In December 2022, Argentina won the coveted World Cup trophy, following an epic final showdown against 2018 champions, France, at the Lusail Stadium in Qatar.

It was a truly monumental match, quite possibly the greatest World Cup final match of all time, triggered by the dynamic duo of Messi and Mbappe, with the Argentine, finally able to cross off a World Cup victory from his vision board. Between both teams, there were a total of 12 goals, (6 goals during the match itself, and an additional 6 goals during the penalty shootout), amounting to 12 opportunities for users to save or invest.

But, what does the World Cup, or the world of football have in common with building wealth?

The future of wealth management in a digital world

The dynamics of finance and wealth management have undoubtedly evolved rapidly over the last few years, driven by advancements in technology, increasing access to the internet, smartphone penetration, and the entrance of fintech startups.

With the traditional model(s) upended, fintechs launched into the market with one purpose; to disrupt the existing financial framework, thereby simplifying, decentralizing, and changing how we view and interact with money. And it’s not hard to see why startups are leading this disruption.

In Harvard Professor Clayton Christensen’s book, ‘The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail’, he makes a case for disruptive technologies (a term he coined in a 1995 article, ‘Disruptive technologies: Catching the Wave’) being a critical factor in a business’s survival and evolution, and attributes the failures of big, successful firms to a sheer unwillingness to innovate.

According to the business and managerial standards of the time, they did everything right. The problem was that the principles of prudent business management encouraged investing in sustaining technologies (which left them behind technologically), rather than investing in the sort of innovative and disruptive technologies that could put them ahead in the market.

“the only instances in which mainstream firms have successfully established a timely position in a disruptive technology were those in which the firms’ managers set up an autonomous organization charged with building a new and independent business around the disruptive technology . . . There is something about the way decisions get made in successful organizations that sows the seeds of eventual failure.”

Clayton Christensen

Simply put, size comes before a fall. Sometimes. The edge startups such as ours possess over larger, more traditional businesses is our nimble size (a disadvantage turned advantage), and ability to cut through the corporate bottlenecks and ‘shackles’ that stall big businesses from innovating, setting them up with an innate ability and propensity to innovate really quickly. And this is a major reason fintechs are fundamentally married to innovation and disruption.

At Cowrywise, one of our key imperatives and differentiation strategies is to embrace constant and consistent innovation by building new products, and optimizing existing ones for better future performance. One of such products is Triggers, which helps users save and invest doing the things they love (but more on this later).

Innovation is at the heart of everything we do, and we have embraced this path to stand out from the crowd.

In a nutshell, the future belongs to those who innovate on one hand and do so quickly, on the other. And we have the tools, infrastructure, technology, team, expertise, and know-how to do so.

What more does the future of wealth management offer, and who will lead the next revolution?

Embedded Finance 2.0

Fundamentally, embedded finance is the use of financial tools and services by a non-financial provider. Or simply put, it’s a way to position or integrate a financial product in a non-financial customer experience, journey, or platform. This allows the platform’s customers to take advantage of a value-added offering within the native customer journey.

The next time you pay for a ride on Uber with your card, pay for a product via a QR code, purchase a meal on Jumia food, or make a down payment for a product on an e-commerce platform (BNPL), you have embedded finance to thank. Tech giants like Google and Apple also want a piece of this market (currently worth billions of dollars) and have created features such as Apple and Google Pay, enabling users to make payments through their flagship products seamlessly.

The technology itself isn’t new and has so far been maximized across payments, lending, and banking sectors. Payments have been one of the first and most common use cases, and a substantial number of providers originate from the payments industry. The good thing is, it’s still evolving.

What makes the next evolution of embedded finance so thrilling is its ability to enable transactions on not just e-commerce platforms, or loyalty apps, and mobile games, but also on applications and digital interfaces that users interact with on a daily basis such as social networking apps like Twitter.

Twitter Tips, for example, is a payment service, which makes it possible for users to get tipped, either with cash or crypto on Twitter. And even beyond social payments, is the ability to embed finance deeper into the fabric of everyday activities.

