A personal finance rule of thumb is to have between 3 to 6 times your monthly expenses as an emergency fund.

Oftentimes, we focus on how fit we are health-wise. We jog to keep our muscles intact. We gym to improve our body shape. Yeah, the fit fam family. We measure and see improvements by how many kgs we burn, how strong we have become, and how energized we feel when we wake up from bed. But before this fitness takes shape, we go through persistent self-inflicted pains just to achieve our goals of body fitness. Many abandon the goal midway. Few see it through. Studies have shown that 73% of people who set fitness goals give them up.

The same analogy applies to our financial fitness. Many give up along the way, forgetting that achieving financial life goals is a marathon and not a sprint. We have to be deliberate about how fit we want our finances to be. Below, we provide the starting point to get your finances in shape.

Financial Fitness Evaluation

Know Your Current Financial Picture

It is difficult to progress without understanding where you currently stand. The starting point is to have a total or near-total picture of where you stand financially. Financial fitness is not measured by how much income you earn. Rather it is measured by how you have positioned or allocated your finances to meet your future financial needs adequately. Getting this picture requires you to focus on key questions, three of which are discussed below.

First, you need to have a thorough grasp of how your monthly income compares with your monthly expenses. Do not leave that to chance; be deliberate about it. Can you afford not to spend everything you earn every month? Yes, you can! So long as you earn something every month or weekly or daily, setting a portion aside untouched is a virtue worth pursuing? At a low-income level, what matters is not just the amount you save but the discipline to cultivate a saving habit.

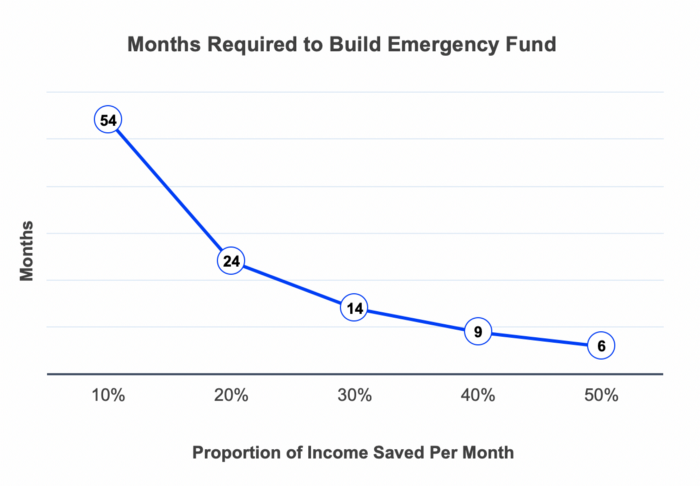

Second, if your monthly income stopped today, how many months’ worth of bills will you be able to pay? A personal finance rule of thumb is to have between 3 to 6 times your monthly expenses as an emergency fund. If you earn ₦200,000 a month and spend ₦150,000 monthly, your emergency fund should be between ₦450,000 and ₦900,000. If you need to accumulate 6 times your monthly expenses as an emergency fund, it will take you just 6 months to achieve that financial goal if you save 50% of your monthly salary. See the chart below that illustrates how many months it will take to hit that emergency fund goal at different saving rates. Where do you fall?

Third, have you tried to answer your financial freedom question? A good test of financial freedom is the “4% rule”. This simply means that we are financially free when our total annual expense is just 4% of our net worth. That is, your current net worth is 25x what you spend annually. For example, Mr Jude earns ₦6Million annually and spends ₦5Million. A simple test of whether Jude is financially free is to check if he has ₦125Million in net worth (Savings and investments combined). Of course, this is a simple way to look at the financial freedom question as the fine details of how this plays out over the years are dependent on the growth of Mr Jude’s annual income, his expenses, the returns he gets on his savings and investment and whether there are emergency events that require massive outflow from such assets over time.

Improving your financial fitness

Set Realistic Financial Goals

Having completed your financial fitness evaluation, you can set actionable and realistic financial goals. It is easy for example to set a short-term financial goal of achieving an emergency fund in 5 to 9 months, depending on your income and what percentage you are determined to save. Similarly, an example of a short-term goal would be to save ₦800, 000 in the next 9 months to cater for your next house rent to avoid “stories that touch” with your landlord.

