Payment is a key action performed on the app for customers to save and invest seamlessly, and we have optimized how you transact on the app with Smart Payment. Before now, debit cards were the only payment option for recurring payments, which presented several issues, like:

- Accessibility problems: From lost or missing cards to expired and even unfunded cards, debit cards have their fair share of limitations. The snowball effect of these limitations is that customers are robbed of the opportunity to make deposits into their automated savings or investment plans at the designated time.

- Low success rates: How many times have you tried to pay for a meal at a restaurant and your card was declined? Most likely, you have been in this situation before. A 2020 report by NIBSS showed that payments had a failure rate of 16%, out of a total of 1.82 million transactions.

- Card retries: Currently, the only way to retry a transaction when it fails is to log in to retry the payment manually. In the event you miss the notification regarding the status of a transaction or the state of your debit cards, you will be unable to save or invest.

The challenges highlighted above mean one thing – a debit card alone isn’t enough to fuel your journey to building wealth, and bank transfers aren’t typically automated. An additional channel was required. The goal of implementing the Smart Payment feature is to overcome these limitations, making it easier for you to save and invest consistently.

This is why we are optimizing how you view and make payments on the app to increase the success rates of your recurring deposits, and set you on the path to financial freedom.

How does Smart Payment work?

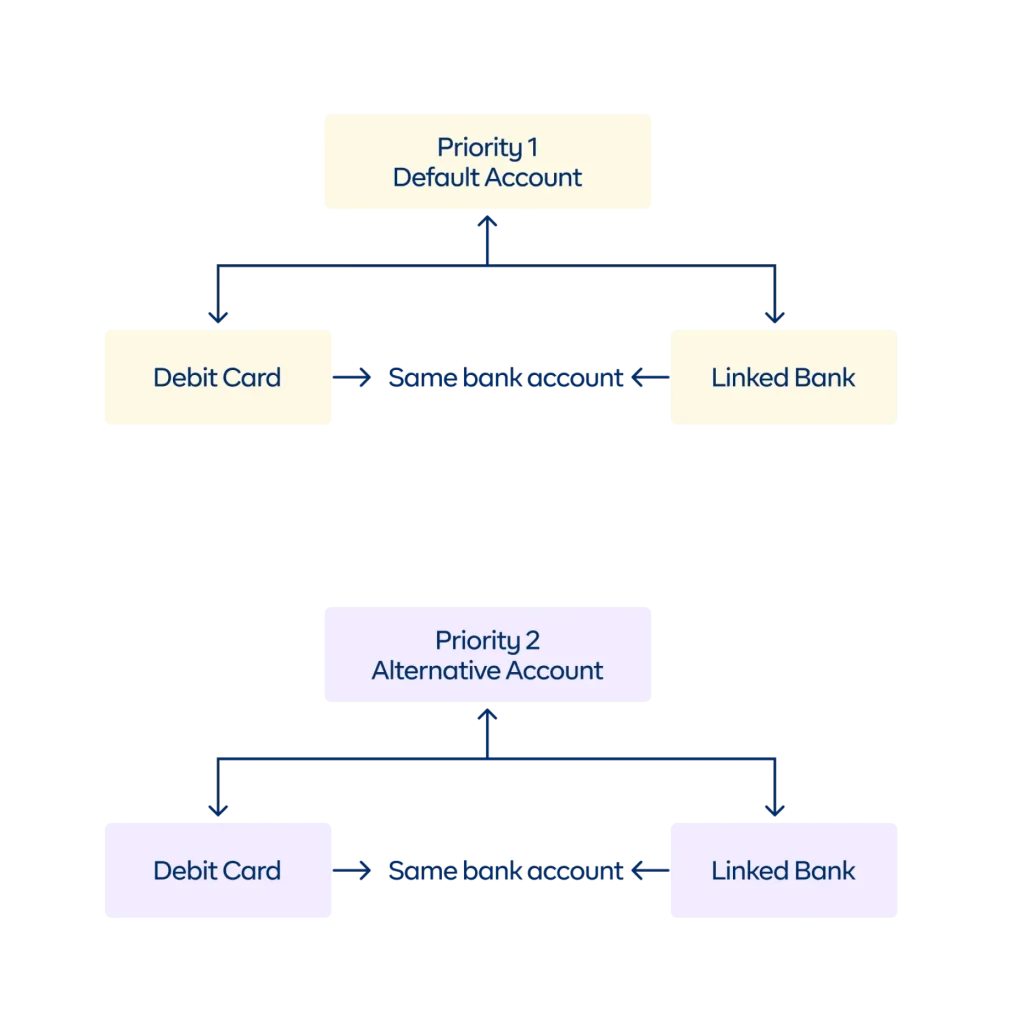

We developed Smart Payment to do one thing – streamline how you make deposits into your plans for increased efficiency. To accomplish this, we have centralized all payment methods into what we call Payment Accounts. A Payment Account is simply a group of payment channels (a debit card and a linked bank) of the same bank account.

For example, Cynthia linked her GT bank account to the app so she could pay directly from the account. But, she has also added her GT debit card linked to the same account. These two payment channels will be classified as one Payment Account.

This is how Smart Payment works.

Scenario 1

Imagine you have a Regular Savings Plan, which you created to save for a car – a 2020 Hyundai Elantra, for instance ?. You set the recurring saving amount for N500,000 to save in the plan on the last Friday of every month. You have added your new Zenith debit card and linked your bank account, which you have always used for withdrawals. Last Friday, we attempted to charge your debit card, but the transaction failed. The Smart Payment system automatically reroutes to charge your bank account (which you linked before, remember).

