Compound interest is a fundamental concept in finance that refers to the interest earned on an initial principal amount, plus other accumulated interest. It is considered a powerful tool for savings and investments, as it allows for an initial investment to grow at an exponential rate over time.

Albert Einstein once famously said, “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.” This quote highlights the power of compounding and serves as a worthy summary of everything this article contains. Here, we will explain how compound interest works, the dangers of market timing and market chasing, and the importance of sticking to a long-term investment plan.

But first, what is compound interest?

What is compound interest? How does it work?

In simple terms, compound interest is the interest earned on the principal amount and all previously accumulated interest. Compound interest is the interest earned on an initial investment, as well as on any accumulated interest. It is a key financial concept that can result in significant growth over time.

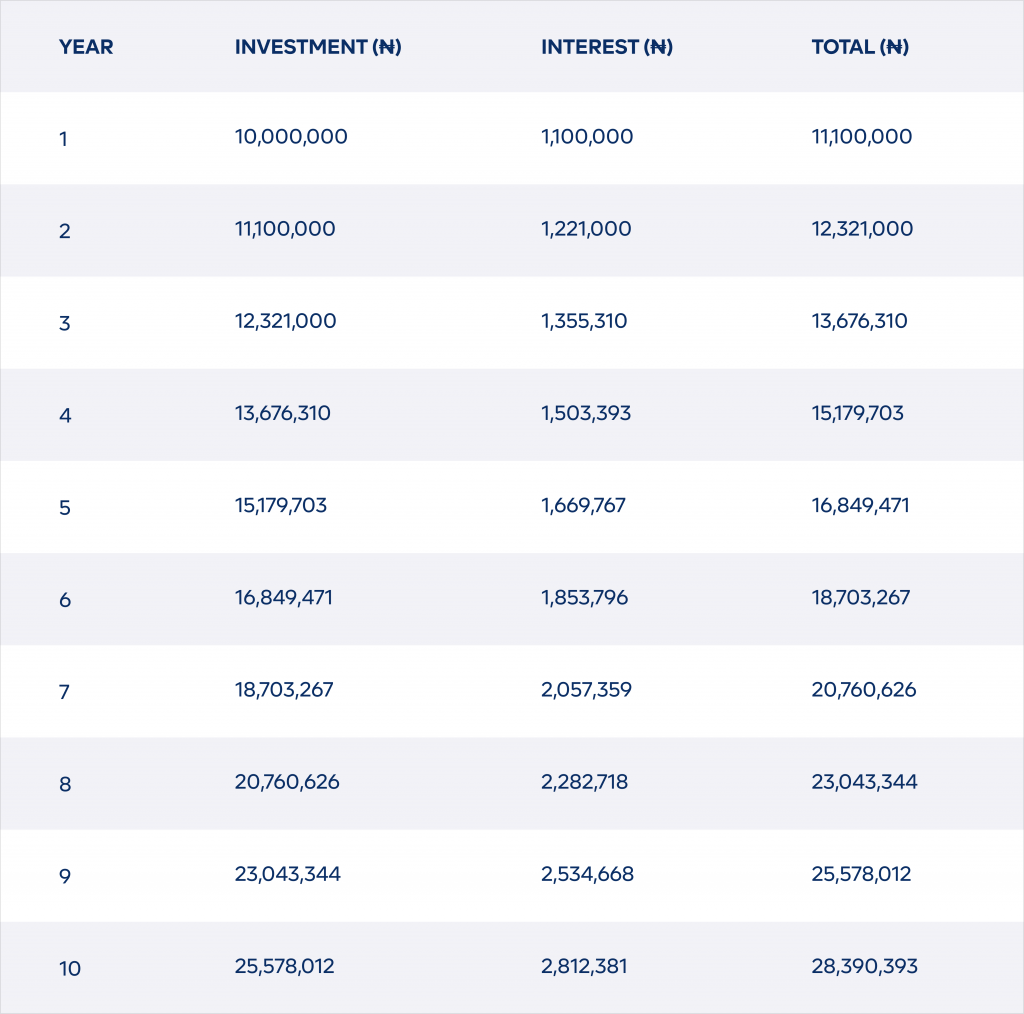

To understand how compound interest works, let’s consider a simple example. If you invest 10 million naira at an interest rate of 11% per year, after one year, you would have earned ₦1,100,000 in interest, bringing your total balance to ₦11,100,000. In the second year, you would earn interest on both your initial investment and the interest earned in the first year. This means that, in the following year, the interest would be calculated on the new balance of ₦11,100,000, rather than the original 10 million naira. Thus, the interest earned in the second year would be ₦12,321,000.

