africa, that could benefit from renewed global investor appetite. You can take advantage of the Eurobond funds we offer on Cowrywise, which have underlying assets such as FGN Eurobonds, Nigerian Corporate Eurobonds, and other SSA Eurobonds.

THEME 2

Elections: The outcome of the Presidential elections will be a major inflection point

Every four years, Nigerians gather to determine who will be the Commander-in-Chief of the Armed Forces. The outcome of the elections has the potential to drastically change the course of the Nigerian economy over the next 4 to 8 years. It is the biggest theme for us, as the decision affects future government policies, our macroeconomic state, foreign investor perception, and domestic financial markets.

Interestingly, our financial markets have shown a response to election uncertainties in the past. In 2015, the battle was between Muhammed Buhari and incumbent President Goodluck Jonathan. Investors did not like the uncertainty, and the equity market index showed this by dropping 14% YTD, up to the week before elections (23rd March). After a peaceful outcome and President Goodluck Jonathan conceding defeat, the market rallied 17% into the first week of April.

However, we note that foreign investor participation in our financial markets during those periods was above 65%. As such, foreign portfolio investors (FPIs) were the major drivers of outflows. Fortunately or unfortunately, depending on who you ask, foreign investor participation has since dwindled to roughly 15%, given the issues with our foreign exchange system. We do not expect to see extreme price movements during this period, as that is usually associated with hot money.

For the first time in a while, there are three strong contenders

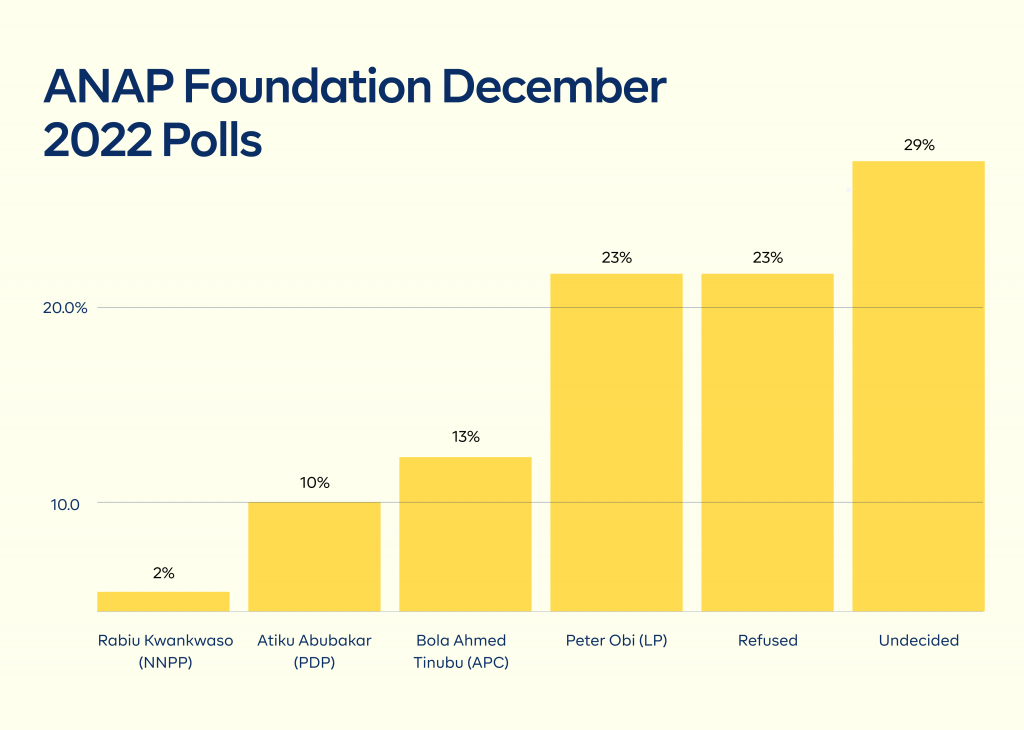

In this election, about 14 candidates are contesting for the presidency. We will focus on the major 3, based on their popularity. These include Atiku Abubakar of the People’s Democratic Party (PDP), Bola Ahmed Tinubu of the All Progressive Party (APC), and Peter Obi of the Labour Party (LP).

