As we discussed interest rates in Nigeria and the direction for this article, a tweet was posted on our Slack channel. It was a simple but powerful tweet that motivated us. Here’s the tweet:

Before we dig into this, let’s tell you our trust story. When we started our noble journey in 2017, we wanted to make it possible for everyone to access legitimate investments, and we did that.

We didn’t stop at making it possible for people to access these investment opportunities with just NGN100, we introduced an improved security structure to the fintech space. We did this by setting up a trust structure in partnership with Meristem Trustees; we’ll explain the importance of this here.

Right from our very first user, trust has always been our currency. Many have come to us with expectations that are impossible to achieve - 10% monthly for instance. We’ve always been clear about such requests, our commitment is to manage your money for steady growth and not make false promises that get you excited. Six years on, that hasn’t changed.

Interest Rates Update

From March 1, 2020, we’ll update interest rates for our savings plans. We’ll share every single detail with you on why we are making this choice. It’s a necessary move to preserve your trust in us and your funds. For your ease, we have broken this explainer into sections:

- Where does the interest on your savings come from?

- Why are our interest rates changing?

- Are mutual funds impacted by this change?

Where does interest on savings plans come from?

Investment Strategy

As your wealth partner, we take a conservative approach to investing your savings. Hence, we focus on investing in treasury bills, high-quality commercial papers and government bonds, in line with our Investment Policy Statement (IPS). The reason for our choices is not far-fetched. These investment instruments are low-risk by nature.

Are you a bit worried that we have treasury bills there despite the CBN restrictions in 2019? Have no worries. The CBN restricted access to OMO bills, not regular treasury bills. We wrote a simple explainer here.

Who oversees us?

When this journey started, we were only registered under the Cooperative Act. Many other firms were at the same time, but we knew we needed to be more to protect the interest of our customers. To provide an extra layer of security, we partnered with Meristem Trustees, which is regulated by the Securities and Exchange Commission, to carry out these key duties of:

- Providing total security for your funds

- Monitoring how we invest your savings

- Holding certificates of investments that back savings on the behalf of customers.

This sterling move took our security structure to the zenith in the fintech space. Today, our standard is being replicated by various online investment platforms. We are glad that this is happening as it translates to improved security for the digital Nigerian investor.

Why are our interest rates changing?

As the turn of the year approached in 2019, interest rates on treasury bills (T-bills) started to drop. Till date, they’re still low. Unsurprisingly, T-bills are significant in this conversation because they make up the bulk of short-term, liquid and secure investments; for many legitimate wealthtech platforms.

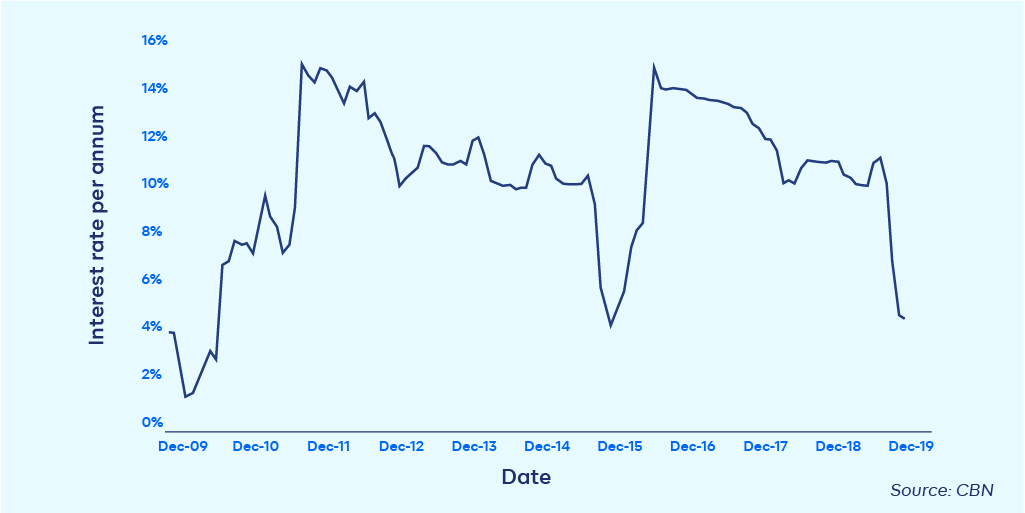

Here’s a graph on the performance of T-bills from December 2009 till December 2019:

From that graph, we can see that it is currently impossible to promise a low-risk investment offer, for less than a year, beyond single-digit returns. To reflect this reality, we are introducing dynamic interest rates.

Currently, it is impossible for anyone investing largely in relatively secure financial instruments, to offer 10% per annum or more.

How our dynamic interest rates work

At the point of creating a savings plan or rolling over one, the prevailing interest rate will be shown. If rates get higher tomorrow, there’ll be an automatic update for new plans or rolled-over plans.

To avoid any confusion, you’ll need to update your app. This is very important.

Are mutual funds impacted by this change?

Currently, we retail 31 mutual funds. This feat of ours was achieved in 2022; a key chapter in our story of democratizing access to investments. Our partner fund managers at the moment are Meristem, Afrinvest, United Capital, Lotus Capital, Stanbic IBTC, ARM, FSDH, Vetiva, SFS Fund and TrustBanc.

Here’s an interesting fact: we were the first platform to make this possible in Nigeria. We didn’t just make it possible, we spiced things up with improved inclusiveness. You can access these funds, which are regulated by the Securities and Exchange Commission, for as low as NGN1000.

On Cowrywise, we have 4 types of mutual funds:

If we break them down further, we also have the dollar and halal funds.

You can read our introductory guide to mutual funds.

With that covered, which of these fund types are likely to be impacted? Any fund that has major investments in T-bills and other money market instruments will be impacted. That is they’ll offer lower rates. In that light, there are three types of funds that can be impacted directly by the drop in interest rates. These are the money market, bond funds and balanced funds. Notwithstanding, money market funds are great for building emergency funds.

Let’s bring this to a close

When you create a savings plan, we take a look at your timeline and assign your funds to a set of financial securities that correspond to the timeline chosen. The longer the timeline, the higher the returns. Based on this, our first tip:

“Give your investments more time to soak in more interest juices.”

Our second tip, build an emergency fund using the emergency plan. It’ll help divert your attention from investments meant for other important goals.

Finally, you should invest in a dollar fund. We have a beautiful one from United Capital that earns 8% returns per annum, don’t leave without tapping here to view it.

—-

We appreciate you reading through this update. You are the reason why we wake up every day to make magic happen. Drop a comment and share with friends so they also know how to validate returns.