How to create a budget:

- Create a budget spreadsheet or use a budgeting app

- List and calculate all your (net) income

- List and calculate estimated expenses

- Fill in your monthly expense

- Evaluate your spending habits

- Set goals that you can track

1. Create a budget spreadsheet or use a budgeting app

I’m tempted to type “duh” because this is an obvious step right? There’s no way to have a budget without actually creating “the place” where you’ll detail your income and expenses. Choose a tool that’s easy to use and accessible. Some people run from the very idea of spreadsheets, but a tool with rows and columns to arrange data is just fine. I’ll advise you not to use a pen and paper for this because the day it goes missing, you’ll have to start over. Better still, we have created a simple workbook you can use for your budgeting needs.

Click here to download the Budgeting Workbook.

2. List and calculate all your (net) income

If you’re a 9 to 5er, your salary is one income stream to take down. However, do not stop there. List EVERYWHERE you’ve made money from in the past few months – side business, monthly vex money from parents (assuming you’re a trust fund kid), etc. However, if you earn only from your salary, then that’s fine, state just that.

3. List and calculate estimated expenses

Your budget should include EVERYTHING you remember that you normally spend money on. Leave nothing out, not even what you spend N5 on (if there’s any such item available in this x3 economy.)

After making the list, put in an estimate of what you think you spend on each item. This is to determine the average monthly costs for each expense.

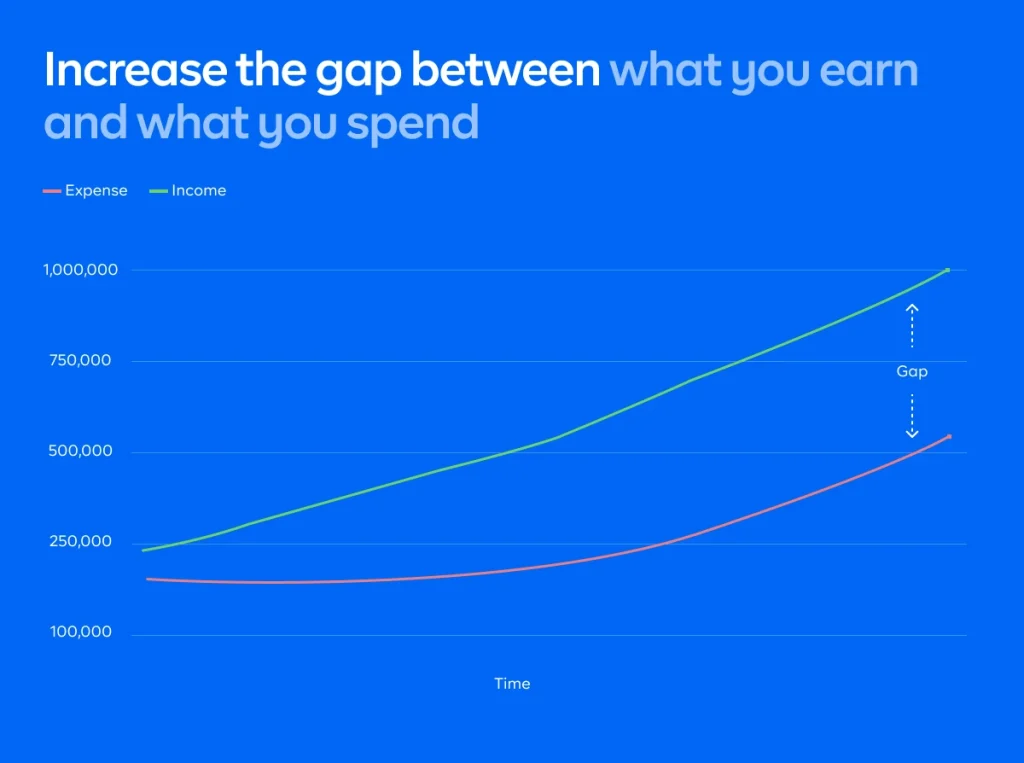

Calculate the difference between your income and expenditure

This is a crucial step in creating a budget – calculating the difference between your income and expenditure. If when you’re done, your expenses are way less than your income, then you’re at a good stop. When I created my first budget, my estimated expenses were higher than my income so I knew I had to adjust. Remember, you want to increase the gap between your expenses and your income. The wider the gap, the more funds you’ll have left to save or invest.