These three candidates have all held political offices and instituted key reforms in their capacities. Their proposed plans are also largely pro-growth: Bola Ahmed Tinubu has often mentioned improving food security, infrastructure, and federalism; Atiku Abubakar has emphasized privatization and breaking government monopolies; and Peter Obi wants to build a production-driven economy.

Polls cannot predict a clear front-runner

The most recent polls conducted by the ANAP Foundation, with a sample size of about 1,000 to 3,000 respondents, showed Peter Obi receiving the most votes. However, the polls were unable to predict one clear front-runner, given the magnitude of respondents who refused to name their candidate, and that was undecided.

The outcome is highly unpredictable

The outcome of the elections is too close to call, and having a clear outlook on policies at this time is extremely difficult. However, each of them has implemented some form of beneficial policy in the past. If their manifestos are anything to go by, any one of them can implement market-friendly policies. However, how they will deal with controversial issues like fuel subsidy removal and insecurity will be interesting to see.

Given the uncertainty, limit your risk by diversifying

Towards election day, a heightened degree of uncertainty, unrest, and agitation, will disrupt markets, particularly equities. We also expect financial markets to react to any significant deviation in fiscal and monetary policy by the new government. Therefore, our advice to investors during this period is to focus on managing risk by diversifying their positions.

A significant part of your allocation should be in conservative investments, such as money market mutual funds. With these funds yielding 10% to 14% p.a currently, they are a great option to ride out this period of uncertainty and allow you to rotate into other investments when there is clarity of where markets are headed post-elections.

THEME 3

Budget: The 2023 fiscal deficit is a catalyst for higher interest rates if CBN stays put

The Nigerian Government, similar to a corporation, generates revenue and incurs expenses. When the FGN does not have enough revenue to cover expenses, it borrows.

From January to November 2022, the FGN achieved 87% of its pro-rated 2022 revenue target. Unfortunately, oil revenues (-64%) and FGN independent revenues (-33%) were the sources of underperformance. Pipeline disruptions and oil theft crippled Nigeria’s production levels, limiting the gains from crude oil price increases.

Nigeria was only able to produce an average of 1.21 million barrels per day (mbpd), lower than 1.6 mbpd budgeted and 1.48 mbpd produced in 2021. A bright spot for the FGN was non-oil revenue, as revenue from corporate tax income exceeded the target by 36%, and value-added tax by 24%.

While 87% of budgeted revenues was achieved, we utilized 95% of total expenditure. In line with previous years, fewer funds were allocated to the much-needed capital expenditure (-60%), while the FGN incurred substantial debt servicing costs (+76%), majorly due to interest paid to the CBN via the ways and means advances. In summary, spending in 2022 was financed by domestic borrowing, and debt service engulfed 80% of our revenues.

