Did you save more during the Covid-19 pandemic and have been wondering “how come“? Then this analysis will interest you.

So much has happened in the past year. No… think about it! Who would have thought that it was possible for planes not to fly… Not because they had faults but because Countries closed their borders.

Twice in 2020, a total lockdown was declared in Lagos, Nigeria and as we speak (or read) there’s a state of emergency in Ontario, not for the first or second time but for the third time!

Imagine if another national lockdown is declared…

Lagosians may not be happy because they are accustomed to the hustle and bustle of the city. Plus, a large percentage of people depend on daily hustles to fend for themselves.

According to this weforum article, 114 million people were estimated to lose their jobs due to Covid-19 in 2020 alone. To put this in perspective, datacommons states that Ghana as of 2019 had a population of 30.4 million people. This means that last year, people who equate over 3 times the population of the country of Ghana lost their jobs.

So we began to wonder how significantly the pandemic affected the savings culture of Nigerians.

Did people save more during the 2020 lockdown?

You might even be able to use this to convince your HR that remote work may make your company’s staff richer.

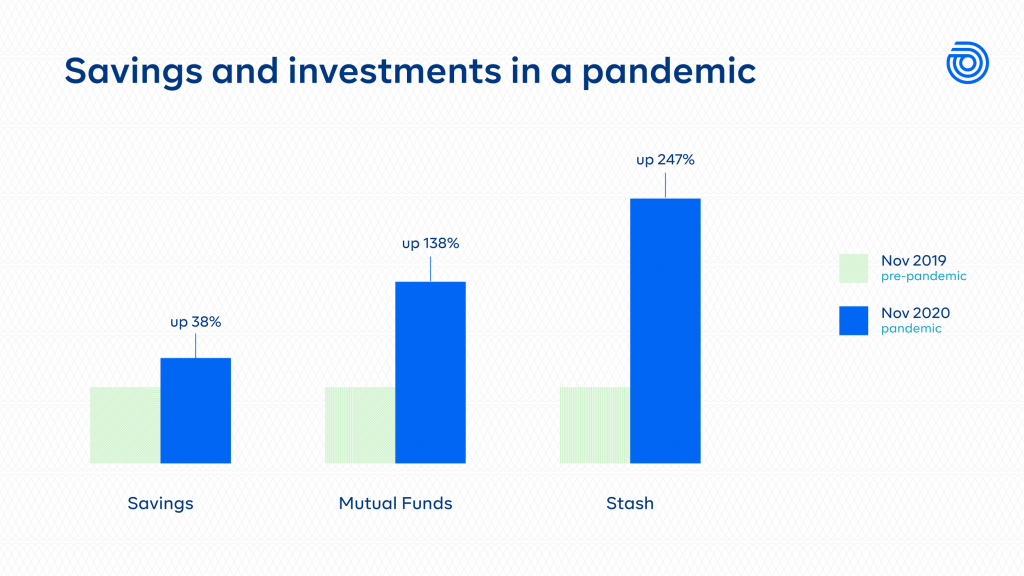

After analyzing a random subset of over 100,000 users on Cowrywise, we found that the average savings as of November 2020 (during covid) was 38% more than what people saved in November 2019 (pre-covid). With the average savings in November 2020 being almost N20,000 more than that of November 2019.

Also, the average mutual fund investments in November 2020 (during covid) was a whopping 138% more than those in November 2019 (pre-covid). Interesting! ?

Finally, Stash (the in-app wallet in Cowrywise) was funded 247% more in November 2020 than November 2019!

Where una dey see money for inside pandemic?

In seeking to understand why and how people were able to save and invest more during the pandemic, there was no one definite answer.

However, these are possible reasons why people could save more during the Covid-19 pandemic than before it…

More transportation and feeding costs are saved when people work remotely

In this conversation with Evans Akanno, he shared the impact that working remotely has had on his company. In his words, “work became remote and it has saved us business costs tremendously”. This definitely did not stop at the corporate level. If remote work saved costs for a business, then it must have done the same for individuals.

On average, an employee using public transportation to work in Lagos may spend between N600 to N1,300 to and fro each day – and this is for a considerably close distance. If you’re living in the outskirts of Lagos (e.g. Akowonjo, Aiyetoro, Egbeda, Ikorodu, Lekki phase 7 ?) and working somewhere really far from your home, then daily transportation costs will be even more.

Let’s not even talk about the hike in transportation costs in the past few months, people who take public transport and those who book ride-hailing services are all feeling the heat.

So back to how this ties to people being able to save more during the Covid-19 pandemic.

Let’s pick the lower end of the spectrum and say that someone who used to spend N600 daily on transportation got to keep that for the most part of 2020 because of remote work. That’s an extra N12,000 per month that could have gone into their savings account.

For the person who spent up to N1,300 daily on transportation pre-covid, that’s N26,000 they got to save monthly doing remote work.

Also, for people who did not have free lunch at their offices and catered for their meals, they got to also save feeding cost and most likely made more home-cooked meals.

In summary, people being able to save, invest and stash more during the Covid-19 pandemic could simply be because they spent less money. Therefore, they essentially had more to keep and then could decide on what they wanted to do with it.

Increased knowledge about the importance of saving and investing

In this article about how to save and invest in your twenties, we highlighted the inspiring story of a 21 year old who bought her first fridge and was happy to share her progress on Twitter. It might seem insignificant but we also highlighted how young people are now more determined to gradually build a better life for themselves.

Interestingly, almost 70% of people who save and invest on Cowrywise are between the ages of twenty one and thirty.

As more young people become knowledgeable about the importance of saving and investing, there will be a rise in the average savings or investments on platforms like ours.

Therefore, this increased average during the pandemic may also be attributed to the fact that more and more people in Nigeria are learning about investments and taking advantage of tools that are readily available.

Increase in creative knowledge businesses

While speaking to a Coach and Trainer, she shared how she began her business when the pandemic hit and a lockdown was made compulsory in Nigeria.

“I started seeing so many webinars during that time. Some for as low as N2,000 and others way higher, but what interested me the most was that a lot of the topics of these webinars were things I could teach. So I decided not to carry last.”

During this time, she started a virtual training school that cost N3,000 for her first class and has grown to charge people N30,000 for sessions. People pay because they find the information valuable.

“At the time, I saw some people say how they wouldn’t join webinars and classes because they could as well learn these things on YouTube, but not everyone is like that. Some people prefer hand holding and do not mind paying a lot for it.”

The low-barrier to entry to starting creative businesses in Nigeria is a plus. “Imagine making over 70% profit on your classes and not having to worry about headaches that come with delivering items from one place to the next. It felt easy and I was able to keep a large chunk for myself since we were not allowed to go out anyway.”

There really were so many webinars during the lockdown too! Lol. And even though there’s something called information overload, people who started virtual classes and other types of knowledge businesses during the pandemic must have been able to make and therefore save more during the Covid-19 pandemic.

In case you need people making pandemic money to cut soap for you

You might know someone who does not fit this analysis

We understand that this data does not represent everyone in Nigeria, as there are many people who had it very tough due to the pandemic, with palliatives being hoarded and people unable to go out and fend for themselves as they normally would.

We, however, hope that this gives you insight into the change that has occured in the savings culture of young Nigerians.

The benefit of hard times

Did you think that people would have been able to save more during the Covid-19 pandemic?

Most people probably did not think that’ll be the case. That’s the thing about hard times though, it pushes most people to do or make more than they thought possible.

Tell us about your savings and investment culture pre and post covid. What has changed?

Have you saved and invested more during the pandemic or were the years before 2020 the rosy years?

Share with us in the comments.

I need help