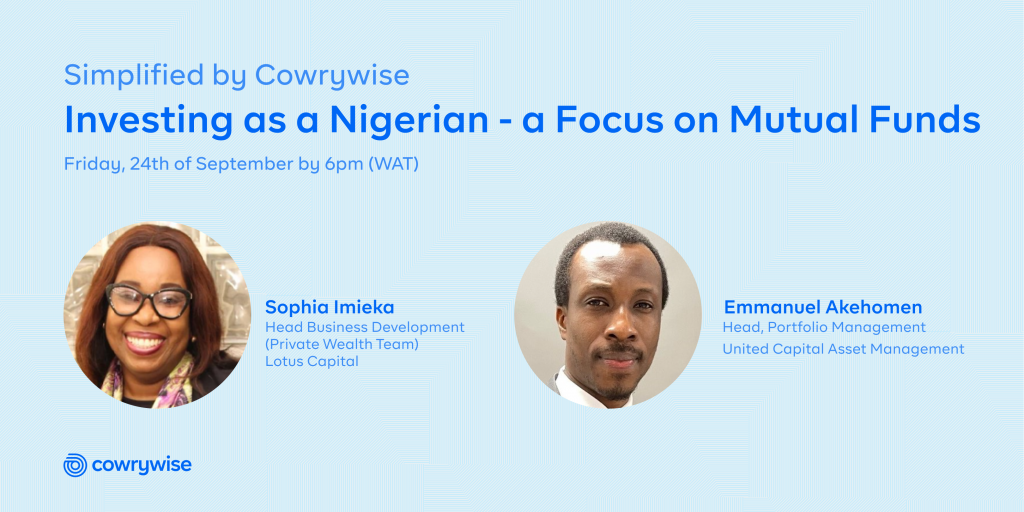

“Simplified by Cowrywise: Investing as a Nigeran – A Focus on Mutual Funds” was a virtual event that was held to break down the concept of Mutual Funds and the importance of investing in them to yield returns. We had two mutual fund experts join us – Sophia Imieka, the Head, Business Development (Private Wealth Team) at Lotus Capital and Emmanuel Akehomen, Head, Portfolio management at United Capital. They explained what mutual funds are, how to start investing in them, how they work and how they can help you generate wealth. This is a summary of the event. Dive in to read and remember to share your thoughts in the comment section.

Sophia Imieka’s Simple Definition of What Mutual Funds are ?

Sofia highlighted the fact that Nigerians are very communal and often share things with one another.

Whether it’s the time when a big meal is prepared and everyone in the family eats together or when students (you’ll get this if you schooled in certain types of Nigerian schools ?) soak Garri so it can swell enough for each person to have a considerable amount.

She asked, “have you ever had a feast in school where everyone contributes their share of food?” The food is then distributed for everyone to eat as a group. If you can relate to this, then you have an idea of what mutual funds are.

Mutual Funds are a Pool of Funds ?

Mutual funds are investments that are made up of a pool of funds. This pool of funds is put together and managed by fund managers who work to ensure the funds generate profit so that investors can earn returns/interests. The pool is made up of different types of assets (conservative funds – low-risk assets, balanced funds – a mix of low and high-risk assets and aggressive funds which are made up of mostly stocks which are high-risk assets).

It gives various retail investors the opportunity to come together and invest capital (money) in the pool of funds without having to worry about paperwork or think through how to ensure the funds do well. That’s the job of the fund manager. When profit is made, investors then earn returns according to how well the funds perform.

Investors are classified into two: Retail and Institutional. A retail investor is an individual or non-professional investor who buys and sells assets through an investment company. While institutional investors invest on other people’s behalf.

Advantage of Mutual Funds? ✅

Mutual funds give retail investors the opportunity to start investing early without having to totally understand the intricacies and complexities that happen behind the scenes when managing investments. Mutual funds are great for new investors who want to begin earning returns from different assets.

Different Types of Mutual Funds ?

There are different types of mutual funds that you can take advantage of:

- Equity Funds: These are funds that invest majorly in stocks of companies

- Fixed Income Funds: This fund can be divided into two categories (1) Money Market Funds: They invest majorly in instruments that mature after a short period of time, usually less than a year. E.g Treasury Bills (2) Bond Funds: They invest majorly in instruments that after a period of more than a year. E.g 3 years of FGN bond.