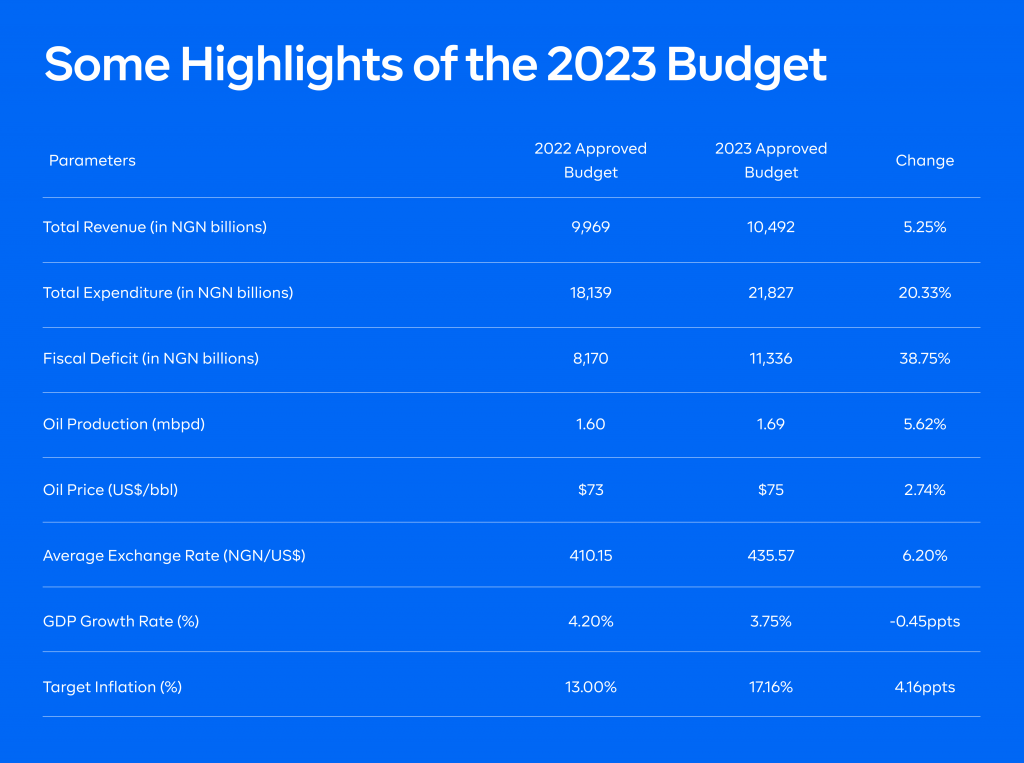

The 2023 budget still shows some unrealistic expectations

For 2023, Nigeria plans to spend NGN21.83trn, the highest in our history. This will be funded by a revenue of NGN10.49trn and a fiscal deficit of NGN11.34trn. To finance part of the deficit (about NGN8.8trn), we will borrow 80% domestically and 20% internationally. The balance will be funded by privatization proceeds and multilateral loans.

Our first challenge with this budget is that some projections are simply not achievable. The FGN is budgeting NGN2.3trn for oil revenues, higher than NGN2.2trn in 2022 when in actuality, all that was generated last year (to November) was NGN586bn.

The oil revenue projection is also based on a US$75 oil price and a production level of 1.69mbpd. While the oil price is achievable, our recent production performance shows that attaining 1.69mbpd is far-fetched, given the issues of pipeline vandalism, oil theft, and lower sector-wide investments. Progress from the new pipeline surveillance system could change our expectations, although slightly.

Another bone of contention is that the revenue target is premised on lower subsidy deductions. The budget only provides funding for subsidies until June 2023 worth NGN3.36trn, after which it is expected to be scrapped. Will a new administration be willing to bite the bullet? We believe a gradual or phased removal is achievable at best, as an outright removal will draw serious backlash.

How the FGN finances the deficit will be critical to markets

That being said, there is a clear indication that the FGN will borrow more than expected to supplement its spending plans. Preference will be for local borrowing, given the higher risk premiums in international markets. However, how the government chooses to finance the deficit, whether from public debt markets or the CBN, is critical.