Long-term financial goals capture a broader spectrum ranging from goals to build your first home, buy your first car, and provide for children’s secondary and university education to goals of having your first family vacation in the Gambia. All these can be planned well ahead of time while you take actionable baby steps to achieve them.

Look for Platforms to Help You Achieve Those Goals

Once you have your short and long-term goals nailed, you need to look for simple but effective tools that will enable you to achieve them easily. Cowrywise’s savings and investments platform is one of such.

Cowrywise allows you to automate your savings freeing you of the hassle of manually moving cash to a savings account. With the tool, you can create different savings plans for different financial goals, set an amount to be saved periodically at predetermined dates: daily, weekly or monthly. Besides the advantage of automation, you get to earn an interest rate 2.5x what any bank would give you. You can also monitor your overall saving balance at a glance.

Adjust Your Lifestyle Accordingly

When trying to achieve physical fitness goals, we are often advised on the choice of food to eat. We watch our sugar and fatty meals and all. If you’re trying to stay fit financially as well, you need to make some tough decisions with respect to your spending habits.

We have some tips for you here on ways to save money.

Why not start today? Take action to strengthen your financial fitness. Start simple. Start with Cowrywise.

RELATED:

Thanks for this.

My pleasure ?

Not bad, but this isn’t extensive enough, it doesn’t contain how many percent does each Mutual fund pay and does investing in higher risk mutual funds bring higher returns, I’d appreciate if an article of this nature is published, thanks

I agree with you

??

Hi Ebubechukwu, every month on the blog, we do a roundup of top-performing mutual funds with all the details you need. It’s called “Market Slice”. In addition, we have a long list of articles on mutual funds that you will find most helpful. You can find all these here: https://cowrywise.com/blog/?s=mutual+funds

Information is helpful

I agree with you. And what’s the minimum amount you can invest with

Thank you I initiated a 10k mutual investment today when are you going get it started

I understand it thanks

I understand mutual funds a lot better now

Yayyyyyy ????

Yea, great one. I understand better now

I understand very well but what’s the duration in which I can invest?

There’s none, strictly speaking, but for you to reap the benefits of compounding, I’d recommend that you think long term – years, not months.

Make sense. I now understand. Make I go teach person son too…

Energyyyyy ?

I understand now ?

I understand mutual funds a whole lot better now

Wow that is good

??

I understand alot better now

This is really interesting and I love cowrywise??

I understand mutual funds a whole lot better now

Great!

I understand mutual funds a lot better now

Uhm…

How does the interest add up?

You didn’t include that part.

Hi Solomon, I wrote a very detailed post on that. You can check it out here https://cowrywise.com/blog/mutual-fund-returns/

Thanks for this. It was helpful

Wow this is good

Yayyyyy!

Thanks Ope, I understand quite better now

Happy to hear that ?

I understand mutual funds better now

Whoop Whoop ??

I understand mutual funds a lot better now

Yayyyyyy! Time to make some money moves ??

I understand mutual funds a lot better now.

??

I understand mutual fund better , with appreciate

Yayyyy!

I now understand mutual funds better! Thanks

Anytime!

I don’t understand?

Hi Peter, please what part isn’t clear? I’d be happy to clarify.

I understand it so mcun

Yayyyyy ??

Thanks it was a nice breakdown

My pleasure ?

I understand it so well. How do I start investing in mutual fund? Can I start with the little fund I have in the celery fund? Please teach and direct me.

I understand mutual fund a lot better now. Thanks

I got you!

I know a little more about mutual funds now

Yayyyy ?

i need load for my Agri farms

Thanks for the detailed information and illustrations in the article. I now understand Mutual Fund better. I will take decision very soon by investing.

Great! The time to take the decision is now ?

How much can I use to invest in mutual.

I understand mutual funds better now.

Happy to hear!

You can start with any amount you have at the moment!

Thank you very much!

I now understand mutual funds better

My pleasure!

Thank you very much for the great insight on Mutual funds. I now understand better but I have a question.