Monzo, a fintech brand based in the U.K, uses a condition-based tool that triggers a service/action, once a stipulated condition is met; a tool they’ve adopted to help users meet their goals, financial or otherwise. The next step in the evolution of embedded finance, albeit, in a deeper form, will be driven by the innovative ability to connect finance to everyday life.

This brings us to the concept of IFTTT.

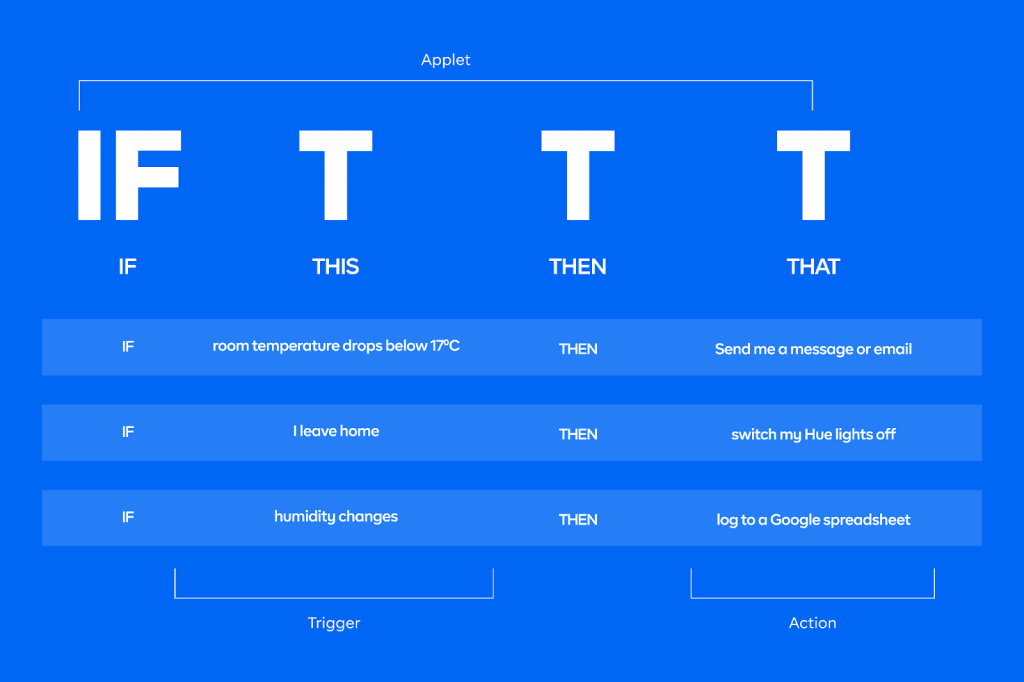

IF THIS THEN THAT – the easiest way to do more with your favourite apps

IFTTT is an incredibly powerful tool that can automate everything, yes, everything in your life. With IFTTT, the possibilities are endless. IFTTT derives its name from the programming conditional statement, “If This Then That” and is a software platform that connects apps, devices, and services from different developers, to trigger or automate web-based tasks, when a user-specific event or condition is met, using “If recipes”, now called applets.

Here are a couple of examples:

1) If you post an image on Instagram, save the file to Dropbox

2) If I star a message on Gmail, save it on notes

3) If a legislation is signed into law, send me a notification

4) If I miss a call, send the caller a text message

Beyond these applications, developers are finding various creative and ingenious ways to utilize the IFTTT service.

Using the core principles of IFTTT, we built a product that relies on a similar framework/applet, (‘save as you x’), to keep saving and investing simple, frequent, and seamless.

We call this product Triggers.

Triggers – an everyday approach to building wealth

Triggers by Cowrywise is a smart, revolutionary, and automated way to save and invest, and it’s the only such product that exists on this side of Africa.