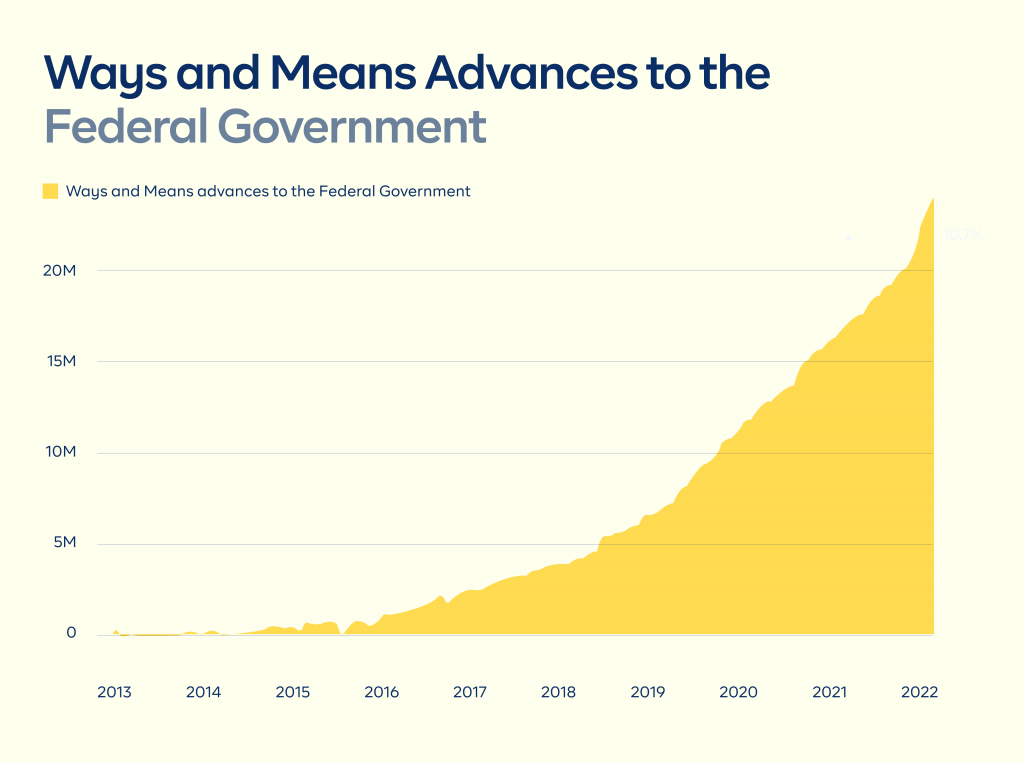

It is not unusual for the CBN to lend to the Federal Government. In fact, the CBN Act permits it, with the rule that the central bank cannot lend more than 5% of the FGN’s previous year’s retained revenue. Using this principle, the maximum amount the CBN was allowed to lend the FGN in 2022 was NGN305bn.

Yet, as of October 2022, the CBN had advanced a total sum of NGN6.3trn to the FGN, about 103% of 2021 revenues, a clear breach of the rules. This was even more than what was obtained from the public debt markets (NGN5.9trn). To date, the Federal Government has borrowed a total of NGN 23trn from the CBN, larger than its domestic debt stock of NGN21trn.

What are the consequences of this?

If the FGN continues to prefer borrowing from the CBN in 2023, yields in the domestic fixed-income market will not rise as high as economic fundamentals imply. This is because FGN would not be under pressure to solicit funding from domestic investors, thus limiting the bargaining power of these investors.

However, we do not think this will be the case, given increased scrutiny from international organizations like the World Bank, which has advised the CBN repeatedly to stop lending to the FGN. As a result, we believe the FGN will seek the bulk of its funding from public debt markets, putting the power in the hands of investors and will cause interest rates to rise. Already, the recently released FGN bond auction calendar for Q1 2023 shows that the FGN plans to borrow between NGN80-100bn for each of 4 different maturities, compared to NGN70-80bn in Q1 2022.

THEME 4

Interest rate dynamics and liquidity: Lower liquidity in H2 2023 will give way to higher interest rates

To fight inflation, the CBN hiked its monetary policy rate by 500bps in 2022, to 16.5%. If Nigeria had a strong transmission mechanism of monetary policy in place, interest rates across the economy should hover around the MPR, and inflation, albeit mostly influenced by structural challenges, should be responding accordingly. However, you will find that in Nigeria, as at the time of writing: MPR is at 16.5% while inflation is at 21.3%, the one-year treasury bill is yielding 6.2%, the 10-year FGN bond is yielding 13.5%, and the overnight rate is at 9.5%. Clearly, there is a disconnect between all these interest rates.

We have been able to find out one key factor that affects the interest rate market in unison and also market behaviour. That factor is financial system liquidity, otherwise known as the cash balances sitting in all deposit money banks in Nigeria.

System liquidity is affected by the forces of demand and supply: 1) Demand for liquidity, and 2) Supply of liquidity. These two factors work together to determine how interest rates move in Nigeria.

