What’s new on Cowrywise?

Over the years, our mission at Cowrywise has remained unchanged – to democratize access to investment opportunities for the young generation of Nigerians and to make the process of saving and investing as simple as sending a tweet.

Why do we announce updates so frequently? To fulfill our promise to you, our customers. Every day, we think about new ways to deliver the best investing experience on this side of Africa. And we are doing this one feature at a time.

These are the new features coming your way. Introducing:

- Streaks

- Direct Debit

- Off-season Triggers on Football Circles

What exactly are Streaks?

Simple definition? A Streak is something that happens or is done over a period without a break. The same logic applies! Only this time, the ‘something’ that happens without a break is your ability to save and/or invest monthly. A Streak is an indicator of your overall financial health and tells you at a glance how many months you have successfully saved or invested – a visual time-based representation of your consistency in meeting your financial goals. For every month you save or invest, you unlock a Streak. If you miss a month, your Streak restarts.

The great thing about Streaks is that it displays your Monthly Top-ups/transactions since you started using the app. Cool, right?

So, you can see how disciplined you have been since you started your journey. Were there months where you didn’t save or invest? Or even periods where you thought you did? Your Streak dashboard will reveal all. An objective look at your historical Streak dashboard is loaded with enough information for you to make more informed decisions.

A quick visual guide and terminologies

The gold lightning bolt: Represents the current number of Streaks you have for each consistent month you saved. Remember, if you miss a month, your Streak restarts from scratch.

The grey lightning bolt: Indicates your lost Streaks. If you missed a month, you lose your previous Streaks, hence the grey bolt.

The grey circle: Indicates the month you didn’t save or invest.

Monthly Streaks: A metric to measure that you save/invest monthly.

Streak count: Represents the current number of Streaks you have.

Let’s use these Streak dashboards to illustrate.

Screen 1: Afolabi started saving/investing in 2020. He had unlocked 9 Streaks in the same year, before losing his Streak in October 2020 and starting afresh in November. He has saved/invested every month since then and currently has 43 Streaks.

Screen 2: Busola currently has only one Streak, after losing her 26-month Streak when she didn’t save/invest in March. Needless to say, she was pained.

Screen 3: Razaq has saved/invested every month since the app launched. He currently has a 75-month Streak – he has saved/invested every month consistently for over 6 years!

This is the part where you log in to check how many Streaks you have so far if you haven’t done so already. Log in here to check your performance and share with us on Twitter, using the hashtag #FutureSelf. Or better yet, share within your community, and show them what consistency looks like!

Get your Streak on!

We are currently running the Future Self Campaign – designed to remind customers that the future is determined by today’s decisions and actions. Keeping a monthly Streak is one such decision. Visit futureself.cowrywise.com to write a letter and receive it in the future. Your future self will thank you.

Direct Debit

To ensure you maintain your Streaks, we have created an additional payment option to facilitate account funding, bringing the total number of funding methods on the app to 3 including debit cards, and bank transfers. Payment is a key action on the app and a common point of friction for customers who want to fund their accounts frequently. Card issues can be tricky – failed charges, expired or missing cards, or general setup issues (having to visit the bank to set up their cards for online transactions) tend to impact customer’s ability to fund their accounts. Bank transfers are also not optimal for recurrent charges. The goal of this feature is to remove this obstacle and make it easier for you to consistently save and invest. Direct Debit is ideal for investors who are particular about automating their plans.

Direct Debit is a simple and secure funding method that allows customers to connect their savings or investment plans directly to their bank accounts, authorizing Cowrywise to make debits directly per instructions set for respective plans. This functionality provides a convenient alternative to card-based transactions for customers who have automated plans.

Note: Direct Debit is best for plans with recurring payments i.e. automated plans and not one-time payments.