Separate your expenses into fixed and discretionary categories

Fixed expenses will include things like transportation, debt, feeding, rent, light bill, etc. These are essentials. Discretionary expenses will include things that are important to you but that are not as important as your fixed expenses. For example, this can include monthly movie dates, travel plans, etc and they can be delayed. However, delaying your feeding, debt repayment (if any), rent, or light bills will ultimately end in tears…

4. Fill in your monthly expense

This is different from the previous point where you estimate what you used to spend on an item. Here, you have to fill in every penny spent monthly in your budget. The table below is an example. You can download the Budgeting Workbook here.

| Expense | Amount (N) |

| Transportation to and fro the office | 25,000 |

| Feeding | 50,000 |

| Data subscription | 15,000 |

| Urgent 2K to younger bro | 2,000 |

| Total | 92,000 |

I’ve found that what works best is to fill this in daily, or at the latest early the next day. This is because there’s only so much the brain can take. Documenting this daily will ensure you don’t forget any item, which will in turn give you accurate numbers at the end of the week or month – depending on the timeframe you want to follow. Also, divide these expenses into cash and bank debits for even more accuracy.

5. Evaluate your spending habits

Now that you’re filling in your daily expenses, you need to understand that that’s only a means to an end. The end here is to improve your financial habits. After one week or one month, evaluate your budget and spending habits. What have you spent the most on? Why? Were there many impulse purchases on your expense list?

Evaluate! Evaluate! Evaluate! After this, you can then move on to the next and final step in budgeting.

6. Set goals that you can track

Now that you’ve evaluated your spending habits and rated yourself Excellent, Good, Average or Poor (does this remind you of Primary School?) You then need to decide on what to double down on and what to stop. Set specific goals and keep track of them.

For example, a goal of yours might be to reduce how much you spend on new clothes each month (if you spend a lot) and increase how much you give to causes that matter to you. In a few months, you can track if you’ve stuck to the goals you set after evaluating your spending habits.

What information do you need to create a budget?

- Income

- Black tax

- Debts

- Savings plans

- Assets/Investments

- Insurance

- Groceries

- Electricity bill

- Entertainment costs

- Eating out

- Transportation

- Travel

Why are budgets so important?

They help you to:

- Know how to manage your money effectively

- Gain clarity about what’s required for your financial plan

- Track if you’re sticking to your financial goals

- Adequately prepare for projects/plan for the future (If a close friend’s wedding is in 5 months, instead of waiting till then, you can begin budgeting and keeping aside a certain amount towards Aso-Ebi and wedding gifts. That way, you’ll not have to spend too much from your salary in the month of the wedding itself. You get?)

- Monitor your financial performance (Is it excellent, good, average, or poor?)

- Imbibe better money habits (and cut out bad ones like impulse buying)

- Organize your spending and reduce/eliminate unnecessary expenses

- Validate or invalidate your assumptions (For example, you might think you spend more on transportation than feeding, but creating and sticking to a budget will help confirm if that’s true)

Watch this video on how to create a budget

Download the workbook here

Easily organize your income and expenses on a single sheet and make your finances easier to understand at a glance. The workbook will help you make sense of your finances, and act as a guide on how to allocate your funds.

Yay! Thank you so much! ?

You should receive an email with your download link shortly

RELATED

How to Budget with an Unstable Income

How to financially plan for 2024

nice article for youngies looking to be billionaires in the nearest future.

Good afternoon Ma/Sir,I have issues starting my savings plan;after putting in my debit card information,the cowrywise app is requesting for bank authorisation for payment after I’ve received password from my bank

I love this. Thank u