As seen from the table, the investment grows to over 28 million naira after 10 years, due to compound interest. This shows the power of compounding in long-term investment growth, as the investment earns interest on the accumulated interest, leading to exponential growth over time.

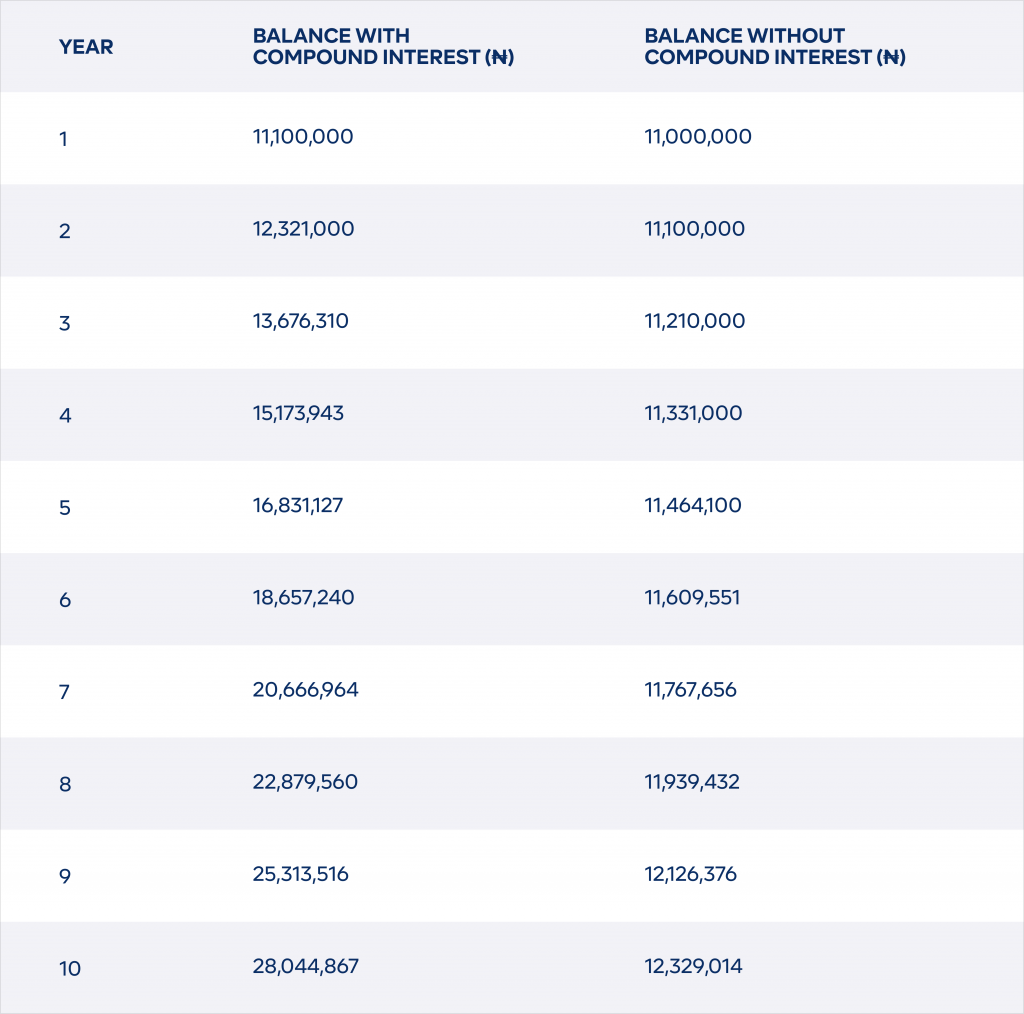

As the table shows, over the course of 10 years, the investment balance with compounding grows much faster than the investment balance without compounding, due to the interest earned each year being reinvested in the following years. This illustrates the powerful effect that compounding can have on long-term investment growth.

Another simple example of how compound interest works is in a savings account. A savings account earns interest on the balance, and as an individual tops up their balance, the interest earned in the following period is calculated on the new, higher balance. This allows the savings to grow at an exponential rate over time.

“The miracle of compounding can turn a mere $1,000 into millions of dollars—or it can strengthen your savings account via compound interest.” — The Motley Fool

Relevant concepts and their roles in earning compound returns

Compounding is a powerful tool for maximizing returns on investments over time. In order to fully understand and take advantage of the potential benefits of compounding, it’s important to be familiar with the relevant concepts and how they work. These concepts include the importance of time, the time value of money, the impact of consistent contributions, dollar-cost averaging and the risks of market timing.

