For over five years, Cowrywise has been committed to one mission; building wealth that lasts for Nigerians. A mission we still pursue today. We believe every Nigerian should have access to investment instruments and the power to secure their financial freedom.

One of the ways we have been able to accomplish this feat is by democratizing investments for Nigerians through access to both Naira and USD-denominated mutual funds, and creating an investment platform with the largest collection of mutual funds in Nigeria.

So far, our dedication is paying off. As a brand, we have maintained our position as the top and trusted platform for mutual funds in Nigeria. We have partnered with the top asset management firms in the country, who collectively control up to 66% of the collective investment scheme industry, to make high-performing mutual funds available to potential investors like you.

Skip to:

Stanbic IBTC Asset Management

This moves us one step closer to our goal of making mutual funds accessible to all Nigerians, and gives everyone an opportunity to start building wealth securely on the leading SEC-licensed investment management platform in Nigeria.

Today, we’re sharing some exciting news! Mutual funds from Stanbic IBTC Asset Management, Vetiva Fund Managers Limited, and FSDH Asset Management Limited are now available on the Cowrywise app. Currently, we boast of aggregating 31 funds across 10 fund managers in Nigeria, meaning you have 31 diverse ways to invest and grow your wealth! ?

Cowrywise x Stanbic IBTC Asset Management

Stanbic IBTC Asset Management Limited, a subsidiary of Stanbic IBTC Holdings Plc, is the biggest non-pension asset manager in Nigeria. They currently dominate the collective investment scheme industry, controlling a whooping 42% of the entire market as at Sept 30th, 2022. With their ties to Stanbic IBTC Bank, and affiliation with the Standard bank Group in South Africa, (the biggest banking group in Africa), their stability and dominance in the market is not surprising.

Since its incorporation in 1992, Stanbic IBTC Asset Management Limited has been providing investment solutions to foreign and domestic portfolio investors, with a major inclusion of mutual funds. Stanbic IBTC has run a large number of campaigns to ultimately urge diverse retail and corporate investors to build wealth with its wide range of investment options.

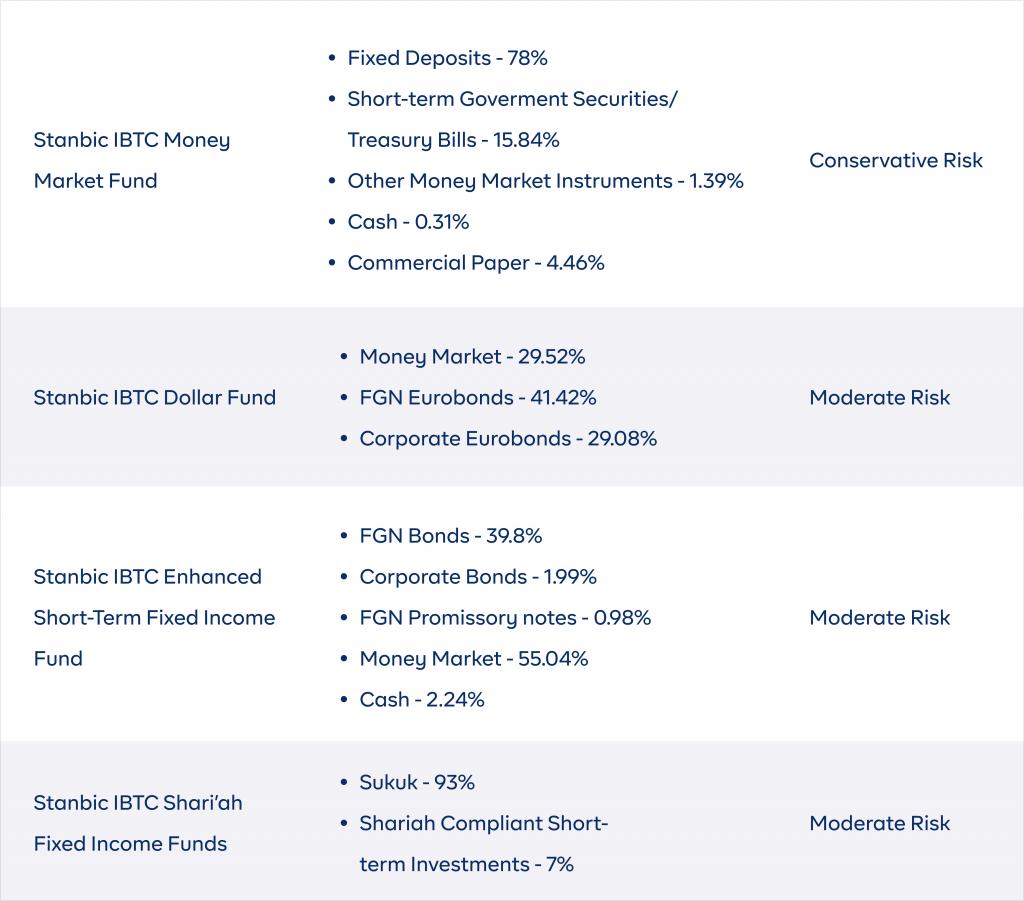

With this new collaboration, we have now added four new mutual funds from Stanbic IBTC Asset Management to our fund listing on the Cowrywise app. These new funds are spread across the conservative and moderate risk levels—giving you diverse options based on your risk appetite. Stanbic also has a dollar mutual fund, which is useful for investors trying to build wealth in dollars and hedge against any further weakening in the naira.

At Cowrywise, we have consistently preached financial inclusion; no matter your background or religion, you have access to investment options tailored for you. That’s why we are excited to list Stanbic’s Shari’ah fixed income funds for our users who are Muslim-faithfuls.