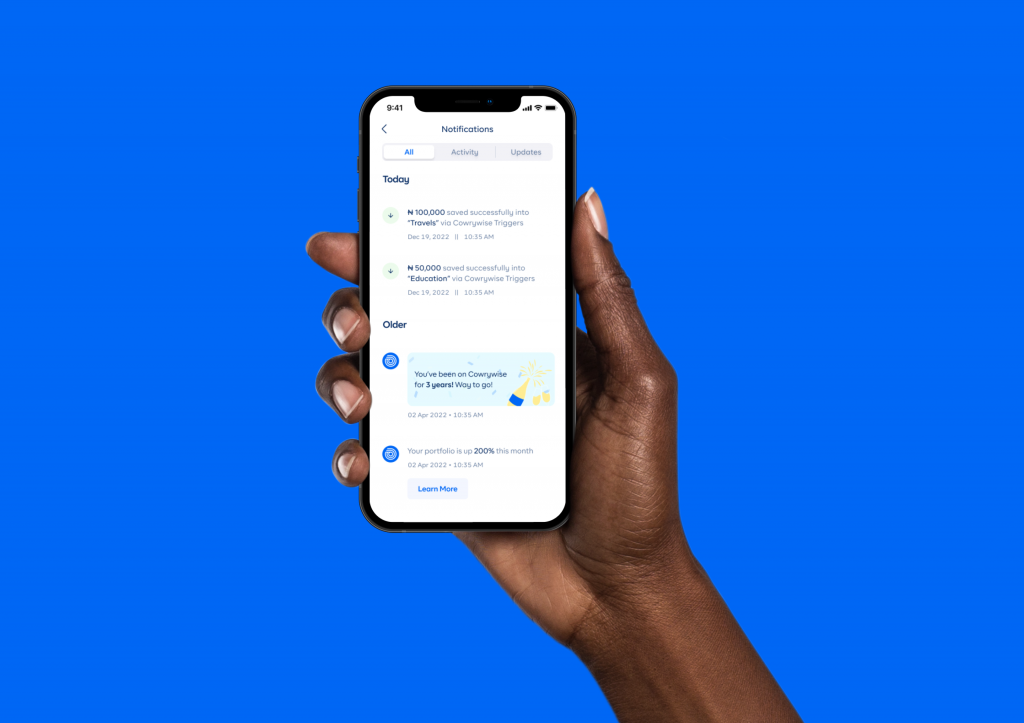

Currently, with Triggers, you can save/invest when you tweet, or when your football club scores a goal. As such, you can save every time Haaland lands a hat trick, or, when you’re passionately replying to a Twitter thread about politics, defending Machala, Wizkid FC, or 30 BG. Every time you take a predetermined action, you’ll be saving or investing, depending on the condition you select. And we are just scratching the surface!

Imagine if you could reward yourself for hitting the gym, or completing your sets on leg day. What if you could save when you finish your favourite series, or we invest on your behalf every time you make a purchase above a certain weekly threshold? What if you could put money aside for every Duolingo streak you make, or invest in dollars for every Tiktok video you upload? The ‘What ifs’ and the possibilities are truly endless, and we have unlocked a new way for users to reward themselves and build wealth while doing the things that matter the most at the same time.

Every time you take an action (x), we save or invest a predetermined amount on your behalf.

This will require a user to include funded debit card details – not to worry, we are SEC licensed and your details are safe. So, for example, if you set up ‘save as you tweet’ on Triggers, we will take N1,000 or your desired amount from your debit card, and place it in a pre-selected savings or investment plan.

This is how it works, and this is the future of embedded finance; a simple, automated way to build wealth and meet your financial goals by connecting finance with everyday tasks that you love. And this is why we launched Triggers.

The real social media currency – the case for Twitter and Football

Are you wasting your time on social media?