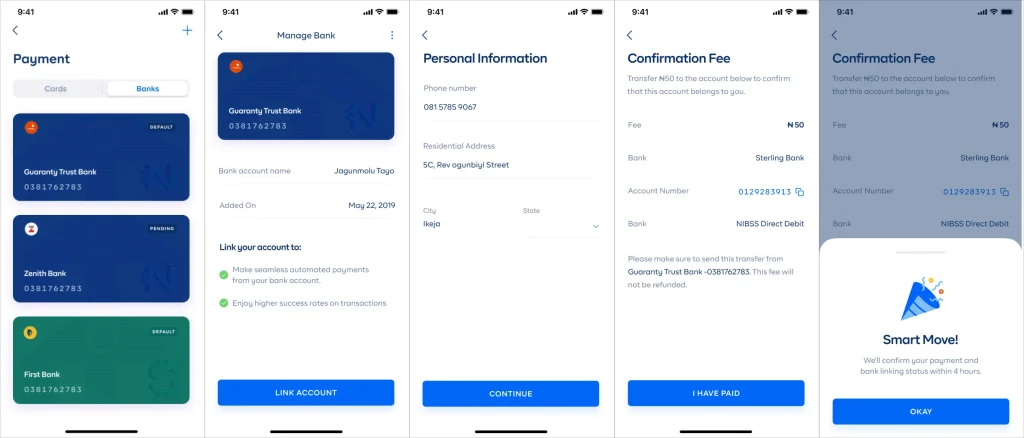

Connect your bank account in a few steps

Image 3: User Interface to link bank account

With Direct Debit, you can link your bank account to any of your automated plans. This way, you can save or invest directly from your bank account, so nothing stops you from reaching your financial goals and maintaining their Streaks.

To link your bank account, here’s all you have to do:

1. Go to Profile > Payments > Banks.

2. Select your bank (only linkable banks can be used).

3. Enter your phone number and address.

4. Send a confirmation fee of ₦50 (details will be provided).

5. Wait for confirmation. You’ll receive a notification once your account is ready to be used for payments.

Confirmation can take up to 24 hours or more, so hang tight!

Once you have linked your bank account, go to your automated plans and change your payment method to “Linked Bank”. The next time you save or invest from an automated plan, you’ll do so directly from your bank account.

Benefits

Financial Inclusion and Convenience: Direct Debit facilitates financial inclusion by giving customers an additional alternative to fund their plans by making recurring payments directly from their bank accounts.

Eliminates late payments/disruption due to card issues: Once you link your bank account, you don’t have to worry about missed payments or forgetting to pay, or even card failures. It eliminates the risk of payment disruption due to card issues like expired or lost cards, ensuring a more stable payment experience. Take Streaks for example. Linking your bank account increases the likelihood that you will never miss a Streak, so far your linked bank account is funded.

Supported Banks

- Access Bank

- Ecobank Nigeria

- Fidelity Bank

- First Bank of Nigeria

- First City Monument Bank

- Globus Bank

- Guaranty Trust Bank

- Heritage Bank

- Jaiz Bank

- Keystone Bank

- Polaris Bank

- Premium Trust Bank

- Providus Bank

- Stanbic IBTC Bank

- Standard Chartered Bank

- Sterling Bank

- Suntrust Bank

- Titan Bank

- Union Bank of Nigeria

- United Bank For Africa

- Unity Bank

- Wema Bank

- Zenith Bank

Off-season Football Activities

We created a Savings Circle for 9 popular teams, so you get to save together with other fans of your team. These teams are Chelsea, Liverpool, Arsenal, Manchester United, Manchester City, Barcelona, Real Madrid, Sporting Lagos and PSG.

You can save a minimum of ₦1,000, for every goal your team scores! Or you can also add a Football Trigger to your plan for when your favourite player scores!

With this update, gone are the days when you could only save with your team during the season, ending the thrill until the new season begins. You can now save with your team for life – on-season, off-season, any season! You can save with your team when they make a transfer, during friendlies, or even for the Women’s League. Anything club-related – you save for it!

Keep supporting your club. Forever!

Click this link to update your app.