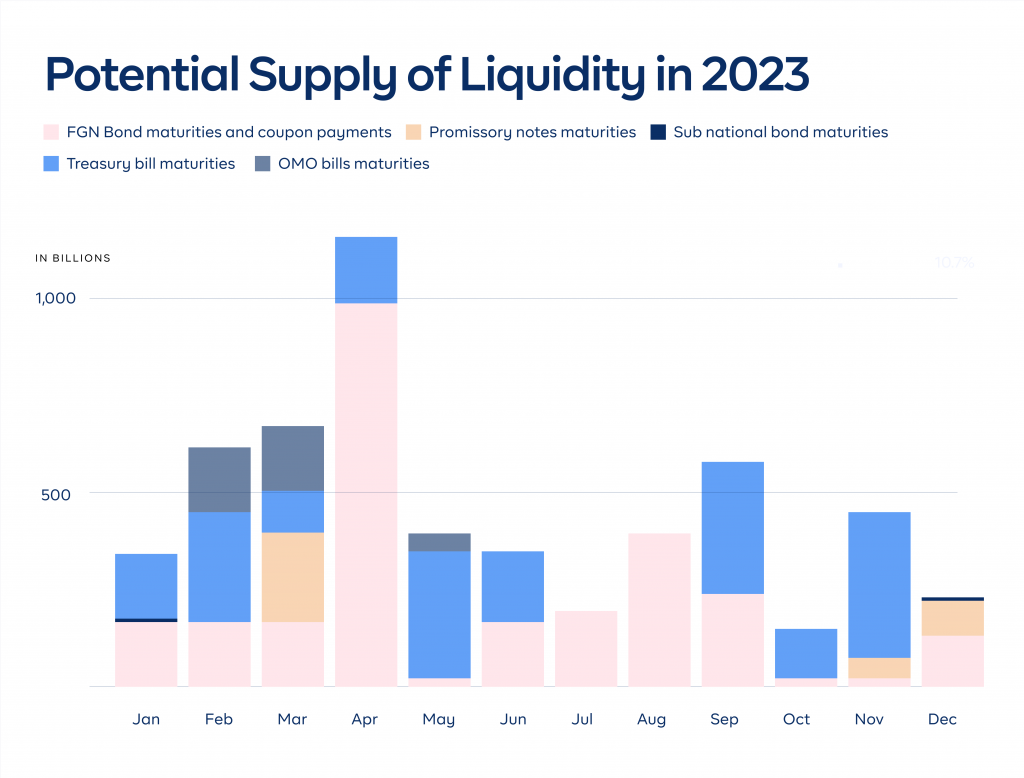

Supply of liquidity is driven by cash inflows from maturing bonds, maturing treasury bills, maturing FX swaps, and distributions made by the Federation Account Allocation Committee. Investment companies like Asset Managers and Pension Fund Administrators, sit on the supply side. Demand for liquidity is driven by debt funding requirements of the Federal Government (majorly responsible) and Corporate institutions. If supply outweighs demand, interest rates will decline, and if demand outweighs supply, interest rates will rise.

So given the liquidity conditions, what will happen to interest rates?

From our analysis of the supply of liquidity, Q1 2023 is a very liquid period, given the large volume of bond and treasury bill maturities. The Debt Management Office (DMO) will also try to take advantage of this, and front load borrowing plans in Q1 to enable it to offer lower interest rates. Therefore, we expect interest rates to remain low this quarter, at most the end of April. Liquidity will thin out in H2 2023, and thus we expect interest rates to rise as a response to the tight market conditions, while the DMO continues to borrow.

