A personal finance rule of thumb is to have between 3 to 6 times your monthly expenses as an emergency fund.

Oftentimes, we focus on how fit we are health-wise. We jog to keep our muscles intact. We gym to improve our body shape. Yeah, the fit fam family. We measure and see improvements by how many kgs we burn, how strong we have become, and how energized we feel when we wake up from bed. But before this fitness takes shape, we go through persistent self-inflicted pains just to achieve our goals of body fitness. Many abandon the goal midway. Few see it through. Studies have shown that 73% of people who set fitness goals give them up.

The same analogy applies to our financial fitness. Many give up along the way, forgetting that achieving financial life goals is a marathon and not a sprint. We have to be deliberate about how fit we want our finances to be. Below, we provide the starting point to get your finances in shape.

Financial Fitness Evaluation

Know Your Current Financial Picture

It is difficult to progress without understanding where you currently stand. The starting point is to have a total or near-total picture of where you stand financially. Financial fitness is not measured by how much income you earn. Rather it is measured by how you have positioned or allocated your finances to meet your future financial needs adequately. Getting this picture requires you to focus on key questions, three of which are discussed below.

First, you need to have a thorough grasp of how your monthly income compares with your monthly expenses. Do not leave that to chance; be deliberate about it. Can you afford not to spend everything you earn every month? Yes, you can! So long as you earn something every month or weekly or daily, setting a portion aside untouched is a virtue worth pursuing? At a low-income level, what matters is not just the amount you save but the discipline to cultivate a saving habit.

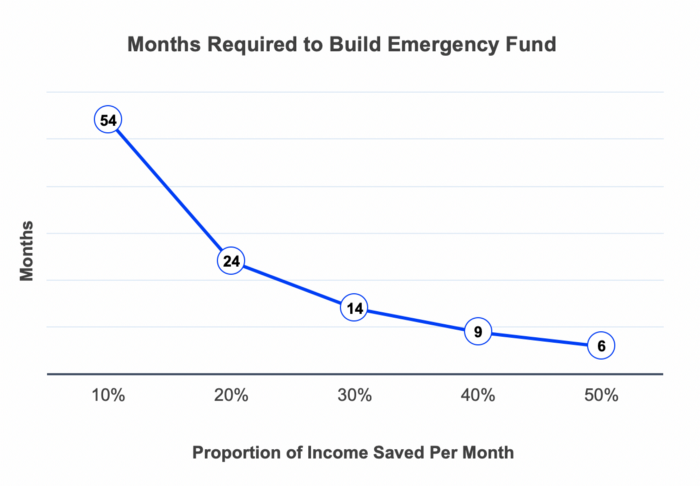

Second, if your monthly income stopped today, how many months’ worth of bills will you be able to pay? A personal finance rule of thumb is to have between 3 to 6 times your monthly expenses as an emergency fund. If you earn ₦200,000 a month and spend ₦150,000 monthly, your emergency fund should be between ₦450,000 and ₦900,000. If you need to accumulate 6 times your monthly expenses as an emergency fund, it will take you just 6 months to achieve that financial goal if you save 50% of your monthly salary. See the chart below that illustrates how many months it will take to hit that emergency fund goal at different saving rates. Where do you fall?

Third, have you tried to answer your financial freedom question? A good test of financial freedom is the “4% rule”. This simply means that we are financially free when our total annual expense is just 4% of our net worth. That is, your current net worth is 25x what you spend annually. For example, Mr Jude earns ₦6Million annually and spends ₦5Million. A simple test of whether Jude is financially free is to check if he has ₦125Million in net worth (Savings and investments combined). Of course, this is a simple way to look at the financial freedom question as the fine details of how this plays out over the years are dependent on the growth of Mr Jude’s annual income, his expenses, the returns he gets on his savings and investment and whether there are emergency events that require massive outflow from such assets over time.

Improving your financial fitness

Set Realistic Financial Goals

Having completed your financial fitness evaluation, you can set actionable and realistic financial goals. It is easy for example to set a short-term financial goal of achieving an emergency fund in 5 to 9 months, depending on your income and what percentage you are determined to save. Similarly, an example of a short-term goal would be to save ₦800, 000 in the next 9 months to cater for your next house rent to avoid “stories that touch” with your landlord.

Long-term financial goals capture a broader spectrum ranging from goals to build your first home, buy your first car, and provide for children’s secondary and university education to goals of having your first family vacation in the Gambia. All these can be planned well ahead of time while you take actionable baby steps to achieve them.

Look for Platforms to Help You Achieve Those Goals

Once you have your short and long-term goals nailed, you need to look for simple but effective tools that will enable you to achieve them easily. Cowrywise’s savings and investments platform is one of such.

Cowrywise allows you to automate your savings freeing you of the hassle of manually moving cash to a savings account. With the tool, you can create different savings plans for different financial goals, set an amount to be saved periodically at predetermined dates: daily, weekly or monthly. Besides the advantage of automation, you get to earn an interest rate 2.5x what any bank would give you. You can also monitor your overall saving balance at a glance.

Adjust Your Lifestyle Accordingly

When trying to achieve physical fitness goals, we are often advised on the choice of food to eat. We watch our sugar and fatty meals and all. If you’re trying to stay fit financially as well, you need to make some tough decisions with respect to your spending habits.

We have some tips for you here on ways to save money.

Why not start today? Take action to strengthen your financial fitness. Start simple. Start with Cowrywise.

RELATED:

Thanks for the write-up but is this advice actually feasible presently? I think they are of long-term plan.

Setting aside 15% of the wedding monetary gift for children’s education, not to talk of 10% of the money for retirement? That’s far…

The children we the partners are just to have, the pregnancy period and expenses during delivery, after birth nko?

How much is the monetary wedding gift sef?

This economy is not encouraging saving, with the frequent inflation.