- Balanced Funds: These invest in a mix of assets (both low risk and high risk). E.g Halal Investment Fund

- Specialised Funds: They focus on specific industries. E.g infrastructure funds

Which Mutual Fund is Best for You? ?

How can you invest and be comfortable with your decisions? When it comes to investments, everyone’s needs and goals are different so these will help you make the best investment decisions:

- Risk Appetite: What is your risk appetite when investing? If you’re a risk taker, you should mostly invest in aggressive funds or balanced funds. If you’re risk averse, conservative funds are best for you. Take a risk assessment test to better understand what type of investor you are.??

- Tenure of investments: How long are you willing to leave your investments? Aggressive funds are great long-term investments while money market funds are great short-term options.

- Your age or life cycle: Are you too young or old to invest? Nope! Now is always a good time to start. However, if you’re between 0-40 years, you can invest more in aggressive or balanced funds while people older can invest in conservative funds.

Emmanuel Akehomenm on Why you Should Invest in Mutual Funds ?

Emmanuel shared the importance of putting your money to work through mutual fund investments asides from saving your money since each person’s goal should be to eventually earn good returns on every investment made.

Mutual funds in Nigeria have made amazing progress over the years so they’re a great choice, regardless of your risk appetite and what you can afford to invest.

10 years of mutual funds in Nigeria (2011-2020)

Here are a few reasons why you should start investing in them: ?

- Inflation management: Investments give you an edge over someone who’s not investing because you earn returns which can compensate for inflation.

- Experts manage the funds: Fund managers manage your money and ensure you earn returns on your investment portfolio.

- Affordable: “If your papa no be Dangote or Adeleke”, you can still invest in mutual funds. ?? It allows you to start with literally any amount.

- Diversification: Remember that mutual funds are a pool of different assets. When in invest in mutual funds, you’re diversifying your investment portfolio without buying your assets separately.

- Liquidity: You can easily convert your assets into cash whenever you need it.

- Good returns: The more you invest, the higher the returns you’ll get.

- Safety and transparency: Your funds are in safe hands. Cowrywise is licensed by the SEC (Securities and Exchange Commission) and you can view how your money is performing and keep track of every fund.

Conclusively… ??

You can start investing in mutual funds right now. On Cowrywise, all you need is a device connected to the internet and you can start building a global investment portfolio.

Ready to begin? Start here.

RELATED:

I was introduced by a friend of mine, but the problem is am still scrared. Though I have registered hope my money is save?

Yes, everything is fine. Just as the article shows, we are under strict regulation.

Please how will I know my balance and how to withdraw my money from cowrywise

Hi Bashirat, it’s easy.

Your Stash balance will show in the Stash tab on your homepage.

While all funds in any of your plans will show under each plan.

Good evening,I had being trying to continue with my registration but stock at the scan stage for the security of one’s account. Kindly help.

Thanks for the assurance ?

Hi, please i made savings today through my mobile app just like the way I usually do it, but it doesn’t reflect in the balance, so how else do i go about it?

Hi ?? Can you please confirm that it now reflects? If not, please reach out to us at support@cowrywise.com and we’d be happy to get that sorted for you.

Thanks man, my complaint has been resolved, Cowrywise is the best ?

???

Is cowrywise still legit

Good evening just wanna be sure if can trust cowrywise in savings money.. I hope I didn’t ask too much?

Pls can you show me your license number on SEC

Hello aside from saving

How can I invest on the app

Hi Ayo, we have a range of financial planning and investment products for you. Feel free to check out cowrywise.com/invest to see our range of investment products.

Hi, good afternoon my name is Peace is your company registered under SEC is it cowry investment securities LTD and cowry Assets management LTD as stated?

Why Cowrywise ask for my BVN and my credit card number,why not acct number..

Information told us not to expose our BVN to any person

it’s as nice as I thought so I think is best investing with cowrywise app

I will try and start saving with small amount

My issue with this is they are asking for my bvn which I’m in daunting to know the reason because it’s risky to share bvn to any online company just like that.

Pls can I know the reason cowrywise is asking for Bvn

I heard that all chinese banks will be close down soon, please hope cowrywise is not also among

I do not think that cowrywise is a Chinese bank Esther