As an investor, money market funds and bond funds are a great way to position

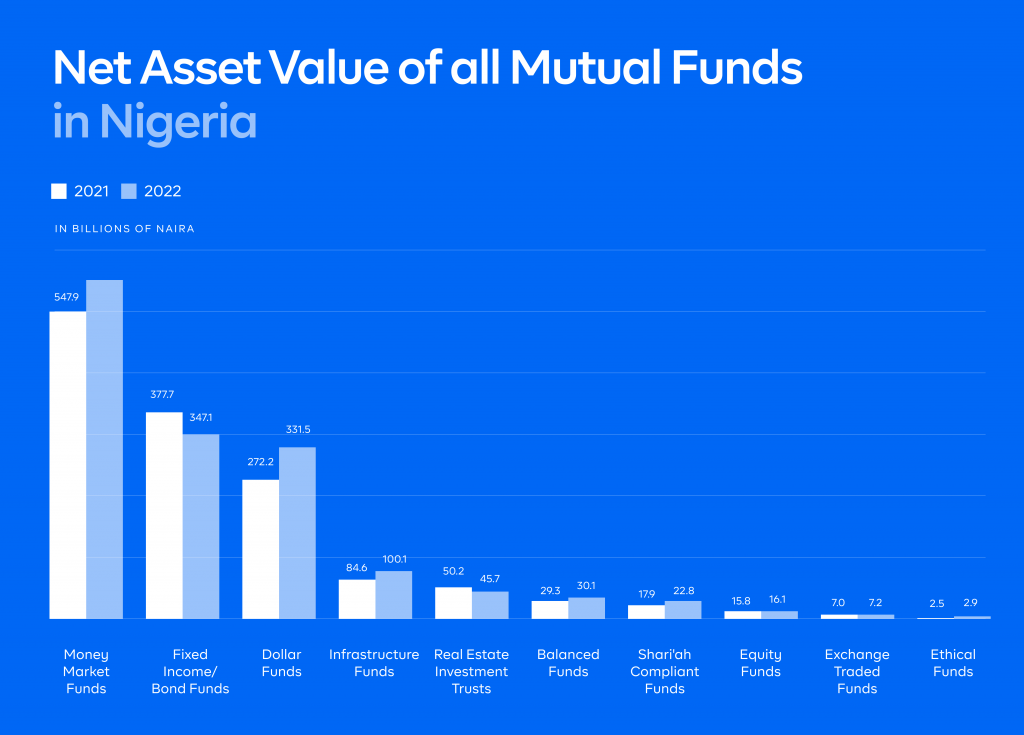

Mutual funds have become an important way for retail investors to key into markets they previously did not have access to. We believe money market mutual funds and bond mutual funds are a great way to get access to professional management, as these funds are offered by SEC-regulated asset managers with a deeper knowledge of fixed-income markets and interest rate expectations. You can have exposure to these types of funds, by purchasing units of them on Cowrywise.

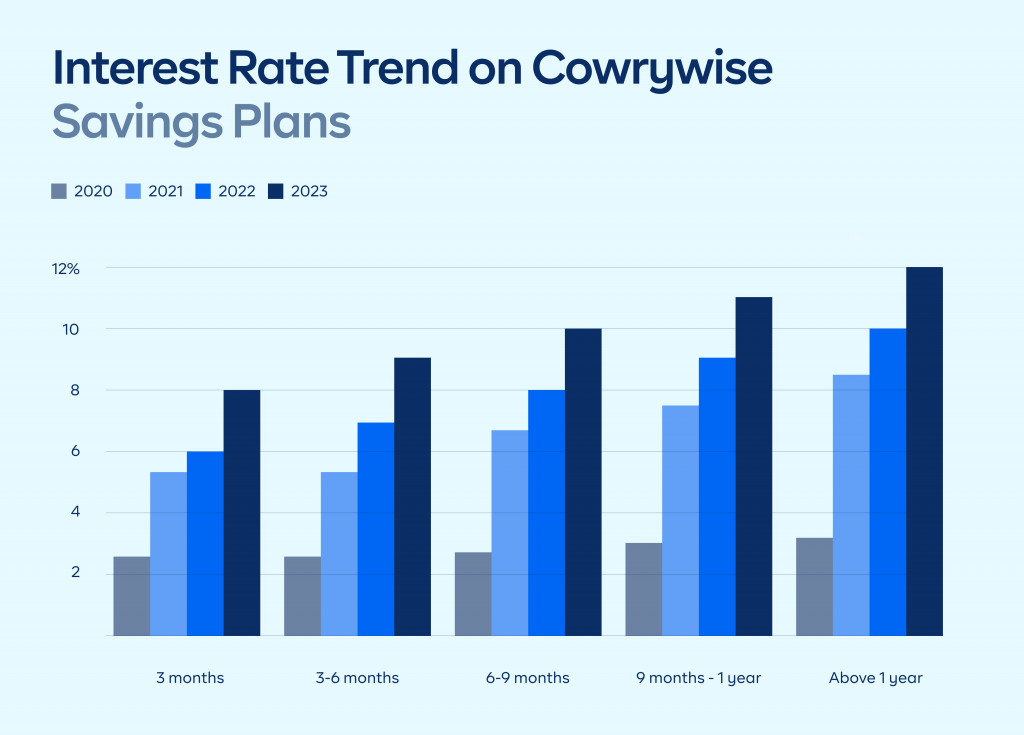

In fact, our savings plans are highly sensitive to interest rate changes and constantly reflect current market realities, and can thus position you for an increase in interest rates.