What is the difference between mutual fund and Investment/Saving plan in a insurance or assurance company

Great question. I’m guessing you now understand mutual funds, so I’d just put this side-by-side.

At a basic level, insurance companies typically offer products that are hinged on specific events – death, damage, retirement etc. So savings products from insurance companies are similar to pension funds, where you make a contribution over a period of time and after that period you begin to get claims on a monthly or yearly basis depending on your contract.

Can you tell the difference now?

I understand better now. But do I have a say in the kind of company my money will be invested?

Okay. Thanks Ope.

But what determines the interest?

Hey Marvelous, I broke this down in this post- https://cowrywise.com/blog/mutual-fund-returns/

I’m sure you’d find it helpful in answering your question ?

Thanks Ope!

I understand mutual funds a lot better now! ☺️

Yayyy!

Wao! Very Interesting….. I really understand it all…. Thanks Ope

You’re welcome!

I understand mutual funds better now

You’re welcome!

This is a more detailed explanation on mutual fund but your start up requirements is my problem.

I understand mutual funds better now. Thanks

Happy to hear this, Taofik ?

Uhmm Ope in my mind we are already gees ?

Buh i need some answers ..

Been trying to save in dollars since for a while now

But I’m confused ?care to put me through?

Theo my G ??

Your best bet would be to take advantage of dollar mutual funds. You can find out everything you need to know here: https://cowrywise.com/blog/invest-in-dollar-mutual-fund/

Thanks a lot for ur help with this info looking forward to knowing more about mutual fund

I understand mutual funds better Now.

Great ?

I understand a lot better now. Thank you.

However, some questions:

1. Is it possible I lose all my money or run at a loss on mutual funds? Or is it a situation where, as long as I leave it long enough, I’ll bet my money back?

2. Also, can I invest in different level risks, e.g aggressive and balanced, at the same time?

I hope I don’t miss the answers.

Thank you.

Great!

1. Chances of losing all your money are quite slim, but, I’d advise that you invest based on your risk appetite because no investment, however safe, is without risk. In terms of long term investing, compounding really helps.

2. Yes, you can invest in funds across board.

I Understand a little bit better..

but one question I have is when we say ‘low risk in loosing all your capital’. Does it mean it is possible to loose all the money one used to save in mutual funds. Or just the interest would be lost?

Chances of losing all your money are quite slim, but yes, you may lose some of your capital in some cases.

Thanks for the article. Self explanatory

You’re welcome

I understand but how many days will it take for the investment to return

Thank you much much. This was really helpful.

I now understand mutual funds better

Thanks a lot ope

I understand it now and I will make sure people around me do this

Nice and good explanation, I loved it

Nice break down of mutual funds

Thank you!

Thank you so much for this.

My pleasure ?

I now. Understand

Greatttttt!!

I now understand better, thanks

??

I understand mutual funds better now.

Yayyyy!!

Simple to understand thanks

?

I understand mutual fund now

Great! ?

Thank you so much. I now understand what a mutual fund is.

You’re welcome!

What happens when the fund manager ran into a loss??

I just want to be sure

There are policies set by the government to protect users, and “customers” of these fund managers, but it only covers those who use licenced management companies. Guess what? Cowrywise has a SEC (Securities & Exchange Comission) licence in the fund/portfolio management category, so you can go to sleep knowing your money is safe ???

Okay,I will try

I understand mutual funds a lot more better now

I really understand mutual funds much better now with these ice cream illustration. The best presentation I’ve ever heard on investment

Thanks…this was good for starters

I understand mutual funds now. The breakdown was amazing. I’ve invested in mutual funds before using the app but honestly, I was just investing without a clue because I trust you all but knowing all this, I get it now and I’m definitely going to be more consistent with the investments. Great one Ope

Exactly what I did earlier today… I merely just invested because I believe in the visions and word of mouth from the many people using the platform. ?

This article didn’t state the percentage you’ll be earning when you invest in mutual funds.

I know what mutual fund is about now.

Thank you

Yea that was helpful

Well, I really hope to understand mutual fund more as my investments blossom.

Am new in this ,the bottom line for me is that Mutual funds will help me grow my money while I relax and watch and pray.

