Investing and trading are two very different things, but people often confuse them. The truth is that they’re both lucrative businesses, but they serve different purposes and have different risks involved. Some people prefer to invest while others prefer to trade, and neither one is really better than the other – it just depends on what you want out of your money.

Investment vs Trading

Investing is the purchase of an asset with the intention of holding it for an extended period of time. Trading, on the other hand, refers to buying and selling assets with a short-term profit objective in mind.

Investing can be considered passive when compared to trading because you’re not actively looking for opportunities to buy or sell stocks and other securities—you’re simply holding onto them until you decide it’s time for them to be sold.

Investments are often made based on fundamental analysis (the study of company fundamentals) rather than technical analysis (the study of price patterns). This means that investors typically analyze companies’ financial statements and projections when deciding which investments make sense for them; this makes investing more about long-term growth potential than short-term gains.

Which is better investing or trading?

Investing can be said to be better than trading in the following ways:

- Investing is more secure. In investing, you are using a long-term strategy and not making emotional decisions based on the market’s current condition.

- Investing is more stable. Because you have to hold onto your investment for longer periods of time in order to make it grow, there is no chance that the value of your investments will decline overnight (which can happen with trading).

- Investing is more passive than trading. When you invest in stocks or bonds, they typically continue doing what they’re doing until they pay off in dividends or interest payments—that’s not always true when it comes to day traders who may make trades that put them at risk if things go south for them quickly enough!

Day trading and investing

If you are considering day trading as a way to make money, keep in mind that it is a very risky and time-consuming endeavor. Day traders often work long hours to stay on top of their trades, which takes away from sleeping or other activities. Additionally, they need to have an extensive knowledge base about the financial markets, including how to use technical analysis tools like swing trading software and pivot point calculator websites.

They also usually have large sums of cash available for investment because they cannot afford to lose any money or take any risks with their investments. If you don’t have these things but still want to become a successful trader (without risking your life savings), consider starting out with small amounts until you’re comfortable enough with your strategies before moving up in scale.

If your goal is simply wealth creation over time rather than quick profits from day trading then investing may suit you better. It requires less work overall while offering similar potential returns over time given proper research beforehand into which types of stocks would benefit most from owning at those times.

However, if this type of analysis sounds too complicated then maybe try investing first so that once you get used to doing some basic research there will be no stopping progress towards achieving greater financial goals later down the line!

Stock investing vs trading

When it comes to making money in the stock market, there are two distinct approaches that investors can take: investing and trading. Though both methods involve buying and selling stocks (and sometimes other securities), they differ primarily in their time frame and risk profile.

The main difference between investing and trading here is that investors typically buy shares of a company with an eye towards holding them for the long term. Investors may also sell at some point during this timeframe, but they’re not necessarily looking to do so. When they do choose to sell their investment holdings, it’s because they think those shares will be worth more in the future than they are today—that is, if you hold onto your Apple stock until 2050 and its value increases by 50%, then you’ve made money on your investment!

On the other hand, trading consists of buying and selling stocks frequently to try and make profits based on short-term fluctuations in their prices. Generally, investing in stocks is seen as a long-term activity while trading is considered short-term.

Value investing vs trading

Value investing is a long-term strategy. In contrast to the short-term trading strategies discussed earlier, value investors seek to buy shares of companies at a discount to their intrinsic value and then hold them until they reach that intrinsic value or increase beyond it. This requires patience and discipline on the part of the investor, but it can be quite profitable over time if done correctly.

Trading involves buying and selling assets based on technical indicators like price charts or trend lines—all while being aware of other market participants’ actions. It’s an active approach that requires you to constantly monitor current news events and changes in market conditions as well as your own positions in order to make optimal decisions about when it might be the best time to sell off some investments while still holding onto others for future gains.

However, there are many pitfalls along this path where inexperienced traders may lose money due to misjudging their own abilities or taking risks outside their comfort zone which ultimately leads to losing all their investments altogether.

Crypto investing vs trading

Crypto trading involves a lot of risks, high stress levels and much more time spent on your computer. It’s not easy to achieve profit with this method because you will have to spend hours in front of your computer screen without seeing any profits yet. You can even lose money in the long run if you don’t know what you are doing or how to manage risk properly which makes it much less profitable than crypto investing.

In contrast, crypto investing has less stress levels because it does not involve any actual trading activities but simply buying cryptocurrencies that have the potential for growth over time (like BTC). This allows you to make profits even when the market is down as long as there is still some good news coming out from the companies behind these coins such as partnerships with large companies like Amazon or Facebook.

