Last week Tuesday, it was announced that the Central Bank of Nigeria’s Monetary Policy Committee raised the Monetary Policy Rate (MPR) by 1.5% raising interest rate to a record 26.25%, making this the third consecutive increase. This decision, aimed at controlling the country’s surging inflation, has significant implications for the economy and individual investors. Let’s explore what the MPR is, how it functions, and its effects on your financial decisions.

What is the Monetary Policy Rate?

The Monetary Policy Rate (MPR) is the benchmark policy interest rate that sets the basis for other macroeconomic interest rates in Nigeria, such as the rates at which the Central Bank of Nigeria (CBN) borrows from and lends to banks, as well as the rates at which banks set on their lending and deposit taking activities. The MPR is a crucial tool used by the CBN to manage inflation, control money supply, and stabilise the economy.

How Does the Monetary Policy Rate Work?

Basically, the MPR acts as a master control for the economy’s lending and borrowing activities. Here’s how it operates:

- Central Bank Lending: The CBN sets the MPR, influencing to a degree the rate at which it lends to commercial banks.

The CBN lends and borrows from banks using the Standing Lending Facility and the Standing Deposit Facility. The rates at those windows are determined by the MPR +/- the rates at the asymmetric corridor (more on this in the next section). - Commercial Bank Rates: Commercial banks use the MPR to determine their interest rates. A higher MPR means banks charge higher rates on loans to cover their costs, while a lower MPR allows for cheaper loans.

- Economic Impact: Adjusting the MPR affects economic activity. Increasing the MPR makes borrowing more expensive, reducing spending and investment to help control inflation. Conversely, lowering the MPR makes borrowing cheaper, stimulating economic activity but potentially increasing inflation.

Recent MPR Increase and Economic Context

On May 21, 2024, after a two-day meeting, the CBN’s Monetary Policy Committee (MPC) raised the MPR by 150 basis points, from 24.75% to 26.25%. This move aims to address the high inflation rate of 33.69% recorded in April 2024.

“The key focus of the MPC at this meeting remained to achieve price stability by effectively using tools available to the monetary authority to rein in inflation.”

– Yemi Cardoso, CBN Governor.

Additionally, it was noted that increasing inflation is mainly fueled by food expenses, elevated transportation costs, infrastructure challenges, insecurity, and currency fluctuations. Policy changes, such as the removal of fuel subsidies and the floating of the Naira, have contributed to high inflation and increased living costs.

However, the Cash Reserve Ratio (CRR) of Deposit Money Banks (DMBS) was retained at 45 percent. The MPC also put the Asymmetric Corridor around the MPR at +100 and –300 basis points. It retained the liquidity ratio at 30 percent.

What it means…

- Cash Reserve Ratio (CRR): This is the percentage of customer deposits that banks must hold as reserves with the CBN. Leaving it at 45% means banks continue to have a significant portion of their deposits tied up, limiting their ability to lend freely. This can further tighten credit and discourage spending.

- Asymmetric Corridor: This creates a band around the interest rate (MPR) where the CBN is willing to lend or borrow money from banks. In the meetings, the Asymmetric Corridor was voted to remain unchanged at +100/-300 bps, which means the CBN lends at 27.25% (26.25 + 100 bps), and borrows at 23.25% (26.25 – 300bps). By doing this, the CBN is:

- Discouraging banks from depositing excess funds with them (low interest rate of MPR – 300 basis points).

- Making it slightly more expensive for banks to borrow from them (interest rate of MPR + 100 basis points).This aims to push banks to lend more in the economy, but not at an excessively high rate.

- Liquidity Ratio: This is the minimum amount of liquid assets (cash and easily convertible investments) that banks must hold relative to their total deposits. Keeping it at 30% means banks need to maintain a certain level of liquidity to meet customer withdrawals.

How Does This Affect Me?

The increase in the MPR to 26.25% impacts your financial activities in several ways:

Borrowing Costs

- Loans and Mortgages: Expect higher interest rates on loans and mortgages, leading to increased monthly payments and overall borrowing costs. Businesses may also face higher financing costs, potentially slowing growth.