THEME 5

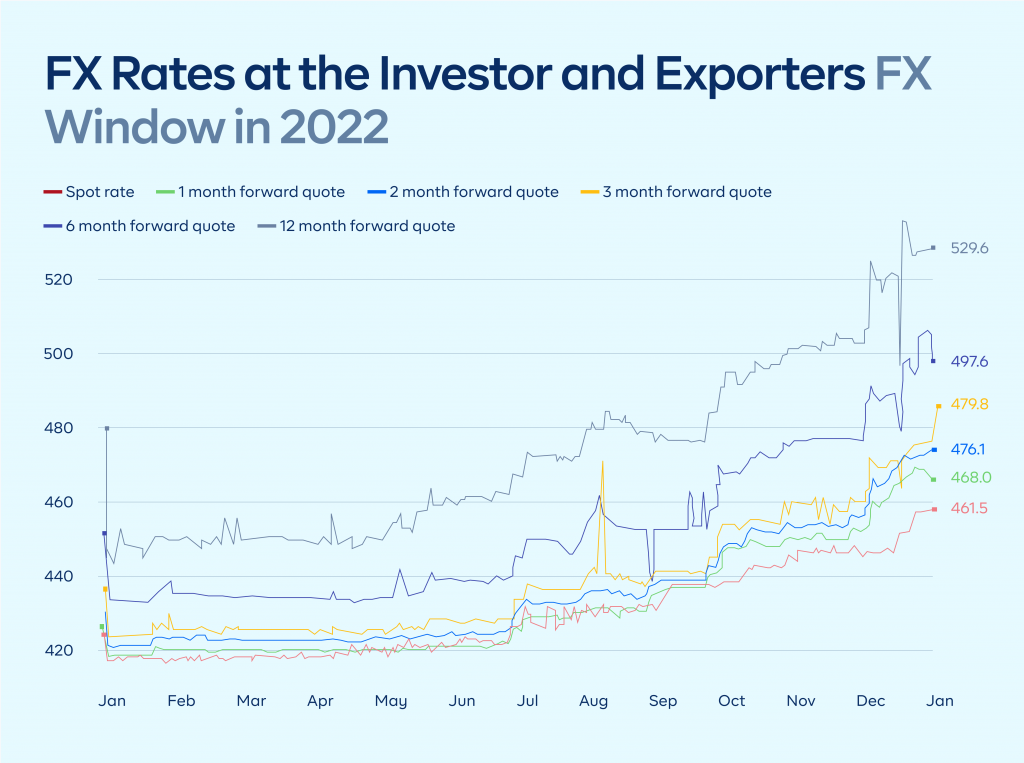

FX: Further devaluation is expected at the official FX window

We cannot close this report, without giving our thoughts on the naira to dollar exchange rate. 2022 was by all accounts, a bad year for the naira, which lost 30% of its value at the parallel market to NGN750/US$, and 7% at the official market to NGN445/US. We also closed 2022 with a lower level of foreign exchange reserves, at US$37.1bn compared to US$40.5bn at the end of 2021.

We would have expected that, with oil prices rising as high as US$123/bbl in 2022, the naira should have been supported strongly by booming FX reserves, but we would have been wrong.

A few reasons are to blame for the naira’s predicament

- Nigeria’s lower oil production translated to lower oil export earnings, which is the most significant contributor to our FX reserves.

- Non-oil FX sources remained insignificant in their contribution, pushing the CBN to launch policies such as the RT 200 FX rebate scheme.

- Large subsidy payments continued to be made, increasing the country’s import bill and putting pressure on FX reserves.

- Capital inflows from foreign investors dwindled, given the confusion with our multiple exchange rate systems, FX repatriation issues, and rising interest rates in the U.S.

- Amidst all of these, the CBN continued intervening in the official FX markets, further depleting Nigeria’s stock of foreign currency.

The parallel market was affected by the same factors above. However, the value of the naira was further worsened by news of the redesign policy.

In 2023, we strongly believe the naira will be devalued at the official market to reflect current market realities, as the CBN’s “managed” way of supporting the currency is not sustainable. Interestingly, the current exchange rate on one-year non-deliverable forwards is NGN525.65/US$, which shows that the market is still pricing in a devaluation.