Dividend investing vs trading

In the world of investing, there are two main strategies: dividend investing and trading. Dividend investing is a long-term strategy that involves buying stocks or bonds, holding onto them for years or even decades, and collecting dividends as you go. Trading involves buying and selling stocks within weeks or months. The most common type of trader is an active trader who buys low and sells high within seconds or hours (or minutes).

There are pros and cons to both strategies but in general, dividend investing presents a safer way to make money over time while also providing more flexibility with tax planning.

Share investing vs trading

Investing in shares is a long-term strategy and should be treated as such. The objective of investing in the stock market is to create wealth over a period of time, which can be achieved by investing in companies with sound financials, good management and product differentiation.

When you invest in stocks, you own a fractional percentage stake in that company’s overall value, allowing you to benefit from its success. Shares can be sold at any time for their current value on the open market (known as ‘trading’). Trading involves buying low and selling high within short periods of time (usually months).

Trading shares involves predicting short-term movements in price movements of individual stocks or groups of related securities, often taking advantage of early information available before others have it.

Active investing vs trading

Active investing is buying and selling stocks regularly. Investors buy low, sell high, buy when they think a stock is undervalued and sell when they think a stock is overvalued. They are not afraid to buy or sell a stock at any time.

The key difference between active investing and trading is that active investors typically hold their positions for longer periods of time than traders do. However, as an investor, there are no hard-and-fast rules about how long you should hold onto your investments before selling them.

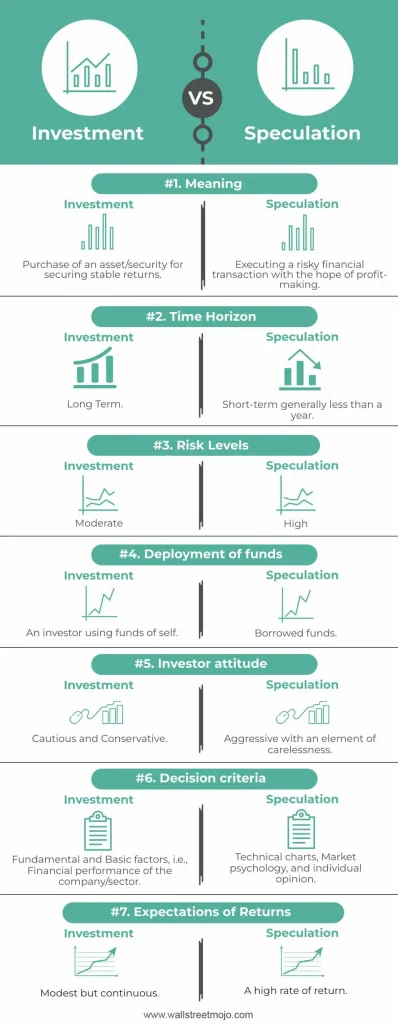

Investment vs Speculation

The goal of investing is to make money over a long period of time by purchasing assets whose value should increase over time due to stable economic conditions or technological advances—and then holding onto those assets until needed. Speculation also involves purchasing an asset to profit from subsequent price fluctuations but it involves a relatively higher level of risk and more uncertainty of returns.

Learn more about speculators in the stock market.

Source: Investment vs Speculation

Investing vs Trading: Which is more profitable?

There’s no definitive answer to the question of whether investing or trading is more profitable. It depends on your personal preferences.

Can you become rich by day trading?

While it is possible to make money day trading, becoming rich solely through day trading is unlikely for most people. There are successful day traders who have made substantial profits, but the reality is that a vast majority of them lose money.

What is the safest type of trading?

There is no such thing as a completely safe type of trading, as all investments involve some level of risk. However, one of the very low-risk options to get involved with is long-term investing in a diversified portfolio of low-cost index funds or exchange-traded funds (ETFs).

Trading can be a lot more stressful than investing, especially if you’re not doing it right. There are several elements to successful trading such as timing, psychology, and risk management. But if you’re willing to put in the time to learn these, they can make you a more successful trader.

Bottom line

Investing and trading are different depending on how long you intend to hold your asset for profits. Also, keep in mind that there’s no such thing as a sure thing, and you should always consider the risks and rewards of your investment or trading decision.

Ready to get started on your investment journey? Invest in top naira and dollar mutual funds with Cowrywise, and earn the most attractive returns on the market.

My opinion about trading is that one does not necessarily have to take a lot of time monitoring the market movement because if the strategy of Take Profit and Stop Loss is applied, trading becomes less risky. Take Profit and Stop Loss strategy will make me spend less time on trading.

I prefer investment because I am a salary earner