By gaining a thorough understanding of these key concepts and their roles in earning compound returns, individuals can make informed decisions and create a successful investment strategy.

The importance of time in compounding.

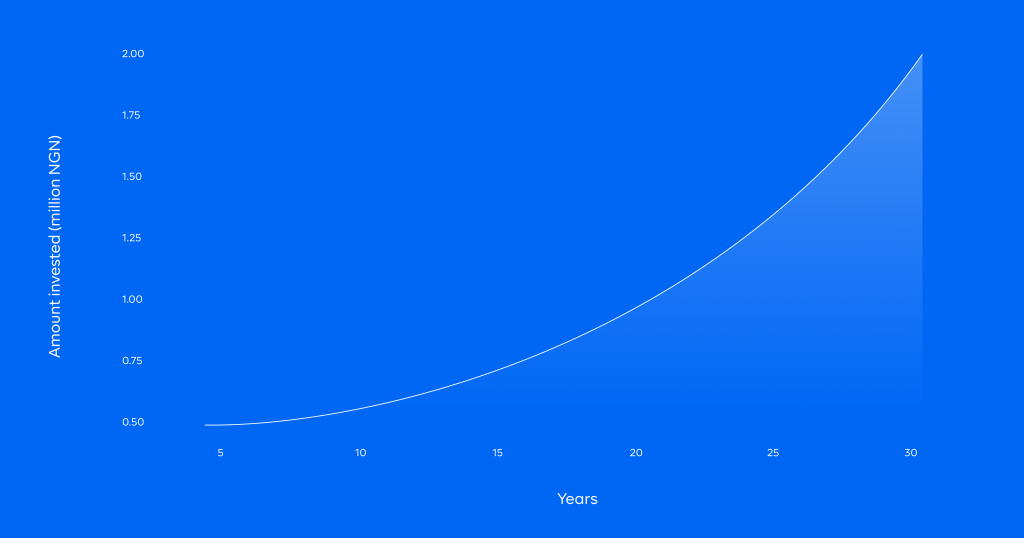

The concept of compound interest is based on the idea that time is a critical factor in the growth of an investment. The longer an individual invests their money, the more significant the impact of compound interest will be. In fact, many financial experts consider time to be the most important factor in maximizing the benefits of compound interest.

According to Investopedia, “The earlier an individual starts investing, the longer their money has to grow and compound, resulting in a larger balance at retirement.” This highlights the importance of starting to invest and saving at a young age, as the longer an individual has to invest, the more significant the impact of compound interest will be. Additionally, Bankrate states, “The longer the time frame, the more compound interest can help your money grow.” This emphasizes the importance of a long-term investment strategy, as the exponential growth from compound interest can only be fully realized over a longer period of time.

The importance of time in the growth of compound interest cannot be overstated. By starting to invest and save at a young age, and adopting a long-term investment strategy, individuals can maximize the benefits of compound interest and achieve their financial goals.

The impact of regular contributions on compound returns

The impact of regular contributions on compound returns can be substantial, as regular contributions can greatly increase the amount of money an investor has invested and therefore the amount of compound interest earned.

Compound interest is the interest earned on an investment’s principal, as well as on any previously accumulated interest. By making regular contributions, an investor adds to the principal, which increases the amount of interest earned over time. Over time, the interest earned on the principal grows and compounds, leading to a much larger final investment balance compared to making a one-time investment of the same amount.

For example, if an investor invests a one-time amount of ₦100,000 at a 10% p.a. interest rate, after 20 years the investment balance would be ₦627,219.07. However, if the same investor contributes ₦5,000 per month for 20 years at a 10% p.a. interest rate, the investment balance would be ₦1,678,066.14, more than two and a half times greater than the one-time investment.

In addition to the benefits of compounding, regular contributions can help to average out market fluctuations, as the investor is purchasing more units when the price is low and fewer units when the price is high. This is known as dollar-cost averaging and can result in a lower average cost per unit and potentially higher returns over the long term.

Overall, making regular contributions to an investment account can have a significant impact on compound returns, helping investors to accumulate a larger investment balance over time. It’s important to start investing as early as possible and to make consistent contributions in order to take advantage of the benefits of compounding and dollar-cost averaging.