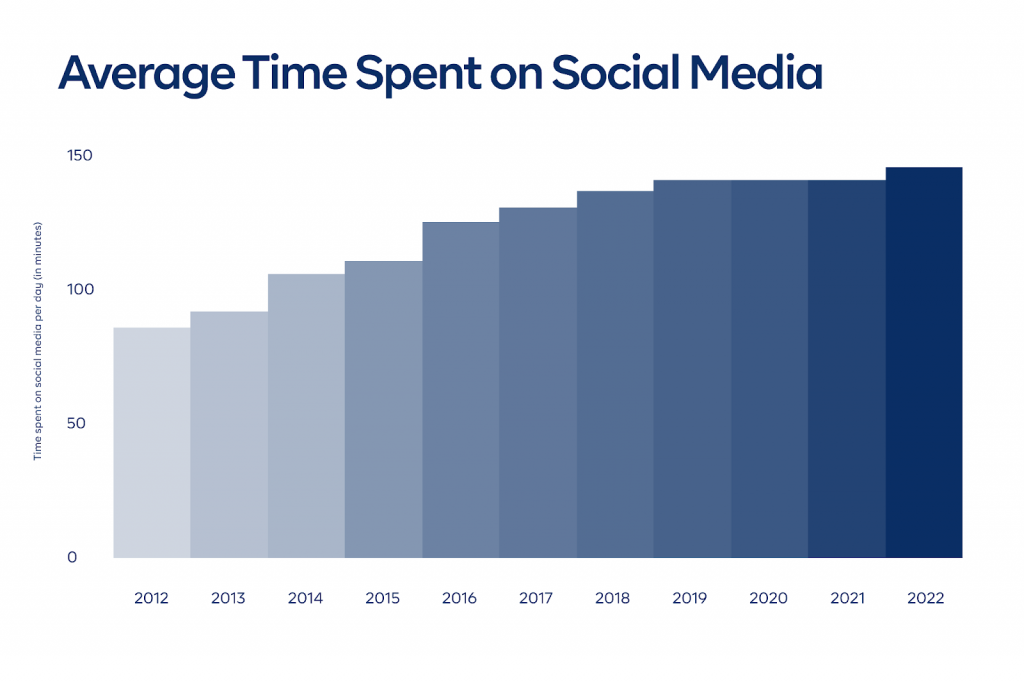

Undoubtedly, social media has become entrenched in everyday life; we technically can’t do without it. Whether it’s to connect with friends, and family, search, or find the latest news, trends, products, or brands, we spend a great amount of time online.

Recent data shows that young people spent an average of 2 hrs 27 mins a day in 2022, a two-minute increase from 2021 numbers, the highest recorded ever and the first increase in the last four years.

Over the years, several studies have shown the diverse effects of spending time on social media. Some are negative, such as the assumption that social media is a waste of time. It’s not unheard of, for administrative officials to point accusatory fingers at social media as the primary culprit of a degrading reading culture among students. Or parents who blame the same for their children’s academic failures or woes. Other effects tend to be positive, and to some degree, outweigh the negative.

Democratization and access to information, global exposure, financial knowledge, and more importantly, an opportunity to invest in your future while spending time on social media. That’s the irony. We have turned a supposedly time-consuming endeavour into a wealth-building engine, by building a tactful, innovative approach to turn the narrative of ‘wasting time’ on social media on its head, helping users maximize the time they spend on social media, in this case, Twitter.

Why Twitter? And why football?

We optimized the product for high-volume, high-impact activities, that could help users save and invest more often than usual. The average active user logs in and tweets at least once a day. In a typical football season, each team plays 38 matches, at an average of 2.6 goals per game, which gives a fairly rough idea of how much users can put aside by adopting Triggers.

But, first, let’s make a case for Twitter and football.

Tweeting to save

The key benefit of Triggers is that you save and invest doing the things you love. And netizens love to tweet. Twitter is the apex platform for sharing opinions, and there’s never a shortage of opinions to go around, on any topic, issue, or trend. Let’s put this in perspective.

There are 365 million Twitter users globally, with a total monetizable audience of 203 million, and collectively they make as many as 500 million tweets per day, (about 350,000 tweets per minute). If 5% of the total users adopted Triggers, assuming they each made only one tweet/day, with the condition that they save $1 for every tweet, collectively they would have saved as much as $18,250,000 by the end of the year.