In the parallel market, we expect electioneering activities to cause the exchange rate to remain high. However, we believe the naira in the parallel market is highly undervalued, and we expect a naira appreciation in that market towards the latter part of the year.

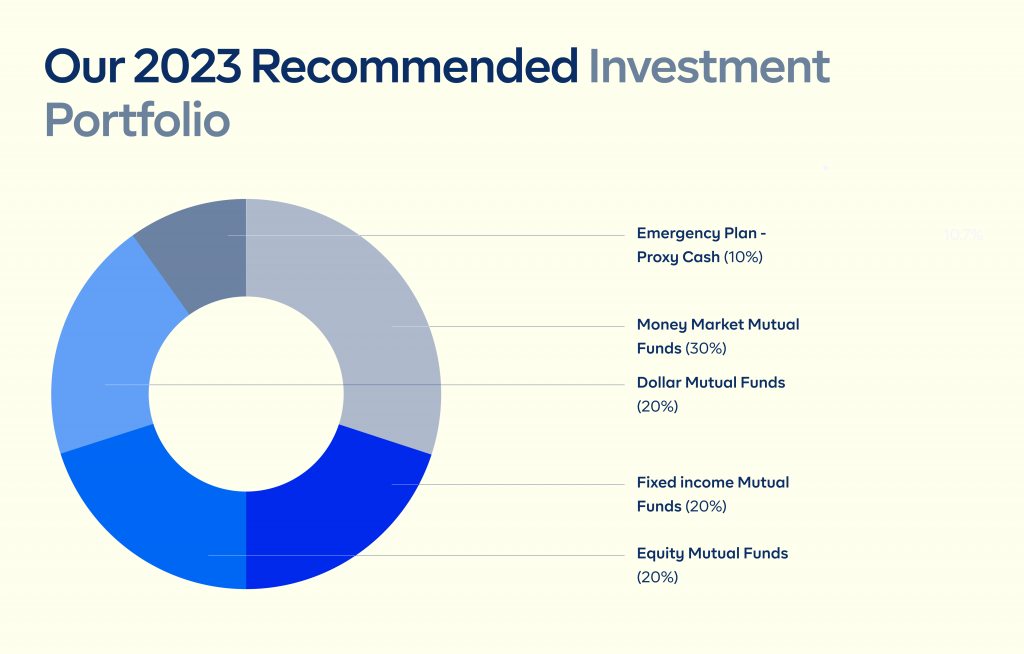

Final words: In 2023, diversification is key

When all is said and done, 2023 carries a lot of risks and uncertainty: unpredictable election outcomes, unanticipated policy changes, and a possible global recession. We believe the tips to a successful investment strategy this year are to diversify your investments, manage risks, and not chase returns. As part of our commitment to democratize the everyday African’s access to credible investments, our strategy has been to offer several regulated investment opportunities for our users, across multiple asset classes. As such, you can build a well-diversified investment portfolio for 2023 directly on Cowrywise, and actively monitor your wealth-building journey.

Aside from taking into consideration the global and local macroeconomic dynamics, we infused the persona of our users into developing our recommended portfolio. Given the demographic and economic features we considered, it is suitable for Gen Zs or millennials, NGN salary earners, car owners or Bolt regulars, a landlord or a tenant. The beauty of using Cowrywise is that you can easily factor in your own investment goals and investment horizon, into your asset allocation. For example, if your investment portfolio is to fund your schooling in 3 months, you can easily allocate more of your capital to liquid assets like money market funds or Eurobond funds if you are paying your fees in USD.

Below is our recommended portfolio:

We favour a higher allocation to money market funds (30%), given their high yields and low-risk profile. Second for us is bond funds (20%), which are important for regular income generation and will do well when rates decline in H2 2023. Then, our next preference is for dollar mutual funds (20%), given their ability to preserve your wealth and protect you from further possible naira devaluation. We also allocate 20% to equity mutual funds, for our users to have exposure to dividend-paying stocks and stocks with solid fundamentals, which can still do well in an election year. Finally, we allocate 10% to emergency funds, to take care of your emergency/liquidity needs, without needing to liquidate your investment positions.

Happy investing in 2023!

Need a copy? Get the report here. 👈

RELATED

Cowrywise is now the largest aggregator of mutual funds in Nigeria