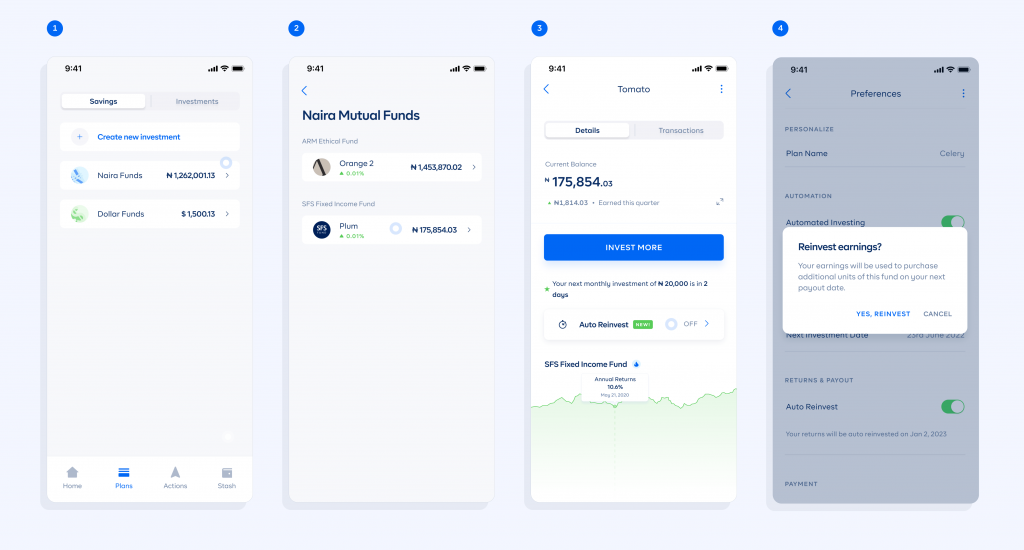

This is why at Cowrywise, we build to ensure we set up proper structures to ensure regular contributions to savings and investment plans. With automation, an investor on Cowrywise can set daily, weekly and monthly regular top-ups on their account to keep enjoying the significant impact of compounding.

The impact of regular contributions on investment returns is clear and substantial. Warren Buffett, a famous investor, has often emphasized the importance of consistent contributions in achieving investment success. He said, “Do not save what is left after spending, but spend what is left after saving.” This quote highlights the importance of making consistent saving and investing a priority, rather than an afterthought.

The importance of dollar-cost averaging and its impact on returns

Dollar-cost averaging is an investment strategy that involves regularly investing a fixed amount of money into a particular investment, regardless of its price. This strategy can be used to overcome short-term setbacks and obstacles in investing because it helps to average out the cost of the investment over time, reducing the impact of short-term price fluctuations.

For example, if an investor starts investing ₦50,000 per month into a stock that is currently trading at ₦100 per share, they would receive 500 shares. If the stock price drops to ₦75 per share the following month, the investor would receive 666.67 shares. As the stock price increases as well, the investor will continue to purchase fewer shares, but the overall value of their investment will increase. This is because the investor will have a larger holding of shares that are worth more, and the increased value of their investment will compound over time. Over time, the average cost per share will be lower, as the investor buys more shares when the price is lower and fewer shares when the price is higher.

In this way, dollar-cost averaging can help investors overcome the fear of investing at the wrong time or when prices are high. By investing a fixed amount regularly, investors can take advantage of lower prices to buy more shares, and avoid missing out on potential gains.

Additionally, dollar-cost averaging can help to reduce the overall volatility of a portfolio, as the investor is not fully exposed to the ups and downs of the market. By investing consistently over time, the investor can benefit from the long-term performance of the investment, rather than being impacted by short-term price movements.

Dollar-cost averaging is an effective strategy for building wealth over the long term. By consistently making contributions to an investment portfolio, regardless of market conditions, individuals can take advantage of lower prices during market downturns and higher prices during market upturns. As Warren Buffett said, “If you’re investing in a wonderful business, you want to buy more of it.

The concept of time value of money in compounding

Time value of money (TVM) is a fundamental principle in finance. It refers to the idea that money has a different value depending on when it is received. In other words, the value of money received today is greater than the same amount received in the future due to the opportunity cost of not being able to invest that money and earn a return.

When it comes to compounding, TVM plays a crucial role. The longer the investment is held, the greater the opportunity for compound interest to grow. This is because the interest earned in a given period is reinvested and earns interest in subsequent periods. As a result, the investment balance grows at an exponential rate over time.