The same principle applies to the average user here. An active user in Nigeria, who tweets twice or thrice a day, on the condition to save a minimum of 1,000 for every tweet, could save or invest between N730,000 and N1,095,000 by the end of the year.

The more tweets you make, the more you save/invest. A perfect recipe for steady financial growth. Zero stress. 100% automation. Build wealth one tweet at a time.

Football saves: Leveraging the Nigerian spirit of football

Nigerians have always had a special place in their hearts for football, with Forbes Africa calling it a “love affair”, that has blossomed over the years into an obsessive relationship. Nigerians love football, and even more so, foreign football leagues.

Every fan loves and supports their preferred clubs, usually, to the point of sheer irrationality – but, this is the nature of fandom. And it’s not hard to see why. Football is competitive. It’s a leveller. A unifier. A game that cuts across class, tribe and religion. It is a surefire way to get Nigerians together in the same room, and it’s a strategic approach to nation-building. And now wealth building.

There’s a slight difference between Football Triggers and Football Savings Goals. Read this article for more clarity.

Football Triggers helps users save or invest when their preferred club scores a goal. So, for every goal they score, Cowrywise saves a minimum of N1,000 on your behalf from your designated debit card.

Currently, there are 8 clubs on Football Triggers fans can choose from; Arsenal, Barcelona, Chelsea, Liverpool, Manchester United, Manchester City, PSG and Real Madrid. Typically, fans connect Triggers to their favourite club but are at liberty to connect Triggers to more than one club to increase how much they can save or invest per time. Back to the math.

If user A connects Triggers to his savings plan (4 clubs, with 2.6 goals on average per match across 38 matches, at N3,000 per goal), user A would have successfully saved N1,185,600 by the end of the season. If user B connects Triggers to her investment plan (6 clubs, 2.6 goals scored average, 38 matches, at N5,000 per goal), user B would have successfully invested N2,964,000. Coupled with the additional benefits of dividend payouts, capital appreciation, periodic returns, or compounding, Triggers is a fun, easy way for users to reward themselves for following their passion while building wealth doing the things they love.

This is the future of wealth management.

How we built Triggers – Concept and idea

It started in early 2020. The concept was simple – how to make users save money when certain actions happen outside the Cowrywise app. The first version of Triggers was built using IFTTT called “save as you x”.

This version had 2 major problems.

- It was heavily reliant on the IFTTT platform, hence users had to leave the app and set up an IFTTT account

- The user experience didn’t fit in well with what we had on the mobile and web apps.

This version never made it to the public and was only tested internally. The development was put on hold for more research to take place.

Fast-forward to 2021, the football season had just started and so the team created Saving circles for football fans to save money anytime their team scores, and then the idea came.

How Saving Goals worked

The SavingGoals service was built with Vanilla Nodejs – It’s a simple service and didn’t need any framework baggage, which influenced the choice. It fetches data from football APIs and then notifies the Core app what football circle to charge.

Every morning we fetch the list of football matches for the day and then the Saving Goals service registers and promptly schedules a background job to get the scores at the end of the match. We also built a nifty slack bot to notify us when this process takes place.

This was important because it was with this framework that Triggers was built, ensuring we didn’t have to rely on another automation platform.

Building the Triggers service

Using our learnings from Saving Goals, building the Triggers service seemed easier than ever – or so we thought. The engineering team settled to use Nestjs for this service after a vote. The next part was breaking down how this service was going to work.

We broke it down into simple parts.

- Trigger: An action that happens outside the platform e.g Chelsea scoring, User Tweeting, etc

- Source: A Source is an app that provides one or more triggers e.g Saving Goals as a source provides “Chelsea scoring a goal” as a trigger, Twitter service provides “Make a tweet” as a trigger

- Connection: A connection is a link between a user on Cowrywise and a Trigger i.e a user setting a trigger on a plan

- Hook: A notification that a trigger has happened

- Channel: Where the trigger event comes from or the medium with which it comes through

With this framework, it was easy to model any Trigger we were going to add.

