If you’ve ever wondered why some people seem to always have money, while others are always struggling with their finances, the answer may be in their personality. You might not realize it, but there is something called financial personality, and it can play a big role in your ability to handle and manage money.

In this article, we will talk about financial personality. Can it affect your finances? What are the types of financial personalities? How does your personality affect personal finance? Why is personal finance dependent upon your behaviour? Keep reading.

What is financial personality?

Financial personality is how you handle money—the way you think about it, the beliefs that guide your behaviours and the actions that result from those beliefs. Financial personality isn’t just about how much money you have; it’s also about how well (or not so well) you manage what little money comes into your life.

It turns out that each of us has a unique set of traits and characteristics that dictates our personal style for managing finances—whether we’re consciously aware of them or not! And even though there are some things in life we can control and some things we can’t, there are always ways to adapt ourselves, so our personalities don’t stand in the way when trying to achieve success financially.

Can your personality affect your finances?

There is no single answer for why some people are more financially successful than others. Your personality, and the way it may or may not align with your financial goals and actions, can be one factor in determining how much money you have at any given time.

There are five main personality traits that researchers often look at when assessing someone’s financial status: conscientiousness, agreeableness, neuroticism, openness to experience and extraversion. These traits can help shape how you handle money in various ways.

You may think that the way you handle your finances is just a matter of habit, but the truth is that it’s likely informed by the kind of person you are. If you’re someone who struggles with spending, for instance, there’s a good chance this stems from an aversion to debt or a fear of being without money in an emergency.

Let us briefly look into the financial personality types.

What are the six types of financial personality?

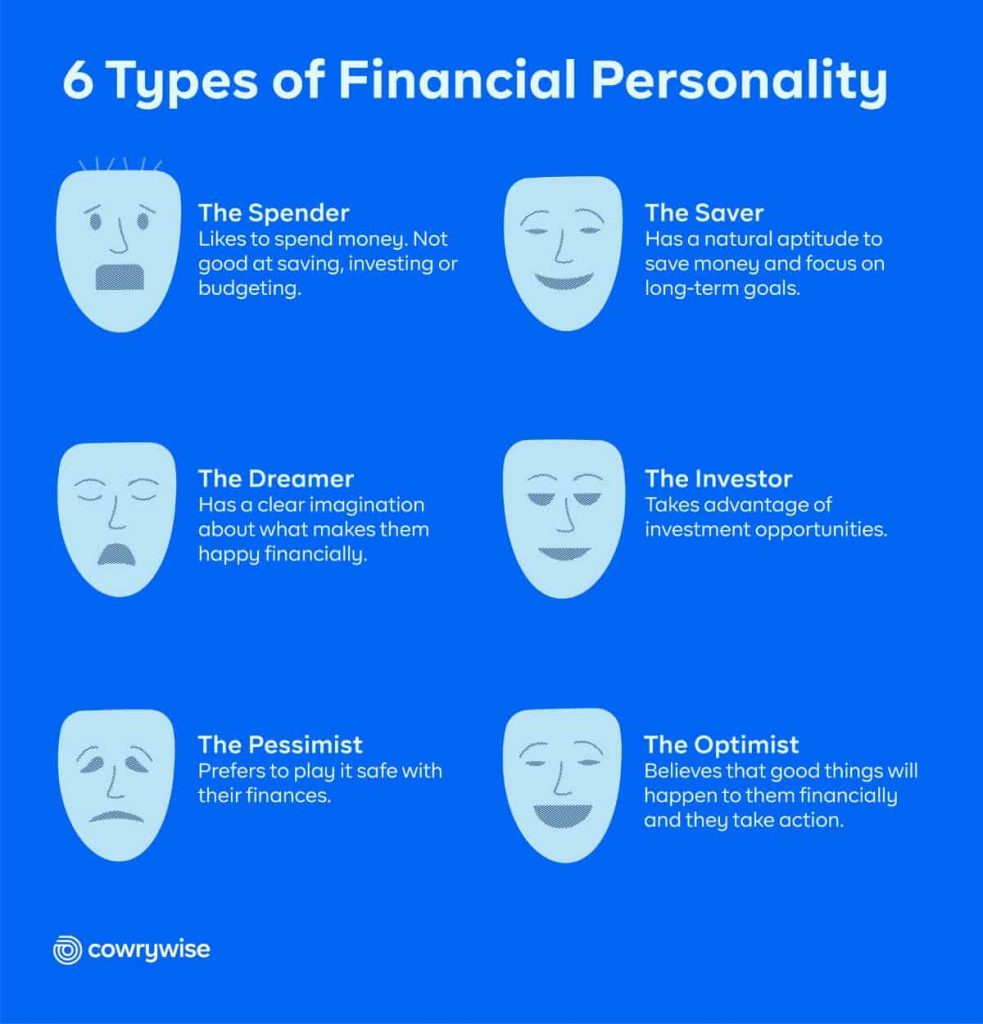

The six types of financial personality are The Spender, The Saver, The Dreamer, The Investor, The Optimist, and The Pessimist.