To illustrate this concept, consider the following example:

If you were offered the choice between receiving ₦1m today or ₦1m in one year, most people would choose to receive the money today. This is because you can immediately invest the money and earn returns on it. If you were to receive the ₦1m in one year, you would have missed out on a year’s worth of potential investment returns.

The slides above show that the time value of money is an important factor in determining the future value of investments and the value you can get from compound interests. When considering an investment opportunity, it’s important to consider how much time you have to let your money grow. The longer you can let your money grow, the more you will benefit from the compounding of interest over time.

The concept of time value of money is a crucial principle for anyone interested in investing and building wealth. By understanding the importance of time in the growth of investments, individuals can make informed decisions about their investment portfolios and potentially increase their returns over the long term.

Start investing now and kickstart your journey to potential compound returns over the long term.

The Dangers of Market Timing and Market Chasing

One of the biggest pitfalls that investors face is the temptation to time the market. Market timing refers to the attempt to predict the future performance of the stock market and buy or sell accordingly. Unfortunately, market timing is a risky strategy, as it’s nearly impossible to accurately predict market movements. By trying to time the market, investors run the risk of missing out on market gains or buying into the market at a high point just before a downturn.

Market chasing is another dangerous habit that investors should avoid. This refers to the practice of buying stocks that have recently performed well, in the hopes of riding the momentum. While this may seem like a smart strategy, it often leads to buying high and selling low. By chasing after hot stocks, investors are more likely to miss out on long-term gains and end up with lower returns.

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves.”. — Peter Lynch

For example, if you try to time the market and sell when it’s down, you may miss out on a rebound and miss out on potential gains. On the other hand, if you chase after a hot stock or market trend, you may end up buying at a high price and face the risk of a market correction. As The Motley Fool notes, “the best way to grow your wealth in the stock market is to be a long-term investor, not a market timer or market chaser.” Instead of trying to time the market or chase after hot stocks, it’s important to have a well-diversified portfolio and focus on your long-term financial goals.

Why you should consider compound returns while making investment plans.

Compound interest is a slow burn, but over time it can result in a powerful financial fire. It is a powerful force that can significantly impact your investment returns over time. It’s a simple concept: interest earned on your investment not only adds to your principal balance, but it also earns interest in the future.

Here are some reasons why you should consider compound interest when planning for investments today:

- Long-term growth: Compound interest can help your investment grow significantly over the long term. The earlier you start investing, the more time your money has to compound, resulting in potentially larger returns in the future.

- Passive income: By investing in an interest-bearing account, you can earn passive income from the interest earned on your investment. This can help provide a stable source of income for your future.

- Potentially higher returns: Compound interest can provide a higher return compared to simple interest. The longer your investment compounds, the greater the potential for returns.

- Tax-efficient: In many cases, compound interest is tax-deferred. This means that you only pay taxes on the interest earned when you withdraw the funds.

How to position your investments for compound returns.

When planning for investments, considering the power of compound interest is crucial for maximizing growth. Doing this involves taking several steps to maximize the potential for growth. Here are some tips to consider:

- Start early: The earlier you start investing, the longer your money has to compound and grow. It’s as simple as that.

- Invest consistently: Regular investments, even if they are small, can add up over time and take advantage of compounding.

- Choose the right investments: Look for investment options with a history of solid returns, such as stocks and mutual funds.

- Diversify your portfolio: Spread your investments across different assets and industries to reduce risk and increase the potential for long-term growth.

- Be patient: Compound interest takes time to grow, so be patient and resist the temptation to withdraw your money early or make sudden changes to your portfolio.

FREE TIP: Automatically reinvest your investment returns to enjoy compound returns

The best way to enjoy compound returns is to set up automation on your investment plans, as this helps you ensure that you take advantage of both consistent contributions and enjoy more returns on the returns you already earned.

Cowrywise users enjoy this feature with a single click. With the Auto Reinvest feature, it’s super easy to automate the process of putting investments to work. Basically, you can automatically get additional units of your investments purchased for you automatically.

The power of compound interest in long-term investment growth cannot be overstated. It’s important to note that the benefits of compound interest are only realized over a long period of time, which is why it’s so crucial to start investing early and consistently. With the right strategy and patience, even modest investments can potentially grow into significant sums over time, thanks to the power of compound interest.

So, if you’re looking to start investing and take advantage of the power of compound interest, start today with Cowrywise.

Financial Calculator

great post

I loved reading this, very straightforward

This is interesting. The early I understand the best way I go.