Stanbic IBTC Asset Management Limited, the foremost mutual funds’ provider consistently blazing the trail amongst others, brokered a productive partnership with Cowrywise. We are super excited to announce that the Stanbic IBTC mutual funds are now live on the Cowrywise platform.

We aim to offer our customers an array of investment options tailored to their preferences, as we believe this is essential to winning investors. This partnership, thus, proves as a strategic enabler set to redefine investment offerings for investors. It also further endorses Cowrywise as the top aggregator of mutual funds in Nigeria.

“Our partnership with Stanbic IBTC is an avenue to reach a new market that can

be assured of capital preservation and maximum returns on investment. There is no better way to utilize resources towards a fruitful cooperation.”

— Yarmirama Ashama, Snr. Product Manager, Cowrywise.

Who is Stanbic IBTC Asset Management Limited?

Stanbic IBTC Asset Management Limited is the wholly-owned asset management subsidiary of Stanbic IBTC Holding Company Plc, affiliated with the biggest banking group in Africa, Standard Bank Group in South Africa. Beyond controlling 42% market share of collective investment schemes as an asset manager, they are a strong and recognised industry leader in stockbroking, pension management, custody and investment banking.

Licensed as a Portfolio Manager and Investment Adviser by the Securities & Exchange Commission (SEC) in Nigeria in 1997, Stanbic IBTC Asset Management Limited has consistently offered numerous investment services for over 20 years. These offerings range from traditional asset classes which include equities, fixed-income securities and mutual funds to alternative investment options such as unlisted equities and private equity opportunities.

Stanbic IBTC Asset Management Limited is the largest non-pension asset manager by AUM, number of mutual funds and the size of mutual funds as well. Currently, the fund manager records over ₦900billion Assets Under Management (AUM); the largest naira-based mutual fund and USD-denominated mutual fund in Nigeria with over ₦219b and $410m respectively.

Stanbic IBTC Asset Management Limited was recognised as the Best Managed Funds for Money Market during the Business Day Award in 2018, and also as the Best Mutual Funds Provider in Nigeria by the Global Banking & Finance Awards.

How do the Stanbic IBTC Mutual Funds Work?

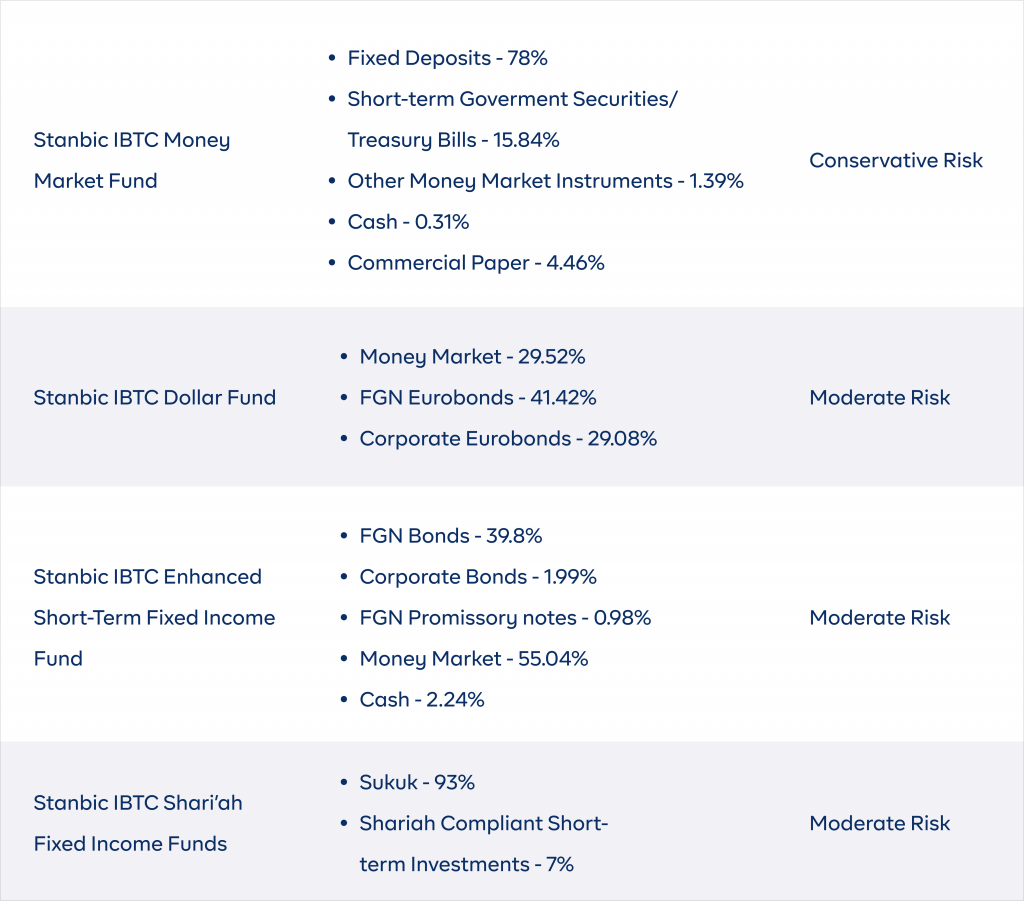

We have now listed four new mutual funds from Stanbic IBTC Asset Management to our fund listing on the Cowrywise app. The details of these funds are explained below:

Stanbic IBTC Money Market Fund

The Stanbic IBTC Money Market Fund aims to achieve both stable income generation and capital preservation by investing 100% of the portfolio assets in high-quality short-term securities like treasury bills, commercial papers, and fixed deposits with low risks for conservative investors.

This fund is particularly suitable for investors seeking a short-term investment horizon, safety and preservation of capital, regular stream of income, diversification and reduction of concentration risk.

Stanbic IBTC Dollar Fund

Stanbic IBTC Dollar Fund aims to provide currency diversification, income generation and stable growth in USD. It achieves this by investing in a mix of Eurobonds, short-term USD deposits and USD equities.

The Fund is targeted towards retail investors, High Net Worth Individuals (HNIs) and Africans in Diaspora, who wish to diversify their portfolio to include foreign currency investments.

Stanbic IBTC Enhanced Short-Term Fixed Income Fund

The Stanbic IBTC Enhanced Short-Term Fixed Income Fund aims to provide competitive yield, liquidity and safety through various investment options from short to medium-term securities. The fund targets investors with low-risk appetites seeking high returns and can invest for longer than 90 days.

It also suits investors who prefer to invest in treasury bills directly for more competitive returns than traditional funds.

Stanbic IBTC Shari’ah Fixed Income Fund

The Stanbic IBTC Shari’ah Fixed Income Fund aims to provide ethically-minded investors with liquidity and competitive returns by investing in a mix of Sukuk Bonds and short-term shari’ah-compliant investments.

It targets investors with a medium to long-term investment horizon and belief in shariah principles that are seeking higher returns than typical Shariah fixed deposits.

Want to get a slice of mutual funds from Stanbic IBTC? Do these:

- Get the updated Cowrywise app here

- Create your account or sign in to your existing account.

- Tap “Invest”

- Then choose your preferred mutual funds option from Stanbic IBTC.

TRENDING

Cowrywise is now the largest aggregator of mutual funds in Nigeria