Thanks alot ope,I understand better now..

Thank you . I understand mutual funds now.

I understand better. Thanks

It is quite informative.

I understand mutual funds so much better now…nice one, I like ur explanation.

I totally understand better now..it really pays to read through.

Nice one,but if one what’s to quit before the due time, what is the process please

Sure, I understand better now… I already started investing by the way and it feels so great! ?

Is the interest rate every year only??

thank you so much for sharing like this article. Please click here , https://einvestment.com l,

After transferring money for investments, what follows?

Thanks so much for the enlightenment, I clearly understand.

These are my little questions:

✓ if I start my investment with N50,000 (for in stance), do I have to be paying the N50,000 every month ?

✓ when exactly will the returns be paid? Annually or Quarterly?

Thanking you as I await your response

Thanks for the explanation. I will make investing in mutual funds my next point of call.

Great to hear that!

Hi Ope, is there any form of cash out in mutual fund investment?

Hi Femi, could you please rephrase your question so I can understand you better?

I believe what Femi is trying to say is, at the end of the mutual fund investment, will there be any money paid to we the owner of the investment? Is it possible to withdraw cash?

Yes i really understand,,,.

Thanks a lot,,

You’re welcome!

I understand mutual fund now

Happy to hear that!

Thank you for this explanation, I think I’m ready to start investing in Mutual funds.

Great to hear! You can start by signing up here http://cwry.se/blog_signup. After you have signed up, this video has all the steps you need to get started: https://youtu.be/1CAJplBSpUw

I understand mutual funds better now.

While going through the write-up, I discovered some investments under the “conservative” category have a reduction in the returns over the years. Please can you help explain the meaning of those trends?

Now I understand what mutual fund investment really means.

Thank you for the update.

I will give it a try soon

Well explained. Can I get a phone number for direct contact with any of the cowrywise agent?

The lessons are educative. I am already giving it a trial with Mango savings. Thanks.

Thanks alot. Now I understand.

I understand mutual funds better now, thank you.

I understand mutual funds a lot better now

I understand mutual funds better. What I do not understand is what to do when your investment is “free falling” – losing money. It would be helpful of you do an article on that, Ope. Another thing you could do is to do an article on what to look out for when shopping for a mutual fund manager or mutual fund asset. Thank you for all you do, Ope. Happy 2022!

Thanks for the suggestions! I’ll definitely consider this.

This article was really helpful and educating. I now better understand mutual funds

It was helpful but I will like your opinion or let me say guidance of each funds, like u made an example with the ice cream u should be abel to say this sweet for try it out u will like it

Thanks ope,I understand mutual funds better now.I have a question though, what’s the minimum amount investable in these mutual funds?

Hi Joy,

Thanks for your comment.

There’s no minimum amount, you can begin small and grow your investments from there.

I understand mutual fund better now

Thanks so much. I understand this better. Hope to invest soon.

Thanks. I now understand mutual fund now!

Thank you very much. I understand better now what mutual fund is.

Thank you for this..Now understand mutual funds

Hey. I’m Abdulrahman Malami and i really appreciate for the information and me gonna ask a single question, what’s the minimum amount of money for the investment? Thank you

I now understand mutual funds better now

This information has helped many clients in the investment. It is a type of investment that allows the client to invest in different types of assets. There is nothing to worry about the procedures, the fund managers will administer your money.

I understand mutual funds. Now I’m craving ice cream.

I do understand now what mutual funds but how do I start

Diversification and expert management is probably the best thing about mutual funds. Right now both passive and active funds are getting traction.

I understand it a bite but I still have some question? Mr Ope all the investment you analysed through the ice method all are still risk taking what is the difference is that some are high risk why others are low risk? I have your app the person that introduce me to it only told me the 3 months savings plan which I just gave it a try now. I saw others stocks so I needed more clarifications so that I know what to do. Thanks for your explanations pls I still need a customer service number for more guard.

Thanks Ope for this insight, I now have an understanding of what mutual fund is about though more information is still needed

When am I going to get my investment money back

Thank you very much. Very insightful and so fun to read.

I understand mutual funds now, thank you .

I understand