- Credit Cards and Personal Loans: Interest rates on credit cards and personal loans are likely to rise, making borrowing more expensive. It may be wise to delay non-essential borrowing or shop around for the best rates.

Savings Returns

- Savings Accounts: Higher interest rates on loans often translate to higher rates on savings accounts and fixed deposits, as financial institutions compete to attract deposits.

- Investment Returns: Investors in fixed-income investments like bonds may see better returns due to higher interest rates, though the value of existing bonds with lower rates may decline.

Investment Strategies

- Stocks and Bonds: Higher interest rates can negatively impact stock markets as companies face higher borrowing costs, reducing profitability. Conversely, new bonds will offer higher yields, attracting investors seeking stable returns.

- Real Estate: The real estate market might cool down as higher mortgage rates make property purchases more expensive, potentially slowing price increases or even leading to price declines in some areas.

In conclusion, the Central Bank of Nigeria’s decision to raise the Monetary Policy Rate to 26.25% reflects its commitment to combatting inflation. This hike reverberates across the economy, influencing borrowing costs, savings returns, and investment strategies. As individuals navigate these changes, staying informed and adapting financial plans accordingly becomes paramount.

Maximise Your Savings with High-Interest Rates

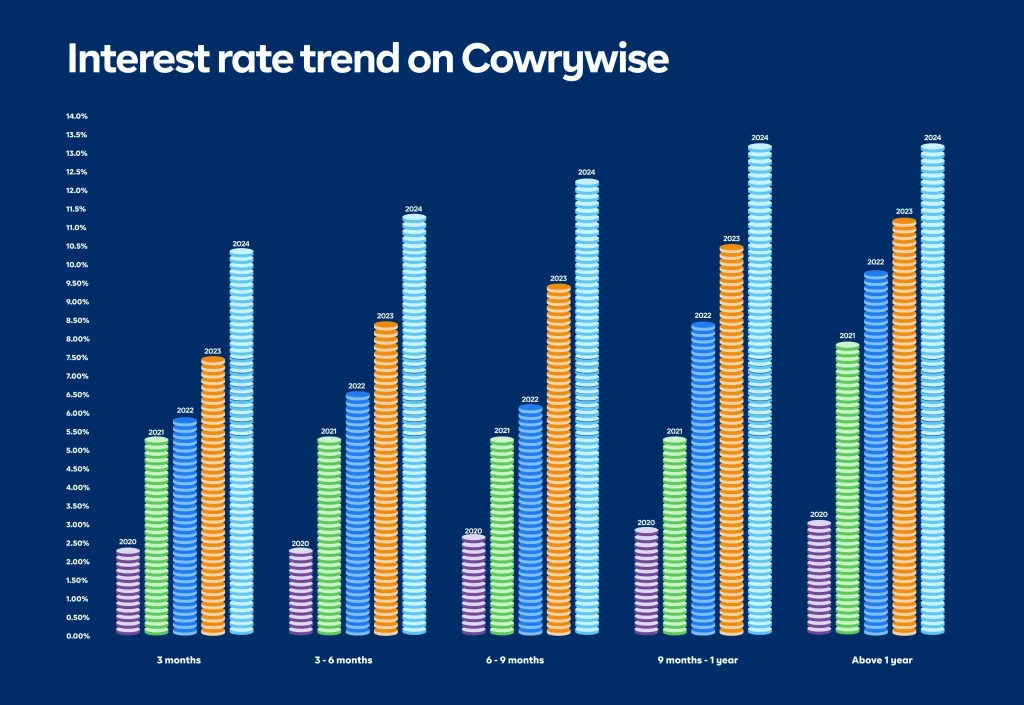

In light of the rising MPR, consider maximising returns on your savings. Cowrywise offers attractive interest rates—up to 19% on conservative investments—providing an opportunity to grow wealth significantly in a high-interest-rate environment.

Conservative investments, like money market funds, are set to gain if short-term rates continue to rise. These funds typically invest in short-term, low-risk securities and can provide higher returns when interest rates are high. By leveraging these options, you can ensure your savings work harder for you, growing steadily and securely.

Take advantage of the current economic conditions and consider Cowrywise for your savings and investment needs. With competitive rates and a focus on conservative investment strategies, it’s a smart way to enhance your financial growth.