This way, you never miss out on your goals because of a technical setback.

Setting up your Payment Account increases the success rate of your transactions and reduces the amount of manual effort required to keep your goals on track.

To increase the chances of a successful deposit, each Payment Account is categorized into two groups – Default and Alternative accounts. Think of this like a superhero (Default Account) and a sidekick (Alternative Account). You only ever need to call the sidekick when the superhero is unavailable because he is saving someone else. The same logic applies here.

This means that whenever an automated deposit has to be made, we will prioritize and charge your Default Account through the two available channels (linked bank and card) first, and only attempt to charge your Alternative Account if the Default Account fails. (P.S. If it is a manual top, we will only charge your Default Account).

This way, you just need to provide us with the payment options, while we focus on prioritizing which payment method to debit to increase the chances of a successful transaction.

Prioritizing Payment – the engine that keeps your transactions running

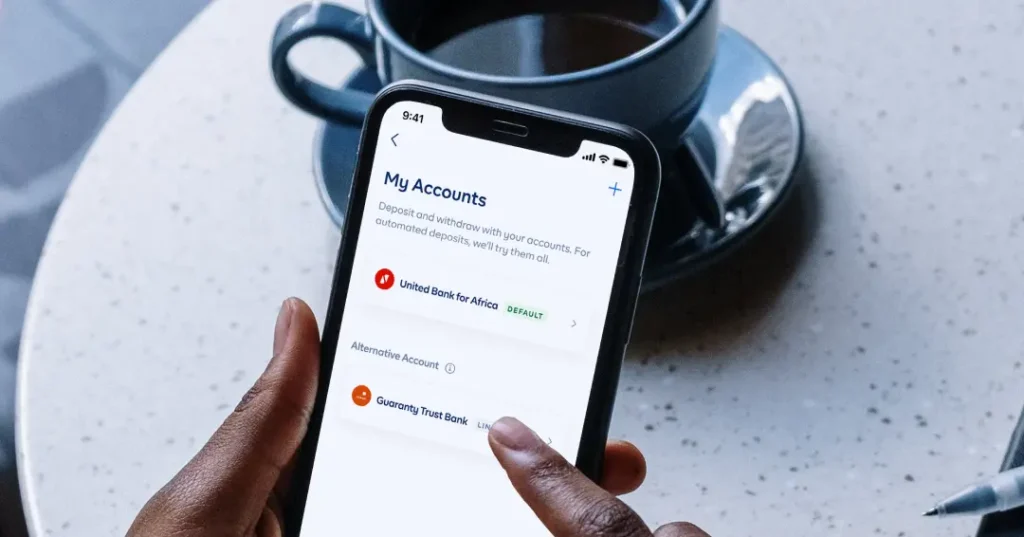

As mentioned earlier, Smart Payment is set up to ensure you enjoy successful transactions on your Cowrywise account. To achieve this, you need to rethink how you view payments on the app. What this means is that there won’t be a distinction between which account or card is meant for depositing or withdrawing funds. All payment methods added to the app will be considered for deposits/top-ups based on priority.

With the update, customers can decide which account will be their Default Account and which will be the Alternative Account. In this case, when the Smart Payment System attempts to save or invest in any of your plans, it prioritizes your Default Account first for that transaction. And if that fails, we will automatically attempt to charge your Alternative Account.

Scenario 2

Here’s another scenario.

Cynthia created a Managed Portfolio 2 months ago, which she invests in on the 28th of every month. She understands the importance of consistency and compounding and sets up a Default Account and an Alternative Account (remember, each account should have a debit card and a linked account from the same bank).

On the 28th of June, we attempted to charge her Default Account – we charged her Wema debit card first which failed. We then attempted to charge her Wema bank account, which also failed – remember we will automatically attempt to charge your accounts starting with the Default Account as first priority.

Transaction failures could be due to several reasons, none of which may be attributable to the bank. The scenarios mentioned here are purely hypothetical.

Since the Default Account failed, we attempted to charge her GTB debit card (of her Alternative Account which also failed), before we got a successful charge on her GT bank account. All in a day’s work, and without any effort on her part!

The bottom line here is this. Investing and building wealth isn’t easy, and our goal is to make it much easier. To make the most of Smart Payment, it is important to add at least a debit card and an account with the same bank as your Default Account. If you have multiple accounts, you can add another payment channel as your Alternative Account.

Not sure how to link your bank? We wrote an extensive article here for a guide to linking your bank account – a process known as Direct Debit. Or watch the video below for additional context!

Conclusion

Smart Payment completely changes the way you transact on the app, allowing you to save and invest seamlessly with minimal human intervention. Take Obasola for instance.

Obasola has a regular savings plan, to save a recurring saving amount on the 30th of every month. He added his new Access debit card (to top up) and linked his Zenith bank account, which he uses for withdrawals. We attempted to charge Obasola’s debit card as instructed, but the transaction failed. He didn’t take action on the notification or email and didn’t log in to manually update his payment method to retry the transaction. As a result, he missed the opportunity to save, setting him back by one month. Not to mention he lost his 52 month Streak in the process.

Obasola eventually set up his Payment Account increasing the chances of a successful transaction and reducing the amount of manual effort required to keep his goals on track.

You should do the same.

Be like Obasola. Log in to set up Smart Payment here