Cowrywise x FSDH Asset Management Limited

While this asset management company started off as a department of the FSDH Merchant Bank Limited in 1997, it later morphed into a fully-fledged company, FSDH Asset Management Limited, in 2001. The company has since then grown to become a leading asset management firm in Nigeria.

Licensed by the SEC as a Portfolio Manager, a Fund Manager, and a Corporate Investment Adviser, FSDH Asset Management Limited builds wealth for Nigerians across all economic classes by leveraging its team of best-in-class fund managers and a large range of high-performing assets.

“At FSDH Asset Management, we conduct a detailed risk profiling of our clients to determine their risk threshold, investment horizon and liquidity requirements for the appropriate product and asset classes.”

“Our collaboration with Cowrywise is to help drive financial literacy and awareness to diverse categories of investors with available product options to meet specific requirements.”

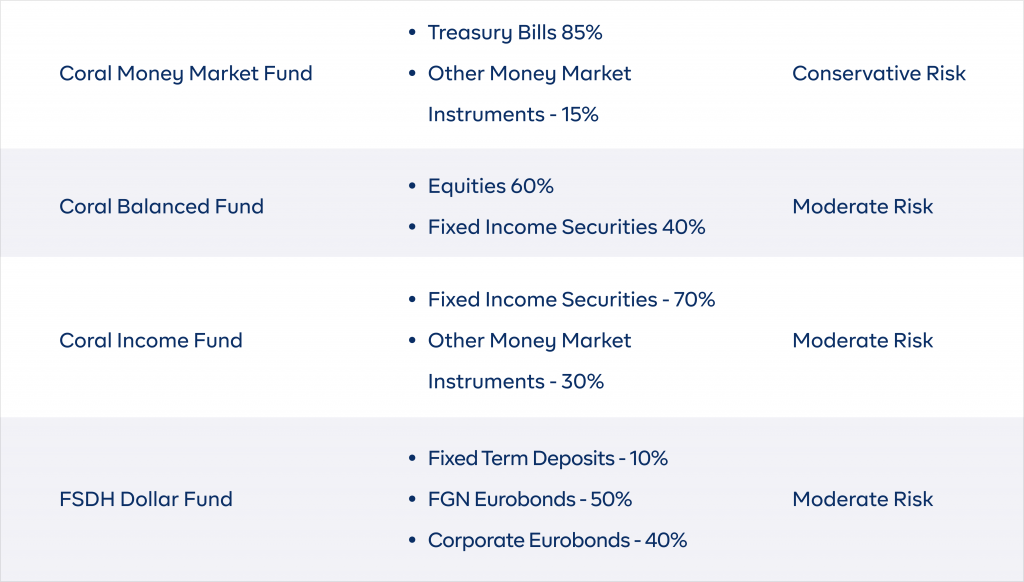

Now, Nigerians can easily access the Coral Money Market Fund, Coral Balanced Fund, Coral Income Fund, and the FSDH Dollar Fund on Cowrywise, with their composition across treasury bills, equities, fixed income instruments, and other money market instruments.

For investors looking for safe, liquid and income generating naira instruments, the Coral Money Market Fund and the Coral Income Fund are your go to funds. For investors looking for capital growth in the long term and want some risk exposure, the Coral Balanced Fund gives you a good diverse mix of equities, bonds and money market instruments. While the FSDH Dollar Fund is there to help you build a consistent income stream in USD.

Cowrywise x Vetiva Fund Managers Limited

Vetiva Fund Managers Limited, a subsidiary of Vetiva Capital Management Limited, is a pan-African financial services company registered by the Securities and Exchange Commission in Nigeria as a portfolio manager. They are also the champions of exchange-traded funds in Nigeria, which track the investment performance of major sector and benchmark indices in Nigeria. Our new collaboration with experienced fund managers at Vetiva makes it possible for investors to access the Vetiva Money Market Fund on the Cowrywise app.

The Vetiva Money Market Fund is an actively managed open-ended fund that provides capital stability, liquidity, and diversification while providing a competitive return to fund investors. This fund is particularly suitable for investors seeking a short-term investment horizon, safety, and reduction of concentration risk.

“Our trademark in Vetiva is “The future doesn’t just happen, it has to be built” and in line with this, we are very excited about this partnership with Cowrywise.”

“We believe it would provide us with avenues to engage more young individuals towards building a lasting financial future by providing them with easy access to some of our investment products.”

— Oyelade Eigbe, Managing Director, Vetiva Fund Managers Limited.

Watch this video on how mutual funds work:

Mutual funds make so much sense for retail investors; they are able to access investments they cannot directly, they benefit from the solid investment expertise that these asset managers have, while doing so at a very low cost.

As a brand, we are fully licensed as a fund manager by the SEC and all our activities are in compliance with regulatory requirements to protect your investments. We are strong advocates of building wealth through mutual funds, which is a great investment instrument all investors should maximize. All mutual funds available on the app are screened by professionals, with a solid background in fund management, through tried and tested brands.

Do you want to enjoy this mix of investment options from leading fund managers in Nigeria? It only takes a few minutes. Simply follow these steps:

- Get the updated Cowrywise app here

- Create your account or sign in to your existing account.

- Tap “Invest”

- Then choose your preferred mutual funds option.

It’s important to take your risk assessment to understand your investor type, and we will show you options tailored to your appetite.

TRENDING:

Cowrywise is now the largest aggregator of mutual funds in Nigeria

Wow I will love to have a try of dis

This is great ?

Yes I will love to join did marked team

Awesome**

Lovely very good interested

I’m interested I need money for my

Grilled business

Please can I use the money have saved to invest on this investment.

Nice one

Learning is part of educating, its wonderful, great opportunity in life.

Am interested I need money to power up my small business

This is-interesting looking forward for a positive dealings with you guys in future