See which one applies to your current personal finance habits.

1. The Spender

Spenders are impulsive and impetuous. They’re not great with money, either. They’re not good at saving, investing or budgeting, nor are they good at managing debt. If you find yourself struggling with these things more than others, you may be a spender.

Spenders like to spend their money on luxuries and other short-term pleasures. They have trouble saving because they’re so focused on enjoying themselves now.

2. The Saver

If you’re a saver, you’re a step ahead of the game in terms of saving money. You have a natural aptitude to save money and focus on long-term goals. You know what your savings strategy is, and tend to stick with it even when temptation arises.

As a saver, you are practical with savings. And one of the things you might have done is making your savings automatic by linking your bank account to a wealth management solution like Cowrywise.

3. The Dreamer

The dreamers have a good understanding of what makes them happy and they know how to get it. The trick is that they don’t usually let their emotions dictate their financial behaviour. They have a plan, and they stick with it regardless of how much they want something else at the moment.

If you’re a Dreamer, then your financial habits are likely to be the ones that will make you financially successful. Dreamers are intuitive and have vivid imaginations about what makes them happy and how it relates to their finances. Then, they think of ways to implement and take action.

4. The Investor

You are able to take advantage of investment opportunities when they arise, even if they seem risky or complicated. You keep an eye on the markets and stocks to make sure that any investments that aren’t performing well are out of your portfolio.

Investors are motivated by the potential return on investment; they want high returns without much risk—so if they see two options with similar potential gains but one has greater risk attached, they’ll choose option B every time!

5. The Optimist

As the name suggests, optimists are people who believe that good things will happen. They enjoy seeing the silver lining in every situation and tend to have a cheerful disposition. Optimists are more likely than any other personality type to be successful financially: they save money and make investments, take calculated risks, and generally have a knack for making money.

In fact, optimists’ positive outlook on life has been linked with better physical health and overall happiness as well! It’s understandable why this might sound like an oversimplification of what makes someone successful—but it turns out to be true. Research shows that there is a strong correlation between optimism and financial success. This study also showed how optimists are generally more financially successful than pessimists!

6. The Pessimist

The pessimist is the kind of person who sees an opportunity to save money on everything. They are not just looking for ways to save money, they expect that there will be a reason to save money. They are always thinking of ways they can cut costs and keep their finances healthy.

Pessimists tend to avoid risks and prefer to play it safe with their finances. This can make them seem boring, but it also means that they will never have debt problems because they don’t spend frivolously!

Pessimists are always prepared. They’re like Boy Scouts—always prepared for the worst possible outcome and ready to deal with it when it happens.

Why is it important to know your money personality?

Knowing your money personality can help you make better financial decisions and improve your finances in general.

But how?

Well, it all comes down to understanding yourself and the people around you (your family, friends, etc.) better. Knowing how someone with a certain type of personality will react in a certain situation will allow you to respond appropriately.

For example, if someone has an Extrovert personality and they take out too much debt on their credit card because they want to buy something nice for their family, they may end up regretting it later when they aren’t able to pay off the debt on time. Knowing this ahead of time could prove helpful when deciding whether or not to take on a financial burden.

Your behaviour is a reflection of who you are.

Why is personal finance dependent upon your behaviour?

The way you manage your finances is a direct result of the kind of person you are. Extroverts are more likely to have bad money-saving habits. They can spend the little they have on things like social events. Introverts would not have this spending problem because they already feel uncomfortable with social situations.

However, if someone has a strong sense of self-awareness, then their personality traits won’t necessarily dictate their financial future—it will only give them an idea as to what sort of lifestyle they want to live but not necessarily how they should go about making choices around spending/saving.

Conclusion

I hope that you have a better understanding of how your personality affects your financial decisions. By learning more about yourself and how you interact with money, you can start to make smarter choices. Whether it’s saving some money or spending more on what matters most, knowing your personality type is key.

So, what is your money personality type? What personality type do you think makes the most money? Share with us in the comments.

Did you learn something? Help share this article!

RELATED

How Your Friends Affect Your Personal Finance

Fear of investing: Cowrywise report

Behavioural Finance in Action: How Emotions Affect Your Investment Decisions

What is Personal Finance? A Guide To Better Managing Your Money