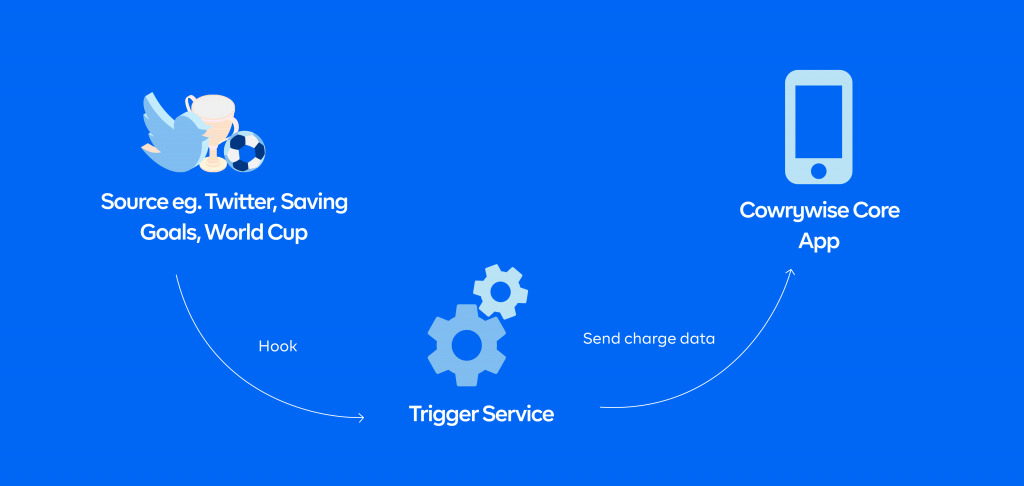

Each Source has to have its own service (independent of the Triggers service) which will notify triggers of events. Once the Triggers service receives a Hook (a notification that a trigger has happened), it checks for which users have a connection set up for that particular trigger and then notifies the core app via our internal fault-tolerant webhook service. The core app now has the charge data needed to make a saving/investment on behalf of the user.

Setting this up was the first part and maybe the most important part. The next part was determining how a user would set it up.

The Triggers Service exposed a few APIs to do the following:

- Fetch a list of sources

- Fetch a list of Triggers and channels (and filter by source)

- Create a connection

- Fetch a list of connections

To create a connection, the user selects a plan and follows through with the flow to input the amount they want to be charged for every event that happens. The great thing is, they never have to leave the app – even when they set up a Trigger like “save as you tweet” that requires them to link their Twitter account.

The best thing about the Trigger service is that we can always add new Triggers, without making an app update. So, look out for more Trigger services the next time you open the app.

Leveraging Nigeria’s love of football – World Cup Triggers

Back to the World Cup. The football leagues typically go on break during the World Cup. And to ensure that users continued to save and invest during that time, we optimized the existing Football Triggers infrastructure for the World Cup.

Users saved/invested supporting their preferred football teams or players; whenever a country or player scored a goal. As fans cheered for every goal scored and every match won, they had more reasons to celebrate.

Building wealth takes time and requires patience. What better way to do so than with the game you love?

And fans had a blast during the finals, as users who adopted the service and selected one or both teams on the service, saved or invested for every goal (12 goals in total) scored during the match.

Unfortunately, all good things must come to an end.

The World Cup is over, now what? The football leagues will be resuming, with the Premier League kicking off on Boxing Day, December 26, 2022. It’s not too late to connect Triggers to your savings or investment plans to keep building wealth before the end of the season in 2023.

What’s next for the future of wealth management?

Plans are already underway to include more sources in the coming months. Soon, users will be able to save or invest when they use Netflix, Tiktok, Instagram, Uber, or even when they hit the gym.

What sources would you like us to connect with next? Tell us in the comment section below.

The possibilities available will continue to expand. So long as fintechs continue to unlock innovative products and services, and embrace data-driven insights, to offer hyper-targeted solutions that fit the user’s lifestyle and financial journey.

This is the future of wealth management and our goal is to champion this cause.

Additional Sources

ALSO READ

Financial Inclusion in Nigeria

Survey on Personal Finance in Nigeria